Matt Cardy

Introduction

It is time to talk about an organization I’ve by no means lined earlier than. It is also an organization that does not essentially match my technique, as I are likely to keep away from corporations in low-barrier industries.

On this case, I am speaking about Domino’s Pizza (NYSE:DPZ), the world’s largest quick-service pizza restaurant.

I am writing this text due to two causes:

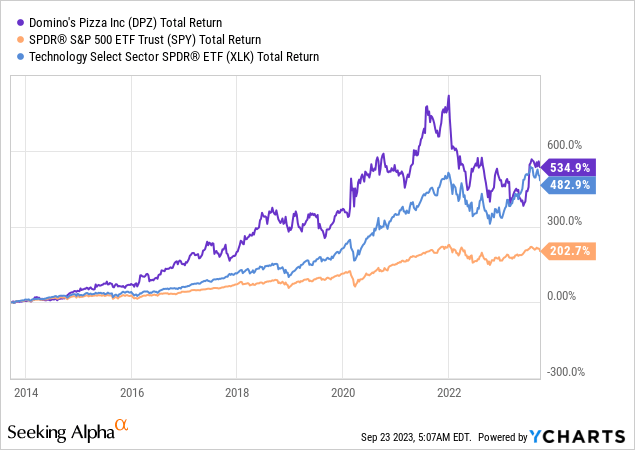

- It is time I talk about an organization that has not solely crushed the market over the previous 20 years but in addition crushed high-flying tech shares. Now, the corporate has been going sideways since 2020, as rising inflation is doing a quantity on shoppers. Getting insights into the corporate’s spectacular enterprise mannequin and the state of the patron is all the time fascinating – and necessary.

- Not solely is DPZ a formidable performer. It additionally has a historical past of aggressive dividend development and buybacks which can be more likely to proceed, thanks to the corporate’s capacity to innovate and develop in a really aggressive market.

So, with out additional ado, let’s get to it!

The DPZ Enterprise Mannequin

I’ve had Domino’s Pizza loads of occasions. I can not say that I choose it over conventional Italian pizza. Nonetheless, its enterprise mannequin is genius. Similar to McDonald’s (MCD), Domino’s has turn out to be a spot the place individuals know precisely what they’ll count on by way of service and high quality. It is also extraordinarily handy.

Relating to the worth it brings to the desk, the corporate goals for a simple mannequin the place all kinds of consumers discover meals gadgets they want at respectable costs.

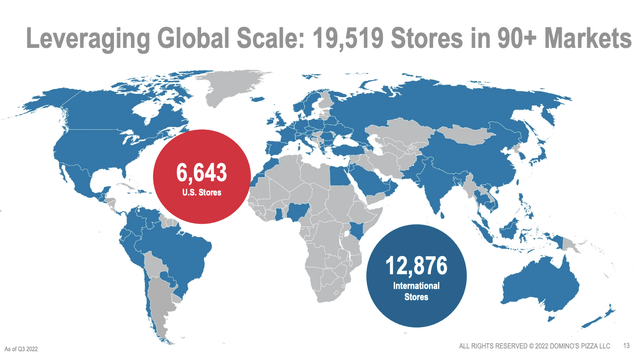

Going into this 12 months, the corporate had greater than 19,800 places in 90 markets.

Domino’s Pizza

Domino’s operates primarily within the domains of supply and carryout, and curiously, it primarily features as a franchisor, as nearly 99% of Domino’s world retailers are owned and operated by impartial franchisees, which exhibits simply how enticing the DPZ franchise mannequin is.

Additionally, due to this, the corporate makes most of its cash from its Provide Chain section. That is the section the place the corporate sells components to franchise shops.

| USD in Million | 2021 | Weight | 2022 | Weight |

|---|---|---|---|---|

|

Provide Chain |

2,700 | 62.0 % | 2,898 | 63.9 % |

|

U.S. Shops |

1,498 | 34.4 % | 1,487 | 32.8 % |

|

Worldwide Franchise |

298 | 6.8 % | 295 | 6.5 % |

|

Intersegment Revenues |

-139 | -3.2 % | -143 | -3.2 % |

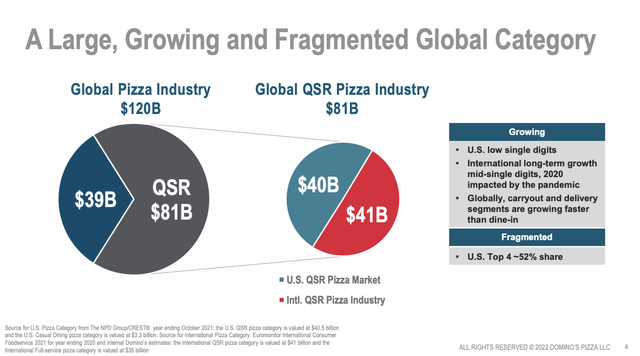

Having mentioned that, the worldwide pizza trade is estimated to be roughly $120 billion. Greater than $80 billion comes from QSR eating places. The U.S. dominates half of that market.

