Ronald Martinez

You are in all probability acquainted with AT&T (NYSE:T) and its inventory at this level.

Numerous digital ink has been spilled on the huge telecom firm over the previous couple of years, particularly in mild of the corporate’s latest breakup with Warner Bros. Discovery (WBD) and all the surrounding drama.

You are in all probability additionally acquainted with the corporate’s dividend, which was the star of a lot debate on Searching for Alpha and elsewhere when it was minimize in 2022 for the primary time in 29 years.

From the skin, the corporate seems like a large number as shareholders have needed to endure controversy after controversy in a interval of heightened volatility for the corporate.

Nevertheless, concentrate on these noisemakers and you may miss the information; the corporate is a well-run, deleveraged, simplified enterprise with sturdy money stream – one thing that was solely cemented in our thoughts additional on account of the corporate’s latest Q3 earnings.

That stated, we predict there could also be a good higher solution to generate earnings off of the inventory going ahead.

As we speak, we’re protecting A.) the latest earnings report, B.) the corporate’s future prospects, and C.) why promoting places on AT&T could be one of the simplest ways to play the inventory for income-focused buyers.

Sound good? Let’s dive in.

Q3 Earnings

AT&T got here out of the gate swinging of their latest earnings report.

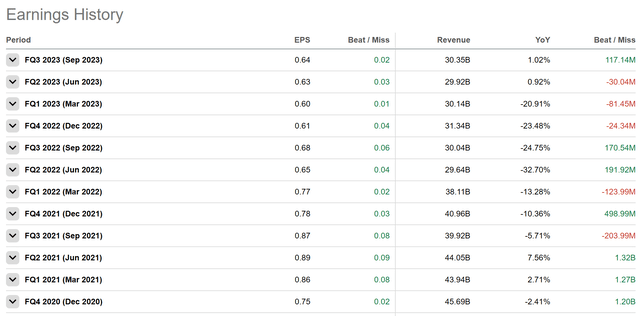

The corporate reported EPS of 0.64 cents per share, which topped estimates and was the very best revenue reported over the past 12 months:

Searching for Alpha

AT&T additionally reported greater than $30.3 billion in income in Q3, which was a beat as nicely.

Whereas year-over-year income development was lower than spectacular at 1%, the 2 latest quarters of constructive prime line development firmly put to mattress the notion that AT&T’s outcomes shall be risky over the long run.

In different phrases, as evidenced by these outcomes and the stabilizing financials, AT&T is again to ‘enterprise as regular’ with their core communications enterprise.

For some context, FY 2019 was the 12 months of peak AT&T ‘gluttony’. In that 12 months, the corporate produced $181 billion in income, $27 billion in working earnings, and carried ~$150 billion of long-term debt on its stability sheet.

During the last twelve months, AT&T has produced $122 billion in income, with $31 billion in working earnings whereas carrying ~$126 billion in long run debt.

That is important progress on the debt entrance and the margin entrance.

However how did the titanic firm handle to show the boat so shortly?

Briefly, all the aforementioned drama. Reducing the bloated media arm and loading it with debt improved margins and deleveraged the corporate in a single fell swoop. Reducing the dividend has additionally allowed administration elevated flexibility relating to making strategic investments.

Moreover, a renewed concentrate on the corporate’s core money cow enterprise has helped scale back drag throughout the board.

AT&T’s Prospects

Earlier than the spinoff, AT&T was an octopus of an organization, with tentacles out in each course. The guardian firm was dwelling to a communications division, a media division, a tech division, and extra.

Following the breakup, the corporate’s sole focus is its core communications enterprise, which has been the revenue driver from the start. This may be seen from WBD’s gross & working margins, that are much less spectacular and certain lowered pre-breakup AT&T margins.

In impact, AT&T’s enterprise has now been lowered to the next few verticals:

The Communications section offers providers to companies and customers positioned within the U.S. and companies globally. Our enterprise methods replicate bundled product choices that minimize throughout product strains and make the most of shared property. This section incorporates the next enterprise models:

- Mobility offers nationwide wi-fi service and tools.

- Enterprise Wireline offers superior ethernet-based fiber providers, IP Voice and managed skilled providers, in addition to conventional voice and knowledge providers and associated tools to enterprise clients.

