- World liquidity has surged forward of a probable hike in U.S cash provide

- Given the historic BTC pump amidst the liquidity surge, is one other rally seemingly?

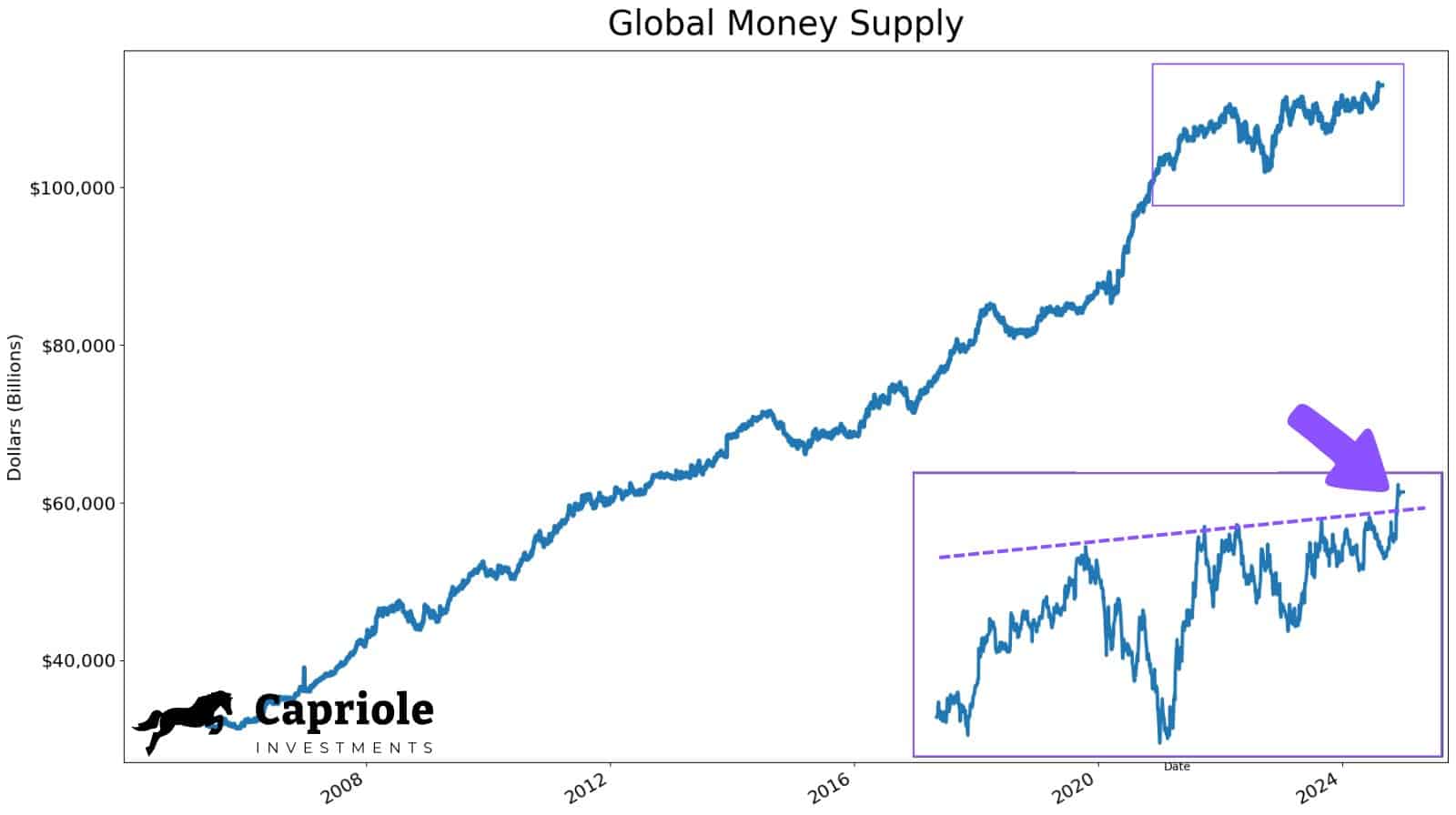

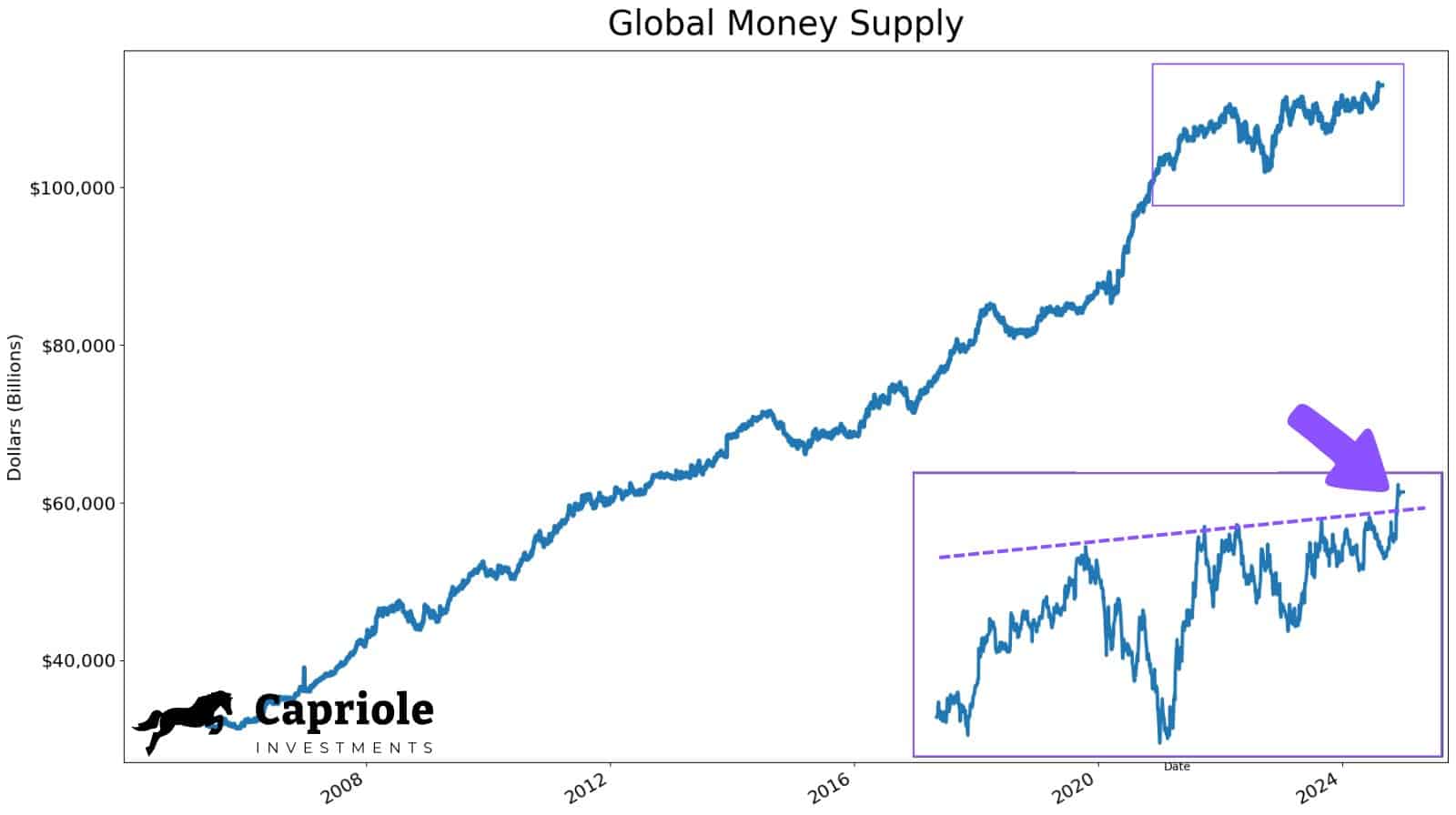

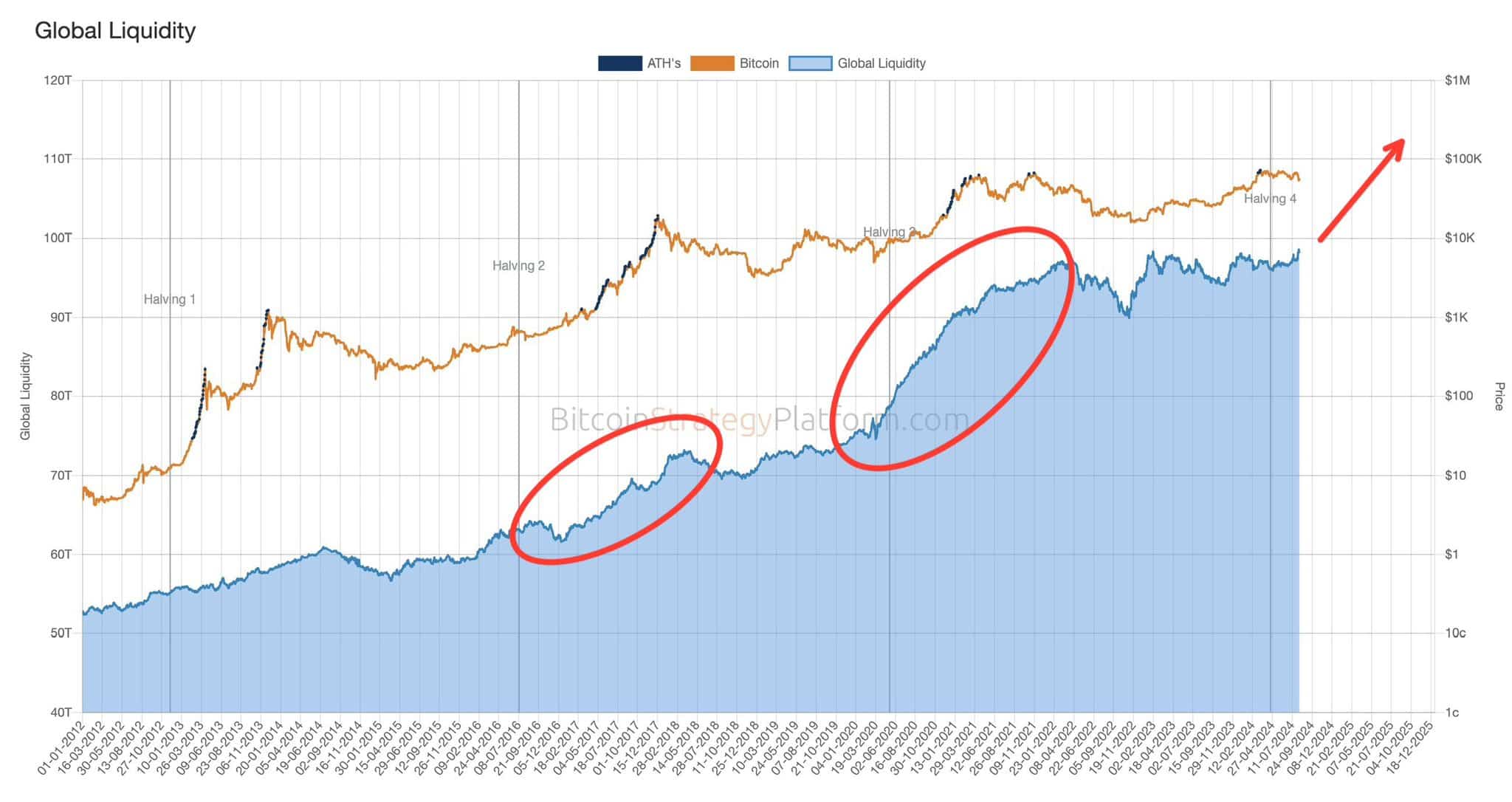

There’s an more and more favorable macro set-up for Bitcoin [BTC], particularly from a liquidity (cash provide) perspective. In actual fact, based on Charles Edwards, Founding father of crypto-hedge fund Capriole Investments, the general world liquidity has exploded above a 4-year consolidation degree now.

“World cash provide is exploding up. Plus, we simply broke out of an enormous 4-year consolidation. What do you assume this implies for Bitcoin?”

Supply: Capriole Investments

Whereas a number of components might have an effect on BTC’s costs, the world’s largest digital asset is a widely known liquidity junkie. Such a spike in world liquidity might arrange BTC for an upside potential.

