- The altcoin market has remained bearish, with no vital development triggers.

- Analysts counsel a possible restoration solely after Bitcoin achieves a $100,000 milestone.

The cryptocurrency market has been witnessing a considerable downturn within the altcoin sector, which has struggled to realize momentum amidst a broader market deal with Bitcoin [BTC].

In latest weeks, the altcoin market cap skilled a major drop from its late Might peak of $1.182 trillion to a present valuation of simply over $1.06 trillion.

This shift displays a broader sentiment of warning and bearish momentum that appears to align with a scarcity of considerable new narratives driving investor curiosity in comparison with previous cycles, per analyst Crypto Ash.

Bitcoin waits for $100K

Crypto Ash pointed out that the much-anticipated ‘Mega Altseason’ stays elusive, as the overall altcoin market cap has regressed to ranges not seen since December 2023.

Present market circumstances present no vital drivers akin to earlier years’ improvements, leaving the altcoin sector in a state of limbo.

In line with Crypto Ash, the potential for vital altcoin rallies hinges on Bitcoin’s efficiency, suggesting that an actual altcoin season might not start till Bitcoin achieves the landmark value of $100K.

Within the meantime, he suggested that this era may very well be perfect for accumulating undervalued utility-based tokens.

He emphasised that though retail curiosity stays subdued, savvy buyers and whales are actively positioning themselves throughout this downturn, indicating a strategic buildup in anticipation of future beneficial properties.

In the meantime, Crypto Distilled, one other crypto analyst, has supplied insights into the circumstances needed for an altcoin rebound.

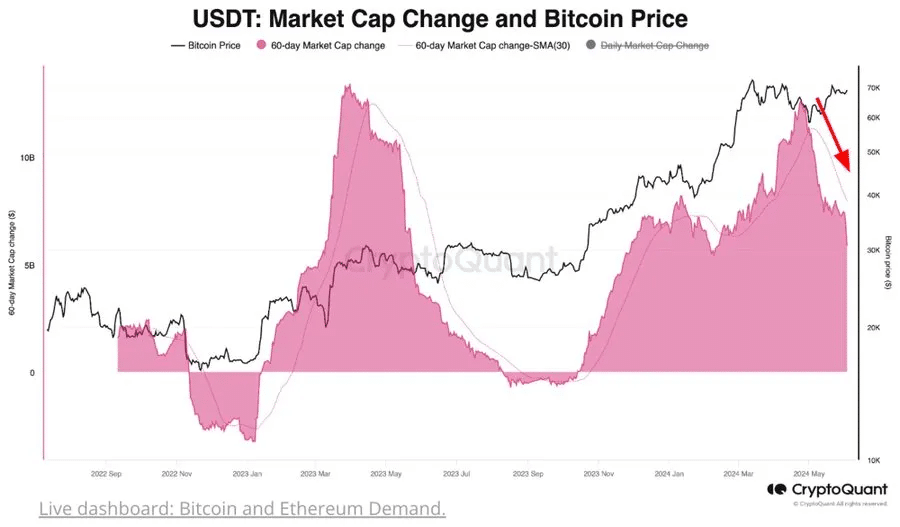

He emphasised the significance of liquidity, significantly from stablecoins like Tether [USDT], that are important for altcoin liquidity on decentralized exchanges (DEXes).

Supply: X/Crypto Distilled

He famous that USDT development has been minimal for the reason that eleventh of February, and a resurgence in stablecoin liquidity is crucial for a sustainable value rally in altcoins.

Moreover, Crypto Distilled steered monitoring the Sensible Contract Platforms index, as these platforms are important for decentralized functions (dApps) and considerably affect market developments.

The presence of Layer 1 governance tokens provides liquidity to their ecosystems, and the potential introduction of an Ethereum [ETH] ETF may very well be a major liquidity driver.

He disclosed that JamieCoutts, a chief crypto analyst, identified two essential indicators to observe: an uptrend within the Sensible Contract Platforms (SCP) sector and an increase within the Altseason Index.

