After Amazon and Fb reported blowout earnings, sending their shares up double digits after hours and soothing the bitter style left from the current disappointing earnings from MSFT, TSLA and GOGL, everybody was trying on the final Magazine 7 of all of them, the (previously?) largest firm on this planet, Apple which nevertheless left a bit to be desired, as a result of whereas the iPhone maker reported each income and EPS which beat (iPhone gross sales really beat this time whereas Mac, iPad and Wearables all missed), the corporate’s Higher China income dissatisfied, coming in beneath estimates, with Service revenues additionally disappointing.

Here’s what the corporate reported for fiscal Q1:

- EPS $2.18 vs. $1.88 y/y, beating estimates of $2.11

- Income $119.58 billion, +2.1% y/y, beating estimates of $117.97 billion

- Merchandise income $96.46 billion vs. $96.39 billion y/y, beating estimates $95.14 billion

- IPhone income $69.70 billion, +6% y/y, beating estimates of $68.55 billion

- Mac income $7.78 billion, +0.6% y/y, lacking estimates of $7.9 billion

- IPad income $7.02 billion, -25% y/y, lacking estimates of $7.06 billion

- Wearables, residence and equipment $11.95 billion, -11% y/y, lacking estimates of $12.02 billion

- Service income $23.12 billion, +11% y/y, lacking estimates of $23.37 billion

- Higher China rev. $20.82 billion, -13% y/y, lacking estimates of $23.5 billion

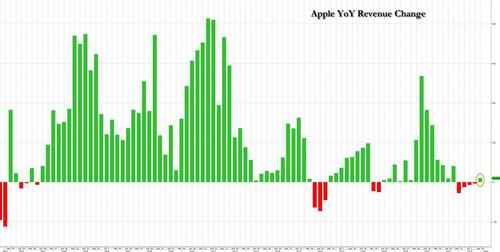

- Whereas Income of almost $120BN lastly grew from a yr in the past, ending a interval of 4 quarters of decline, it was nonetheless down from two years prior.

- Gross margin $54.86 billion, +9% y/y, beating estimates $53.56 billion

- Money and money equivalents $40.76 billion, above estimates $38.81 billion

Whereas the numbers have been blended, the excellent news is that AAPL managed to keep away from a fifth consecutive quarter of annual income declines (it could have been the primary time because the firm’s existential disaster within the Nineties).

Commenting on the quarter, CEO Tim Prepare dinner mentioned that “immediately Apple is reporting income progress for the December quarter fueled by iPhone gross sales, and an all-time income file in Providers. We’re happy to announce that our put in base of energetic units has now surpassed 2.2 billion, reaching an all-time excessive throughout all merchandise and geographic segments. And as clients start to expertise the unimaginable Apple Imaginative and prescient Professional tomorrow, we’re dedicated as ever to the pursuit of groundbreaking innovation — consistent with our values and on behalf of our clients.”

CFO Luca Maestri chimed in that “our December quarter top-line efficiency mixed with margin growth drove an all-time file EPS of $2.18, up 16 % from final yr. Through the quarter, we generated almost $40 billion of working money move, and returned nearly $27 billion to our shareholders. We’re assured in our future, and proceed to make vital investments throughout our enterprise to help our long-term progress plans.”

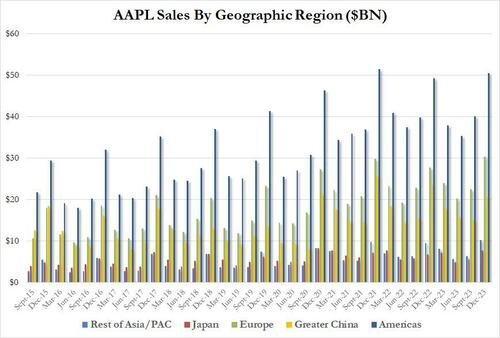

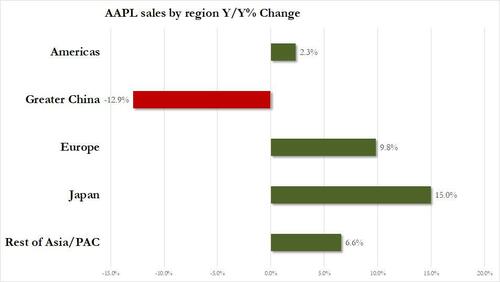

Regardless of the optimistic rhetoric, the rumors concerning the firm’s weak point in China turned out to be true, and revenues there missed estimates of $23.5BN badly, the corporate producing simply $20.82BN in gross sales in what till not too long ago was the most important progress market, confirming motion by Beijing to shun the western mobile phone. Right here is the geographic breakdown of Apple’s gross sales…

… and right here is the YoY change. China’s 13% drop stands out like a sore thumb.

