Overview

Antilles Gold (ASX:AAU, OTCQB:ANTMF) is an Australian mining firm centered on gold and copper tasks in Cuba by means of joint ventures with the Cuban Authorities’s mining firm, GeoMinera.

With a change within the US‐Cuba relations, Cuba is turning into a vacation spot for miners. To encourage international investments in its mining sector, the Cuban Authorities has instituted enticing funding legal guidelines and sensible mining and environmental rules. The nation additionally gives funding incentives, together with a waiver of 15 % revenue tax for eight years, no import duties, and no withholding tax on international providers or dividends. Royalties on metallic gross sales are fastened at an business normal of three %.

Moreover, the Cuban Authorities permits JV loans and gross sales proceeds to be deposited in a foreign bank account for disbursement on to collectors, successfully eliminating nation credit score danger.

A number of worldwide corporations have established operations in Cuba, together with Toronto‐primarily based mining big Sherritt Worldwide and Australian oil & gasoline firm Melbana Vitality. Commodities buying and selling firm Trafigura additionally has a significant presence in Cuba, commissioning the US$300‐million Castellanos base metals mine in 2017, which was developed in a three way partnership with GeoMinera.

Antilles Gold’s partnership and wonderful relations with GeoMinera has resulted in fast venture allowing and entry to a number of new improvement alternatives for the Australian firm.

Antilles Gold gives robust development potential by means of two close to‐time period improvement tasks, Nueva Sabana and La Demajagua, and two exploration tasks, El Pilar porphyry system and Sierra Maestra copper concessions.

The Nueva Sabana is a close to‐time period, gold‐copper mine improvement inside a 50:50 JV with GeoMinera, and is anticipated to initially produce round 55 grams per tonne (g/t) gold in a focus from a excessive‐grade gold cap adopted by ~25 % copper focus. Challenge improvement technique contains finalizing the mineral useful resource estimate (MRE) in January 2024, finishing the feasibility examine by April 2024, and starting the ten‐month development program in June 2024. The venture is anticipated to generate robust money stream from mid‐2025.

The second proposed mine improvement is La Demajagua open-pit mine, which is more likely to produce ~50,000 tpa of gold arsenopyrite focus (32 g/t gold, 27 % arsenic), and ~10,000 tpa of gold antimony focus (28.8 g/t gold, 48 % antimony, 1,200 g/t silver) for 9 years. In accordance with the plans, development will start in late 2024, with commissioning in mid‐2026. La Demajagua may even embrace the development of a business focus processing facility to deal with La Demajagua’s gold arsenopyrite focus and imported gold pyrite focus, with the capability to provide 100,000 oz gold per yr in dore, which is able to additional enhance JV revenue and cashflow.

The corporate’s two exploration tasks comprise the 17,800‐hectare El Pilar Concession in Central Cuba protecting a cluster of three copper‐gold porphyry deposits (El Pilar, Gaspar and San Nicholas), and three concessions totaling 54,000 hectares throughout the producing Sierra Maestra copper belt in Southeast Cuba, with indications of porphyry deposits extremely potential for copper, gold and molybdenum.

Antilles goals to recommence drilling of the El Pilar porphyry system in mid‐2024 after its concession has been transferred to a brand new JV with GeoMinera. Importantly, there’s a chance for Antilles to grow to be the bulk proprietor of the brand new JV, which might allow the longer term switch of a controlling curiosity to a significant mining group for any mine improvement.

Antilles intends to take a position a part of the anticipated surplus money stream from the Nueva Sabana mine to fund the exploration of main copper targets, together with the El Pilar copper‐gold porphyry system, and the Sierra Maestra copper belt.

Firm Highlights

- Antilles Gold Restricted is an Australian mining firm listed on the ASX (AAU) and OTCQB (ANTMF).

- The corporate is concentrated on gold and copper tasks in Cuba by means of joint ventures with the Cuban authorities’s mining firm GeoMinera. The connection with GeoMinera opens new improvement alternatives for Antilles and de-risks allowing processes.

- The corporate is engaged in 4 improvement tasks: 1) Nueva Sabana gold‐copper mine; 2) La Demajagua gold mine; 3) El Pilar porphyry copper venture; and 4) Sierra Maestra copper concessions. Of those, Nueva Sabana and La Demajagua supply close to‐time period improvement alternatives.

- The Nueva Sabana is a close to‐time period gold‐copper mine improvement venture with a ten‐month development starting in June 2024. The venture is anticipated to generate robust money stream from focus gross sales from mid‐2025.

