- Bitcoin exhibits a “double-top” sample, hinting at a doable fall to $50K.

- Regardless of bearish traits, optimistic long-term projections recommend a major future rise in Bitcoin’s worth.

Bitcoin [BTC] was hovering above $61,000 as soon as once more at press time, after briefly dipping to $58,000 ranges the day prior to this, displaying indicators of restoration with a 24-hour excessive of $62,949.

Nonetheless, on the time of writing, Bitcoin was buying and selling at $61,200, reflecting a lower of 1.2% over the previous 24 hours.

This sample of fast recoveries adopted by setbacks is sparking debate amongst crypto analysts, who foresee a doable additional decline to the $50,000 degree.

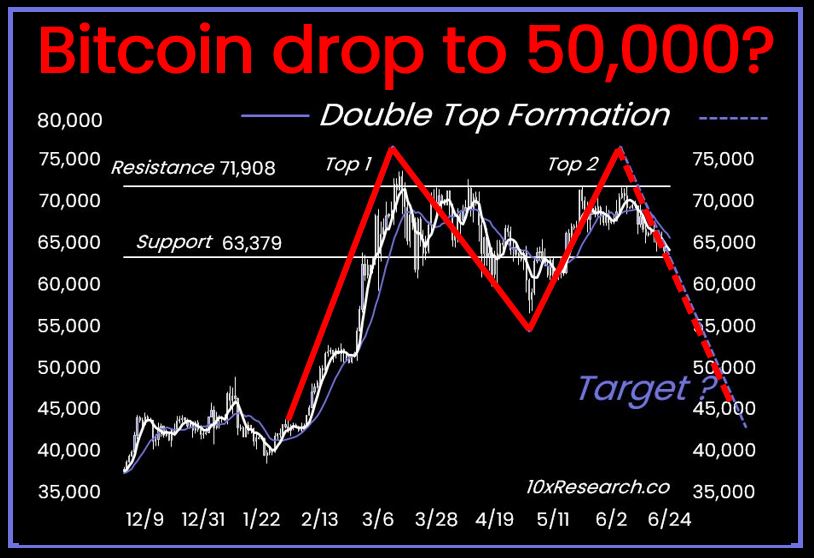

Double high exhibits additional drop To $50k

This bearish sentiment is bolstered by the formation of a “double-top” value sample, a technical indicator that usually heralds forthcoming bearish traits.

The sample, characterised by two consecutive peaks of comparable peak separated by a trough, means that Bitcoin won’t solely revisit however probably break under the $50,000 threshold.

This situation is seen as more and more seemingly given Bitcoin’s battle to surmount established resistance ranges, pointing to potential vulnerabilities in its present market energy.

The idea of a double-top sample in buying and selling is critical because it sometimes signifies a reversal from a previous uptrend.

10x Analysis has highlighted that Bitcoin is manifesting this sample, which has traditionally preceded substantial value declines.

Based on their evaluation, if Bitcoin fails to carry above the crucial ‘neckline’ help degree, it might result in a pointy lower, probably reaching as little as $45,000.

Market insights from the agency means that this bearish sample is solidifying, supported by observations of vary buying and selling between $60,000 and $70,000.

The potential transition from this buying and selling vary right into a topping formation might spell hassle for retail buyers, notably as many altcoins are inclined to observe Bitcoin’s lead and will additionally face vital drops.

