Maxiphoto

Expensive readers/followers,

I have been in high-yield delivery shares earlier than – and it is one of many few areas and investments the place I really took realized losses in my investments. Because of this, it is an space I am very cautious about. I’ve written two articles about AMSC ASA (OTCQX:ASCJF), to start with, because of a subscriber request. The articles themselves garnered a surprisingly excessive like/remark ratio, which is one thing I have a look at. I am joyful to take a look at corporations that readers appear to take pleasure in me .

So with reference to AMSC ASA, I do not really feel that I am tooting my very own horn too loudly once I say that I managed to keep away from a unfavorable RoR on this firm. Even with dividends, the corporate is down 8.29% since March, which is way worse than the S&P500.

AMSC ASA RoR (Searching for Alpha)

However the time has come to revisit the corporate. Is it maybe extra engaging now? It needs to be until one thing elementary has modified.

The one factor I’m positive about is that I’m in no hurry to repeat my errors within the delivery sector. So that is an space the place I cross my t’s and dot my i’s.

Revisiting AMSC ASA – Delivery with high-yield

The similarities to Ocean Yield, an organization that I’ve beforehand been invested in and really misplaced cash in, are quite a few. This can be a ship financing firm, very like Ocean Yield was. Which means it owns so-called bareboat charters for maritime property and leases them to varied corporations across the globe, in what could be in comparison with a triple-net lease construction for REITs.

Additionally, as maybe the foremost threat – it is a minuscule firm. On a world scale, it is barely definitely worth the identify. It was established again in -05 and is traded underneath the ticker AMSC natively in Oslo, and presently owns lower than 20 vessels. You’ll be able to think about it safer than your typical nano firm as a result of AMSC is definitely owned partially by Aker ASA (OTCPK:AKAAF), a large Norwegian conglomerate I seem to personal – however this doesn’t equate to a low threat or good returns.

$230M in market cap is what the corporate has. It is foremost argument for investing is the Jones Act. What on earth is the Jones Act?

The Jones Act is a 1920 regulation that limits how cargo is transported by sea. It requires any cargo shipped between U.S. ports to be carried by U.S. ships, with American crews. That is a part of what offers the corporate its benefit. It is even proper there within the identify.

AMSC IR (AMSC IR)

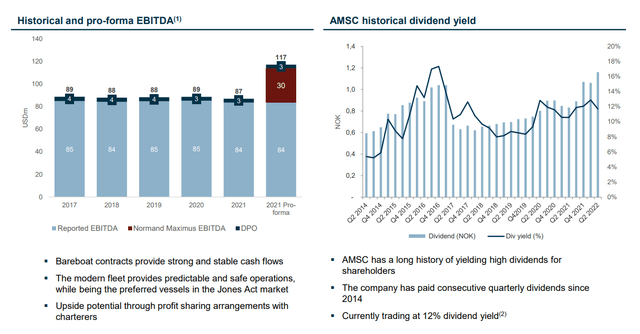

Identify, emblem, and every thing – it is clear what this firm is. Its arguments are similar to these as soon as introduced by Ocean Yield. Predictable EBITDA and dividends from in-demand property with good, accretive acquisitions. Few maturities. Fashionable ships – I’ve heard most of this earlier than.

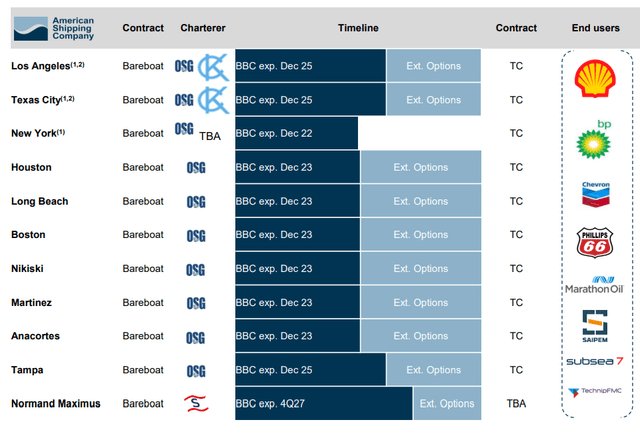

A mixture of issues brought on Ocean Yields’ downfall, however an absence of diversification in subsectors in delivery was considered one of them. AMSC fortunately has a bit totally different construction, even when they’ve fewer vessels. (Supply: 2Q23 Presentation)

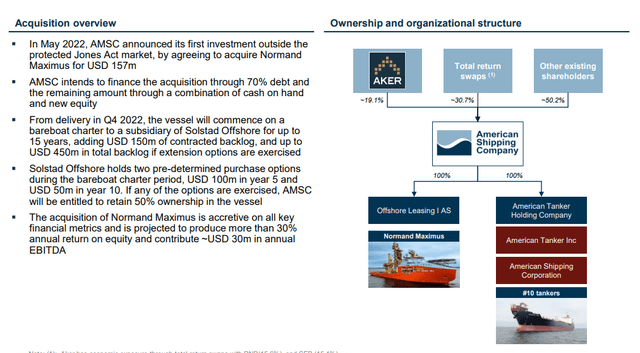

Sadly, AMSC has not too long ago determined that it is shifting exterior the Jones act.

