Wirestock

Funding Thesis: I take the view that America Movil may see a rebound in upside, on the idea of rising LTV and a discount in long-term debt.

In a earlier article again in October 2022, I made the argument that America Movil (NYSE:AMX) had seen spectacular development in revenues and earnings, however the present inflationary atmosphere may probably see a plateau in 5G demand going ahead.

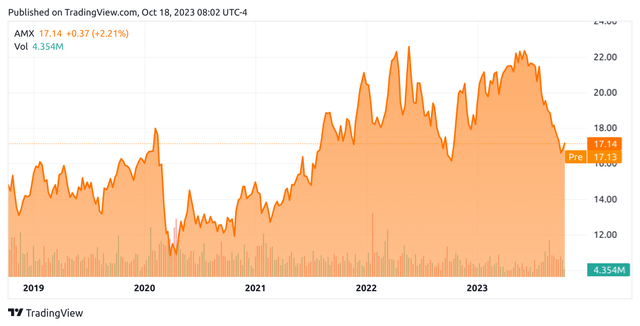

Since then, the inventory has descended to a value of $17.14 on the time of writing:

TradingView

The aim of this text is to evaluate whether or not America Movil has the flexibility to see continued development from right here taking latest efficiency into consideration.

Efficiency

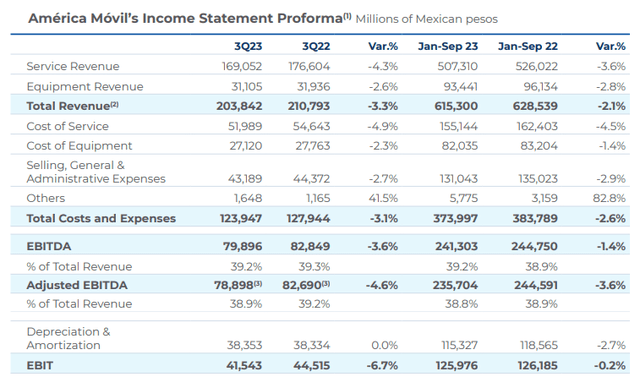

When Q3 2023 earnings results, we will see that as in comparison with the identical quarter final 12 months – complete income is down by -2.1% which is essentially all the way down to a discount of -3.6% in service income.

America Movil Q3 2023: Monetary and Working Report

With that being stated, it needs to be famous that the discount in income is due in vital half to the appreciation of the Mexican peso. America Movil states that given fixed trade charges, service income was truly up by 3.8%.

Moreover, we see that EBIT (earnings earlier than curiosity and taxes) is down by -0.2% on that of final 12 months. As soon as once more, this was influenced by the appreciation of the Mexican peso as in comparison with all different currencies in America Movil’s area of operations.

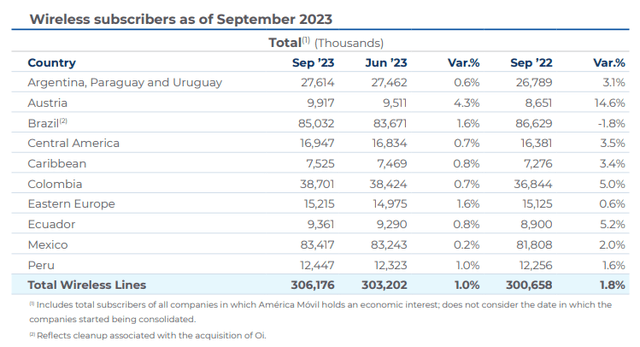

As we will see, Mexico and Brazil are the most important markets for America Movil by wi-fi subscribers.

America Movil Q3 2023: Monetary and Working Report

Nonetheless, Mexico stays by far the most important marketplace for the corporate by income – with Q3 2023 income coming in at 81.904 billion Mexican pesos as in comparison with 11.489 billion Brazilian reals for a similar quarter (which is equal to roughly 41.494 billion Mexican pesos) at a charge of 1 MXN = 0.276883 BRL on the time of writing.

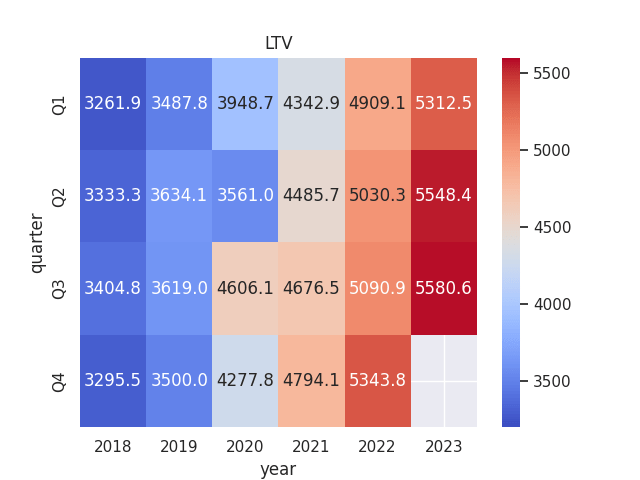

From this standpoint, I wish to additional assess the well being of buyer demand throughout the Mexican market by gauging lifetime worth per quarter – i.e. the typical worth that America Movil realises from every buyer throughout the lifetime of the corporate’s dealings with that buyer.