- Shopper Wireline offers broadband providers, together with fiber connections that present our multi-gig providers to residential clients in choose places. Shopper Wireline additionally offers legacy telephony voice communication providers.

On the entire, AT&T now seems like a leaner, hungrier Verizon (VZ).

Here is how the businesses presently evaluate following their latest respective Q3 outcomes:

| TTM | Verizon | AT&T |

| Income (in billions) | $134 | $121.7 |

|

Working Revenue |

$30.4 | $31 |

|

Working Margin |

22.7% | 25.4% |

|

Lengthy Time period Debt |

$134.4 | $126.7 |

|

Lengthy Time period Debt / Op Revenue |

4.42x | 4.08x |

It is robust to argue that AT&T does not look higher on each entrance. Plus, it is clear that AT&T is an actual competitor within the house. Their bodily service footprint is nicely established, and the corporate ought to have the ability to proceed to churn in working income quarter after quarter.

Oh, and one different factor; AT&T is attractively priced.

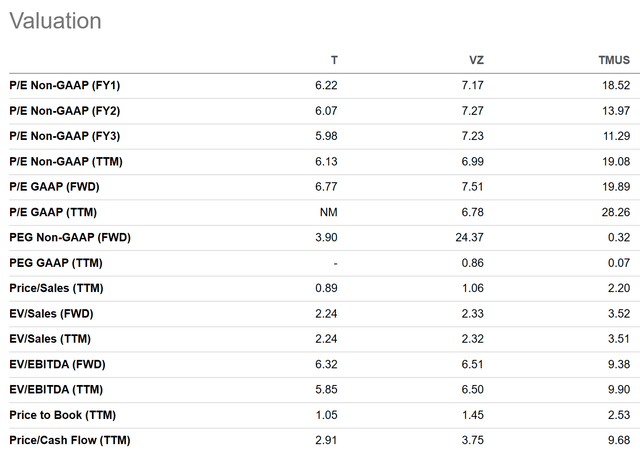

When put next with Verizon, regardless of the higher operational outcomes we have coated, AT&T is definitely priced extra competitively. The identical goes for T-Cellular (TMUS), the one different actual competitor within the communications enterprise.

On practically each metric, AT&T is essentially the most attractively priced inventory of the three:

Searching for Alpha

On prime line gross sales, guide, and money stream, AT&T takes the cake when in comparison with its friends.

Moreover, AT&T compares favorably vs. the common S&P constituent on P/E and EBITDA multiples.

All in all, AT&T’s renewed working focus, improved monetary efficiency and comparatively engaging valuation seem to place the corporate, and its inventory, in a terrific mild. We expect the prospects are good for buyers seeking to become involved at this time limit.

The Commerce

Nevertheless, regardless of the engaging valuation and favorable operational outcomes, one of the simplest ways to make the most of AT&T’s simplified enterprise and potential future success might not be to easily purchase the inventory.

Whereas shopping for the inventory does lock in a ~7% dividend that shall be strongly backed by the corporate’s money flows, saturation of AT&T’s finish market makes us assume that share costs could wrestle to understand considerably within the coming months and years.

This leaves us with an intriguing answer for juicing increased returns out of AT&T – promoting put choices.

If you promote a put choice on a given inventory, you are agreeing to buy inventory at a given value (referred to as the ‘Strike Value’) over a given time-frame till the choice expires.

In return for committing to probably shopping for a given inventory at a given value, the put vendor receives a money premium to maintain, much like insurance coverage.

Then, one in every of two issues occurs.

In a single situation, the inventory trades above the strike value by the expiration date of the choice, by which case the put vendor will get to maintain the premium generated as revenue.

Within the second situation, the inventory dips beneath the strike value, and the put vendor wants to purchase shares on the strike value with a purpose to fulfill the choice. This can possible imply an unrealized loss within the quick time period. Nevertheless, the put vendor will nonetheless get to maintain the premium generated.

Thus, promoting put choices both results in earnings and a return of your money used to collateralize the place, or earnings and a inventory buy of the identical worth within the underlying firm.

Provided that we like AT&T’s prospects as we have laid out, presently we just like the $14 strike, December fifteenth put choices:

Expiry & Strike (TradingView)

These choices are buying and selling at $21 per contract, which represents a 1.52% return over the subsequent 47 days. If AT&T trades above $14 per share by December fifteenth, then you definitely get your money again and get to maintain the premium. If AT&T trades underneath $14 per share by expiration then you definitely get to purchase inventory at $14 and preserve the premium. A win-win!