AMSC IR (AMSC IR)

I haven’t got a problem with the financing resolution. However I do consider the corporate shifting exterior Jones is a web unfavorable for what was in any other case way more protected if a small sector. The asset in fact has a contract, and I am not ready to say that is all-in-all a unfavorable for the funding thesis. However it doesn’t make issues much less complicated. Sure, the entire fundamentals say that the Maximus M&A might be accretive – nevertheless it was precisely this type of specialised vessel that partially brought on hassle at Ocean Yield. The Maximus is an offshore building vessel within the heavy-duty subsea sector – and whereas the contract, on the floor, appears to be like safer, I do know properly that if issues do take a downturn, there’s little or no security available anyplace right here. (Supply: 2Q23 Presentation)

I like the corporate’s portfolio of vessels in any other case. It is a very stable assortment of Veteran-Class MT46’ers, sort MR with not a single vessel older than 2007, or 15-16 years. It is a very “younger” fleet, and the $84-$85M value of EBITDA that we’re getting yearly appears secure. 52% LTV is sweet even now and would have been wonderful two years again throughout ZIRP. (Supply: 2Q23 Presentation)

However the firm suffers each from constitution focus in addition to expiration focus – and that is doubtless what has pushed the share value down fairly a bit.

AMSC IR (AMSC IR)

So you possibly can see, whereas the tip customers are diversified, the corporate’s vessels are just about simply chartered by OSG, with many expirations in 2023, lest choices are used for extensions.

The Maximus will end in a big improve in firm EBITDA, round $30M extra per 12 months, which might allow both dividend progress or elevated security and debt downpayment. Nevertheless, to name the corporate “secure” when it comes to dividends can be flawed. AMSC adjusts its dividend the place wanted, and minimize it as late as 2021.

AMSC IR (AMSC IR)

The corporate’s elementary benefits, and why I think about it an organization value at the least stay, even in 2Q23, its bareboat charges and aggressive place. That the development of recent vessels is considerably increased than something AMSC can supply the constitution corporations is evident. For example, the corporate has a delivered value at common $107M per vessel. The most cost effective newbuild deliveries and transaction values for the years 2015-2017 have been $130-134M, greater than 25% above AMSC. The 2026E newbuild value, inclusive of inflation, is estimated to be round $175M (Supply: Philly/NASSCO, AMSC IR).

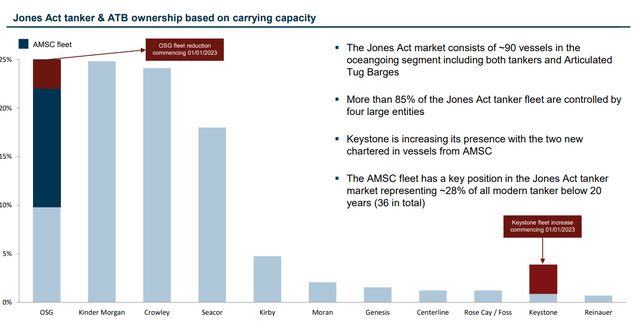

So for the foreseeable future, AMSC has a definite benefit within the area. Nevertheless, OSG has already communicated its intention to cut back its fleet measurement – and OSG is the most important participant within the Jones Act. That is doubtless additionally the explanation, or at the least a part of the logic behind the transfer exterior the Jones Act. Whereas the corporate has been capable of transfer these property to a different Jones Act participant, Keystone, any shift right here is prone to result in instability – as we’re seeing right now within the share value, down double digits. (Supply: 2Q23 Presentation)

AMSC IR (AMSC IR)

The corporate’s foundational enchantment stays. It affords long-term lease options with important financing benefits in addition to possession optionality on the finish of the leasing time period. It is an uneven threat/reward, simply because it was with Ocean Yield. To be clear, Ocean Yield didn’t go bankrupt. It simply went non-public at a value under my buy value. And whereas the Jones Act continues to be a significant a part of the US tanker economic system, and the present refinery utilization and fossil gas traits level in the appropriate course, I have been on the receiving finish of the unfavorable stick for an organization like this for too lengthy to be simply swayed by a 12% yield.

I’ve, as they are saying, been burned as soon as.

Nonetheless, a case could be made for why AMSC ASA could also be an attention-grabbing funding – and we should not let one mistake make a complete sector unattractive.