Domino’s Pizza

The 4 largest chains within the U.S. dominate 52% of that market, which exhibits simply how fragmented this trade is. In spite of everything, entry boundaries are low. Everybody could make a pizza.

Promoting it to the plenty with out dropping cash is the place it turns into tough.

Therefore, along with providing meals at enticing costs with fast service, Domino’s has made it its purpose to turn out to be much more handy.

Because the market chief in pizza supply within the U.S., Domino’s boasts roughly 32% share of supply {dollars} and round 19% share of carryout/drive-thru QSR pizza client spending.

To develop its footprint on this space, the corporate has turn out to be tech-focused.

Digital channels have turn out to be key, contributing to almost two-thirds of world retail gross sales.

The corporate has additionally developed numerous ordering platforms, incorporating GPS-enabled monitoring techniques, and launched a complete loyalty program, Piece of the Pie Rewards, geared toward enhancing buyer engagement and expertise.

Particularly on this financial atmosphere, loyalty applications intention to keep up good client relationships.

Domino’s Pizza

Even higher, Domino’s expertise is predicated on three pillars:

-

Predictive Insights: Using superior analytics and machine studying, Domino’s faucets into historic gross sales knowledge to precisely forecast product demand. This permits the corporate to handle stock effectively, minimizing wastage whereas assembly high-demand intervals.

-

Tailor-made Engagement: By complete buyer evaluation, Domino’s segments its clients primarily based on previous orders and preferences. This segmentation permits personalised advertising efforts and bespoke promotions, enhancing buyer loyalty and satisfaction.

-

Digital Developments: On the forefront of digital transformation within the meals trade, Domino’s has innovatively crafted its ordering app, streamlining the pizza ordering course of for customers throughout numerous units. Moreover, the app incorporates a real-time GPS monitoring system for patrons to observe their orders.

Whereas I do not need the info to again up that Domino’s meals is best, it does have expertise options that improve its margins and permit it to supply an excellent higher buyer expertise.

Taking Issues To The Subsequent Stage

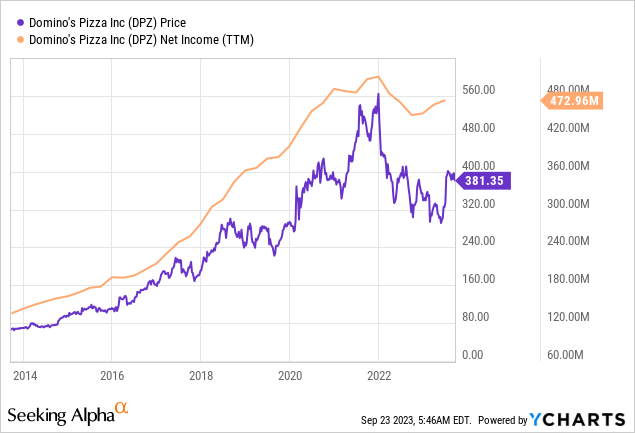

Domino’s is, indisputably, one of many best-performing corporations over the previous 20 years. Nonetheless, since 2020, its inventory value has gone sideways after peaking in 4Q21.

Like many different corporations, the pandemic resulted in too many traders betting an excessive amount of cash on a brand new restaurant atmosphere. When the pandemic ended, inflation soared, and traders rotated a reimbursement into non-pandemic shares. An excessive amount of development was priced in over the previous few years.

The excellent news is that whereas internet revenue has slowed, the corporate stays in a terrific place – even in mild of elevated inflation.

In the course of the second-quarter earnings name, the corporate offered insights into pricing methods, revealing a 3.9% common value improve throughout the U.S. system in 2Q23.

The corporate projected an identical pattern for 3Q23 earlier than a moderation to roughly 2% within the fourth quarter.

Domino’s additionally acknowledged the challenges within the U.S. supply enterprise, with the second quarter witnessing a decline in same-store gross sales of three.5%.

Nonetheless, the carryout enterprise remained sturdy, posting a robust same-store gross sales development of 5.6%.

Moreover, the corporate lined its world retail gross sales development outlook, aiming to trace between the low finish and midpoint of its two to three-year outlook of 4% to eight%.

