- Trump’s keynote at Bitcoin Convention 2024 could affect crypto laws and market dynamics.

- Bernstein famous BTC’s latest features and highlighted vital shares and market positions.

As Donald Trump gears as much as ship the keynote handle on the upcoming Bitcoin Convention 2024, a brand new evaluation from Bernstein Analysis, led by Gautam Chhugani, highlighted a blind spot out there.

Bernstein’s evaluation

Based on Bernstein, Trump’s potential reelection may herald vital regulatory shifts, which might dramatically affect Bitcoin [BTC] and the broader crypto market.

Increasing on this, Bernstein identified that Bitcoin markets have just lately regained momentum, with BTC surging by 13% final week to surpass $67,000.

Supply: CoinGecko

Shares associated to cryptocurrencies skilled even larger features, rising by 22% over the identical interval.

Bernstein’s report categorizes seven vital shares into 4 teams: hybrid BTC/AI information facilities (Core Scientific, Iris Power), Bitcoin mining consolidators (Riot Platforms, CleanSpark, Marathon Digital Holdings), BTC company treasury (MicroStrategy), and crypto broking/trade platforms (Robinhood).

“We view giant Bitcoin mining consolidators as high-beta Bitcoin proxies, with value motion being pushed by underlying Bitcoin value and potential cashflows from working leverage.”

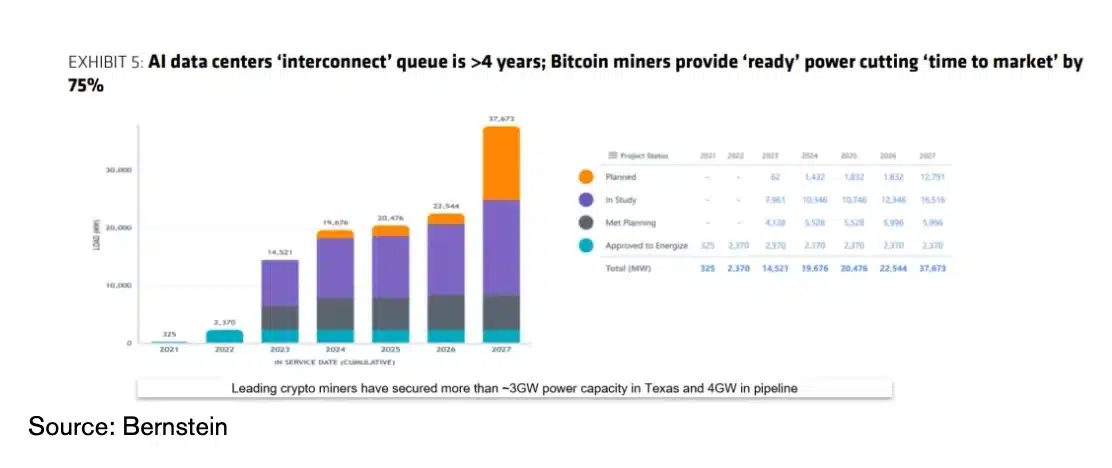

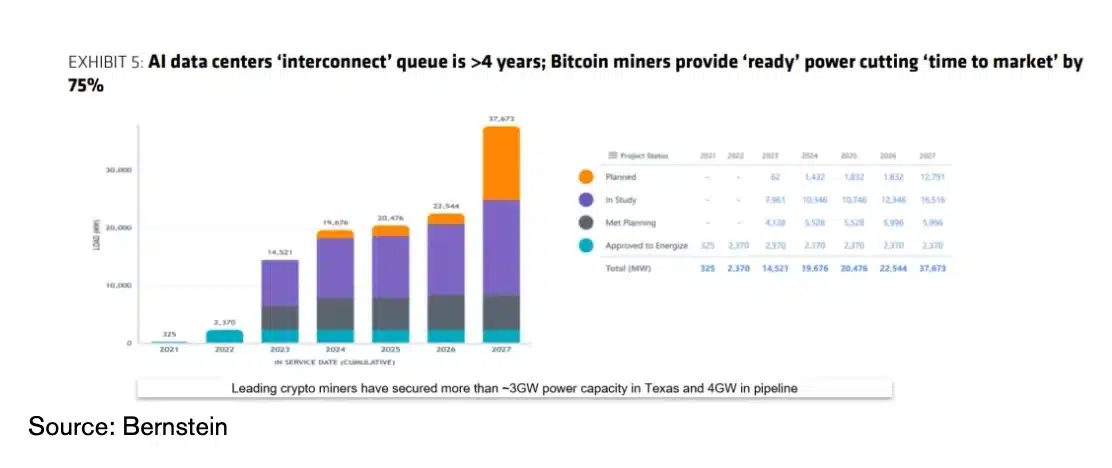

Moreover, the hybrid BTC mining and AI information heart operators had been recommended for his or her distinctive market positioning.

“Bitcoin miners discover themselves in a novel place, led by their disproportionate ‘energy entry’ in a power-constrained world.”

Supply: Bernstein

The report additionally mentioned the attainable results of the upcoming U.S. elections and Trump’s crypto stance.

Trump and his affect on Bitcoin

Trump’s upcoming speech on the Bitcoin 2024 Convention in Nashville has sparked appreciable curiosity, fueled by his latest advocacy for cryptocurrency and the eye-popping ticket value of $844,600—equal to 13 BTC.

Analysts are warning merchants concerning the dangers of shorting Bitcoin forward of Trump’s speech, amid rumors that he may declare Bitcoin as a strategic reserve asset for the U.S.

This transfer that would considerably affect BTC’s worth and market dynamics.

On the time of writing, Bitcoin was buying and selling at $67,000, reflecting a downturn on day by day charts as per CoinMarketCap.

Nevertheless, with the Relative Energy Index (RSI) at 62, the market reveals robust bullish sentiment, suggesting that the latest drop could merely be a short-term fluctuation.

Supply: TradingView