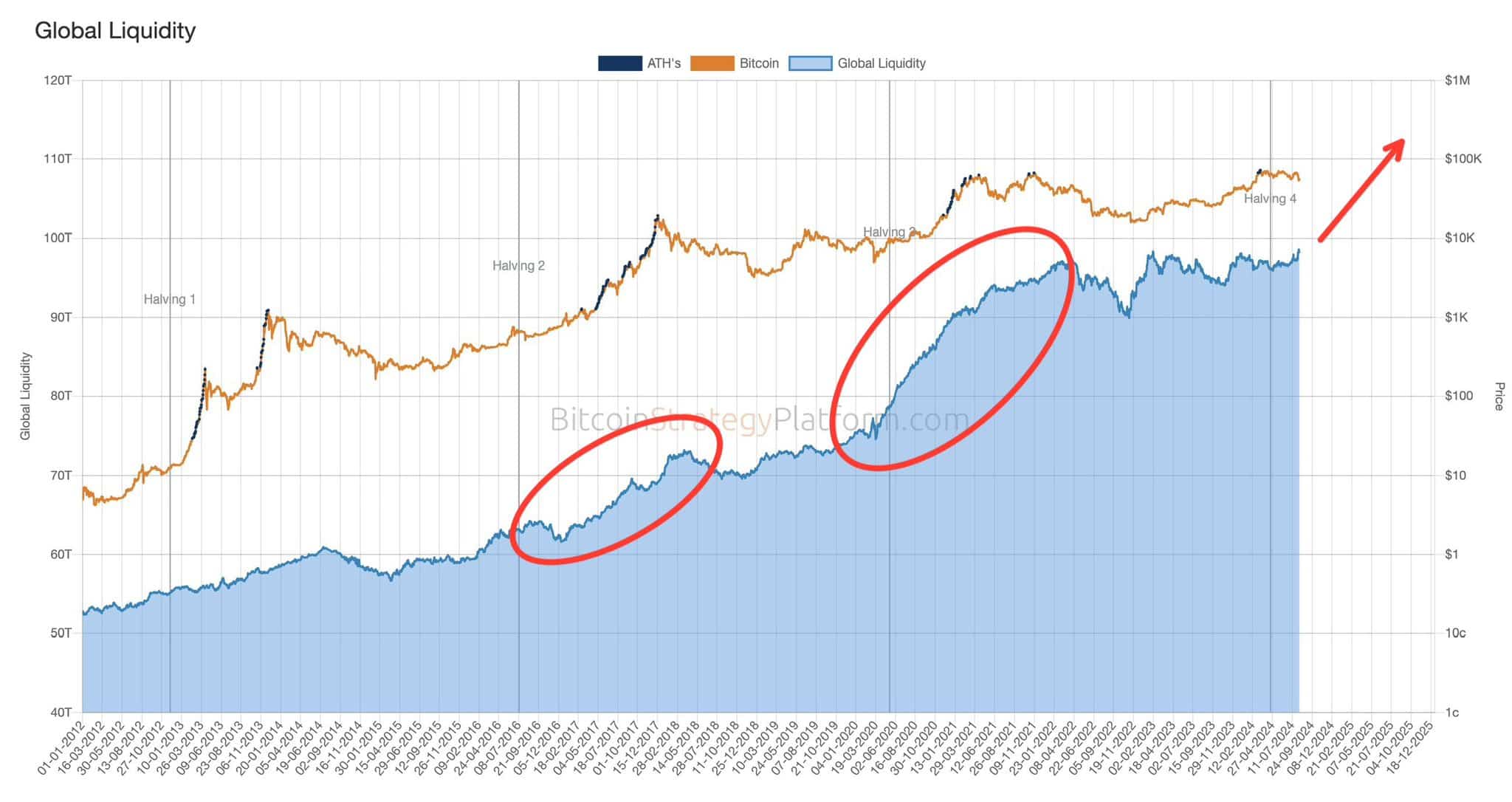

For context, the cycle highs in 2017 and 2021 coincided with an uptick in world liquidity, as noted by one market analyst – Francois Quinten.

“World liquidity is about to spike up. So is #Bitcoin

”

Supply: X/Quinten

U.S liquidity to gasoline BTC costs

The latest surge in world liquidity isn’t shocking, given the start of quantitative easing as central banks reduce rates of interest. Canada and the U.Ok, amongst others, have diminished their rates of interest too.

