- UNI reveals promising indicators of a bullish breakout, with a number of reversal patterns forming.

- Excessive transaction values and a majority of holders in revenue trace at sturdy investor confidence.

Uniswap [UNI] is wanting sturdy and would possibly intention for larger ranges above the $10 resistance. After weeks of performing terribly, the altcoin has seemingly seen a reversal sample, probably staging a breakout.

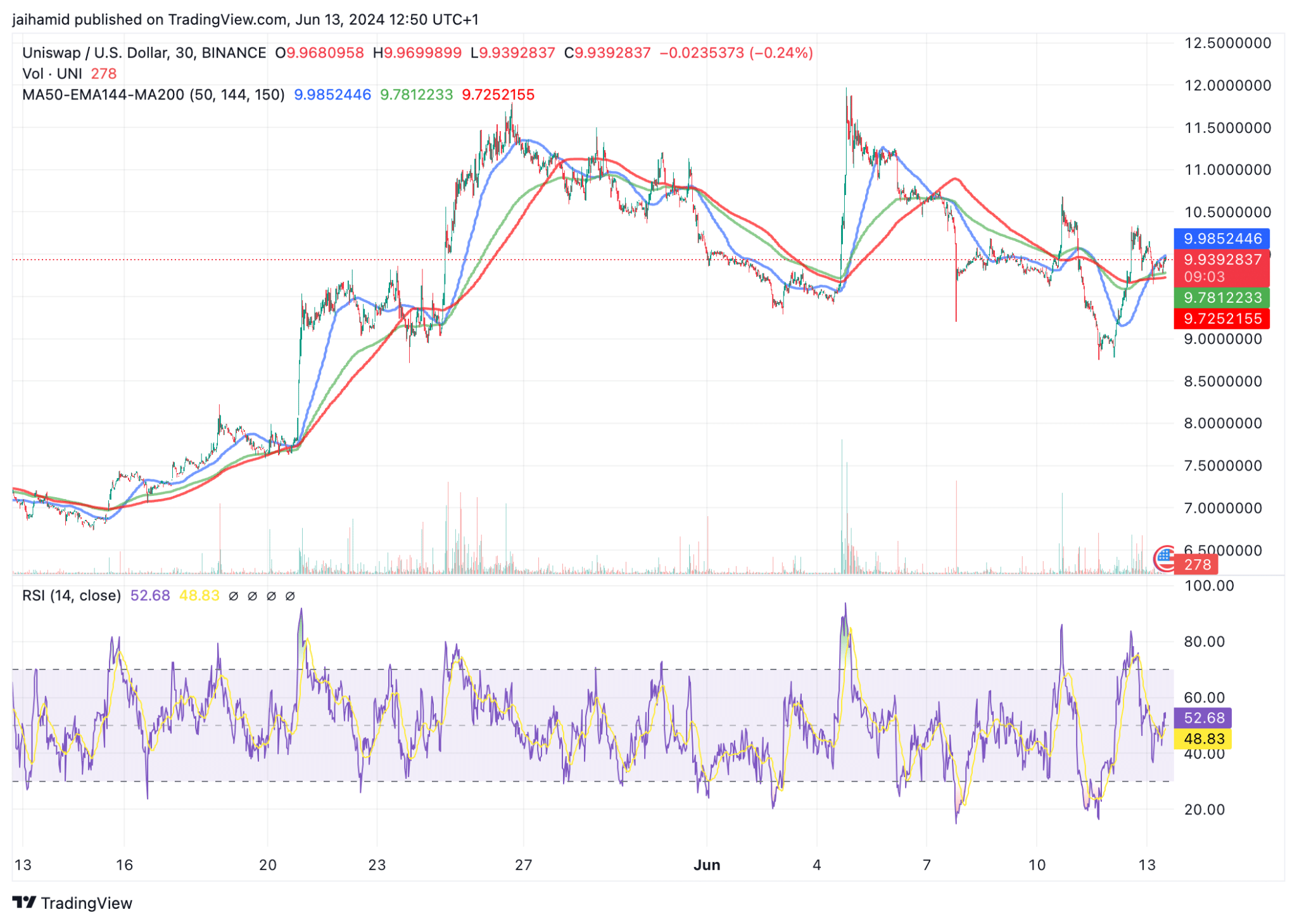

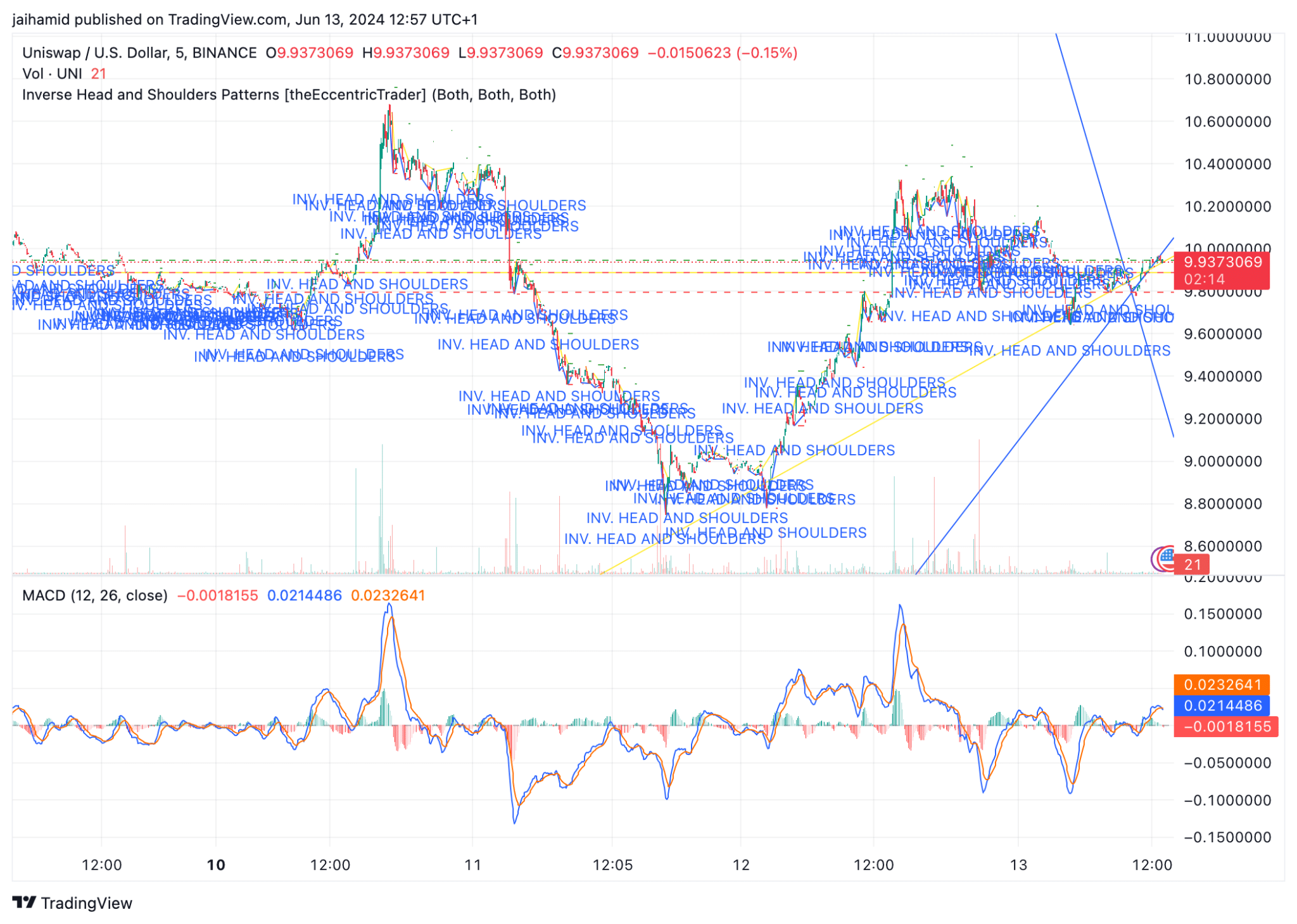

Supply: TradingView

Latest value actions present a restoration from decrease ranges. The MA50 not too long ago crossed above the MA200 (Purple Line), which is usually a bullish sign often known as a ‘Golden Cross.’

