- Aura Finance appeared to have a strongly bearish bias on the upper timeframes, regardless of latest positive factors

- Spike in dormant exercise was regarding for long-term holders

Aura Finance [AURA] registered positive factors price 26% within the final two days. Shopping for quantity picked up within the short-term and momentum additionally shifted bullishly on the each day timeframe. This, alongside a powerful upward transfer for Bitcoin [BTC] on the value charts.

And but, the technical evaluation revealed that the longer-term development was not bullish. The on-chain metrics additionally sparked issues concerning the sustainability of this rally. Ergo, the query – Can AURA bulls keep the trajectory of the previous two days?

Market construction was unbeaten

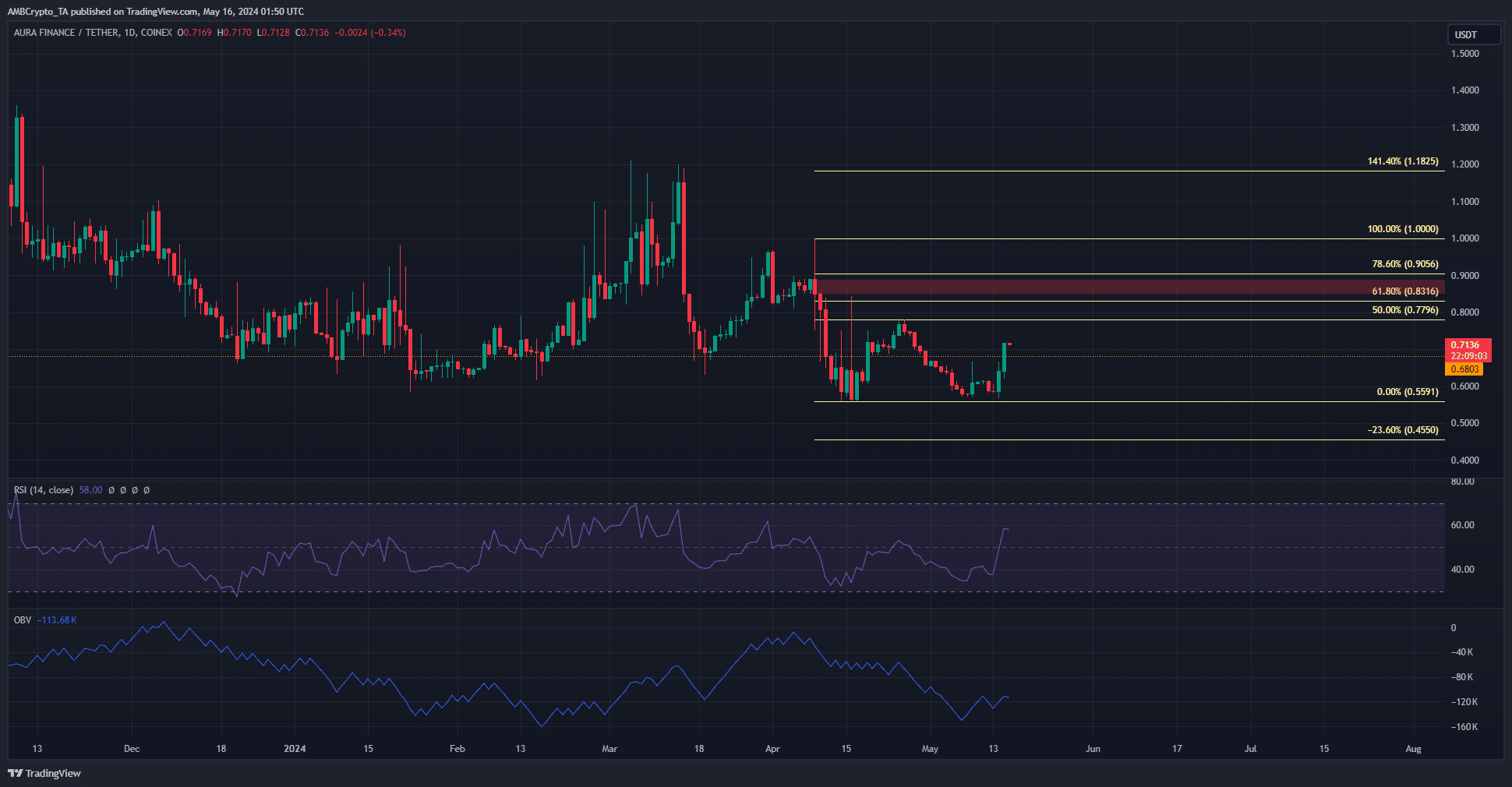

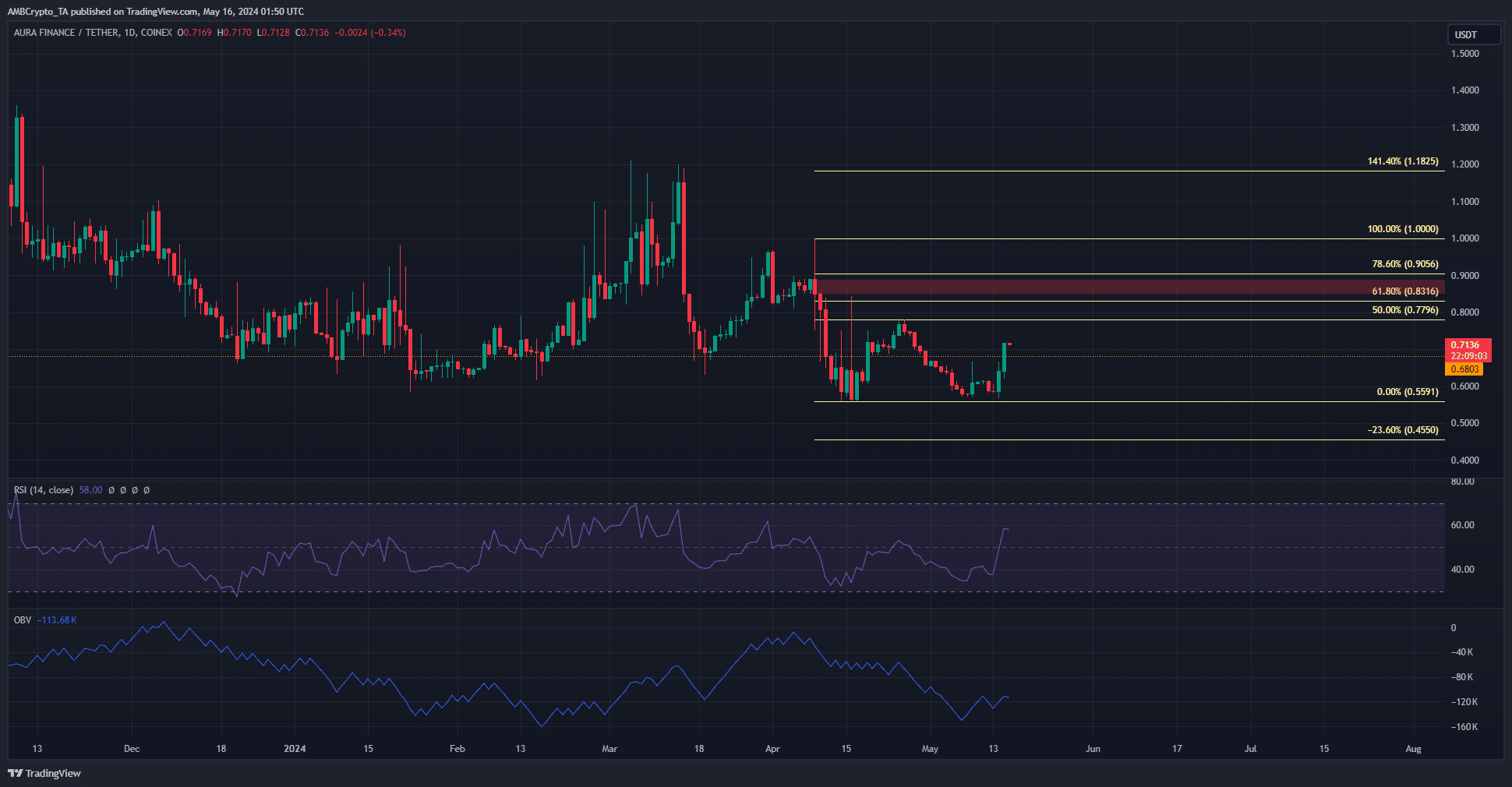

Supply: AURA/USDT on TradingView

On the each day timeframe, AURA has shaped a sequence of decrease highs since mid-March. The drop beneath $0.68 within the second week of March flipped the construction bearishly as soon as extra.

