- Bitcoin noticed short-term volatility enhance because the halving occasion drew nearer.

- The metrics forecast a bullish long-term future for Bitcoin.

Bitcoin [BTC] noticed a sudden drop in costs on the twelfth and thirteenth of April. The promoting stress heading into the weekend noticed BTC fall 14.5% from $70.9k on Friday to $60.6k to mark Saturday’s low.

This led to concern within the altcoin market and contributed to widespread promoting stress.

Market contributors who’ve referred to as for a prime because the halving approaches can be ecstatic, however this view may very well be myopic. The long-term development stays firmly bullish. An inflow of recent traders was nonetheless underway.

The lifeblood of the bull run

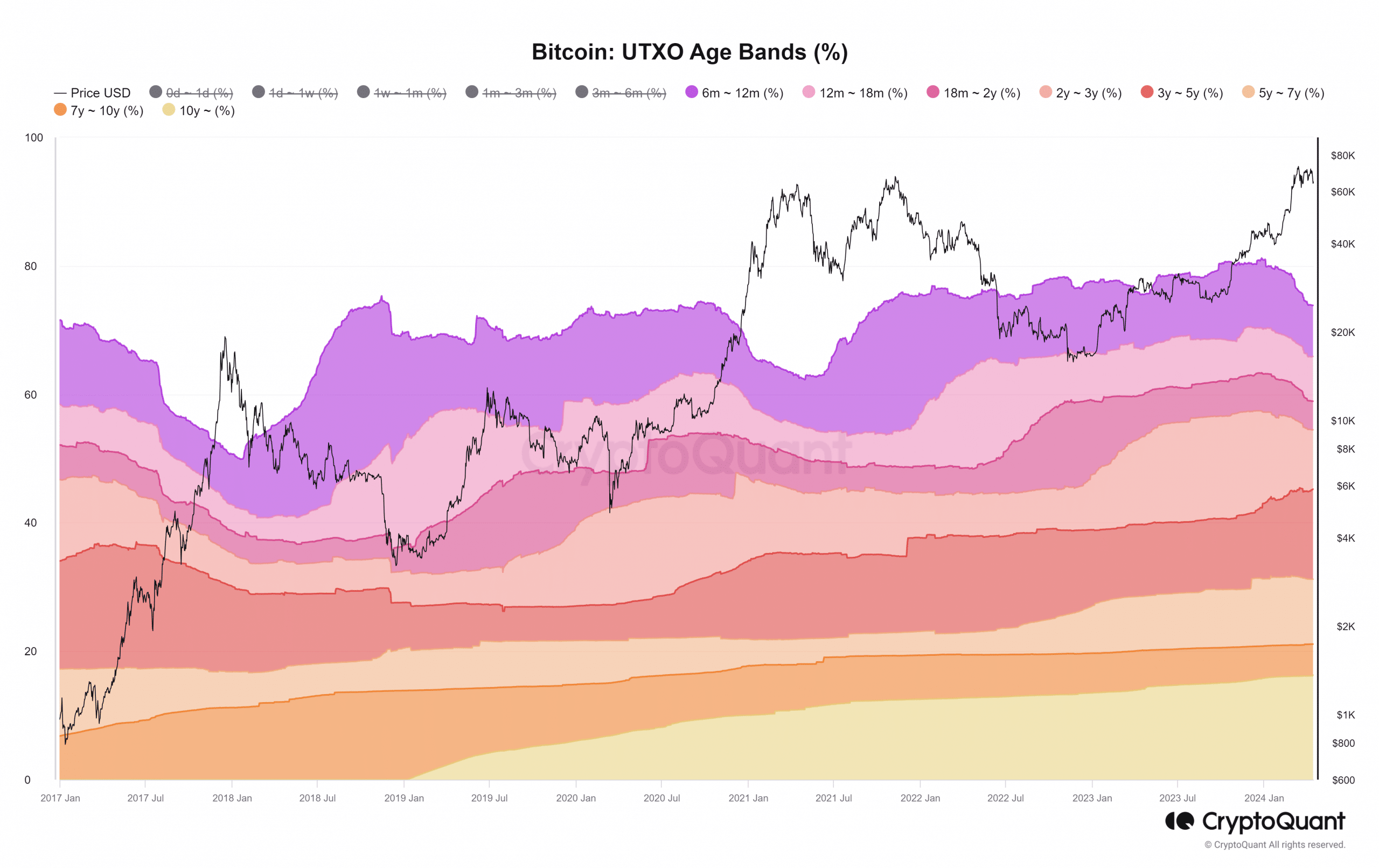

A CryptoQuant Insights submit by analyst Crypto Dan famous a lower within the proportion of Bitcoin held for greater than six months. This was evident from the Bitcoin UTXO Age Bands % metric.