This means that the shorter-term momentum is changing into extra bullish relative to the longer-term pattern. The EMA is presently under the MA50, reinforcing the short-term bullish reversal.

The RSI at 52.68 implies that Uniswap is neither overbought nor oversold, leaving room for potential motion in both route with out speedy strain from merchants trying to dump an overbought asset or purchase an oversold one.

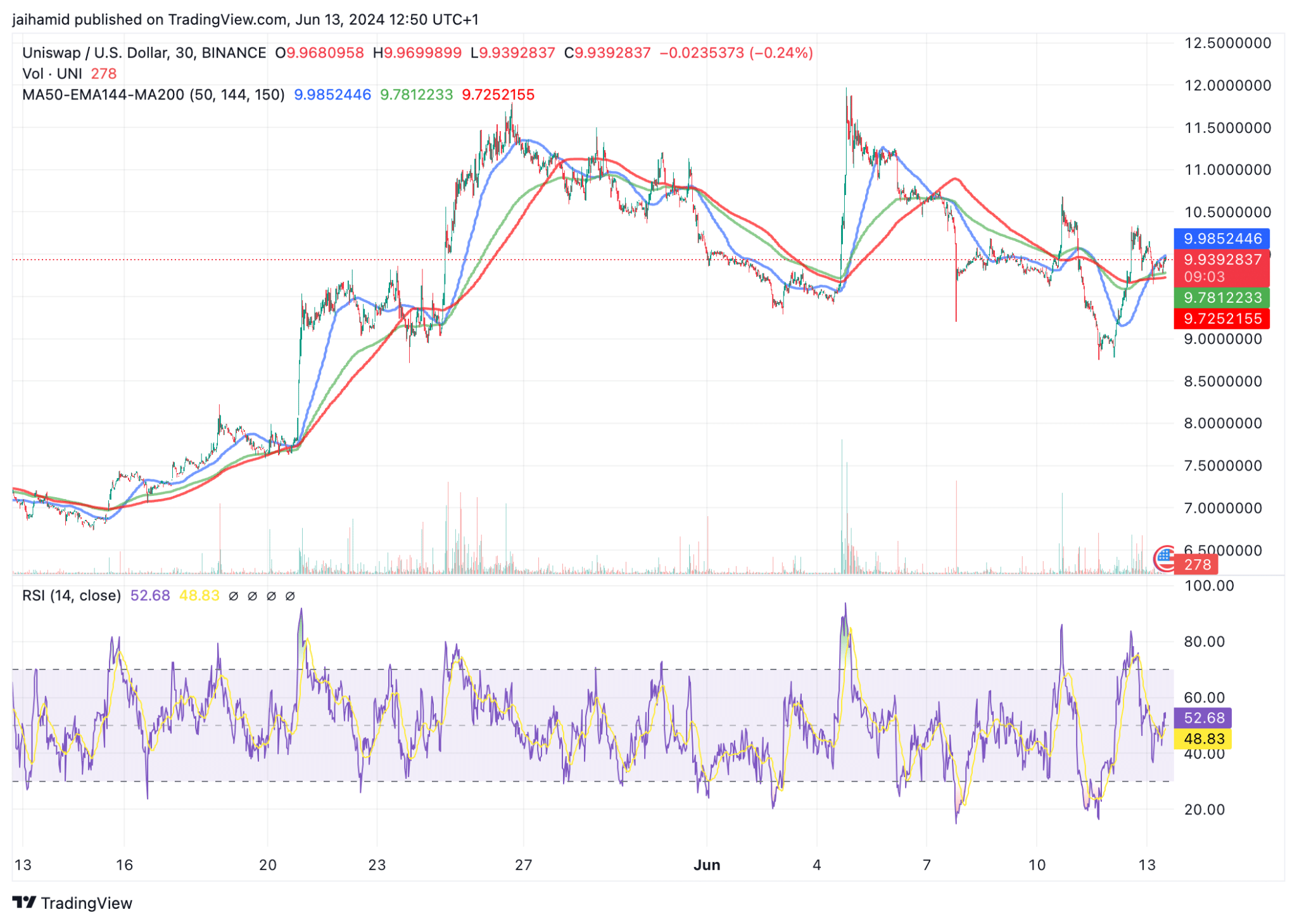

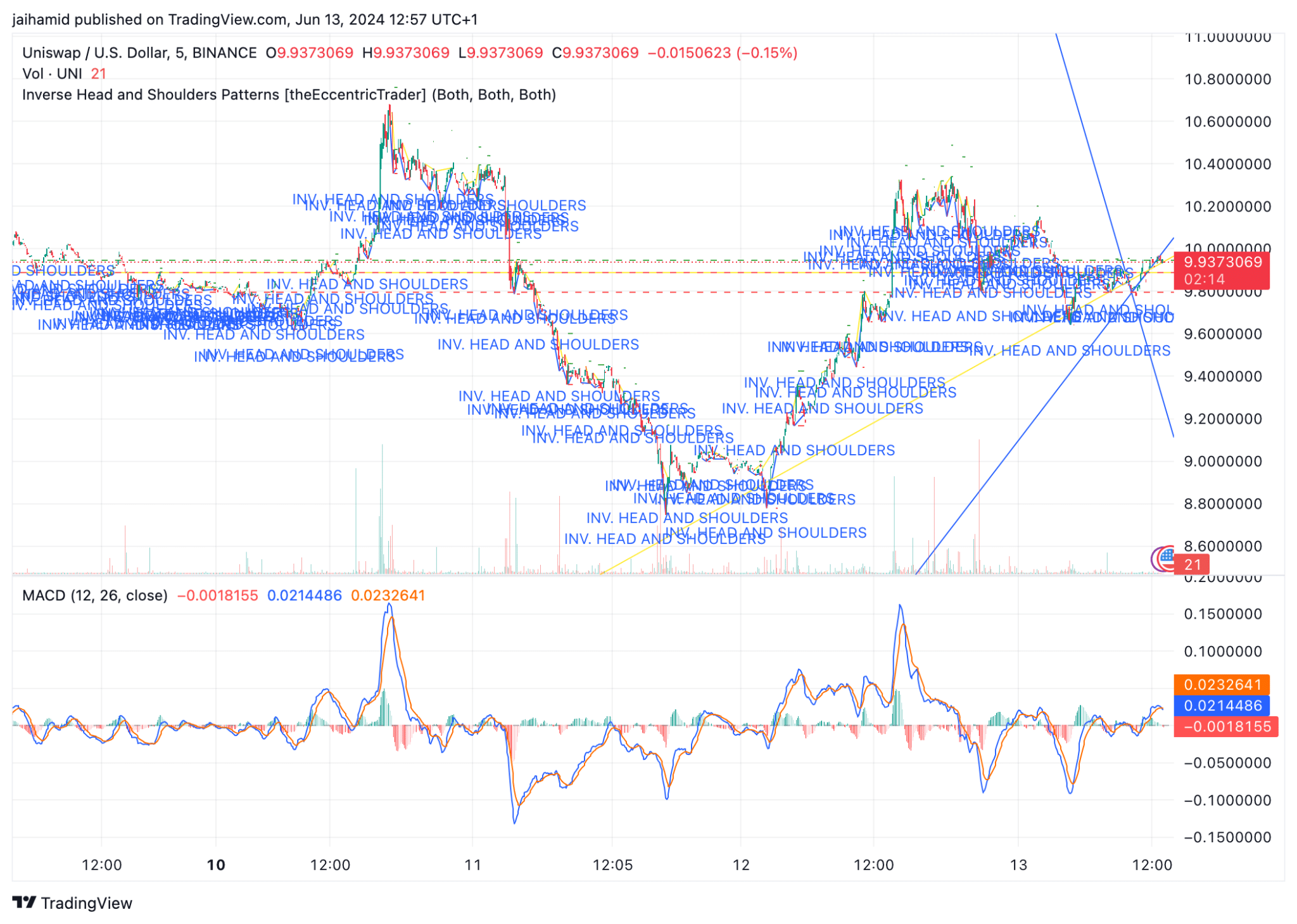

Supply: TradingView

UNI to breakout?

A number of inverse head and shoulder patterns are seen all through the UNI/USDt chart. These patterns are sometimes thought-about bullish reversal setups. Finishing the patterns at all times results in a bullish part.

Nonetheless, the patterns’ effectiveness in predicting upward motion is dependent upon their affirmation—particularly, that decisive breakout above the neckline (indicated by the dashed strains) with vital quantity.

The MACD line (blue) crossing above the sign line (orange) is seen at a number of factors on the chart. This crossover is a standard purchase sign inside the context of MACD evaluation, and sometimes, a bull takeover comes instantly after.

Furthermore, every double-bottom sample on the chart indicators a turning level the place the shopping for curiosity is powerful sufficient to forestall additional declines and push costs larger, initiating a bullish pattern reversal.

