- The altcoin market cap elevated in opposition to the Bitcoin market cap fall.

- The launch of the spot Ethereum ETFs may ship Bitcoin dominance additional down.

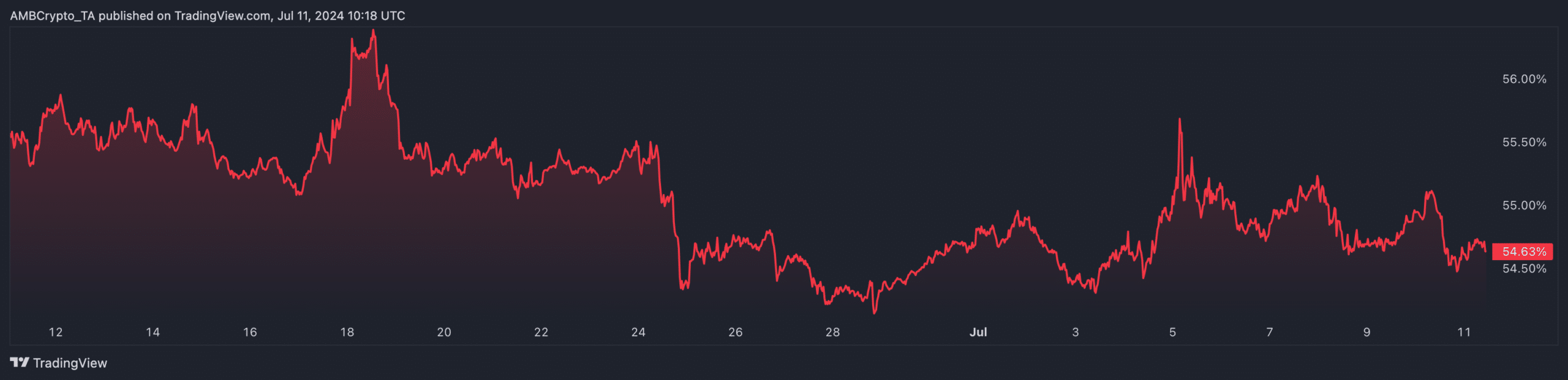

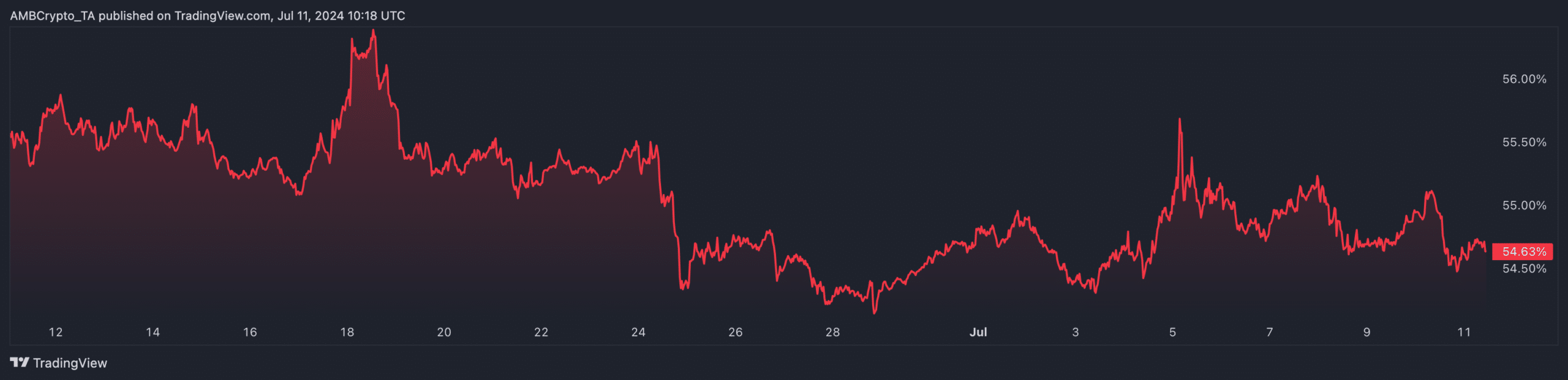

AMBCrypto’s evaluation revealed that the Bitcoin [BTC] dominance chart has been lowering. On the tenth of July, the dominance was 55.10%. Nonetheless, at press time, it was right down to 54.62%.

Bitcoin dominance is a vital indicator of BTC’s value. It’s because it exhibits how the coin’s market cap compares to the market cap of different cryptocurrencies.

Can BTC dominance proceed?

