- Crucial purchase zones for Bitcoin are value proper now

- Bitcoin whales have gathered 358,000 BTC in July, marking an “unprecedented” switch of wealth

Bitcoin (BTC) has skilled appreciable value fluctuations lately, dropping from round $67,000 to under $65,000 inside simply 24 hours. This volatility has caught the eye of merchants and analysts alike.

In reality, Zen, a preferred crypto dealer and analyst, famous on X that Bitcoin’s decline mirrored actions within the inventory market. He claimed,

“$BTC adopted inventory market and dumped. Nearest zone of curiosity 64.5-65k I discussed earlier than was skipped in a single 1H candle – that’s the reason I wrote that it isn’t good for blind restrict orders and requires monitoring at decrease timeframes.”

He emphasised the necessity for warning and shut monitoring of value actions to keep away from untimely purchase orders.

Zen additional recognized essential value zones, stating that the primary strong purchase zone is round $61.4K to $61.8K, with a decrease zone doubtlessly overlaying the CME hole round $58.5K to $60.5K.

Supply: X

Accumulation by Bitcoin whales

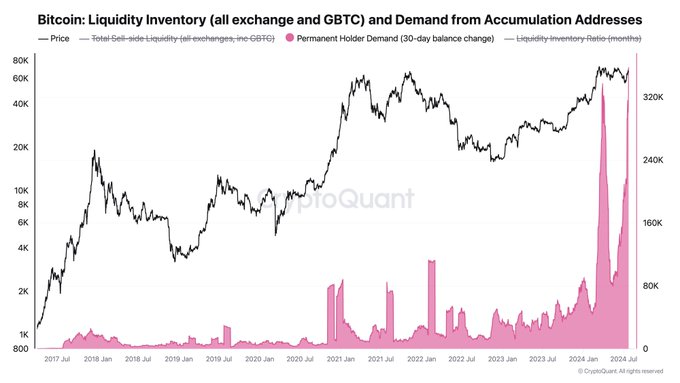

Moreover, on-chain analytics platform CryptoQuant additionally noticed a notable pattern of Bitcoin accumulation by large-volume traders, also referred to as whales. CEO Ki-Younger Ju highlighted this in a current submit, describing the circulation of cash to those traders as “unprecedented.”

He acknowledged that over the previous month, 358,000 BTC has been moved to everlasting holder addresses. July alone noticed international spot ETF inflows of 53,000 BTC.

Regardless of not all BTC being in custody wallets, the buildup section is clear although, with a considerable switch of wealth throughout the crypto market.

Supply: CryptoQuant

Bitcoin was buying and selling at $64,222 at press time, with a 24-hour buying and selling quantity of $37,443,835,918. This underlined a 3.35% decline over the aforementioned interval.

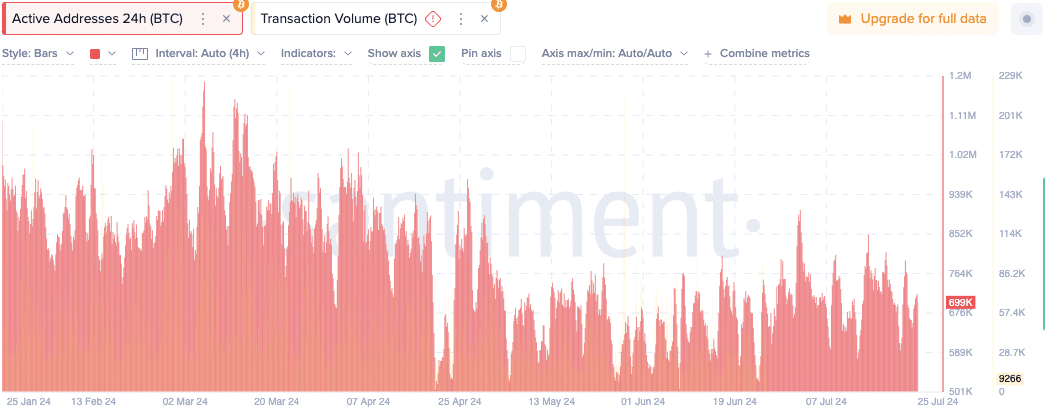

Furthermore, the variety of energetic Bitcoin addresses has proven some variability too, starting from roughly 500K to 1.2M.

On the time of writing, for example, energetic addresses numbered 699K, with a transaction quantity of 9266 BTC – Marking a decline from earlier peaks seen in late February and early June.

Supply: Santiment

Moreover, the Whole Worth Locked (TVL) in Bitcoin stood at $701.92 million, reflecting ongoing engagement and funding within the cryptocurrency market.

The dynamics of energetic addresses and transaction volumes present beneficial insights into market exercise and investor habits.

Influence of potential political developments

The upcoming Bitcoin 2024 convention has generated pleasure, significantly as a result of involvement of 2024 presidential candidate Donald Trump.

Trump has been vocal about his assist for Bitcoin, proposing the addition of BTC as a greenback reserve. This formidable plan goals to ascertain Bitcoin as digital gold. The potential affect of Trump’s presidency on Bitcoin’s value is a subject of appreciable curiosity amongst crypto lovers.