Crypto analyst Miles Deutscher expects that Ponzi tales about decentralized finance will not happen by 2024, regardless of the rise of the recovering trade. Nonetheless, he provides that the EigenLayer airdrop, the largest drop in 2024, might set off the frenzy of the earlier DeFi Ponzi schemes.

Apart from the progressive story, Deutscher is betting on synthetic intelligence, BRC-20, real-world asset tokenization, gaming NFTs and decentralized infrastructure initiatives as essentially the most profitable tales to observe.

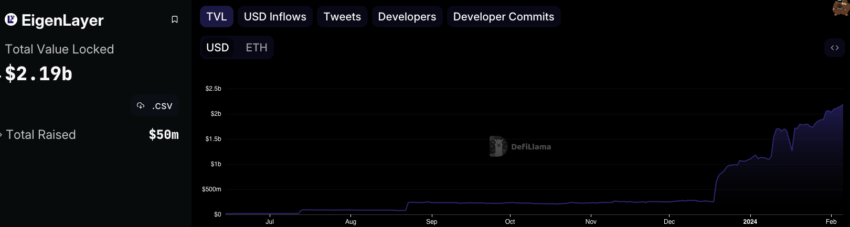

EigenLayer reaches $2 billion in renewed quantity

Deutscher mentioned initiatives like EigenLayer encourage staking cryptocurrencies on a number of blockchains, making coin staking extra capital environment friendly. The consumer can safe a number of blockchains on the similar time and obtain rewards from all blockchains. For instance, Ethereum staked on liquidity platforms like Lido might be redeployed when redeploying apps on EigenLayer, enabling what Deutscher calls yield stacking.

Learn extra: What’s Liquid Staking in Crypto?

Nonetheless, initiatives like EigenLayer, based mostly on the reason of tokenomics, seem at first look to be Ponzi schemes, Deutscher mentioned. Their sustainability can be beneath dialogue.

“I see re-stakes as the following model of the DeFi Ponzis… The re-stakes story, for my part, may be very paying homage to the 2021 DeFi Ponzi protocols. When folks tackle extra danger, they search for returns, they starvation them for on-chain alternatives, and that is what actually noticed the DeFi Ponzi Mania of 2021[and] 2022.”

Learn extra: Yield Farming vs. Staking: Which is Higher?

Critics have identified that DeFi traders chase returns earlier than they receives a commission. However, the rebuilding platforms have already raised $2 billion since their launch.

Widespread apps embrace KelpDAO, ether.fi and Renzo on EigenLayer. On their very own, these three initiatives have raised $800 million to this point.

DeFi Crypto Crime Induced Ponzi Label

Forbes in contrast DeFi staking to a Ponzi scheme in 2022. Forbes famous that the mission will solely be sustainable if extra traders drive up the value of the staking token.

“As a result of nearly all of members are additionally on strike, wagering rewards quantity to a token inflation, which drives the value down. [Therefore] the ecosystem should expertise a major enhance in new traders to offset the rising provide. As a result of it depends on new traders to take care of its worth, it’s much like different Ponzi schemes.”

Final 12 months, the US Commodity Futures Buying and selling Fee convicted Opyn, ZeroEx and Deridex for unlawful transactions. On the time, the company criticized the usage of superior expertise to cover crypto crimes. The company has referred to as for stricter laws round DeFi.

“Someplace alongside the best way, DeFi operators received the concept illegitimate transactions develop into authorized when facilitated by sensible contracts.”

The US Division of Justice charged the founders of the DeFi mission Forsage in 2023 with a $340 million Ponzi scheme. Buddy.tech, the social media platform Web3, has additionally been criticized for its similarity to a pyramid scheme.

BeInCrypto has reached out to Miles Deutscher for remark however has not but heard again.

Disclaimer

In accordance with the Belief Venture tips, BeInCrypto is dedicated to neutral, clear reporting. This information article is meant to offer correct, well timed data. Nonetheless, readers are suggested to independently confirm the details and seek the advice of knowledgeable earlier than making any choices based mostly on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage and Disclaimers have been up to date.