Erik Isakson/DigitalVision through Getty Photos

Funding Thesis

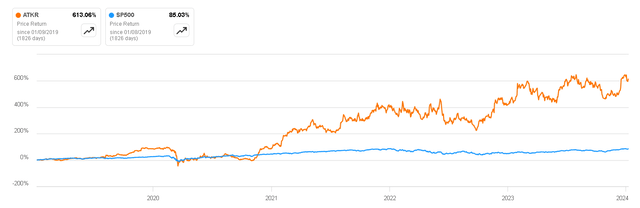

Atkore (NYSE:ATKR) has delivered an distinctive return over the previous 5 years, outperforming the S&P500 index by a considerable margin. This sturdy efficiency serves as a powerful indicator of the corporate’s high quality and resilience.

Whereas the enterprise reveals some cyclical traits, it advantages from varied macro developments which are anticipated to supply important tailwinds within the coming years. Coupled with a track record of successful acquisitions and a demonstrated pricing energy, the corporate stands poised for double-digit development within the high line within the foreseeable future. Even with a conservative outlook, I imagine that the present worth positions the corporate as a ‘purchase’.

Value Return vs S&P500 (Searching for Alpha)

Enterprise Overview

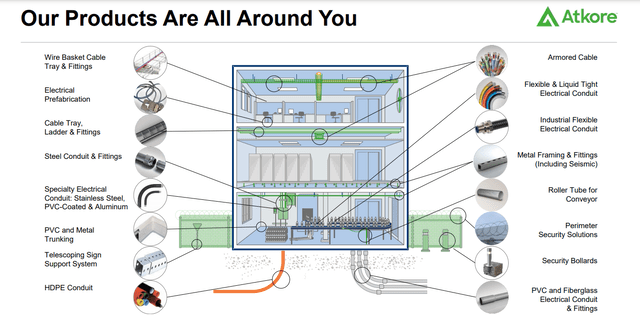

Atkore operates within the electrical raceway and cable administration business. The corporate manufactures and distributes a variety of merchandise utilized in the development and infrastructure sectors, corresponding to electrical conduits, armored cables, cable trays, and different options that facilitate the secure and environment friendly set up {of electrical} methods. In keeping with the corporate itself, these merchandise are ubiquitous and indispensable for the event of cities, making them mission-critical drawback solvers

Atkore FY2023 Investor Presentation

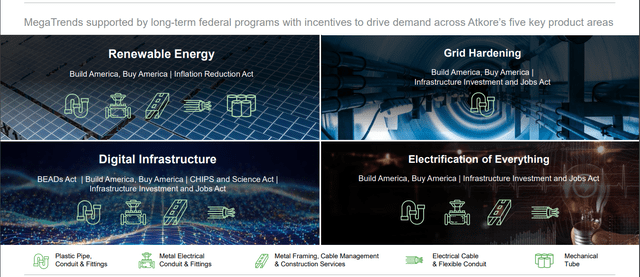

These merchandise, though not fully recurring and depending on industrial and residential investments, have tailwinds within the coming years because of sure macro developments supported by long-term federal applications. We will point out a few of them to make clear how the corporate can profit within the coming years.

- Infrastructure Growth: Electrification usually requires the event and upgrading {of electrical} infrastructure, together with the set up of conduits, cable administration methods, and different elements. Atkore, as a producer {of electrical} raceway merchandise, stands to profit from the elevated demand for these infrastructure options.

- Renewable Power Integration: The shift in direction of renewable vitality sources like wind and solar energy entails the era and distribution of electrical energy. Once more, Atkore’s merchandise could also be important in creating the mandatory infrastructure to transmit and handle this renewable vitality effectively.

- Electrical Autos: The rising recognition of electrical autos contributes to elevated demand for charging infrastructure. Atkore’s merchandise could also be used within the set up of charging stations and associated electrical methods, supporting the growth of EV infrastructure.

- Good Cities and IoT: The event of sensible cities and the Web of Issues (IOT) usually depends on in depth electrical infrastructure.

- Information Facilities: Information facilities are amenities that home servers and different computing gear. Atkore’s merchandise play an important position in making a structured and arranged atmosphere for the complicated community of cables that join servers, storage units, and networking gear with merchandise corresponding to cable trays, conduits, and different cable administration options.

- Fiber Optic Networks: That is essential for high-speed information transmission. They’re used for telecommunications, web connectivity, and varied functions the place quick and dependable information switch is important, and Atkore supplies options for shielding and managing fiber optic cables.