If Bitcoin’s dominance will increase, it implies that the coin is outperforming the typical altcoin. Nonetheless, when it decreases, it signifies that BTC is dropping momentum and altcoins are performing higher.

On a Yr-To-Date (YTD) foundation, the cash have carried out higher. However during the last month, and in latest occasions, the alternative has been the case. If this continues, Bitcoin may fall additional regardless of the correction it has had.

Supply: TradingView

At press time, BTC modified palms at $58.257. This represented a 1.37% improve within the final seven days. Nonetheless, an indicator to verify if Bitcoin is starting to lose it superiority is the TOTAL2.

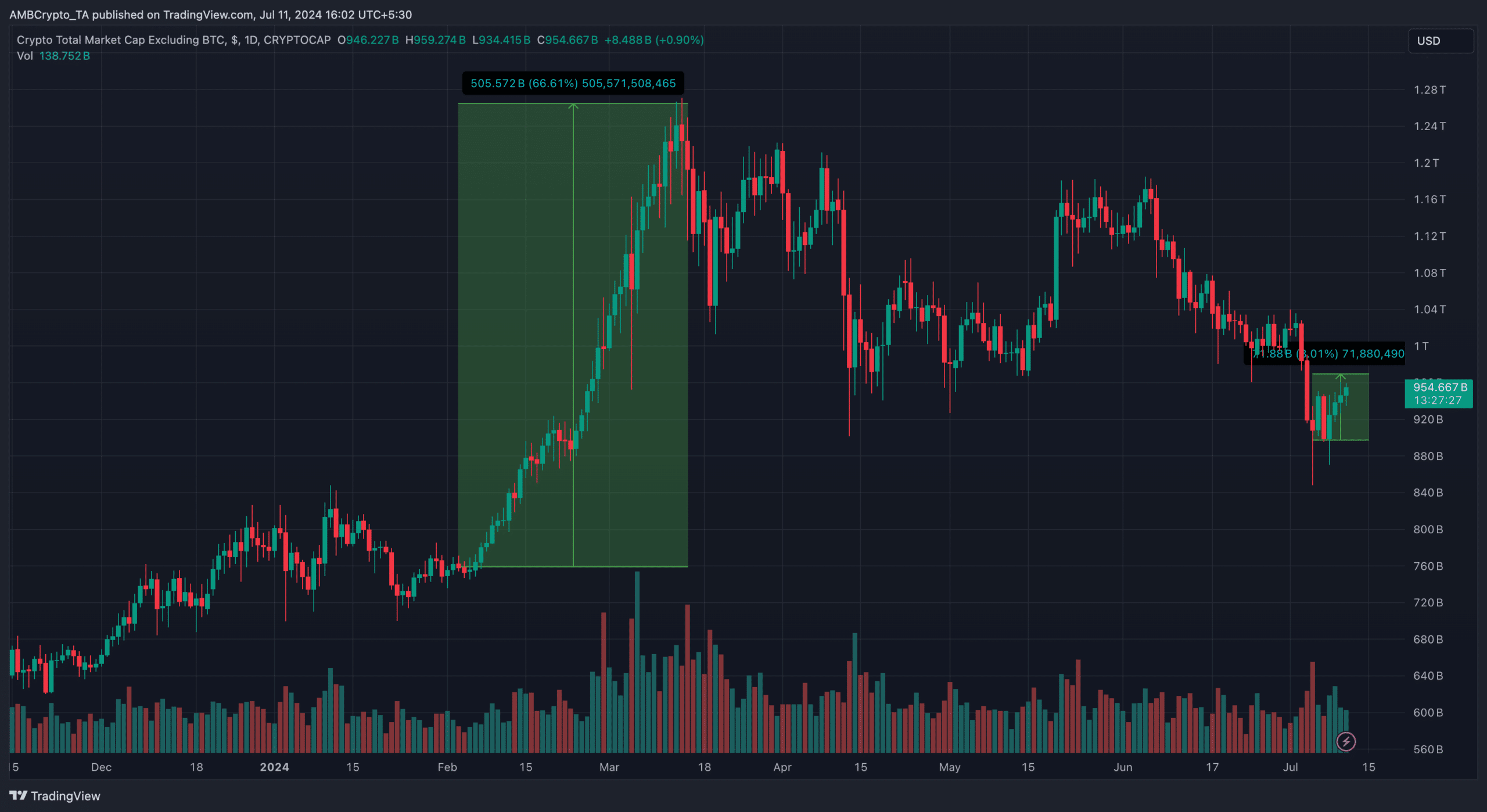

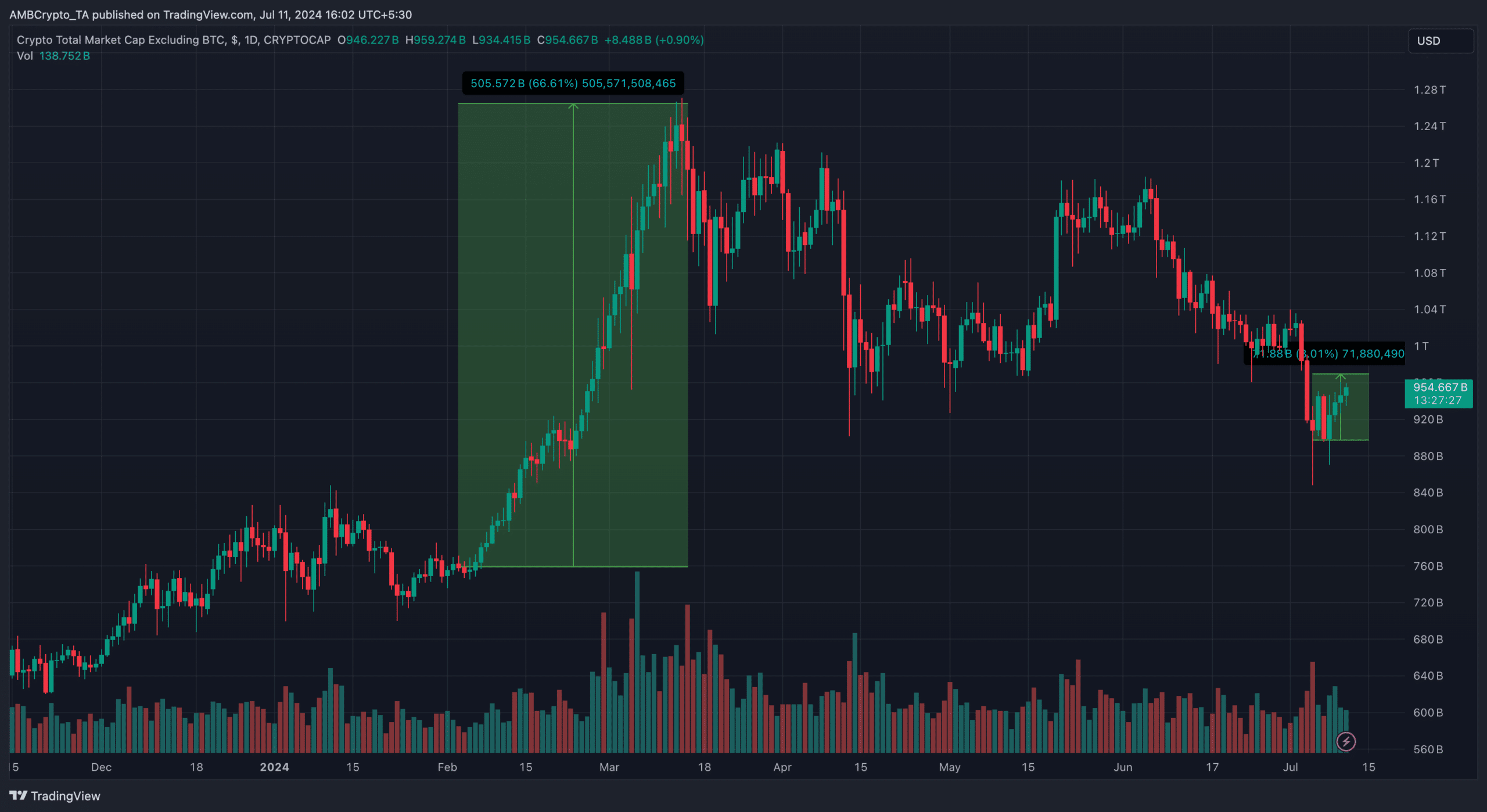

The TOTAL2 is also called the full market cap of the crypto market excluding BTC. If it will increase, it means altcoins are exhibiting a stronger efficiency than Bitcoin.

However when it decreases, it implies that BTC is main the market resurgence.

Between the fifth of July and the time of writing, the TOTAL2 has risen by 8.01%, indicating that the costs of the typical altcoins have been higher than Bitcoin dominance.

Altcoins are ready to present the king a struggle

The final time, the indicator took such steps, the market cap jumped by 66.61% between February and March because the market cap additionally crossed $1.20 trillion. At press time, the market cap was $953.68 billion.

If this continues to extend, it may hit $1 trillion, probably driving a more in-depth transfer to the much-anticipated altcoin season. If this occurs, the BTC’s correction would proceed.