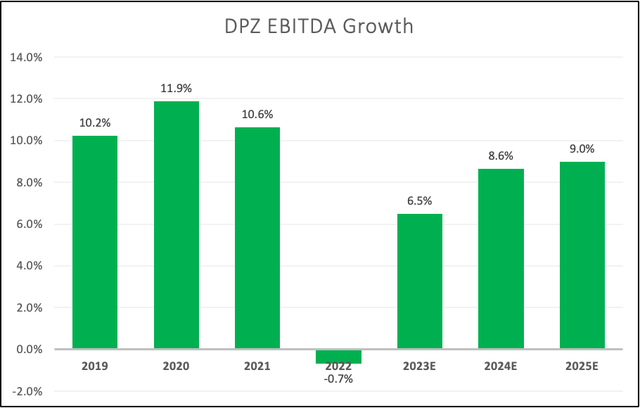

Having that mentioned, analysts count on the corporate to see a big rebound in development. 2022 was a really poor (post-pandemic) 12 months. 2023 is predicted to be higher. 2024 and 2025 are anticipated to see 9% development once more.

Leo Nelissen (Primarily based on analyst estimates)

Whereas I simply gave some 2Q23 numbers, the actual spotlight of the second-quarter earnings name was the corporate’s plans to seize extra development.

For instance, a big spotlight was the just lately introduced partnership with Uber Eats, which is predicted to considerably develop Domino’s supply buyer base.

The corporate made the case that the entry into the aggregator market, catering to almost $5 billion in gross sales for supply amongst U.S. quick-serve pizza eating places, presents a considerable alternative.

The transfer is projected to herald over $1 billion in incremental gross sales for Domino’s U.S. enterprise.

Reuters

The corporate can also be engaged on an even bigger share of the carryout market.

Regardless of this spectacular development, our present aspiration is to drive our carryout market share even additional to a minimum of the identical market share we take pleasure in in pizza supply right now. We have to earn a further 10 factors of market share to succeed in our justifiable share within the carryout section, and this 10 factors represents about $2 billion in extra retail gross sales. – DPZ 2Q23 Earnings Name

Throughout this month’s Piper Sandler Development Frontiers Convention, the corporate elaborated on these plans.

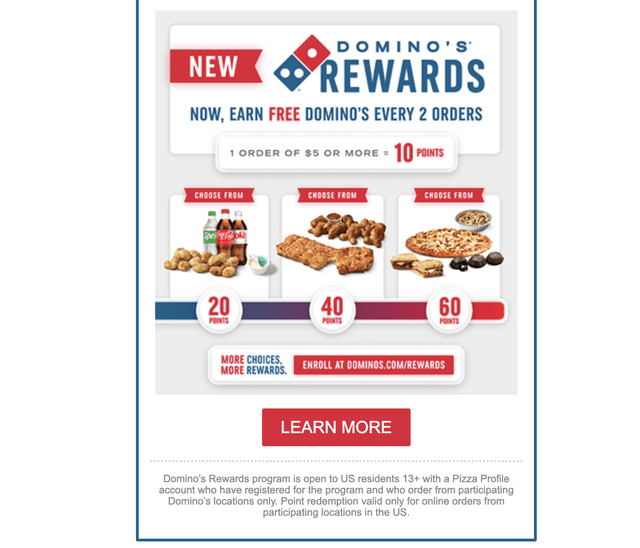

In the course of the convention, Joseph Jordan, the President of the U.S. enterprise at Domino’s, offered an in depth overview of Domino’s new rewards program.

This system, initially launched in 2015, aimed to stimulate incremental orders by growing loyalty and driving the expansion of the corporate’s carryout enterprise.

Nonetheless, by years of analyzing buyer interactions and suggestions, Domino’s realized the necessity for evolution to enhance engagement, particularly for patrons with fewer events.

Key adjustments in this system embody decreasing the earned threshold from $10 to $5, adjusting burn redemptions, and permitting for extra personalised incentives.

Domino’s Pizza

This revamped program is predicted to encourage each carryout and supply enterprise, attractive clients with factors for purchases, in the end resulting in elevated engagement and extra frequent transactions.

Whereas I am not a QSR skilled, this transfer is sensible to me, as we’re now in an atmosphere the place shoppers are watching each penny. It must be simpler to enter sure reward applications, not more durable. It is also a really low-cost technique to get clients to be extra engaged.

Having mentioned that, the corporate is NOT targeted on climbing costs in any respect prices. Its purpose is to thrive primarily based on volumes, and I consider its actions and development measures clearly replicate that.