- The second mine improvement venture is La Demajagua, an open-pit mine gold venture the place development will start in late 2024 and commissioning begins mid‐2026. The venture contains the development of a business focus processing facility able to producing 100,000 oz of gold per yr in dore. This venture may even produce roughly 10,000 tons every year (tpa) of antimony‐gold focus (30,000 oz gold equal per yr).

- The corporate’s two exploration tasks embrace the El Pilar copper‐gold porphyry system and three concessions within the Sierra Maestra copper belt.

- Funding in Cuba gives a number of advantages, together with richness in minerals, decrease working prices and royalties, steady authorities and rules, a number of funding incentives and the provision of a talented workforce.

Key Initiatives

Nueva Sabana Challenge

Nueva Sabana is the corporate’s close to‐time period, gold‐copper mine improvement venture. The venture is held in a 50:50 JV with the Cuban Authorities’s mining firm GeoMinera. It is going to be an open-pit mine developed on the El Pilar oxide deposit in central Cuba.

Outcomes from 24,000 metres of historic drilling outcomes, 1,800 metres drilled in 2022, and the ten,000 metres drilled in 2023 shall be used to determine a mineral useful resource estimate (MRE) in January 2024. A feasibility examine for the proposed improvement of the oxide deposit will observe quickly after that, and the ten‐month development part is anticipated to start in June 2024.

Latest drilling has proven excellent grades for gold and copper, and rising lateral and vertical boundaries of the copper area. The outcomes reinforce the prospect of close to‐time period improvement of the low‐capex Nueva Sabana mine at El Pilar. The excellent grades within the gold area lengthen from the floor to a depth of 40 to 50 metres, and sturdy grades within the underlying copper area proceed for an additional 50 to 70 metres.

The proposed mining fee for the venture shall be 650,000 tpa of ore with a low waste‐to‐ore ratio. The anticipated preliminary manufacturing of 55 g/t gold focus shall be adopted by ~25 % copper focus.

The estimated venture value is roughly $23 million, of which $3 million is shareholders fairness with the steadiness of $20 million funded by means of an advance on purchases of the gold focus by a global commodities dealer.

Chinese language engineering group, Prominer Mining Expertise, which has in depth expertise in designing and setting up gold and copper concentrators, is anticipated to provide the crushing and flotation circuits for the Nueva Sabana mine.

Concentrator to be equipped for Nueva Sabana mine by Chinese language Engineering Group ProMiner