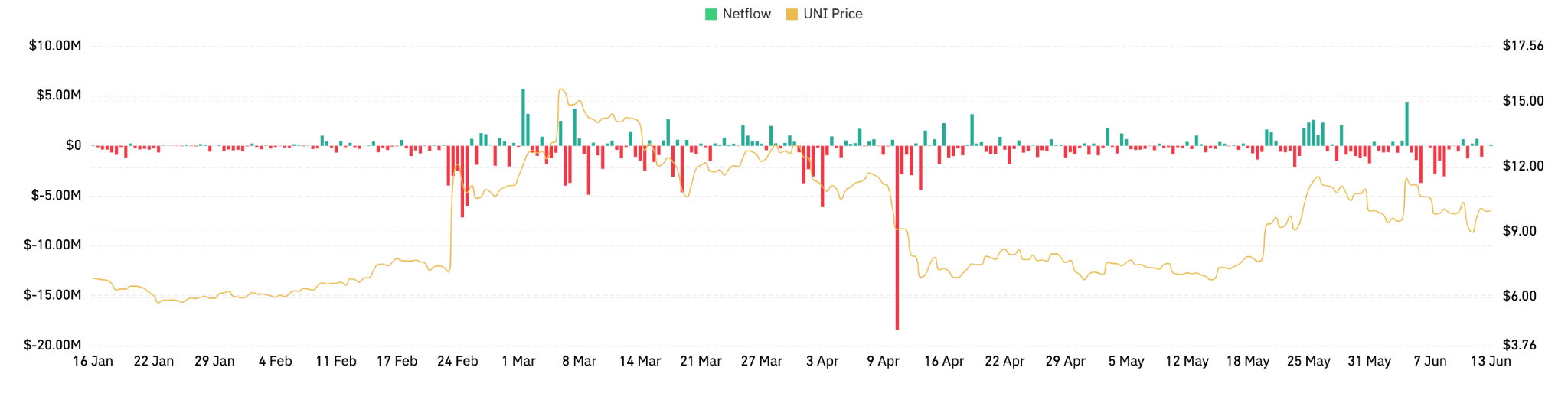

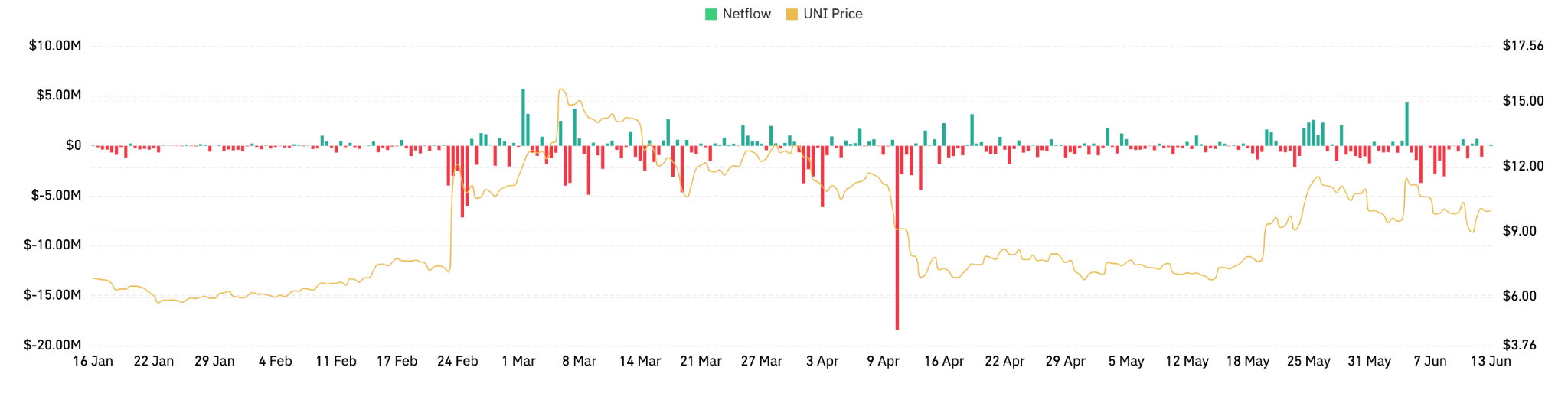

There’s additionally a dramatic spike in web inflows, indicating a sudden improve in tokens being moved to exchanges.