Traditionally, an alignment of those developments has signaled substantial beneficial properties for altcoins, generally exceeding tenfold returns.

In his ultimate ideas, Crypto Distilled drew parallels with the final market cycle, the place Bitcoin responded strongly to post-COVID liquidity shifts.

He noticed that within the present local weather of world uncertainty, liquidity development has not been assembly expectations. So, this cycle might even see a deal with Bitcoin, with altcoin catalysts taking part in a background function.

Market dynamics and investor habits

The disparity in efficiency between Bitcoin and altcoins is stark. As Bitcoin approaches its all-time highs, altcoins flounder, mimicking bear market circumstances.

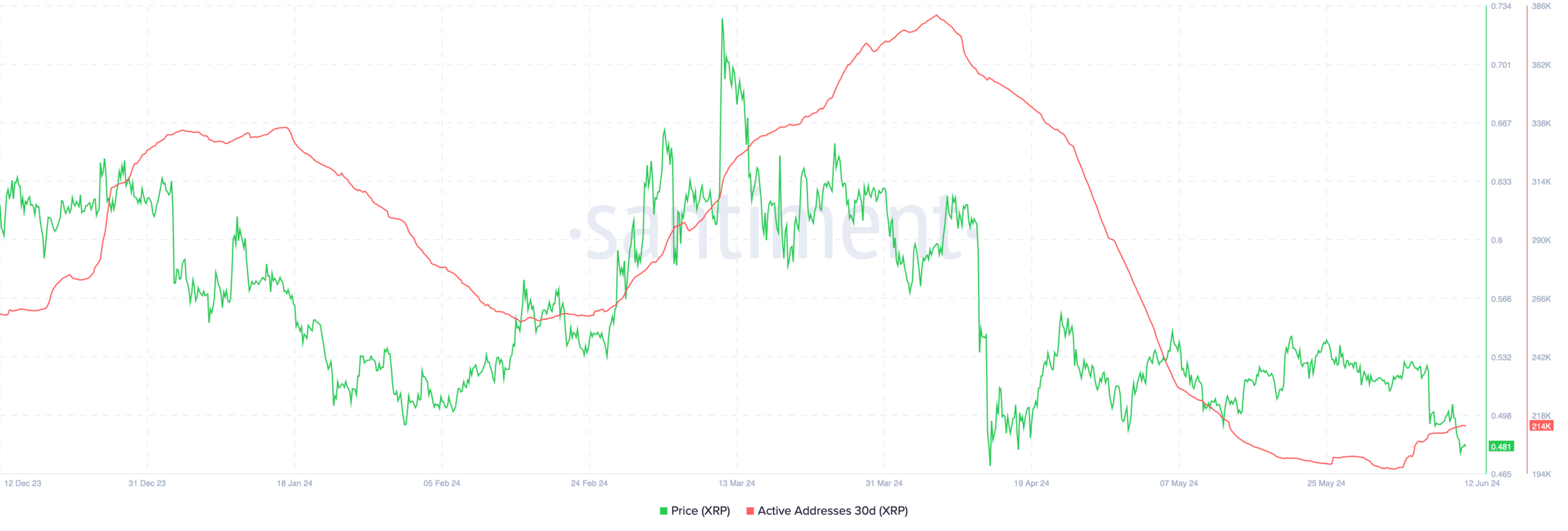

This divergence is especially evident within the efficiency metrics of main altcoins like XRP, which has seen an almost 10% decline in latest weeks.

Moreover, data from Santiment highlighted a major drop in lively XRP addresses, suggesting waning consumer engagement and probably foretelling additional value declines.

Supply: Santiment

Regardless of the downturn, there’s a silver lining as AMBCrypto reported an enhance within the variety of XRP holders by 100,000 in early June, hinting at underlying curiosity regardless of prevailing market challenges.

Learn Bitcoin’s [BTC] Worth Prediction 2024-2025

This complicated panorama means that the altcoin market faces short-term headwinds.

Nonetheless, the groundwork for future rallies may very well be forming behind the scenes as buyers recalibrate their methods in response to evolving market dynamics.