This 1.52% return annualizes to an 11%, which is significantly increased than the present dividend, therefore our considering within the first place.

Dangers

Whereas our commerce thought does have some upsides to it – specifically, the upper earnings – there are some dangers to contemplate as nicely.

First, if the inventory goes to zero, then you definitely nonetheless could also be pressured to purchase inventory at $14, even when shares are nugatory. This is similar danger profile as shopping for and holding the shares outright, however it’s vital to contemplate nonetheless.

Moreover, AT&T as an underlying inventory has some dangers to contemplate.

First, macro circumstances proper now are uneven, which may result in important volatility in AT&T’s share value, as an extension of the market as a complete. Whereas AT&T’s communications providers are largely inelastic, there’s some sensitivity to enterprise spend as institutional purchasers look to optimize / minimize their money outflows.

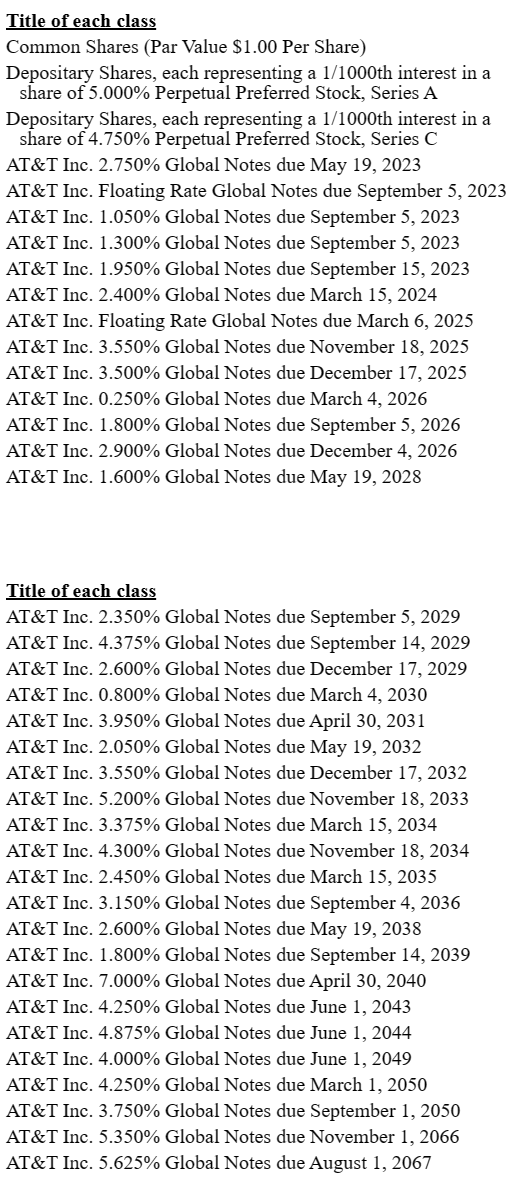

Second, AT&T has a big debt pile which can solely get dearer over time. Positive, the corporate’s present maturity profile and price ladder is comparatively low-cost:

10Q

Nevertheless, as the corporate refinances this debt over time or invests into new Capex, its extremely doable that curiosity bills will develop.

This might hamper fairness returns or worsen total margins, which may result in a decrease a number of and thus a inventory value that stays decrease for longer.

Web web, regardless of these dangers, the conservative profile of the commerce we have advised may ameliorate a number of the concern, all whereas offering even increased potential earnings for buyers.

This looks like a win-win, and one of the simplest ways to play the inventory.

Abstract

General, we like AT&T’s prospects as a leaner, extra targeted firm on higher monetary footing. The inventory is buying and selling at a terrific valuation, and the corporate’s earnings aren’t that delicate to potential financial shocks. We price AT&T a “Purchase”.

Due to these elements, the inventory must also function a terrific platform for promoting put choices. This technique additional reduces danger by decreasing potential value foundation within the title if assigned and offers higher money distributions vs. the dividend or the risk-free price in treasuries.

As we anticipate most buyers in AT&T are right here for the dividend, this might be a win-win technique that is ready to produce much more from the inventory than a easy buy-and-hold technique, particularly given the dangers we have outlined. Good luck on the market!