Supply: Coinglass

Is your portfolio inexperienced? Try the UNI Revenue Calculator

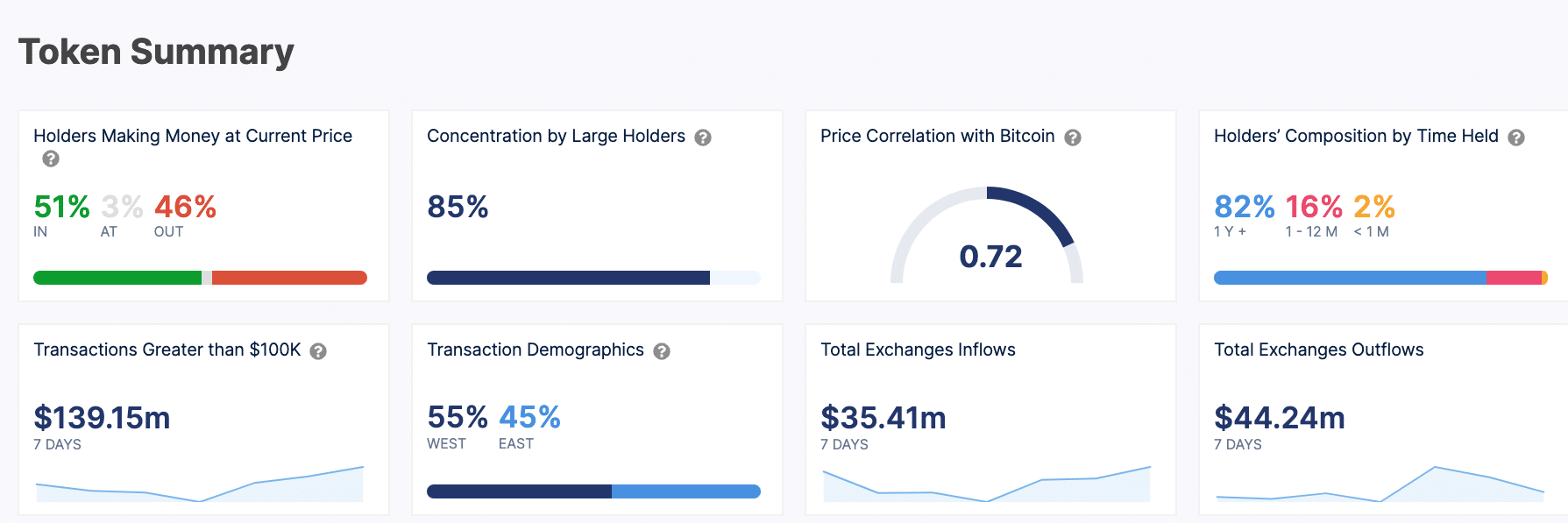

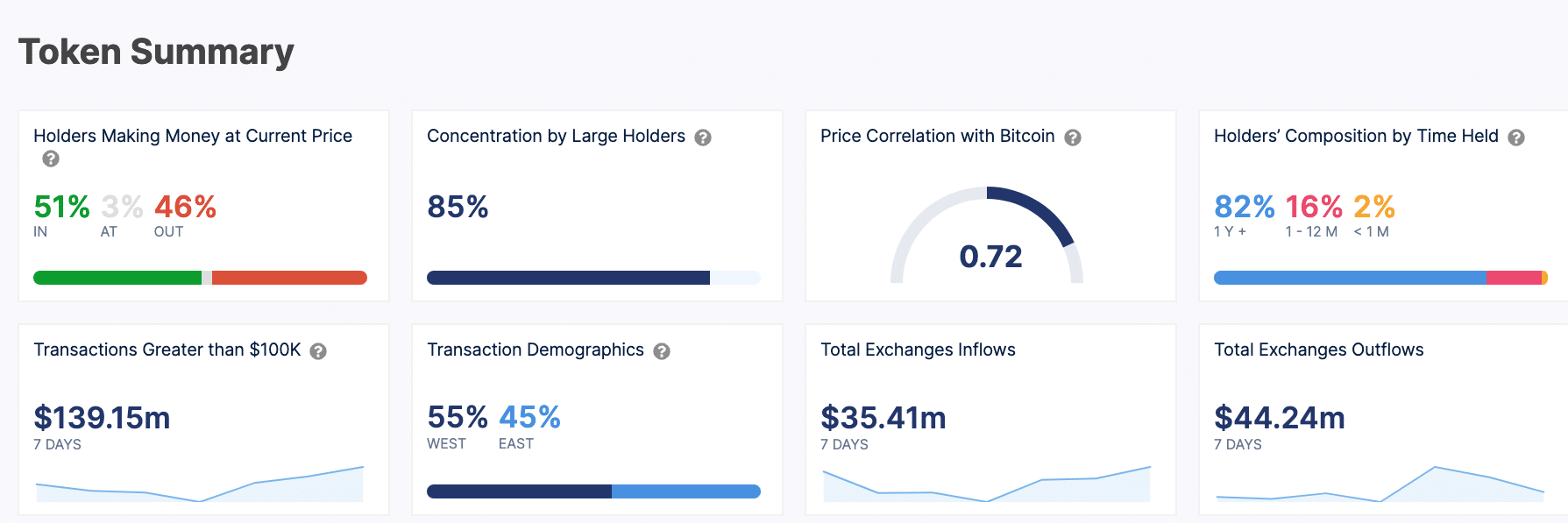

A slight majority (51%) of Uniswap holders are presently in revenue on the present value stage, which can present a psychological incentive to carry onto their investments in anticipation of additional value will increase.

Supply: IntoTheBlock

The excessive transaction values additionally present big curiosity from bigger buyers and establishments, which might additional drive larger value actions for UNI.