After which, with pricing, to me, the pricing at Domino’s has all the time been volume-based. We actually need to have — on an order-by-order foundation, we need to make sure that our franchisees are making the revenue they should, and Sandeep talked to the rise in franchisee profitability. However then, as soon as the revenue per order is established, we’ve, what we name, a high-volume mentality. And so, we value for correct profitability on a per order foundation that can assist drive client to purchase Domino’s extra regularly. And in order that’s type of how we take a look at it. I do not count on to be on the excessive finish of pricing. What I count on to do — and I believe should you take a look at different eating places in our classes, I count on our franchisees to be on the excessive finish of profitability, whereas we’re providing best-in-class worth to clients. – DPZ 2Q23 Earnings Name

Whereas this atmosphere is actually unhealthy for corporations catering to on a regular basis shoppers as an alternative of high-end clients, this technique will doubtless preserve nice buyer relationships, positioning the corporate for quicker development as soon as we’re in a lower-inflation atmosphere – every time that could be.

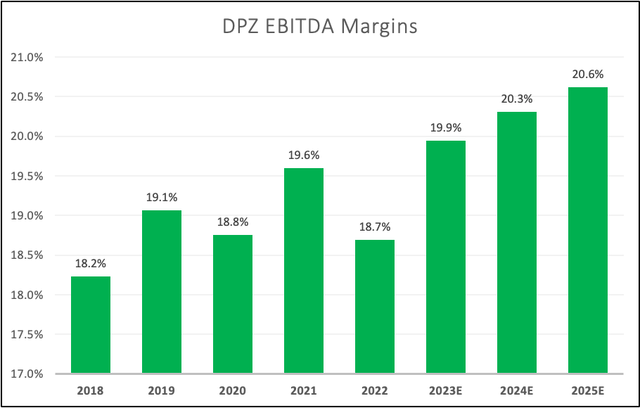

Taking a look at analyst estimates, we see an anticipated restoration in margins to greater than 20% by 2025E.

Leo Nelissen (Primarily based on analyst estimates)

The corporate additionally stays in an awesome spot to reward traders.

The DPZ Dividend

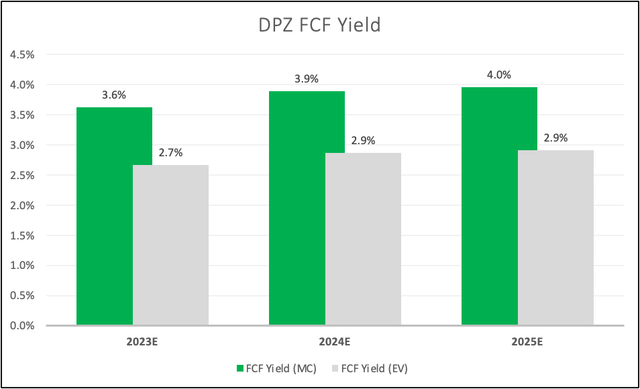

Domino’s has a historical past of serious shareholder distribution development. The corporate, which is predicted to finish this 12 months with a 5.4x internet leverage ratio, has a dividend yield of 1.3%.

That is nothing to jot down house about. Nonetheless, it is backed by a 35% payout ratio and a 33% 2024E money payout ratio, utilizing anticipated free money circulation (as seen within the overview beneath).

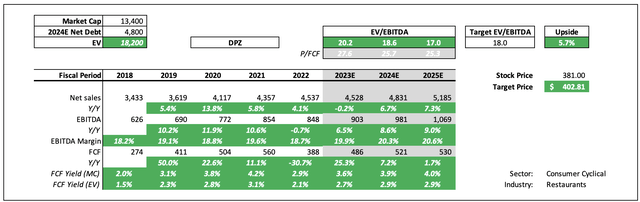

Leo Nelissen (Primarily based on analyst estimates)

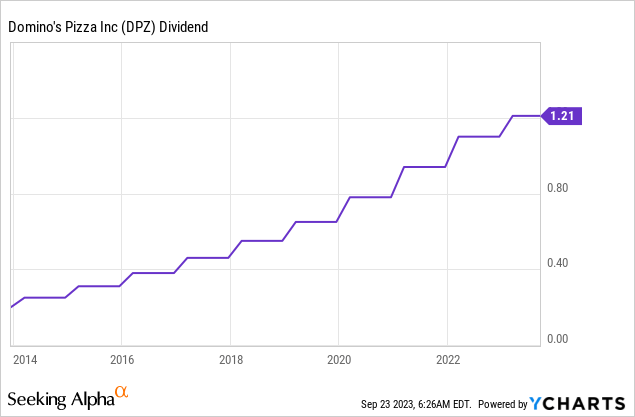

Over the previous 5 years, the typical annual dividend development price was 17.5%.