This decreased proportion implied that newer traders had been coming into the market. This new demand is the gas that will spark the following run. In line with the analyst, this run has been in place for 3 months.

AMBCrypto’s evaluation of the identical metric additionally revealed one other fascinating issue. Previously two cycles, the 6-12-month-old BTC proportion drop through the bull run has been the steepest.

The weeks following the cycle prime noticed the identical age band development larger.

In 2021, this uptrend solely got here after the downtrend flattened out for 3 months.

This steered that traders might look ahead to the 6-12 month age band to type a month-long sideways development earlier than seeking to promote their BTC.

This is only one piece of the advanced puzzle, and traders should even be utilizing different metrics and market developments to make that call.

Among the different metrics that might mark a cycle prime

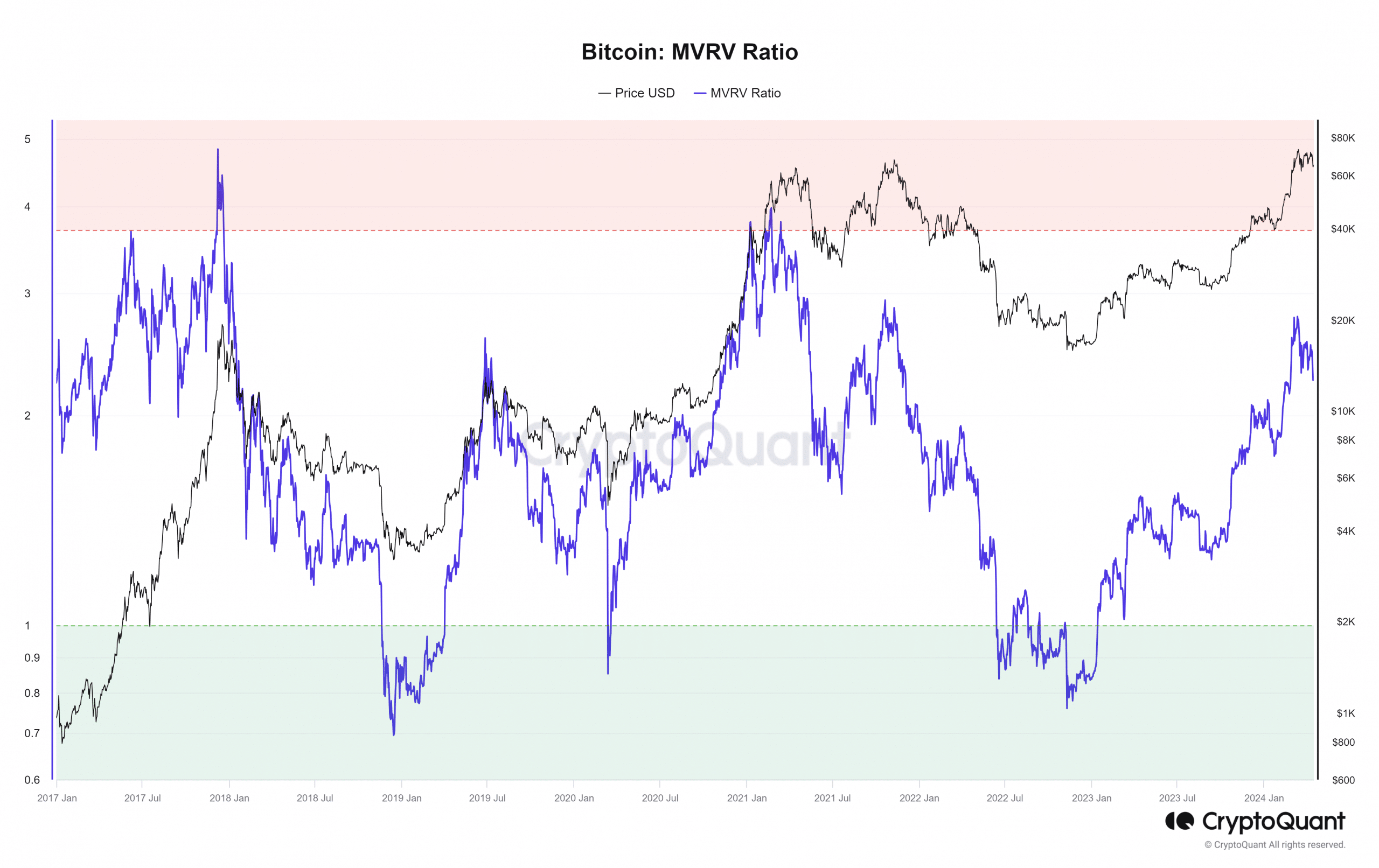

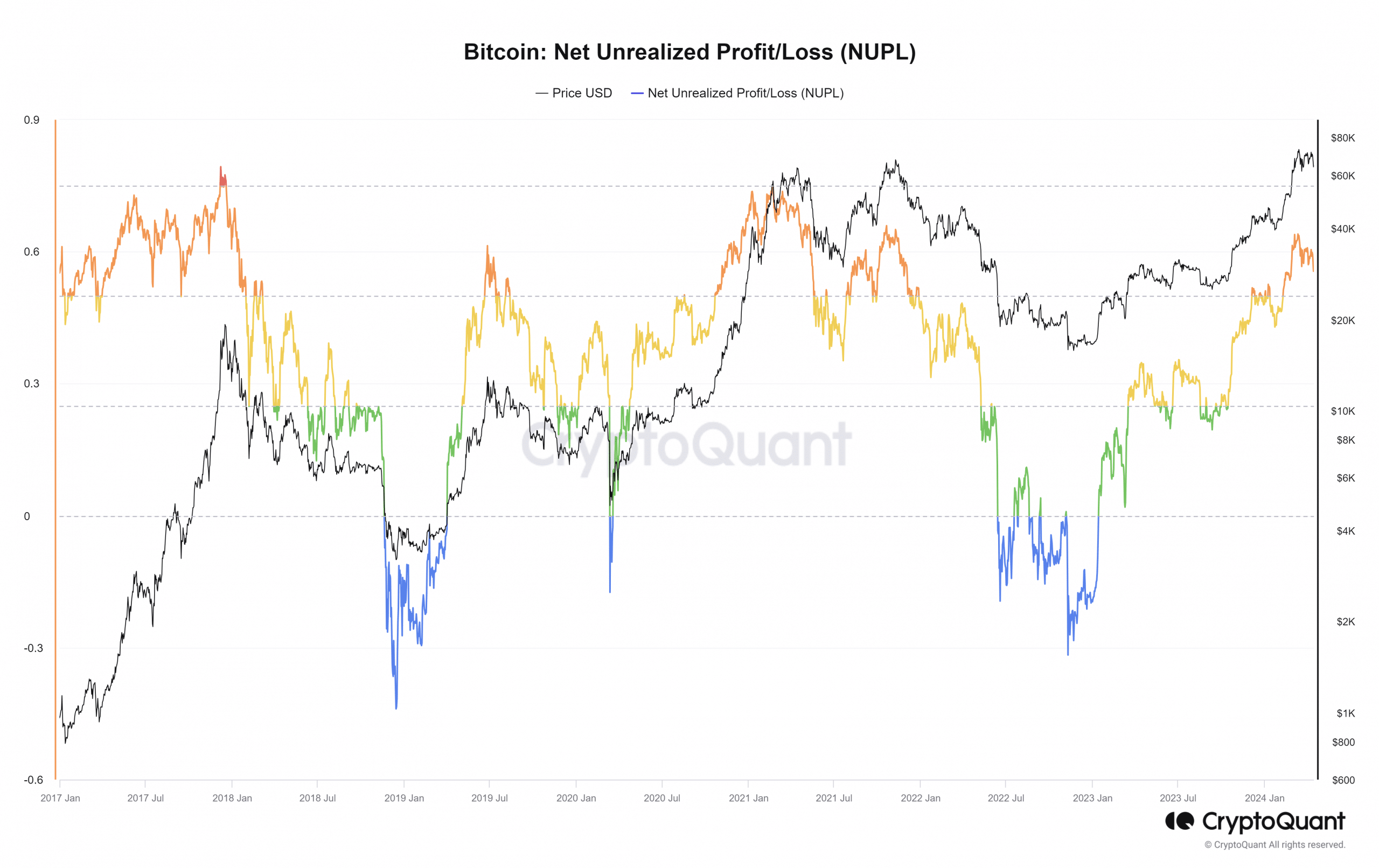

Two of the most well-liked Bitcoin long-term metrics are the MVRV ratio and the Web Unrealized Revenue/Loss (NUPL). They, too, mirrored the bullish state of the market in current months.

The MVRV ratio was at 2.25 on thirteenth April. That is nicely under the three.7 mark that has traditionally marked the cycle tops. The worth development of the previous few months noticed the MVRV ratio development larger.

The that means is that the market cap of Bitcoin has elevated sooner than the realized cap of Bitcoin. In different phrases, the motive to promote has been rising however was not crucial but.

Equally, the NUPL was additionally rising, exhibiting that it was extra worthwhile to promote Bitcoin as the costs climbed.

With a studying of 0.55 on the thirteenth of April, there was nonetheless some strategy to go for the metric to succeed in the 0.7 mark that has marked cycle tops up to now.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Buyers can regulate the conduct of all three metrics within the coming months to know simply how shut Bitcoin is to this run’s prime.

Nevertheless, it must be remembered that the Bitcoin ETFs are a colossal new addition to the market. It’s distinctive to this cycle, and the results of such behemoths available on the market are onerous to foretell.