This should not be a shock: for months, Apple watchers have been beating the drum that the iPhone is underperforming in China, citing sturdy progress by rivals like Huawei, Xiaomi and others, mixed with some authorities businesses banning using the system at work. Apple pushed again significantly on its final earnings name in opposition to that concept; however it seems it was mendacity. At the moment, we realized that gross sales in China really fell almost $3 billion within the crucial vacation quarter. That’s the bottom China 1Q income for Apple since 2020!

CFO Luca Maestri had this to say concerning the plunge in China: “There’s a decline. We’re not proud of the decline however we all know China is essentially the most aggressive market on this planet…We proceed to see vital alternative for us in China in the long run.”

Judging by the transfer in AAPL inventory after hours, the market disagrees.

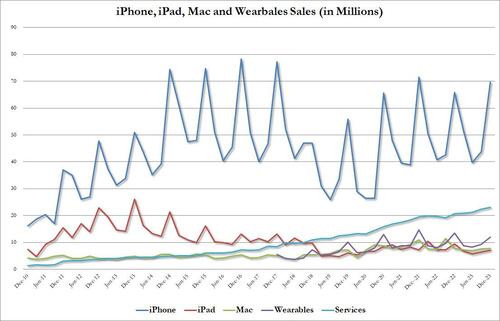

Turning to income by product class, iPhones beat and… that was it: all different classes dissatisfied:

- IPhone income $69.70 billion, +6% y/y, beating estimates of $68.55 billion

- Mac income $7.78 billion, +0.6% y/y, lacking estimates of $7.9 billion

- IPad income $7.02 billion, -25% y/y, lacking estimates of $7.06 billion

- Wearables, residence and equipment $11.95 billion, -11% y/y, lacking estimates of $12.02 billion

Whereas it’s notable that the iPhone 15 grew, the context is crucial – the iPhone 14 Professional earlier than it slumped significantly due to supply-chain hiccups in China (i.e. base impact). That problem wasn’t replicated this yr, plus the iPhone 15 Professional was a a lot greater replace. Nonetheless, the decide up in iPhone revenues was at greatest modest because the chart beneath exhibits.

Mac income was the most important product miss (income was -1.6% or so off of estimates). Pc gross sales have been challenged for over a yr now as customers have been more and more price delicate, and plenty of had already purchased new computer systems in the course of the pandemic. Business analyst IDC expects 2024 to deliver long-awaited progress in laptop gross sales.

Commenting on the disappointing outcomes, Tim Prepare dinner mentioned the lower in Wearables, Dwelling and Equipment was because of a troublesome comparability to new merchandise launched in 2022. That included the primary Apple Watch Extremely and a brand new Apple TV. The 2023 updates within the class have been minor — and Apple handled a couple of days of halted gross sales within the US as a result of patent battle with Masimo Corp.

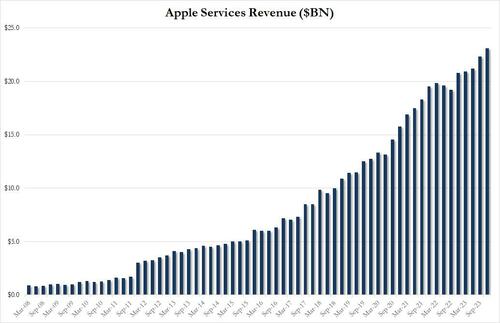

After which there was service revenues, which regardless of rising to a brand new all time excessive of $23.1BN (up 11.3%) missed estimates of $23.4BN.

Nonetheless, in accordance with CFO Luca Maestri, Apple has nicely over one billion paid subscriptions, greater than double what it had 4 years in the past, throughout its ecosystem (this contains first and third-party subscriptions).

Placing all of it collectively, regardless of the stable iPhone outcomes and revenue beat, buyers are dissatisfied by the China numbers, with the inventory falling as a lot as round 4% thus far after-hours, the loss accelerating in the course of the name when the corporate mentioned that in the course of the March quarter it anticipated complete and iPhone income to be just like earlier years when factoring in that 2Q income final yr got here in about $5 billion increased because of sure situations (i.e., stock replenishment). The corporate additionally expects gross margins between 46%-47% for Q2, in addition to working bills of $14.3BN-$14.5BN, and expects service enterprise the present double digit progress just like the present quarter. Lastly, CFO Maestri mentioned companies within the March quarter shall be negatively impacted by international alternate charges and that comparisons for the March quarter are more difficult than in different quarters.

Not surprisingly, AAPL’s inventory is doing the worst of all of the megatechs reporting immediately, with each AMZN and META surging after their repective stories, and solely AAPL sliding.

Loading…