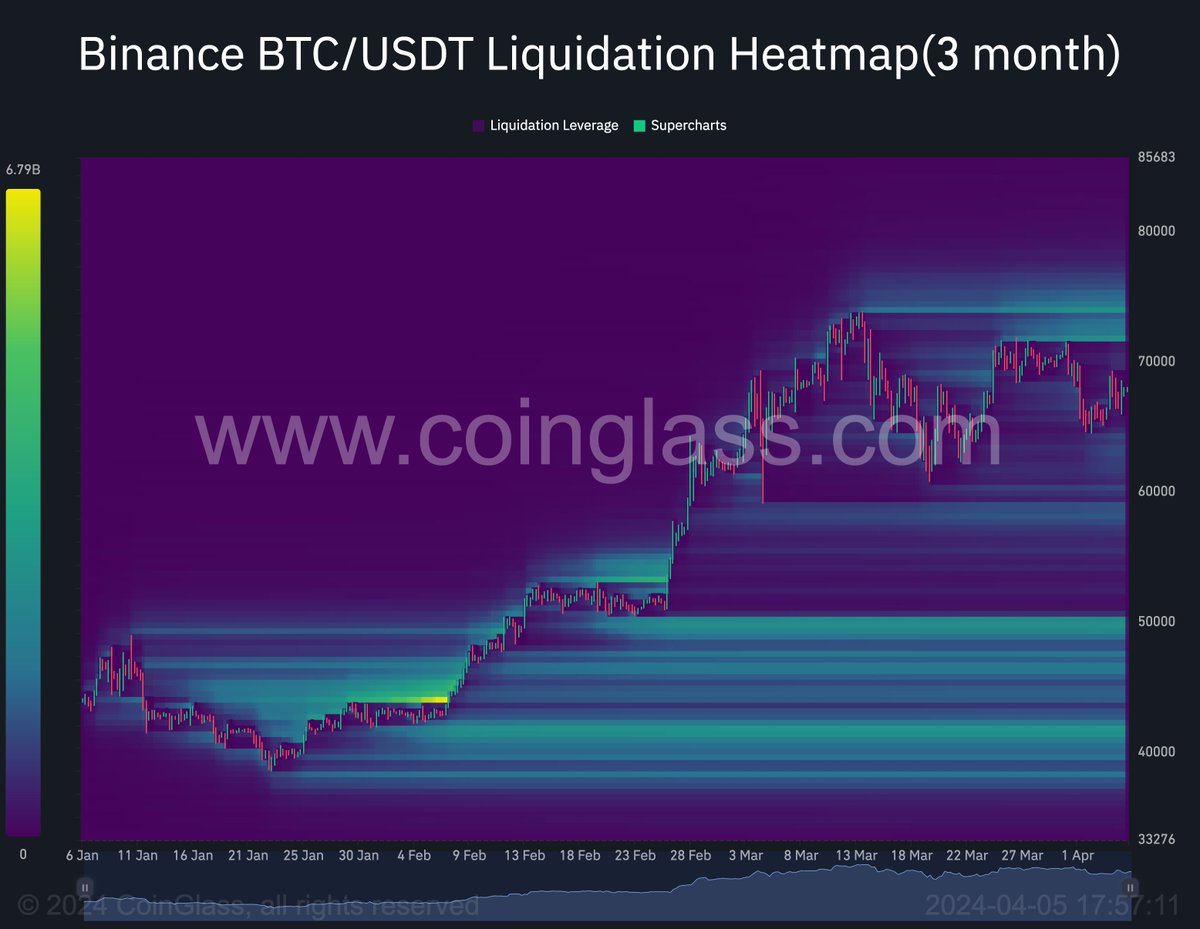

Different analysts, together with Dylan Leclair, have noted indicators that might level to a possible drop in Bitcoin’s value to round $50,000.

Leclair highlights current traits within the derivatives market, comparable to a lower in perpetual futures open curiosity and funding charges as Bitcoin stabilizes under its earlier excessive of $69,000.

This stabilization has led to fewer leveraged longs chasing the all-time excessive breakout, and though there’s a threat of lengthy positions being liquidated round $50,000.

Leclair famous,

“ I discover it fairly unlikely we revisit that degree (however not unimaginable in fact!).”

Supply: Dylan Leclair on X

Bitcoin fundamentals: Backing up the bearishness?

The looming query now’s whether or not Bitcoin’s fundamentals recommend an extra decline. A deep dive into Bitcoin’s key basic metrics sheds some mild.

As an illustration, Santiment data on BTC’s social quantity reveals a peak in mentions of “backside,” suggesting elevated bearish sentiment.

This is without doubt one of the highest social quantity and dominance spikes for the time period up to now 12 months, hinting at potential additional draw back.