Principally, in virtually all present macro developments, Atkore merchandise have a spot and are fully needed. Whether or not in electrification, the Web of Issues, synthetic intelligence, or digitalization, making it an especially engaging funding case.

Atkore FY2023 Investor Presentation

Key Ratios

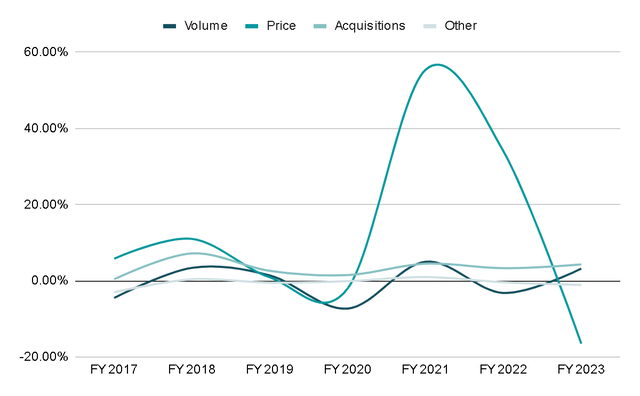

Within the final decade the corporate’s income has grown 8% yearly and I discover it fairly outstanding to say that the corporate has proven extraordinary pricing energy added to fixed M&A exercise because of fragmentation.

As an example, throughout the interval from FY 2017 to FY 2023, the corporate achieved a mean annual income development of 15%. This development was attributed to a considerable 12.7% from worth will increase and an extra 3.4% from strategic acquisitions. These features successfully offset a slight -0.3% lower in quantity and different elements negatively impacting development, corresponding to fluctuations in international foreign money alternate charges and variations within the variety of enterprise days inside the fiscal 12 months.

Up to now, we now have noticed that acquisitions can contribute to a gentle low to mid-single-digit development over prolonged intervals. If quantity persists, propelled by favorable macro developments benefiting the corporate, coupled with ongoing worth will increase, the expansion trajectory seems promising. The prospect of attaining double-digit development within the subsequent decade, whereas initially shocking, appear possible.

Creator’s Illustration

Internet Gross sales Development (Creator’s Illustration)

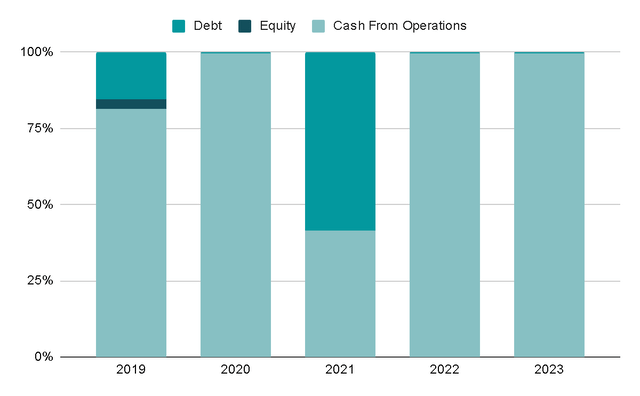

One of many points I recognize most concerning the firm is its prudent capital allocation technique. Over the previous 5 years, 76% of the capital has been financed via internally generated money, with the remaining 24% primarily sourced from debt, a good portion of which was promptly repaid. Consequently, the Internet Debt/EBITDA ratio has constantly decreased, declining from 7.5x in 2014 to 0.5x at this time.

Creator’s Illustration

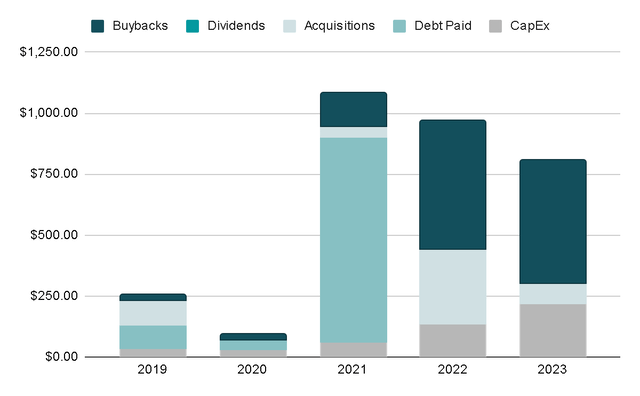

The allocation of this capital has been strategic, with 15% devoted to cash-funded acquisitions, 26% reinvested within the enterprise via CapEx and Working Capital, and 33% directed in direction of rewarding shareholders via share buybacks. Notably, the corporate has allotted $1.2 billion to buybacks within the final 5 years, ensuing within the repurchase of almost 18% of excellent shares throughout this era.