La Demajagua Challenge

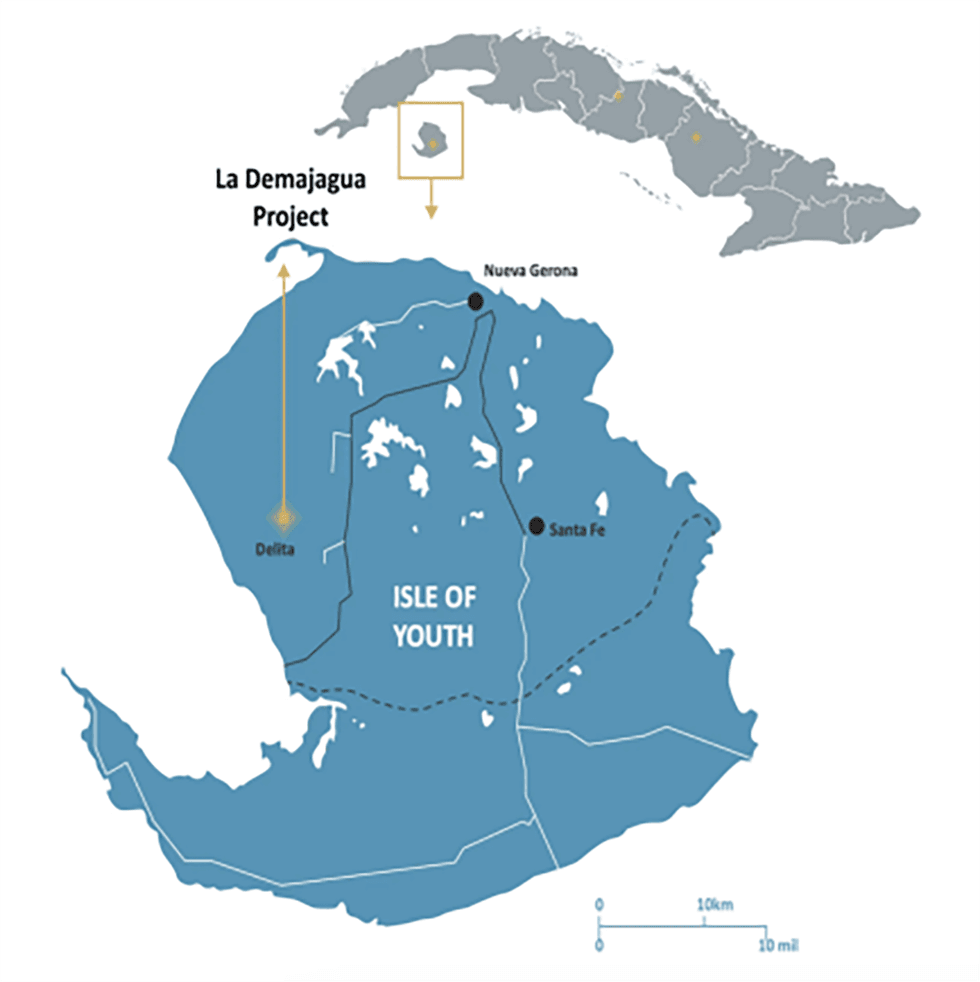

La Demajagua entails the event of a gold‐antimony‐silver deposit as an open-pit mine by the three way partnership firm, Minera La Victoria.

The venture covers 900 hectares of mining concession on the Isle of Youth, 60 nautical miles from mainland Cuba. The venture web site is 35 kilometres from the port metropolis of Nueva Gerona and enjoys wonderful infrastructure when it comes to accessibility by freeway, and availability of water, electrical energy and fiber optic cable.

The venture has an MRE of 905,000 oz gold equal for the open-pit operation. The MRE was calculated from outcomes from 29,000 metres of drilling undertaken by the JV, and selective outcomes from about 50,000 metres of historic drilling and revised after the receipt of extra antimony assays. The venture expects mining of about 815,000 tpa ore to provide two concentrates: 50,000 tpa of gold‐arsenopyrite and 10,000 tpa of gold‐antimony‐silver for 9 years.

The venture may even embrace a business focus processing facility to provide gold dore. The ability will comprise a 75,000‐tpa two‐stage fluidized‐mattress roaster and a 100,000‐tpa carbon-in-leach (CIL) circuit. It’s anticipated to course of 50,000 tpa gold arsenopyrite focus, and 35,000 tpa gold oxide ore from La Demajagua, and 25,000 tpa of imported gold pyrite focus. The general manufacturing goal is 100,000 oz gold per yr in dore for abroad refining. Chinese language engineering agency BGRIMM Expertise Group, which has in depth expertise in designing and setting up roasters, is anticipated to provide the turnkey course of plant.

Complete mine improvement value is estimated at US$145 million, which shall be funded by US$60 million in fairness, which incorporates contribution by a 3rd shareholder within the venture, and the steadiness of US$85 million in debt. The life‐of‐mine money surplus is estimated at ~US$600 million, with an NPV of about US$330 million primarily based on US$1,800/oz gold, and US$13,000/t antimony.

Completion of the definitive feasibility examine is anticipated in September 2024, and development is anticipated to start in late 2024, with commissioning focused for mid‐2026.

El Pilar Copper‐Gold Porphyry System Challenge

El Pilar is an exploration venture with a cluster of three copper‐gold porphyry deposits: El Pilar, Gaspar and Camilo. The venture contains 752 hectares of exploration licenses and 17,000 hectares of reconnaissance permits. The venture shall be transferred to a deliberate new three way partnership, which is anticipated to allow majority international possession.

The venture web site advantages from established infrastructure with entry to a significant freeway, excessive‐stress energy, and a 60 kilometre rail hyperlink to Palo Alto port.

Earlier mapping, soil sampling, floor magnetics, an aeromagnetic survey and 24,000 metres of shallow drilling confirmed the existence of copper‐gold mineralization and recognized the exposures as doubtlessly a big, leached porphyry system. The floor exposures at El Pilar are leached phyllic caps to a cluster of copper‐gold porphyry cores. The extent of surficial hydrothermal alteration signifies the porphyry intrusions have giant dimensions, and potential depths better than 1,000 metres.

Floor magnetics and induced polarization surveys in early 2023 have confirmed a cluster of three doubtlessly giant porphyry intrusives – El Pilar, Gaspar and Camilo. A six‐gap preliminary program has demonstrated optimistic outcomes with good copper intercepts in porphyry‐fashion veining and has indicated the proximity of drilling to the core of El Pilar porphyry intrusive. Particularly, drill gap PDH‐004A assayed 1.23 % copper over its size of 134 metres from 49 metres.