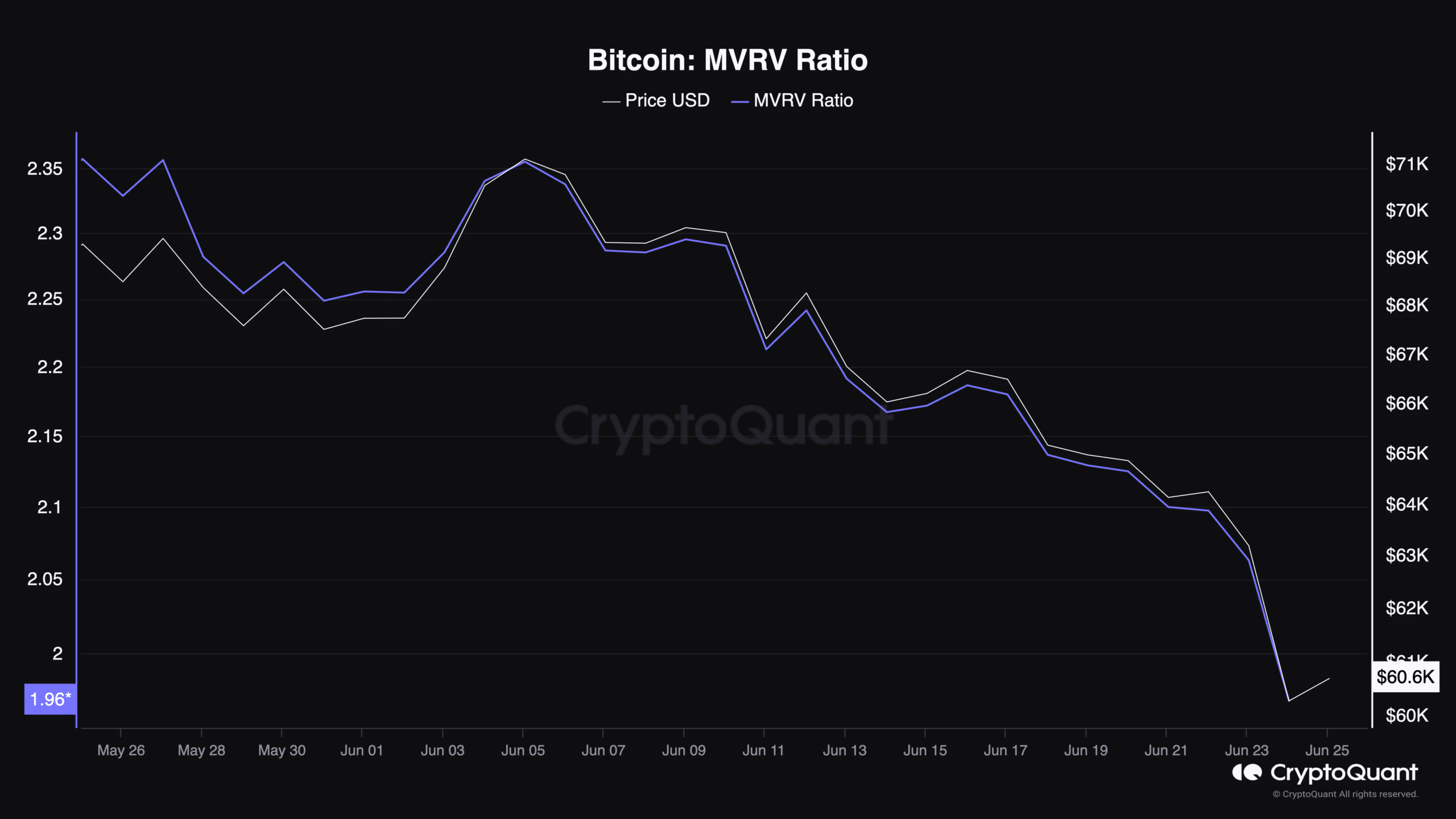

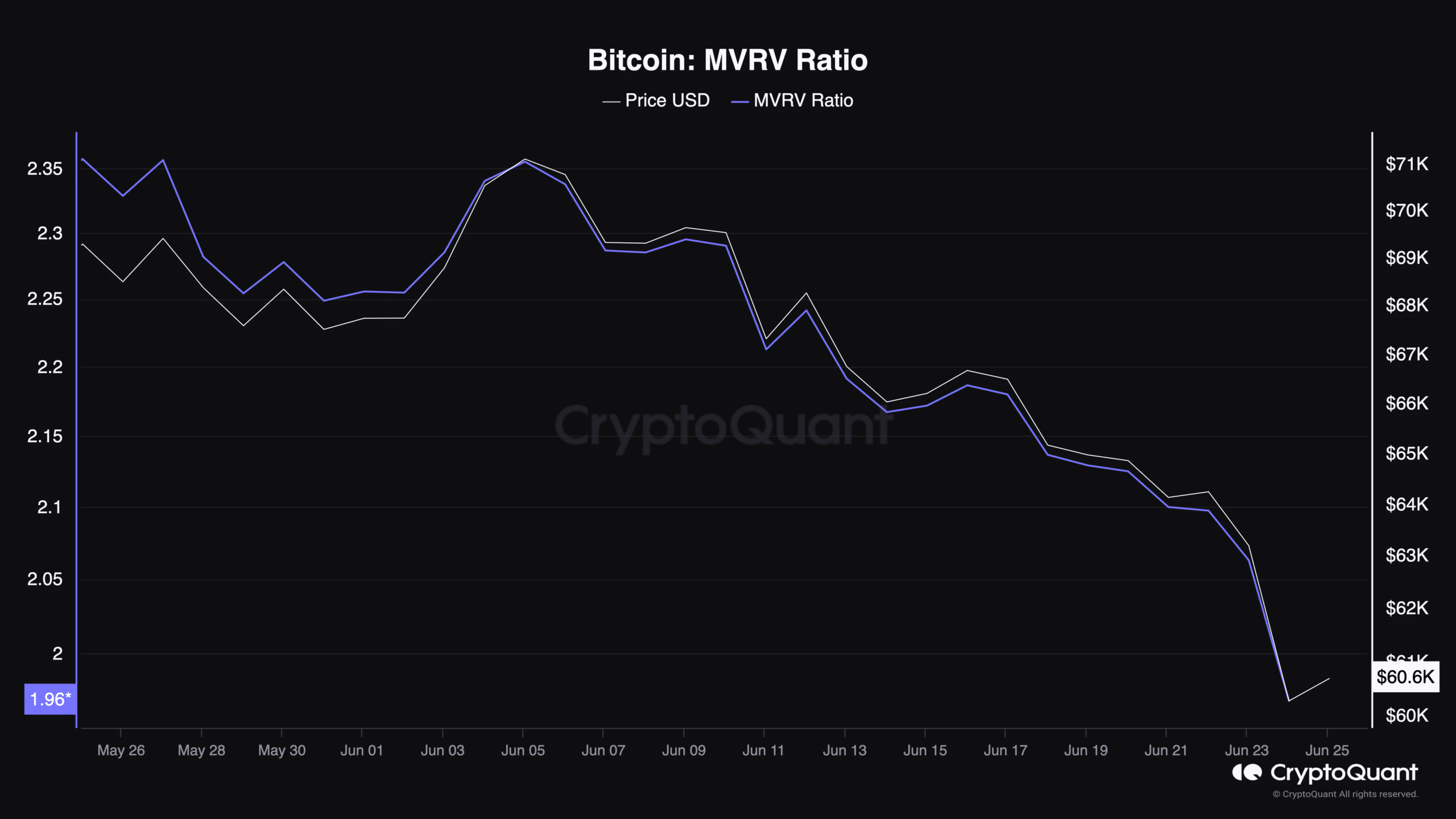

Furthermore, CryptoQuant data signifies that Bitcoin’s MVRV ratio—a metric that compares the market worth of Bitcoin to its realized worth—is intently following the value downtrend, presently standing at 1.96.

Learn Bitcoin’s [BTC] Worth Prediction 2024-2024

The ratio means that Bitcoin’s market worth is sort of double its realized worth, which may point out that the value is comparatively overvalued and would possibly right additional.

Supply: CryptoQuant

Regardless of these bearish indicators, Jack Mallers, CEO of Strike, maintains an optimistic long-term view, envisioning a future the place Bitcoin reaches $1 million per coin.