Creator’s Illustration

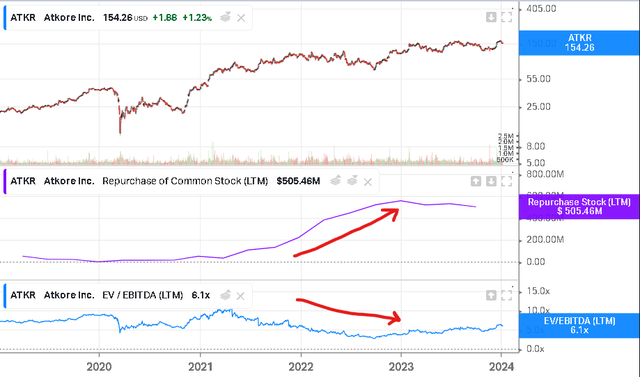

And if we check out how these share repurchases have been carried out, we will discover that since 2021, the extra the valuation fell, the extra they had been allocating to repurchasing shares. This makes excellent sense to me since many corporations that develop via M&A generally make the error of constant to accumulate companies at, for example, 6x EV/EBITDA, once they might “purchase themselves” at 4x EV/EBITDA via buybacks, which generates a lot better worth for shareholders.

Koyfin

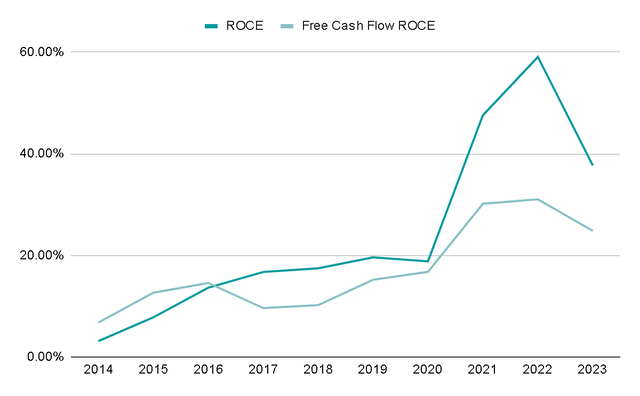

Lastly, given the corporate’s important reliance on acquisitions for development, assessing the returns generated from these transactions is essential. One key metric for this evaluation is Return on Capital Employed (ROCE), which has averaged a formidable 24% over the past decade. Notably, this metric seems to be enhancing every year, indicating extra profitability and worth creation for shareholders.

Creator’s Illustration

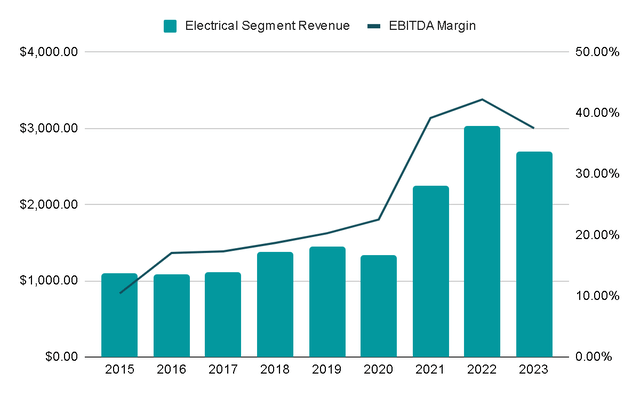

A good portion of the rise in ROCE and margins may be attributed to the strategic acquisitions undertaken between 2020 and 2021, prompting a slight restructuring of the enterprise. Till FY2020, the enterprise was categorized into ‘Electrical Raceway’ and ‘Mechanical Merchandise & Options,’ with common EBITDA margins of 18% and 14%, respectively. Following these acquisitions, the present construction emerged, consisting of ‘Electrical’ and ‘Security & Infrastructure’ segments. This restructuring led to Electrical attaining common margins of virtually 40%, which have confirmed to be sustainable since 2021, whereas Security & Infrastructure skilled a modest lower to 13%.

In essence, the corporate successfully enhanced revenue margins via these acquisitions, showcasing that the administration’s focus extends past mere development for the sake of growth. As a substitute, they’ve efficiently elevated the general enterprise high quality via strategic choices and acquisitions

Creator’s Illustration

Valuation

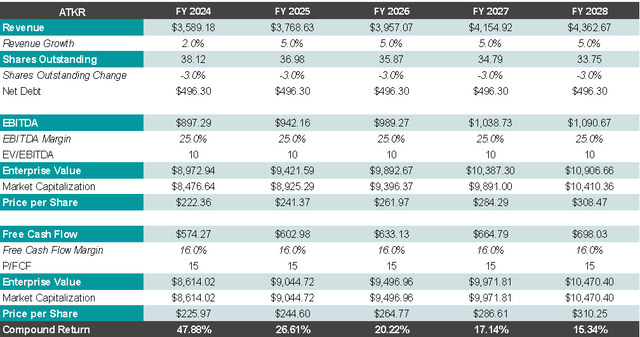

To mission potential returns following a present worth buy, I’ll assess income development, margins, and exit multiples.

