Diego Antonio Maravilla Ruano/iStock by way of Getty Pictures

Introduction

Whereas I nonetheless like regional banks, not each financial institution is buying and selling at a valuation that’s sufficiently interesting to be added to my portfolio. It has been some time since I final checked out Ames Nationwide (NASDAQ:ATLO) and rather a lot has occurred within the US banking sector since so this creates a superb alternative to have one other have a look at this Iowa-based regional financial institution.

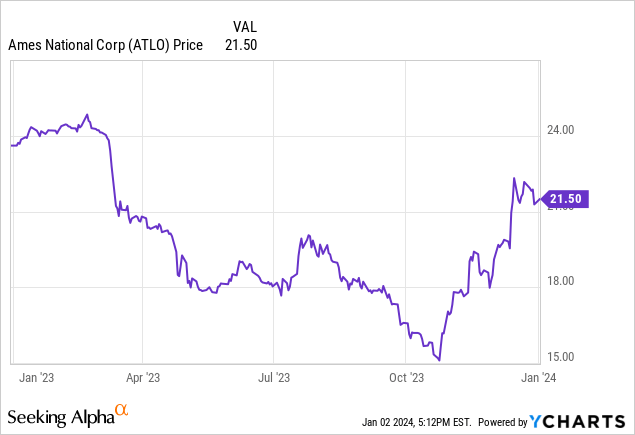

The share value appears to be operating forward of EPS will increase

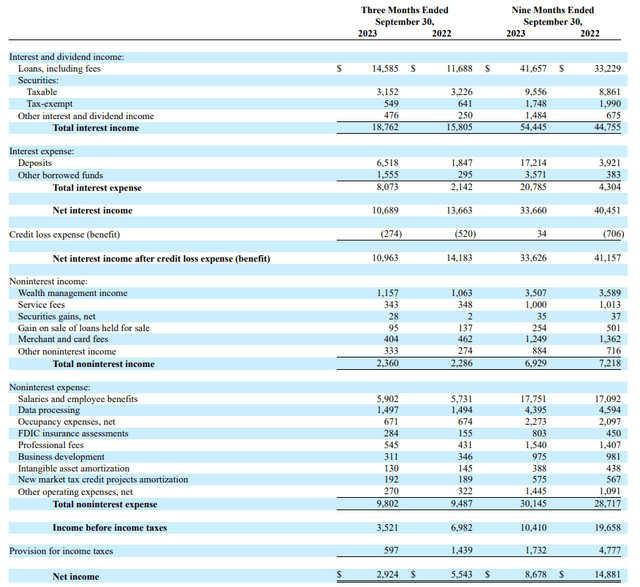

Throughout the third quarter of 2023, Ames Nationwide reported a complete curiosity revenue of $18.8M, which is a rise of virtually 20% in comparison with the third quarter of final 12 months, when rates of interest had been decrease. However as you may think about, the curiosity bills additionally elevated and the revenue assertion beneath clearly reveals the overall curiosity bills nearly quadrupled to $8.1M which resulted in a internet curiosity revenue which was roughly 1 / 4 decrease than in the identical quarter final 12 months.

ATLO Investor Relations

Sadly, the financial institution’s monetary efficiency remains to be very a lot relying on the web curiosity revenue as its non-interest parts have a unfavorable impression on the consolidated outcome. The revenue assertion above reveals the financial institution recorded a $2.4M non-interest revenue whereas the overall non-interest bills elevated to $9.8M. This implies there was a complete internet non-interest expense of $7.4M leading to a pre-tax and pre-provision revenue of lower than $3.3M. Happily the financial institution was in a position to reverse a portion of the provisions it beforehand recorded and due to its skill so as to add $274,000 in reverted provisions to the Q3 outcomes, its pre-tax revenue was $3.5M leading to a internet revenue of $2.9M or $0.33 per share.

This certainly means the quarterly dividend of $0.27 remains to be absolutely coated however as its Q3 outcome was simply $0.33 (together with a lift of some cents per share due to the mortgage loss provision reversion), I miss out on why the inventory is buying and selling at in extra of $20/share proper now. Even the 9M 2023 outcomes had been simply ‘so-so’ with an EPS of $0.97 per share.

That being stated, I used to be very happy with the financial institution’s skill to reverse a few of its beforehand recorded mortgage loss provisions and I used to be questioning if this might maybe clarify the sturdy share value efficiency.