The altcoin is inside this one-day timeframe bearish construction. Although the RSI leaped above impartial 50 to point bullish momentum, it might probably proceed to development downward. The Fibonacci retracement ranges (pale yellow) at $0.83 and $0.9 are anticipated to function resistances and rebuff the bulls.

The $0.85-$0.88 area (highlighted in crimson) has additionally acted as a technical resistance zone. The OBV climbed increased over the previous week, however didn’t attain its April highs – An indication that purchasing stress was current, however won’t be sufficient.

A wave of promoting across the nook?

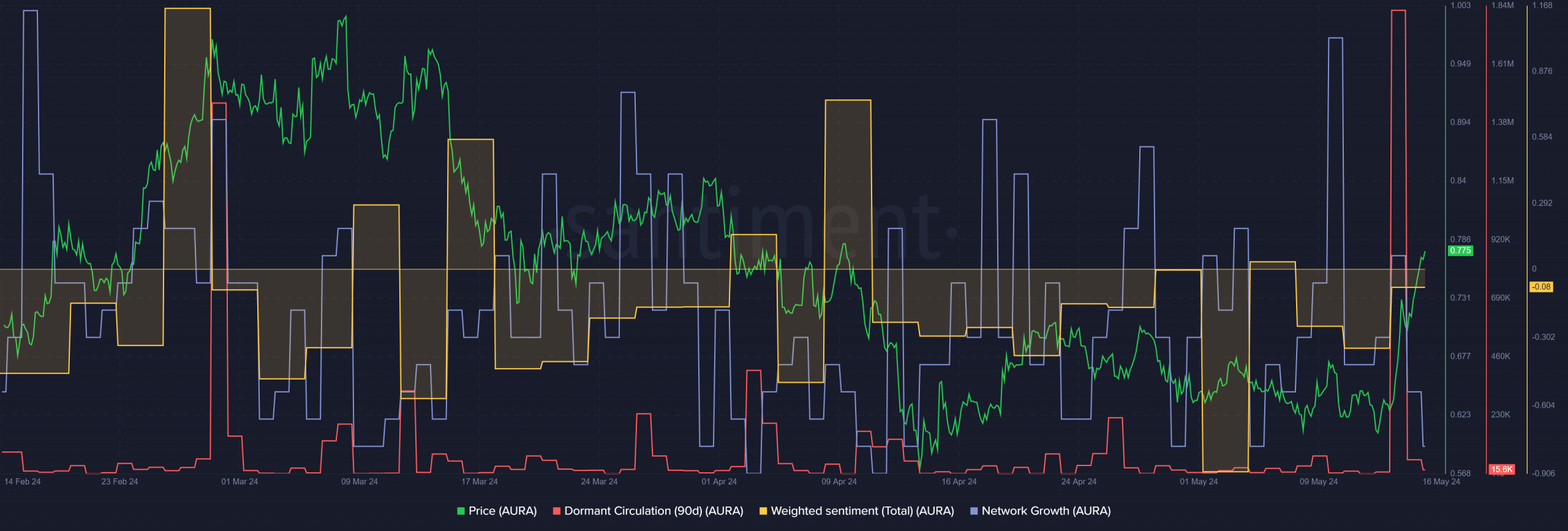

On-chain metrics didn’t present bullishness for Aura Finance both. Community progress has been constant over the previous two months, however the values since February have been beneath 20.

This implies lower than 20 distinctive addresses have been created on the community every day since late February, which might be a miserable discovering for long-term traders.

Real looking or not, right here’s AURA’s market cap in BTC’s phrases

In the course of the close to 30% rally over the previous two days, the dormant circulation famous a large spike, the largest of the previous three months. As anticipated, a flurry of token motion was noticed – A possible signal of promoting stress into the short-term bounce.

Lastly, the weighted sentiment has additionally been adverse for the previous month, underlining how little energy the bulls probably have.

Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion.