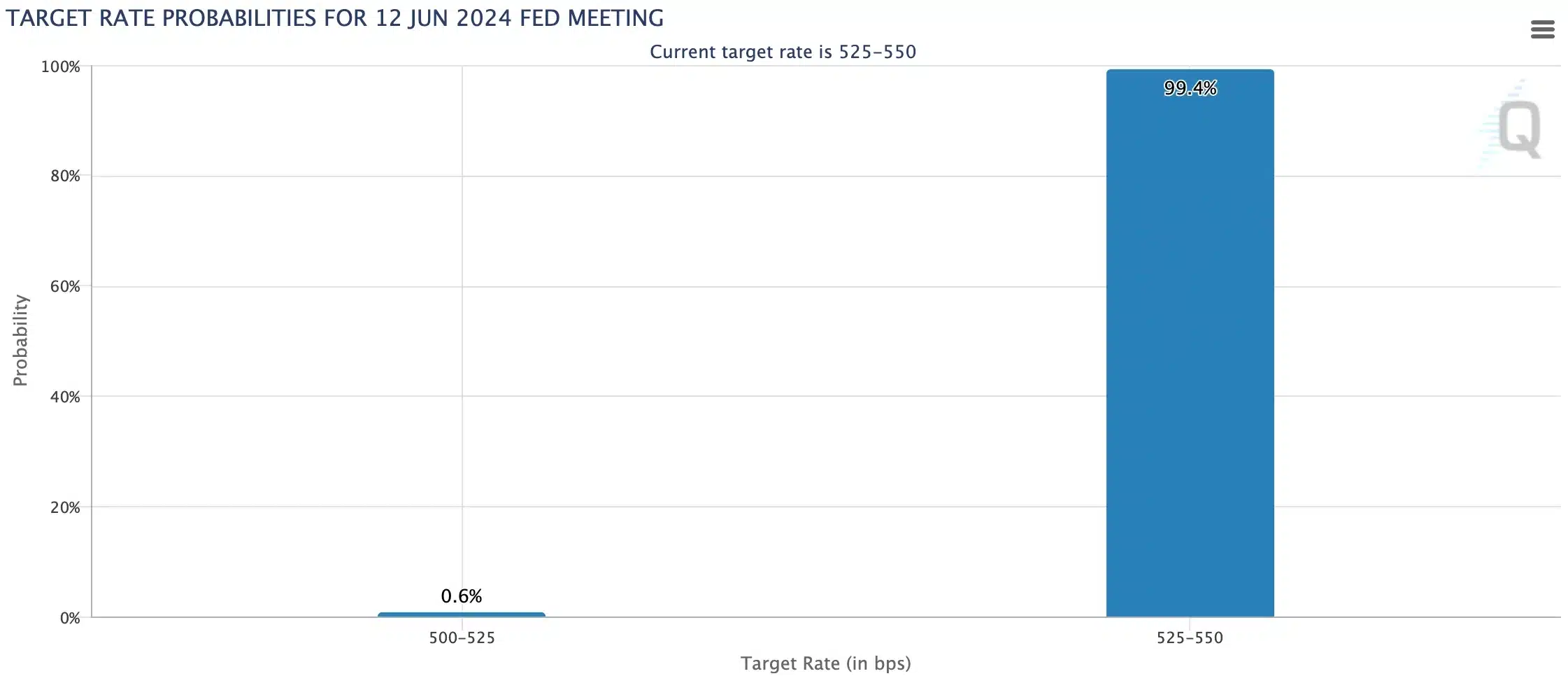

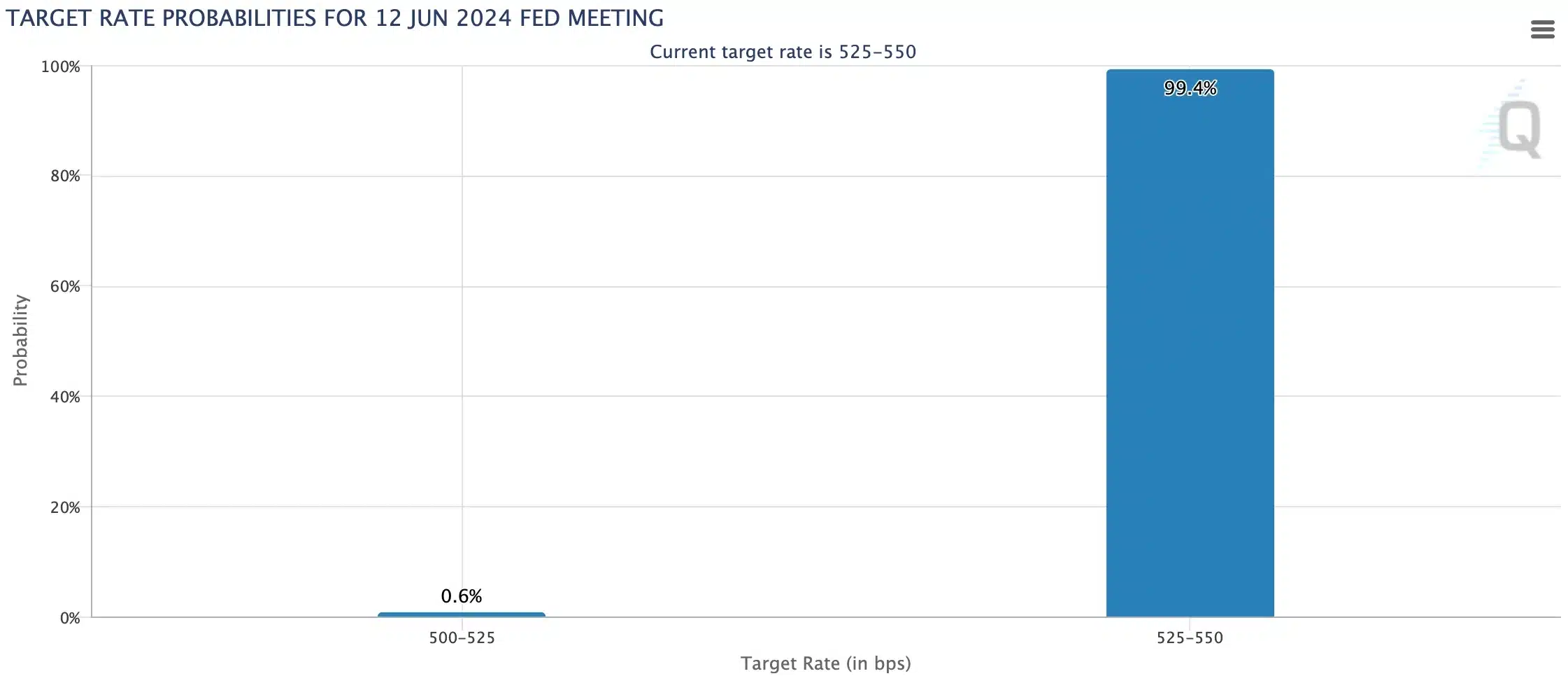

- The CME FedWatch Instrument has indicated a low chance of a lower.

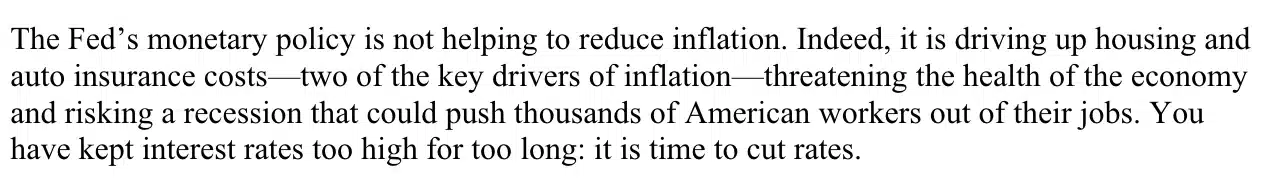

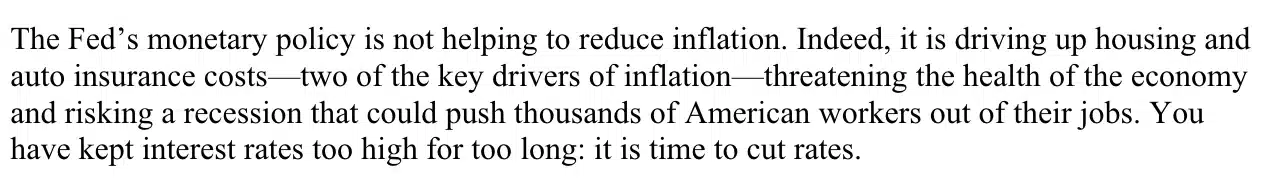

- Senator Warren’s letter hinted at Bitcoin’s bullish scenario.

With the Federal Open Market Committee (FOMC) assembly scheduled for the twelfth of June, the crypto group is abuzz with hypothesis about its impact on market dynamics.

Present indications counsel that rates of interest will seemingly stay unchanged. The truth is, the CME FedWatch Tool indicated at a mere 0.6% chance of a quarter-point price lower on the assembly.

Supply: CME FedWatch Instrument

In different information, Senator Elizabeth Warren wrote a letter to Federal Reserve Chair Jerome Powell on the tenth of June, urging for rate of interest cuts. The letter urged,

Supply: Warren.senate.gov

Influence on the crypto market

In line with CoinMarketCap, the worldwide crypto market was down by 0.45% over the past day on the time of writing, reflecting FUD (Worry, Uncertainty, and Doubt).

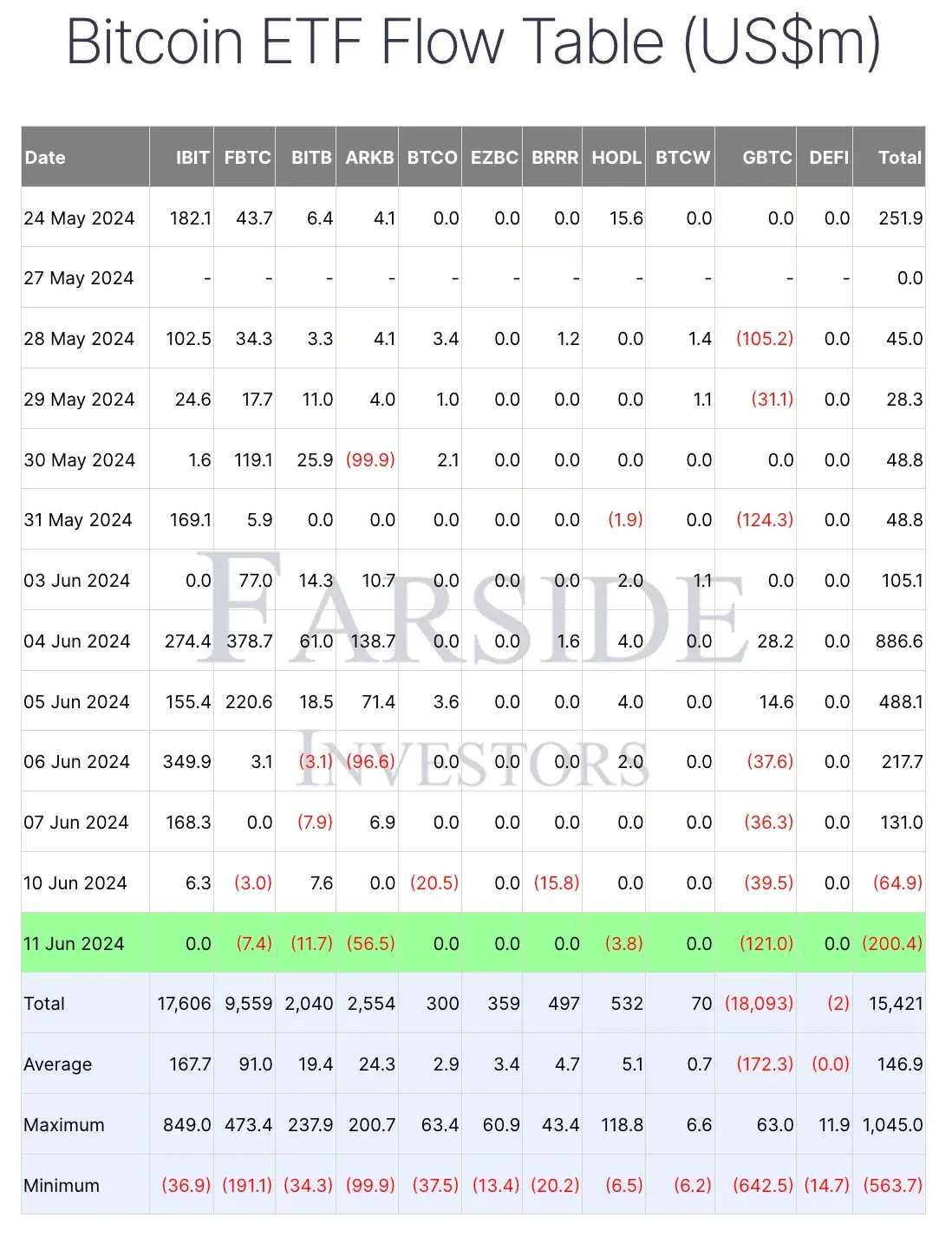

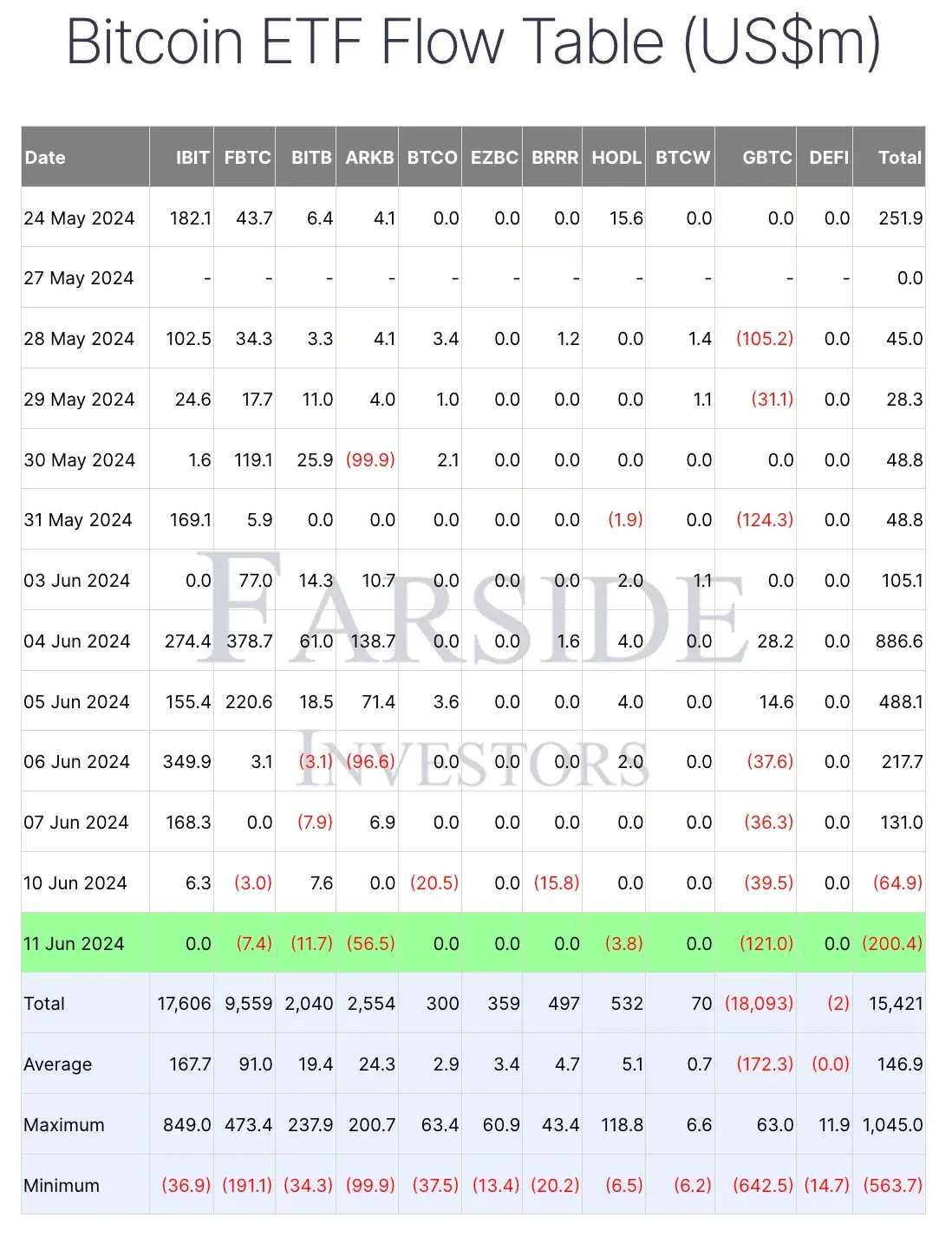

Furthermore, on the eleventh of June, Bitcoin [BTC] spot exchange-traded funds (ETFs) skilled important outflows of $200.4 million, with Grayscale Bitcoin Belief ETF (GBTC) main the pack as per Farside Investors.

Supply: Farside Buyers

Right here, it’s necessary to notice that price cuts typically result in bullish momentum for risk-on property like Bitcoin and cryptocurrency. So, Senator Warren’s enchantment may find yourself serving to Bitcoin and the crypto market usually.

Inflation stays sticky

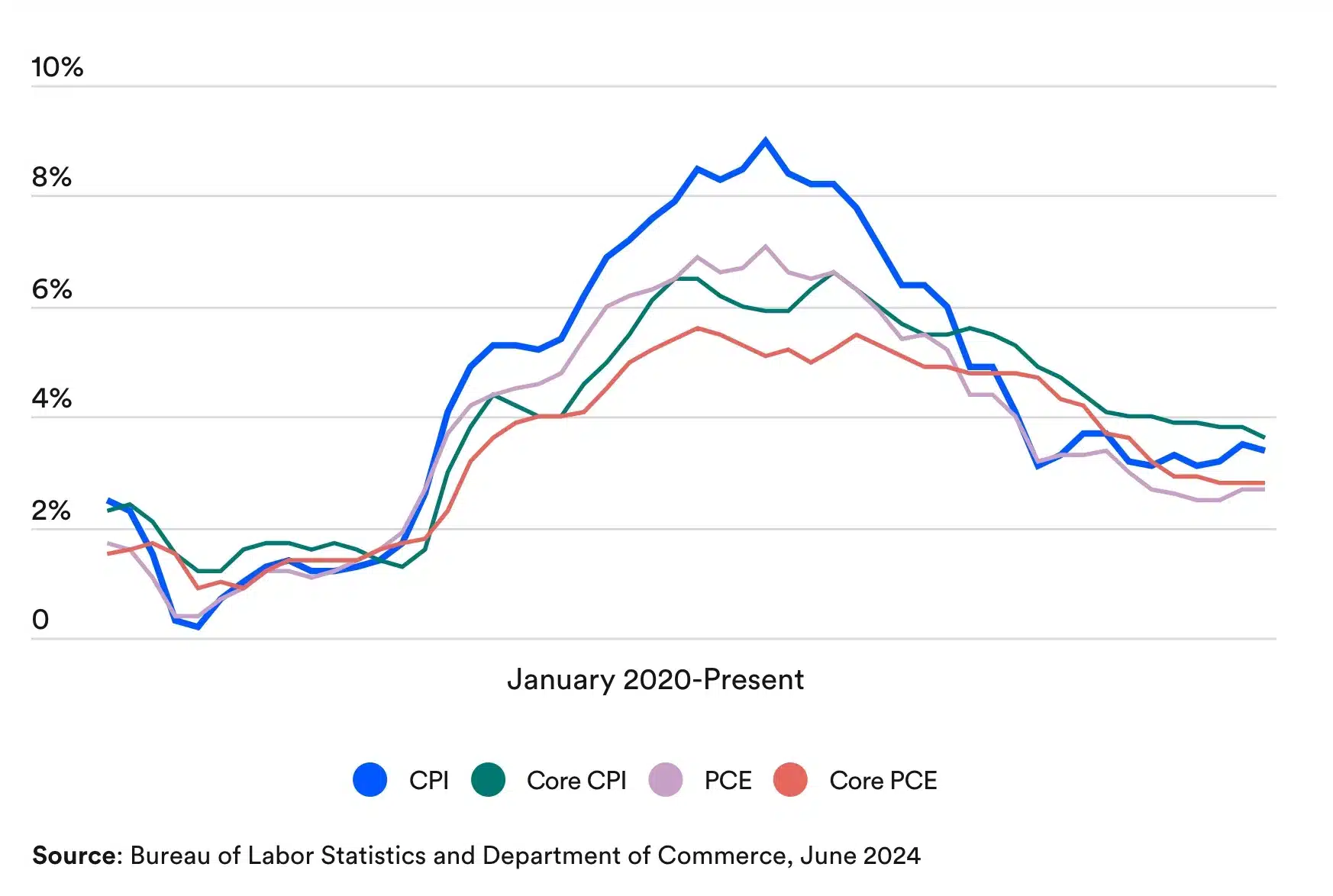

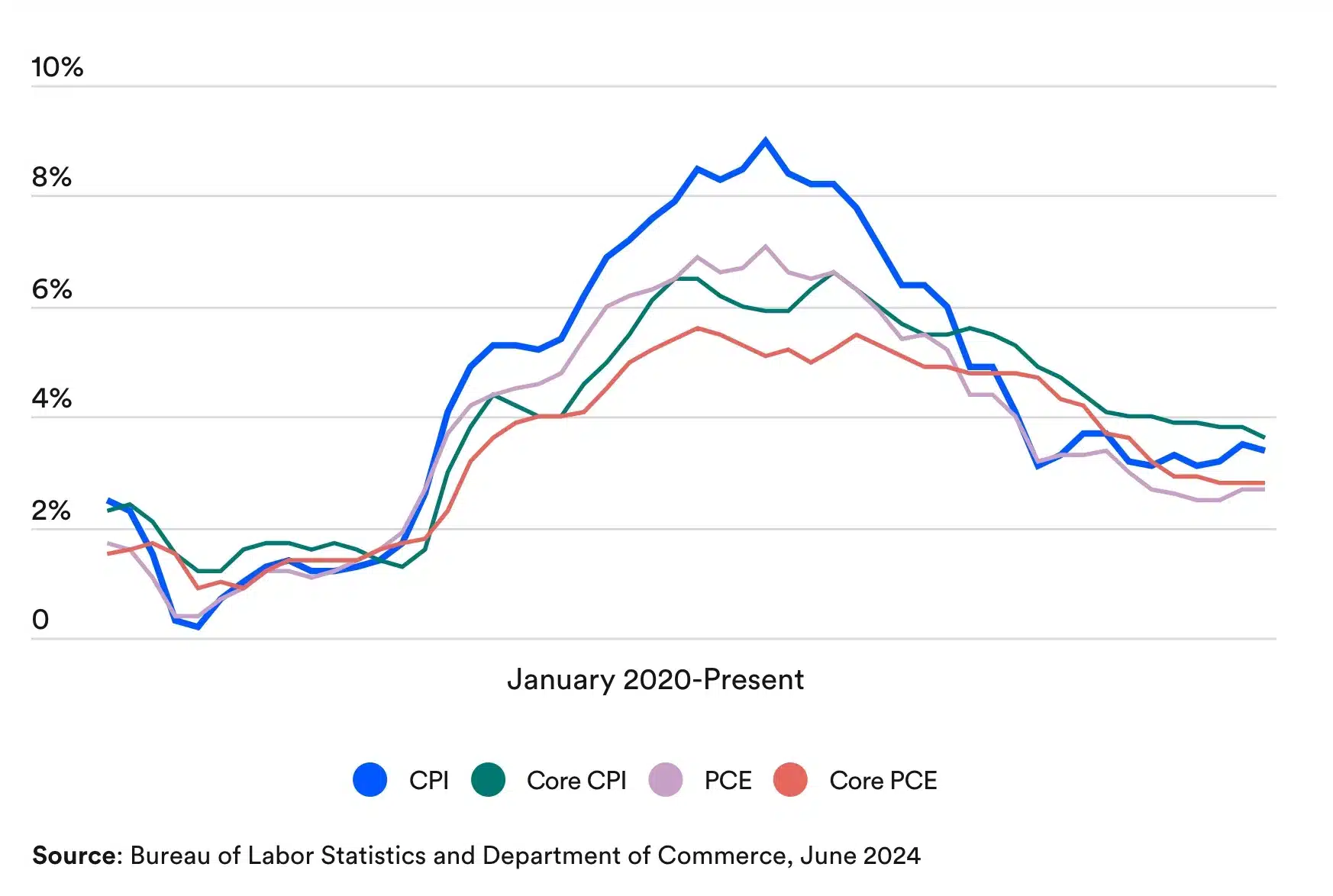

Evidently, the inflation price within the US has been a matter of concern for fairly a while.

In line with the Bureau of Labor Statistics and the Division of Commerce, the Federal Reserve’s most well-liked inflation measure, the Private Consumption Expenditures (PCE) index, has proven sooner enchancment in comparison with the Shopper Worth Index (CPI).

Nevertheless, each indicators point out persistent inflation.

Supply: Bureau of Labor Statistics and Division of Commerce

Optimism persists

Regardless of considerations, Michaël van de Poppe took to X (previously Twitter) and famous,

“It’s necessary to notice that worth motion will be trappy. If the speed choice is unchanged, the markets might need an preliminary response downwards, however normally, the actual transfer occurs at a later level.”

Additional elaborating on his perspective, he stated,

“Bitcoin rallied by greater than ten p.c after earlier FOMC occasions. Ethereum rallied by greater than twenty p.c after earlier FOMC occasions. Each of them corrected by the identical quantity earlier than the occasion, so a repricing again upwards appears affordable to count on.”

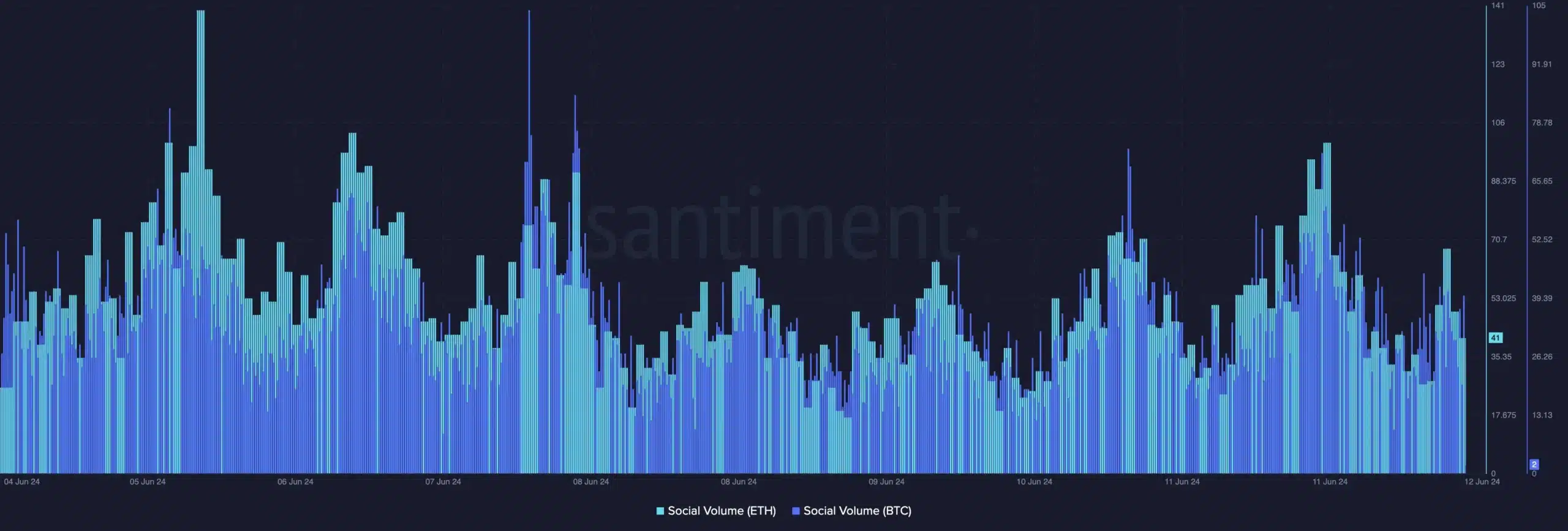

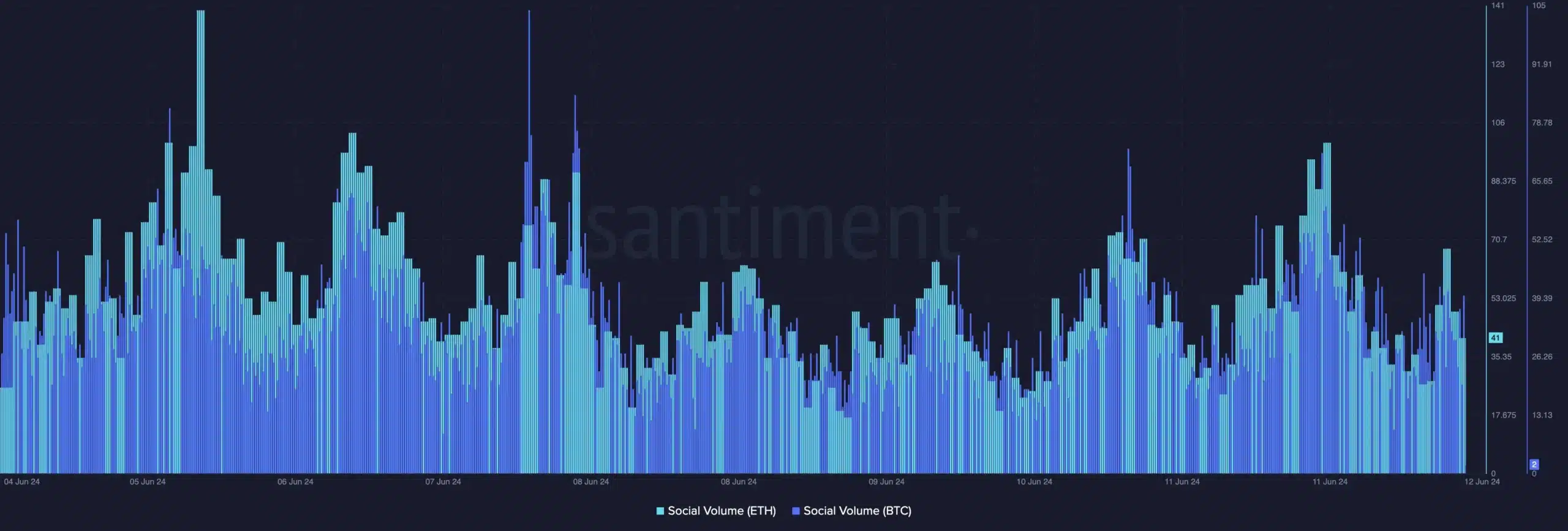

AMBCrypto’s evaluation of Santiment information additional confirmed this, revealing a major spike in social quantity for Bitcoin and Ethereum [ETH].

Supply: Santiment

Therefore, as everybody waits for the Fed’s choice on rates of interest, it could be attention-grabbing to see if historical past would repeat itself or if the market will endure the affect of the FOMC assembly.