Supply: TradingView

One issue that may drive a rise within the dominance is Ethereum [ETH]. Traditionally, when ETH’s value efficiency higher than BTC, it provides energy to different altcoins.

In flip, it reduces Bitcoin dominance. One catalyst market members are wanting ahead to is the launch of the spot Ethereum ETFs.

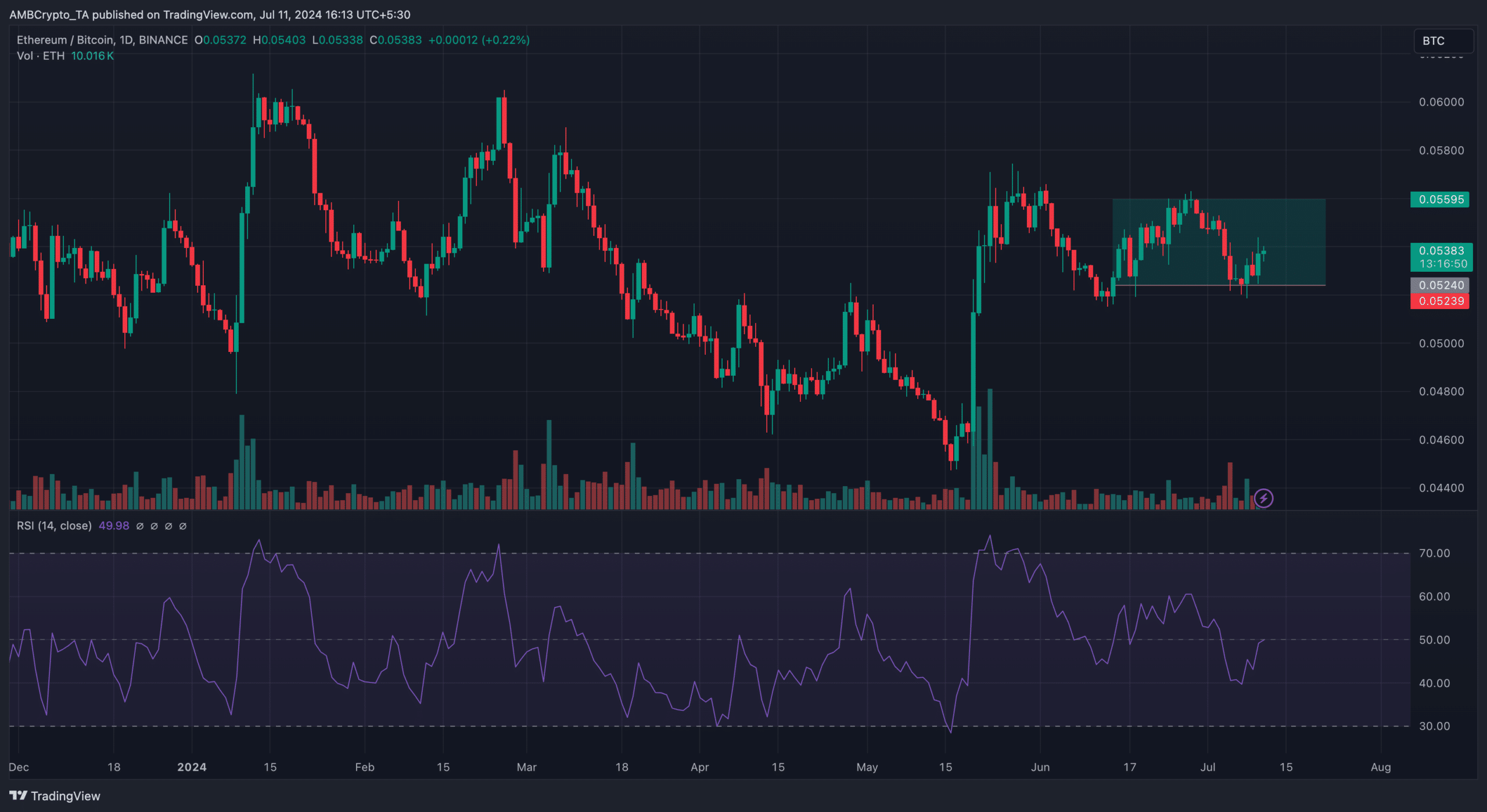

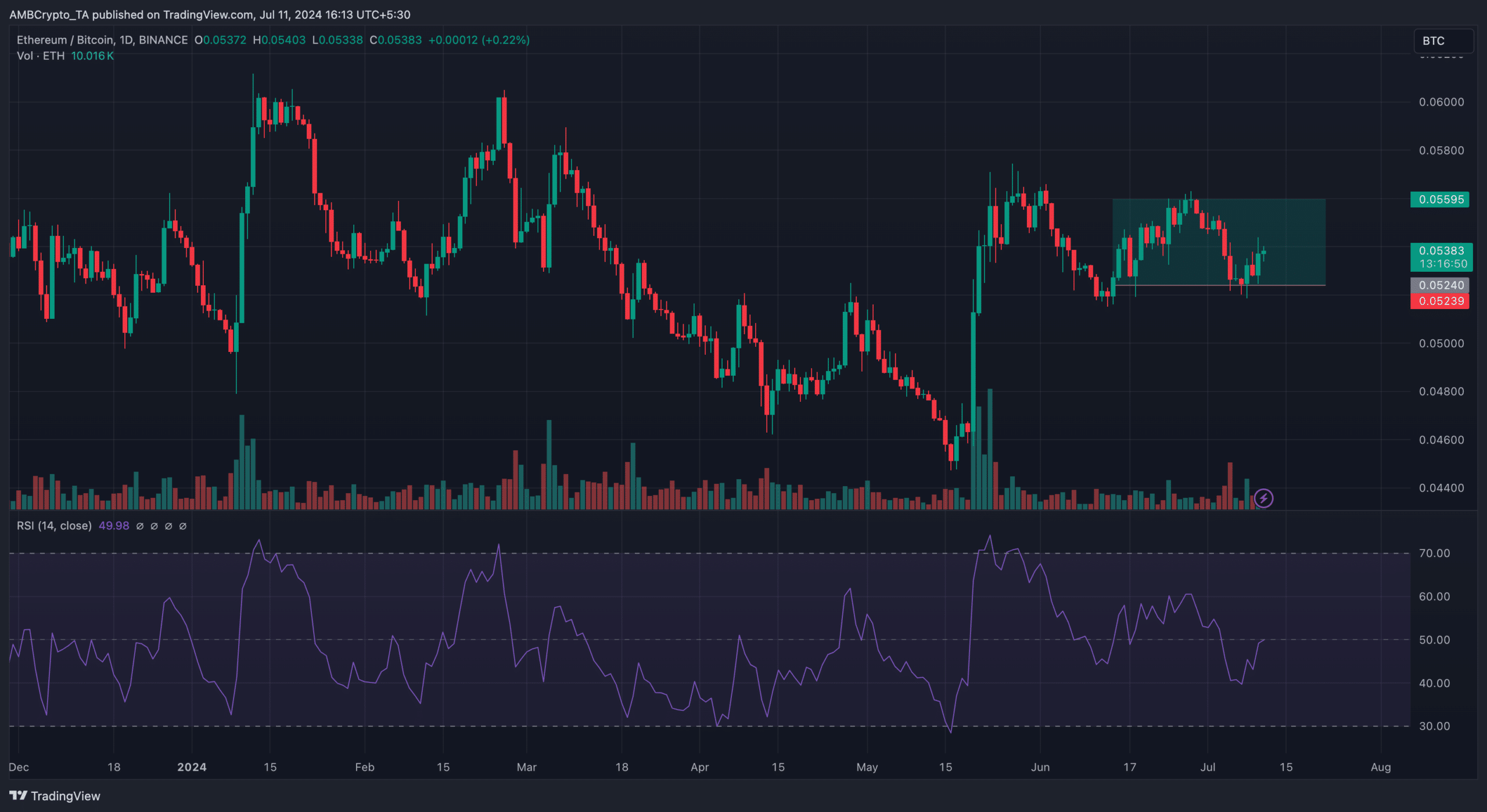

Nonetheless, additionally it is vital to have a look at the ETH/BTC chart to see if the altcoin would take over Bitcoin dominance within the coming weeks.

When the ETH/BTC will increase, it implies that Ethereum is outperforming Bitcoin. However a lower suggests in any other case. Beforehand, the ETH/BTC ratio was 0.051.

Supply: TradingView

Real looking or not, right here’s BTC’s market cap in ETH phrases

However as of this writing, that has elevated to 0.053, that means 1 ETH equaled 0.053 BTC. As well as, the Relative Power Index (RSI) revealed that ETH was gathering a great stage of momentum.

If sustained, this might drive the ratio to 0.056, and attainable ship Bitcoin dominance down.

![As Bitcoin [BTC] dominance drops below 55%, is altcoin season here?](https://wearecryptonians.com/wp-content/uploads/2024/07/bitcoin-dominance-price-news-1-1000x600.webp)