On February 23, the corporate hiked by 10%.

It has hiked its dividend for 9 consecutive years.

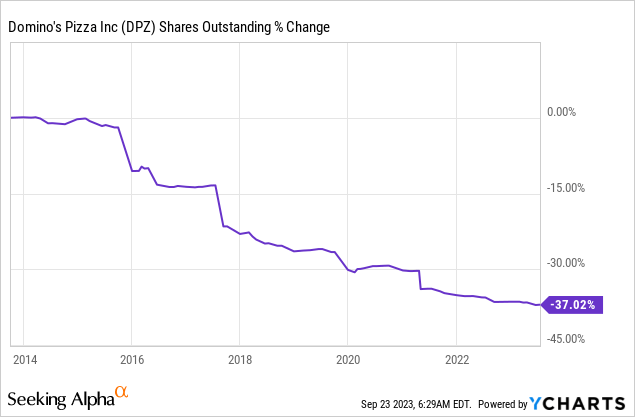

Over the previous ten years alone, DPZ has purchased again 37% of its shares. This has considerably added to its spectacular inventory value efficiency.

Going ahead, I’ve little doubt that dividend development and buybacks will stay elevated.

Valuation

It is a little bit of a problem. Domino’s is not insanely overvalued, but it surely additionally does not provide the worth I want to see in an economic system that might very effectively endure from extended sticky inflation.

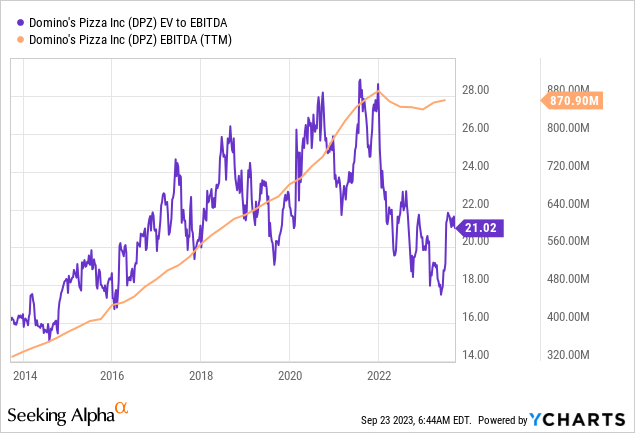

Over the previous ten years, shareholders have benefitted from rising EBITDA (and earnings) on high of a rising valuation a number of. The longer-term median valuation is roughly 20x EBITDA.

Assuming that EBITDA is now rising roughly 300 foundation factors slower in comparison with pre-pandemic ranges, I consider that an 18x a number of is acceptable. This provides the inventory a good worth of $403 per share.

Leo Nelissen (Primarily based on analyst estimates)

This means that my goal is 6% above the present value.

The present consensus value goal is $418.

On September 5, TD Cowen got here out, making the case for a possible upside to $500.

As reported by In search of Alpha:

The agency bumped the pizza maker’s score to Outperform from Market Carry out, forecasting “the attractive 2024-25 U.S. gross sales narrative from the Uber partnership & self- assist initiatives will drive optimistic gross sales revisions & natural EPS beats.”

TD Cowen’s valuation suggests favorable danger/reward of $343 draw back/$500 upside.

“We’re inspired by the soon-to-be launched playbook to ignite Domino’s U.S. supply turnaround balanced between the Uber partnership,” TD Cowen analysts led by Andrew M. Charles wrote in a observe.

Additionally taking part in in DPZ’s favor are a loyalty program that’s getting a refresh this month, a extra frequent cadence of menu innovation and a revamped e-commerce platform.

I agree with the financial institution. In spite of everything, we spent a complete article discussing the corporate’s many tailwinds.

Nonetheless, given my view on the economic system, I want a greater value earlier than making the case that DPZ is a must-own inventory.

What I’ll do is put DPZ on my watchlist. If the market provides us extra weak spot, I believe the inventory can be an awesome purchase, near $300-$320.

Takeaway

In analyzing Domino’s Pizza, it is clear that this world QSR large has efficiently navigated the unstable market and altering client landscapes.

The corporate’s progressive enterprise mannequin, rooted in comfort and bolstered by superior expertise, positions it as a robust client inventory able to aggressive development.

DPZ additionally has a historical past of rewarding shareholders by dividends and buybacks, which has boosted its complete return tremendously.

Whereas the current valuation will not be best, conserving a eager eye on potential market dips and aiming for an entry value round $300-$320 might provide a good danger/reward ratio for potential traders.