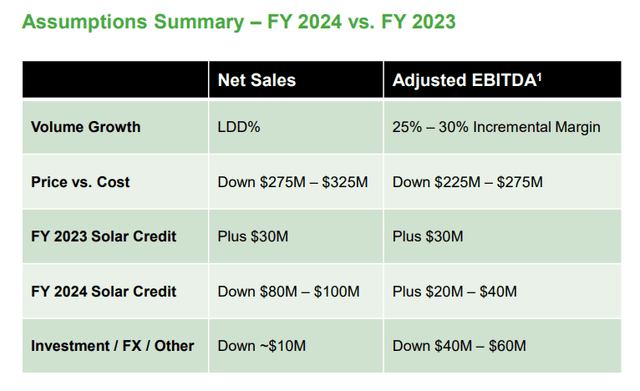

Management’s FY2024 guidance anticipates a income development of roughly 2%. Whereas this will likely appear modest, a better look reveals that the expansion composition contains low double-digit quantity growth, offset by worth reductions and different one-off detractors. Assuming steady costs and the decision of those one-offs, a rise of 3-4% for acquisitions, and at the least 5% for quantity appears sensible. Nevertheless, to be conservative I’ll estimate 5% annual income development for the following 5 years.

Atkore FY2023 Investor Presentation

If these assumptions maintain, sustaining present margins, and making use of exit multiples of 10x EV/EBITDA and 15x Free Money Circulate, a projected worth per share of roughly $300 USD might be anticipated. This projection implies a sexy annual return of 15% over the following 5 years.

Creator’s Illustration

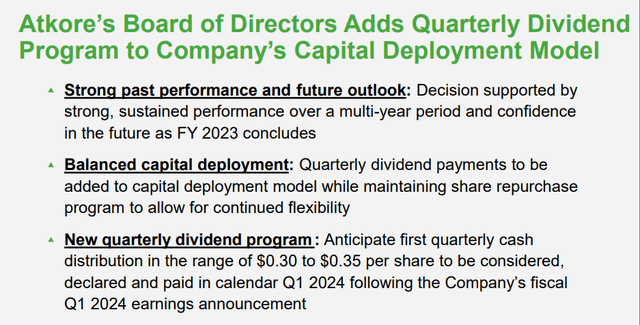

Moreover, administration’s plans to provoke dividend distribution in FY2024 add additional worth. For Q1 2024, they anticipate distributing between $0.30 and $0.35 per share, leading to a modest dividend yield of round 0.8% when annualized. This distribution represents round 10% of the Free Money Circulate generated within the final 12 months.

Atkore FY2023 Investor Presentation

Dangers

Whereas the funding thesis for Atkore seems compelling, it is important to acknowledge the potential dangers that the corporate faces.

Firstly, Atkore’s monetary efficiency is inherently tied to general financial circumstances. Financial downturns can result in delays or reductions in development and infrastructure tasks, impacting the demand for Atkore’s merchandise. Regardless of the corporate having tailwinds for future development, it stays prone to financial cycles.

Furthermore, Atkore operates in a aggressive market the place competitors from different producers {of electrical} raceway and cable administration merchandise might affect market share and pricing dynamics. Whereas elements like fame and reliability play a basic position in clients’ selections, it is also true that there’s restricted differentiation amongst merchandise supplied by Atkore and rivals corresponding to nVent. This aggressive panorama provides a further layer of consideration when assessing potential dangers for the corporate.

Last Ideas

After I first encountered Atkore, the corporate had not but reported outcomes for FY2023, and uncertainties lingered concerning the trajectory of its efficiency within the coming years, significantly amid a decline in income. The panorama has since developed, and it seems that the downturn has bottomed out, with gradual indicators of development rising.

Notably, the corporate had demonstrated sturdy development via worth will increase and strategic acquisitions, but quantity remained a problem. Nevertheless, there are indications that this facet can be present process optimistic adjustments. Coupled with a proactive capital allocation technique and a sexy valuation, the present outlook positions Atkore as a promising funding.

Contemplating the corporate’s optimistic attributes and the mitigated dangers, I’ve determined to assign Atkore a ‘purchase’ ranking.