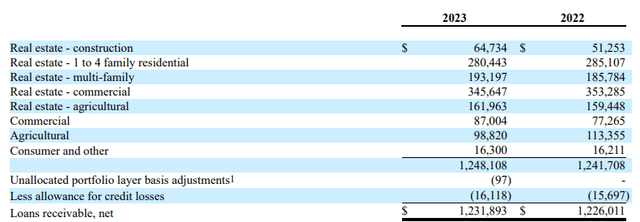

Wanting on the breakdown of the mortgage ebook, it stood at $1.23B together with roughly $16.1M in mortgage loss allowances. As you may see beneath, residential actual property is a vital ingredient of the mortgage ebook though it should even be necessary to control the $346M industrial actual property portfolio.

ATLO Investor Relations

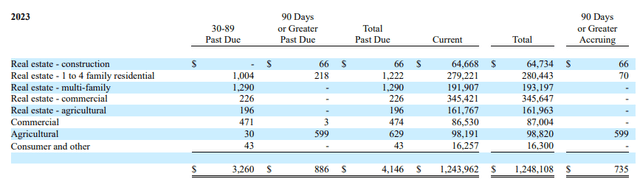

To make sure the financial institution’s mortgage portfolio remains to be strong, I wished to take a look at the standing of the funds. As you may see beneath, of the $1.248B mortgage ebook, solely $4.15M of the loans are categorized as overdue, with roughly 20% of that quantity categorized as in extra of 90 days overdue.

ATLO Investor Relations

That certainly is nice information as the overall quantity of loans overdue in addition to the overall quantity of loans which can be overdue by in extra of 90 days has decreased in comparison with the top of 2023. Based mostly on this breakdown, I now absolutely perceive why the financial institution was in a position to reverse a number of the beforehand recorded mortgage losses. The present provision of $16.1M represents nearly 400% of the present quantity of loans overdue. So even should you’d assume a particularly bearish (and nearly unimaginable) state of affairs the place the financial institution doesn’t recoup a single greenback of the loans which can be at the moment overdue, the present mortgage loss allowance is ample to cowl all losses.

ATLO Investor Relations

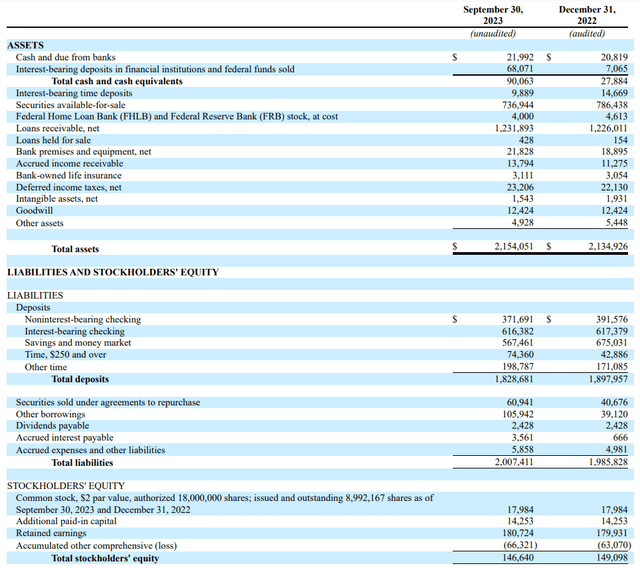

On the finish of the third quarter, Ames Nationwide had a $146.6M fairness place on the stability sheet. Divided over the 9M shares excellent, this represents a ebook worth of roughly $16.3M.

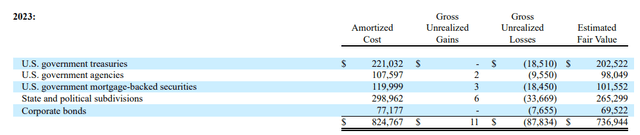

The stability sheet additionally comprises roughly $14M in goodwill and intangible belongings which implies the tangible ebook worth per share was simply $14.75. Happily, the financial institution has no securities which can be categorized as ‘held to maturity’ which implies there aren’t any ‘hidden’ parts on the stability sheet. The substantial portfolio of securities held on the market to the tune of $737M are marked to market and decrease rates of interest sooner or later can have a optimistic impression on that securities portfolio. As you may see beneath, there’s an unrealized lack of $87.8M which is nearly $10/share.

ATLO Investor Relations

Funding thesis

Whereas I’m impressed with the standard of the mortgage ebook because the default charges stay low, the financial institution is at the moment buying and selling at roughly 16-17 occasions earnings. I do count on this to get higher sooner or later as Ames will have the ability to profit from the growing rates of interest on the revenue aspect. That being stated, buying and selling at roughly 1.5 occasions its tangible ebook worth and a double digit earnings a number of, I’m on the sidelines. Ames’ quarterly dividend of $0.27 at the moment represents a 5% dividend yield however this by itself is inadequate to get me within the inventory.