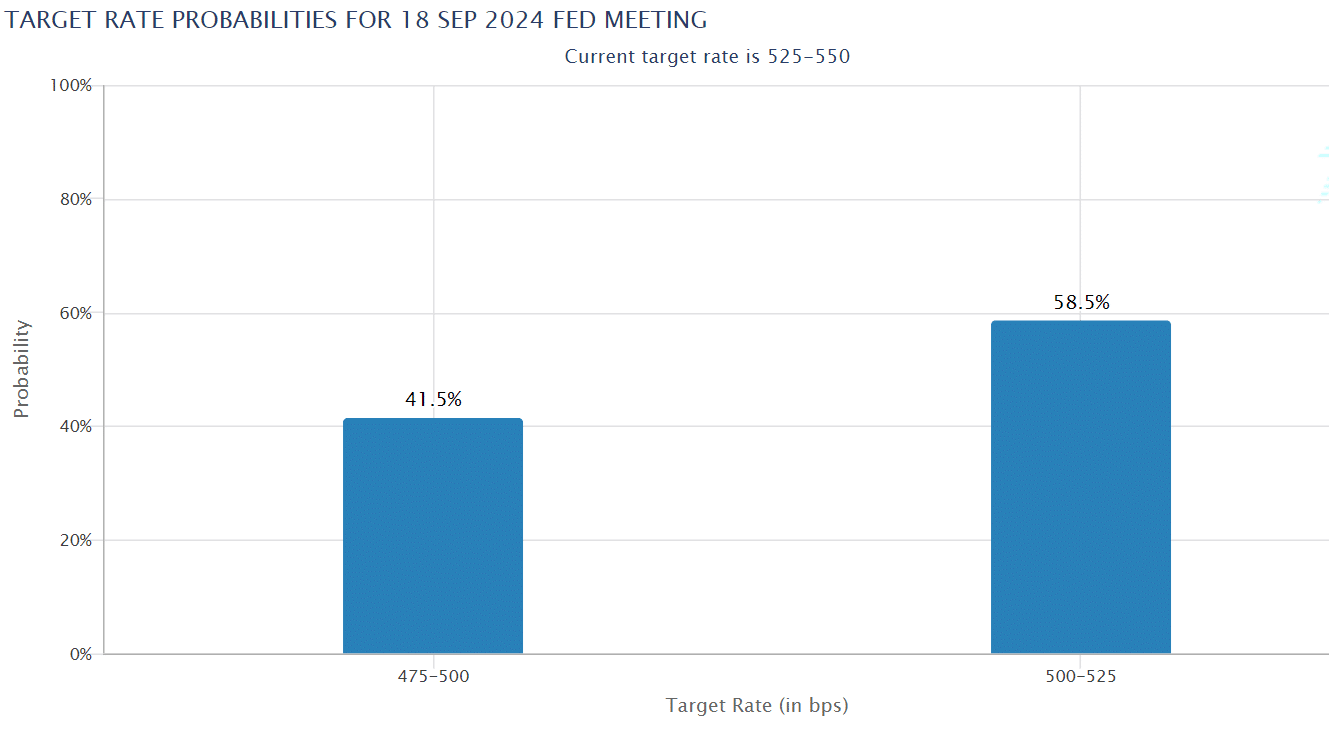

The U.S is predicted to start Fed charge cuts by September, which might additional spike world liquidity and have an effect on the cryptocurrency’s costs. At press time, rate of interest merchants had been pricing a close to 60%-40% Fed charge reduce for 25 and 50 foundation factors, respectively.

Put in another way, merchants at the moment are extremely satisfied of a September Fed charge reduce.

Supply: CME Fed Watch device

Aside from the Fed charge reduce, the U.S liquidity injection would come from the over $300 billion in T-bills (Treasury payments) the U.S Treasury Division will challenge between now and the top of the yr.

For the unfamiliar, T-bills are utilized by the federal government to lift funds to cowl fiscal deficits wanted for total expenditure. In brief, optimistic internet issuance of T-bills will improve U.S liquidity.

In response to BitMEX founder Arthur Hayes, this U.S liquidity setup would push BTC to $100k and break its sideways-downward trajectory.

“I count on that crypto will exit its sideways-to-downward trajectory beginning in September”

In brief, BTC might see large worth appreciation from September onwards.

In the meantime, on the time of writing, the world’s largest cryptocurrency was buying and selling at $60.8k, with BTC going through a short-term promote wall at $63k.