- ARB deposits to exchanges rose sharply after the unlock.

- Wallets holding between 100,00 to 100 million cash continued to build up.

Layer-2 (L2) token Arbitrum [ARB] crashed 14% shortly after greater than a billion of its tokens had been launched into the market as a part of the cliff unlock.

Fears come true

ARB was exchanging arms at $1.9 at 11 am UTC on the sixteenth of March, in response to CoinMarketCap. Nonetheless, costs began plunging dramatically after the scheduled provide unfreeze at 1 pm.

As of this writing, ARB was exchanging arms at $1.65.

About 76% of ARB’s complete circulating provide, value over $2 billion, was distributed to the crew, future crew, and buyers, as per AMBCrypto’s evaluation of Token Unlocks’ knowledge.

Many of those recipients acted shortly to revenue from these tokens.

Based on Spot On Chain, six beneficiary wallets transferred 8.95 million ARBs to Binance inside hours of the unlock.

These wallets nonetheless held over 32 million tokens and will doubtless deposit extra tokens within the days to return, inflicting additional downsides.

Giant whales are bullish although

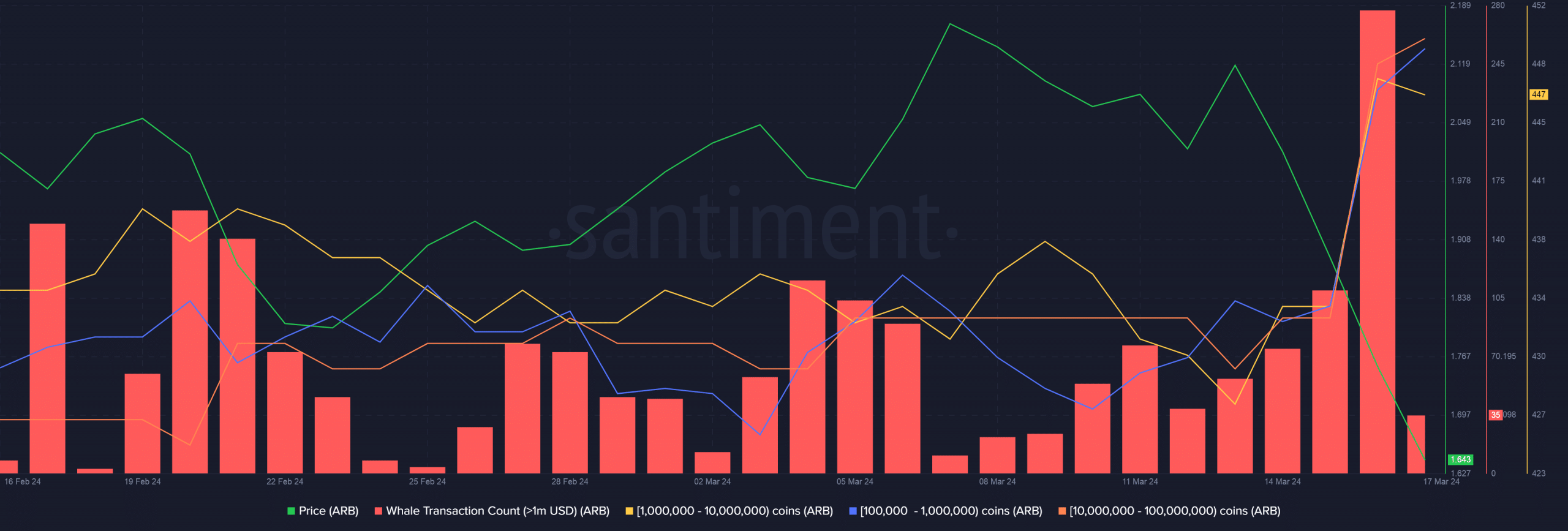

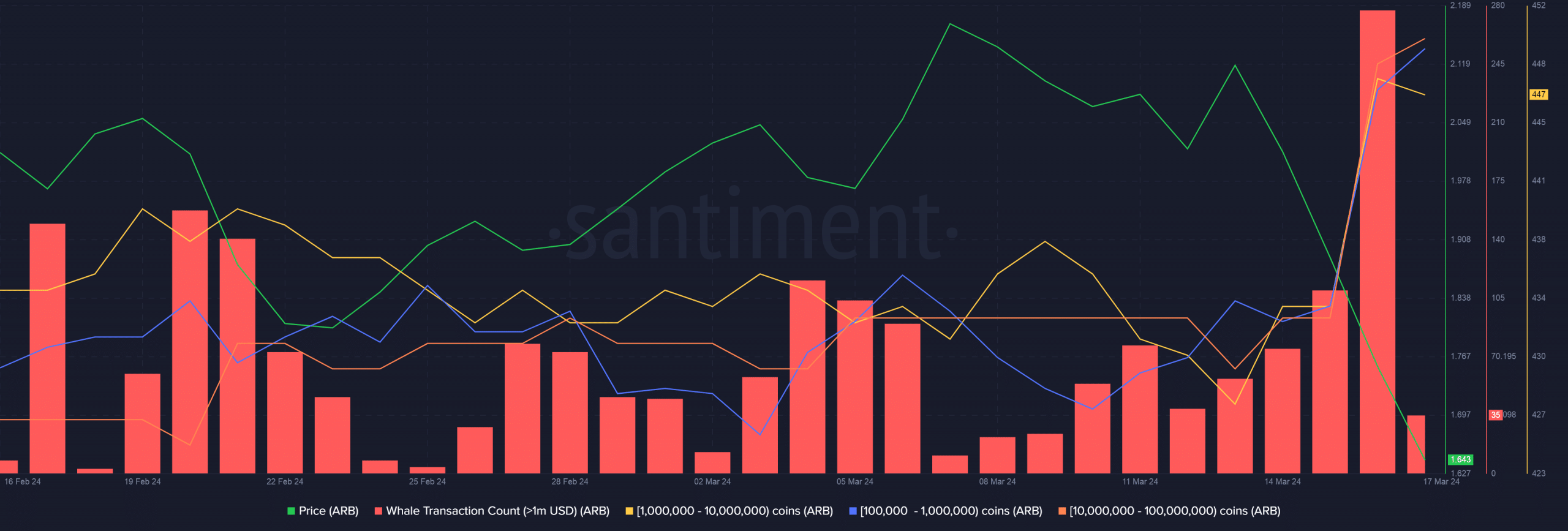

To achieve further insights, AMBCrypto investigated ARB whales’ conduct utilizing Santiment knowledge. Notably, transactions value over $1 million spiked to their highest worth ever on the sixteenth of March.

Supply: Santiment

Nonetheless, most giant whales had been seen to be accumulating ARBs versus promoting. As evident above, wallets holding between 100,00 to 100 million cash rose sharply on the identical day.

Apparently, these person cohorts began amassing tokens within the days resulting in the unlock, suggesting that they had been bullish on ARB’s prospects.

Now that the costs have plunged, it stays to be seen if these whales will proceed to build up or dump their holdings.