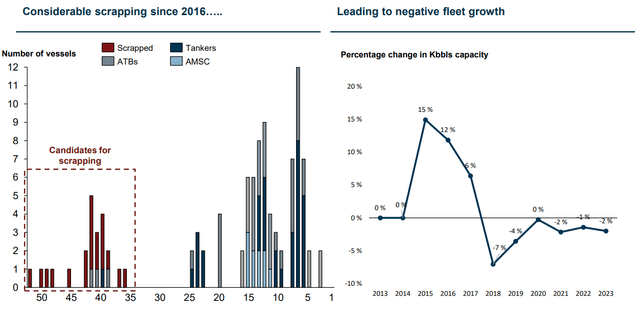

Moreover, the supply of vessels and fleet when it comes to fleet progress is definitely forecasted to be unfavorable. So on the macro facet, loads of issues speak in favor of AMSC ASA. A important quantity of vessels are both already scrapped, or within the strategy of being scrapped, or candidates for scrapping.

AMSC IR (AMSC IR)

Let’s examine what this implies for valuation, and the way we should always view the corporate right here in September of 2023.

AMCS ASA – The upside is there, nevertheless it’s dangerous

Once I beforehand lined AMCS, I thought-about the corporate a “HOLD”, fulfilling solely 2 out of 5 of my funding standards regardless of a big, 12%+ yield. The native P/E on the time was over 15x, which I didn’t think about low-cost and even interesting. There have been cheaper and higher delivery corporations on the market, and alternatives to get in on a excessive yield.

As a result of that is what we have to be clear about. Often, buyers need AMSC for an revenue funding.

However the factor about revenue investments right now, because of rising rates of interest, there are many them on the market, and they’re not exhausting to search out – not even high-yielding ones. It is pretty straightforward discovering 7-8% yielding debt devices or pref shares, which I might view as considerably similar to a dangerous, 12%-yielding delivery enterprise.

I stay properly past the state of with the ability to be tantalized by a double-digit yield and nothing else. The very fact was that in my final article, and at over 43 NOK per share for the native itemizing, the downward potential of this firm within the case the market turns, even with that comparatively well-covered yield for the following 2 years, far outstrips the return potential of that yield.

That’s now a unique case.

Whereas 2 analysts observe the corporate, these analysts have remained pretty regular at a 45-48 NOK, and the corporate has really underperformed this for so long as I can see the historical past (Supply: TIKR.com/S&P International). In my earlier article, I reiterated 30 NOK per share – and I am absolutely cognizant that such a goal might certainly by no means materialize, or at the least not within the close to time period. However I stay firmly opposed to purchasing this firm above something with a “4” as the primary quantity because of the important threat of “simply delivery”.

I consider revenue investments yielding 7-9% are far simpler to search out on the market, with extra stability and security and payouts in roughly the identical measurement, and never asking you to put money into a sub-$250M market cap enterprise.

Nevertheless, as earlier than, I am unable to justify going unfavorable on the inventory. The macro circumstances to allow such a downturn simply aren’t there. A flat improvement – sure – in reality, I consider vitality costs will stay at these costs/comparatively flat, and I do not anticipate a large enchancment within the sector from right here on out.

This makes AMSC “speculative” in each case I have a look at. If you happen to’re wonderful with speculative investments, this can be one for you if you happen to’re offered on these high-income returns/yields.

For me although, the one circumstance the place I might see myself shopping for AMSC is that if the corporate was the place I might think about “low-cost” whereas on the similar time being favorable from a threat perspective. When you might argue for the latter, I don’t consider you, even now, can argue for the previous.

Thus, right here is my up to date thesis for 2023E.

Thesis

- AMSC is an attention-grabbing firm within the delivery sector with a stable portfolio of 11 (12 quickly) fashionable vessels leased to comparatively secure counterparties. The corporate sports activities a double-digit yield and engaging financials however is a small enterprise with a good quantity of threat if because of macro and contract expiration.

- For that cause, I am cautious right here. I would not purchase the corporate at right now’s valuation however would wait, if , for a little bit of a drop.

- My PT for the corporate comes nearer to the historic norm of 30 NOK/share, which is the place I provoke protection right here. I am not altering this for 2023 – it is nonetheless 30 NOK/share.

- The chance of the corporate dropping to this degree with out macro impacts is low – however this signifies simply what I am searching for earlier than I might be keen to “BUY” a spec inventory like this right here.

Bear in mind, I am all about:

- Shopping for undervalued – even when that undervaluation is slight and never mind-numbingly large – corporations at a reduction, permitting them to normalize over time and harvesting capital features and dividends within the meantime.

- If the corporate goes properly past normalization and goes into overvaluation, I harvest features and rotate my place into different undervalued shares, repeating #1.

- If the corporate does not go into overvaluation however hovers inside a good worth, or goes again all the way down to undervaluation, I purchase extra as time permits.

- I reinvest proceeds from dividends, financial savings from work, or different money inflows as laid out in #1.

Listed here are my standards and the way the corporate fulfills them (italicized).

- This firm is general qualitative.

- This firm is basically secure/conservative & well-run.

- This firm pays a well-covered dividend.

- This firm is presently low-cost.

- This firm has a sensible upside primarily based on earnings progress or a number of growth/reversion.

The corporate fulfills 2 out of my 5 standards, making it a “Maintain” right here.

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please pay attention to the dangers related to these shares.