An intensive two‐yr drilling program shall be carried out from mid‐2024 and the corporate notes it could search monetary help for this system from a significant mining firm.

Floor mineralisation at El Pilar

Sierra Maestra Copper Belt Challenge

The venture is an exploration venture protecting three extremely potential concessions for copper, gold and molybdenum within the Sierra Maestra copper belt in southeast Cuba. It features a 3,600-hectare geological investigation license in La Cristina, a 49,000‐hectare reconnaissance license in Vega Grande, and a 1,100‐hectare reconnaissance license in Buey Cabon.

The copper belt spans greater than 200 kilometres of Cretaceous‐age geology intruded by Eocene shares, that are the supply of widespread gold and base‐metals mineralization. The venture is close to the El Cobre mine which is the oldest working copper mine within the Americas. The concessions incorporate a sequence of copper‐gold‐molybdenum zones that show important footprints of hydrothermal alteration usually related to doubtlessly giant porphyry programs.

An intensive, two‐yr prospecting program shall be carried out on the three concessions, commencing in Q1 2024, to establish drill targets.

Administration Group

Brian Johnson – Government Chairman

Brian Johnson is a graduate of civil engineering from the College of Western Australia and a member of the Institute of Engineers, Australia. He has wealthy expertise within the development and mining industries in Australia, Southeast Asia and North America. He was instrumental in establishing profitable corporations within the iron ore and coal sectors. Beforehand, he has served as a director of two listed gold producers, and of corporations with inventory trade listings in London, New York, Vancouver and Australia.

James Tyers – Chief Government Officer

James Tyers is a member of the AusIMM and has greater than 30 years of expertise within the mining business, holding senior administration roles in gold and iron ore operations. He has been related to the Palm Springs Gold Mine within the Kimberley area of Western Australia, and the Cornishman Challenge, a JV between Troy Assets and Sons of Gwalia. He has expertise creating and working iron ore tasks within the mid‐west of Western Australia. He was answerable for creating the Las Lagunas Challenge and is the venture director for the La Demajagua gold mine in Cuba.

Ugo Carlo – Non‐govt Director

Ugo Carlo has greater than 30 years of expertise within the Australian mining business. All through his profession, he has served in a number of senior management roles at Rocklands Richfield, Austral Coal and Conzinc Rio Tinto Australia Group. He’s additionally a former director of the Port Kembla Coal Terminal, the New South Wales Joint Coal Board, and interim chairman of the New South Wales Minerals Council.

Angela Pankhurst – Non‐govt Director

Angela Pankhurst has greater than 20 years of expertise as an govt and non‐govt director, primarily within the mining business. She has been a senior govt for corporations with tasks in Kazakhstan, Nigeria, Vietnam, South Africa and Australia. She has held senior management positions at Antilles Gold and Central Asia Assets. She is at present a director of Consolidated Zinc and a director of Imritec.

Tracey Aitkin – Chief Monetary Officer

Tracey Aitkin is an expert member of CPA Australia and has greater than 30 years of wealthy expertise in finance, administration and employees administration throughout a spread of industries, together with mining, manufacturing, retail, transport and agriculture. She joined the corporate in 2009 and was named CFO in 2010.

Dr. Jinxing Ji – Technical Director

Dr. Jinxing Ji is a seasoned metallurgist with six years of analysis expertise in universities and 26 years of sensible expertise within the mining business associated to gold, silver, copper, zinc and lead. His broad expertise contains due diligence, metallurgical check work, pre‐feasibility examine, feasibility examine, detailed design, plant commissioning help, and operational help for tasks in Turkey, Greece, Canada, China, Romania, Brazil and Papua New Guinea.

Steve Mertens – Mining Director

Steve Mertens is a mining engineer with greater than 20 years of business expertise throughout a spread of commodities, together with 9 years primarily based in Latin America. He has been related to the Goro Nickel Challenge in New Caledonia and the Mina de Cobre Challenge in Panama. Previous to his present function as basic supervisor for the Minera La Victoria JV firm, he was the mining supervisor for Antilles Gold’s Las Lagunas operation within the Dominican Republic.

Chris Grainger – Exploration Director

Chris Grainger holds a PhD in financial geology from the College of Western Australia. He’s an Australian geologist with greater than 25 years of worldwide expertise with involvement in grassroots and brownfield exploration, in addition to useful resource definition and improvement, with a deal with treasured and base metals in South and Central America and the Caribbean. He has been related to Continental Gold’s Buritica gold‐silver venture, and Cordoba Minerals’ Alacran copper‐gold venture.

*This text was written in collaboration with Couloir Capital.