Reasonable or not, right here’s ARB’s market cap in BTC’s phrases

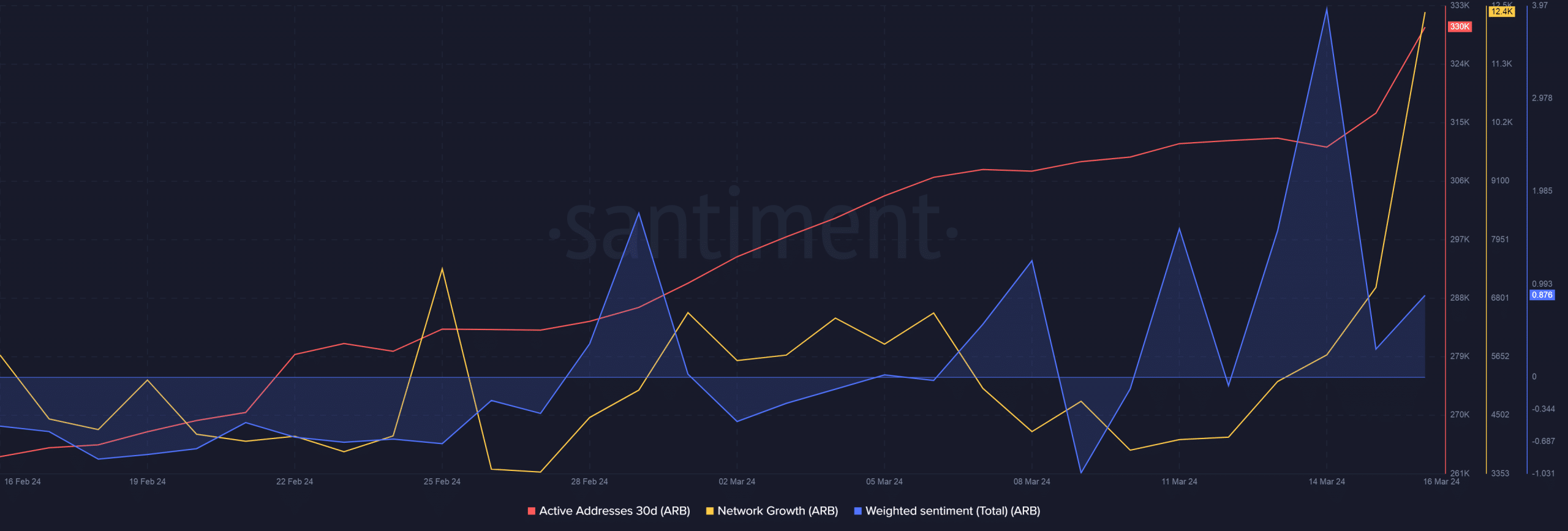

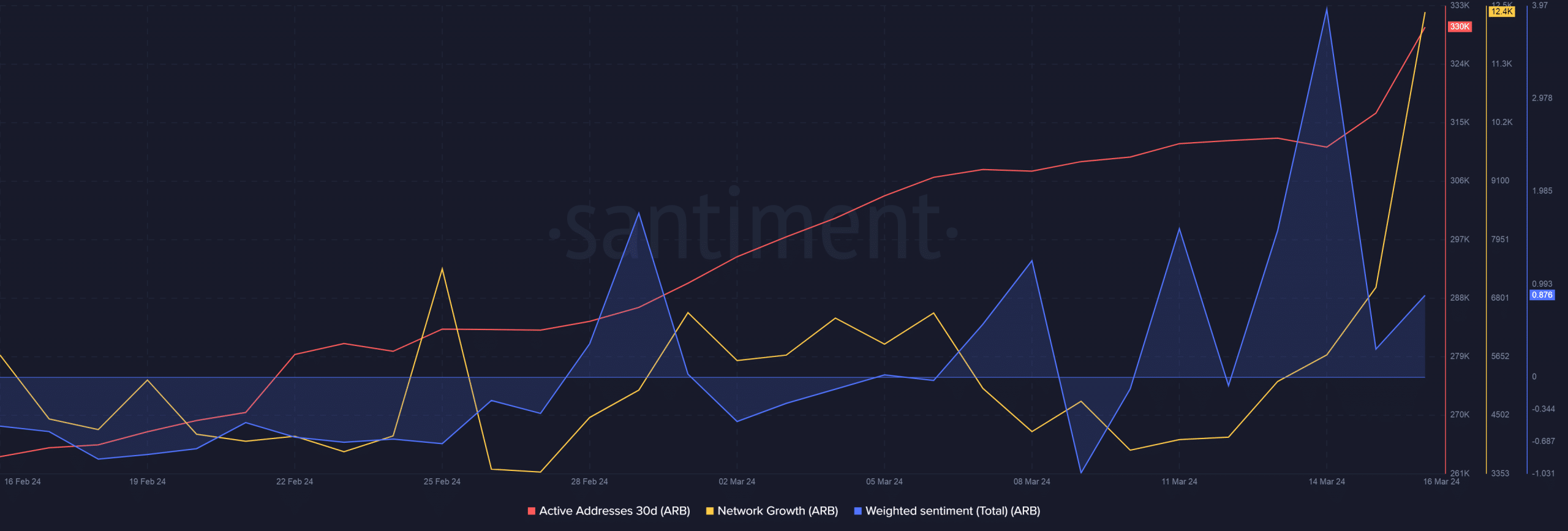

In the meantime, ARB’s on-chain exercise elevated considerably as a result of unlock. About 330k distinctive addresses had been lively on the sixteenth of March, 13k greater than the day gone by.

Furthermore, the variety of new addresses on the community jumped 77%, indicating retail pleasure and mainstream adoption of the token.

Supply: Santiment

![Arbitrum [ARB] falls 14% after 1.1B token unlock, but is a rise coming?](https://wearecryptonians.com/wp-content/uploads/2024/03/arbitrum-token-unlock-1000x600.webp)