To calculate this, ARPU and churn charges for Mexico (throughout all wi-fi subscribers – postpaid and pay as you go) had been sourced and LTV was calculated by quarter as follows:

LTV = (ARPU / churn %) * 100

When trying on the beneath heatmap, we will see that LTV has continued to extend through the years. We are able to see that for 2023, LTV throughout every quarter noticed a considerable enhance on that of the identical quarter final 12 months.

Heatmap generated by creator utilizing Python’s seaborn visualization library. LTV by quarter calculated by creator – all figures in Mexican pesos.

Furthermore, each ARPU and churn charges have been transferring in the suitable path over the long term, i.e. ARPU has been rising and the churn charge (or the speed at which prospects cease utilizing providers by America Movil) has been falling. In Q1 2018, ARPU stood at 137 Mexican pesos with a churn charge of 4.2%. In Q3 2023, ARPU stands at 173 Mexican pesos with a churn charge of three.1%.

From a stability sheet standpoint, we will see that America Movil’s long-term debt to complete belongings ratio has seen a slight lower from that of final 12 months, with long-term debt down by 6.92% over this era.

| Sep 2022 | Sep 2023 | |

| Lengthy-term debt | 380,430 | 354,122 |

| Complete belongings | 1,630,304 | 1,592,142 |

| Lengthy-term debt to complete belongings ratio | 23.33% | 22.24% |

Supply: Figures (in hundreds of thousands of Mexican pesos) sourced from America Movil Q3 2022 and Q3 2023 Monetary and Working Reviews. Lengthy-term debt to complete belongings ratio calculated by creator.

From this standpoint, the truth that America Movil has continued to see rising LTV with out having to extend its long-term debt ranges is kind of encouraging.

The corporate’s fast ratio (complete present belongings much less inventories throughout complete present liabilities) has remained unchanged at 0.63 over the interval.

| Sep 2022 | Sep 2023 | |

| Complete present belongings | 376,582,242,000 | 359,244,037,000 |

| Inventories | 31,821,865,000 | 20,564,752,000 |

| Complete present liabilities | 542,997,774,000 | 533,664,963,000 |

| Fast ratio | 0.63 | 0.63 |

Supply: Figures (in Mexican pesos) sourced from America Movil Q3 2022 and Q3 2023 Monetary and Working Reviews. Fast ratio calculated by creator.

Whereas a fast ratio lower than 1 signifies that an organization doesn’t possess ample liquid belongings to satisfy its present liabilities, I take the view that given America Movil’s long-term debt discount – buyers might be keen to tolerate a decrease fast ratio whereas long-term debt continues to see a discount and LTV tendencies proceed to the upside.

My Perspective

As regards my tackle the above outcomes and the implications for the expansion trajectory of the inventory going ahead, I take the view that America Movil’s decline over the previous 12 months could also be market-related and an indication of buyers being cautious of publicity to rising markets relatively than an indication of underperformance by America Movil per se.

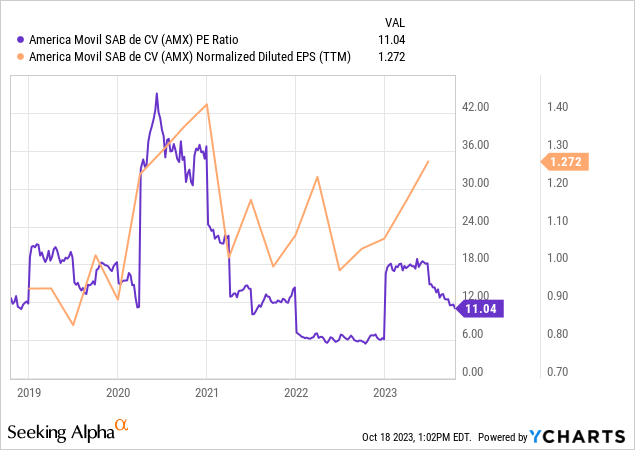

Significantly, when trying on the P/E ratio during the last five-year interval, we will see that America Movil is buying and selling at the same P/E ratio to that seen in 2019, but earnings per share have trailed considerably larger since then:

YCharts

On this regard, I take the view that America Movil is probably undervalued at this level and has the capability to rebound to a previous degree of $22 that we noticed earlier this 12 months.

Dangers and Trying Ahead

When it comes to the potential dangers to America Movil presently, I take the view that macroeconomic elements might stand to affect the corporate’s trajectory going ahead.

Whereas I take the view that the worth drop that we now have seen within the inventory over the previous 12 months is unjustified, the inventory might keep at such ranges and even see additional draw back if fairness market sentiment deteriorates extra typically and appeals for rising market shares additionally declines.

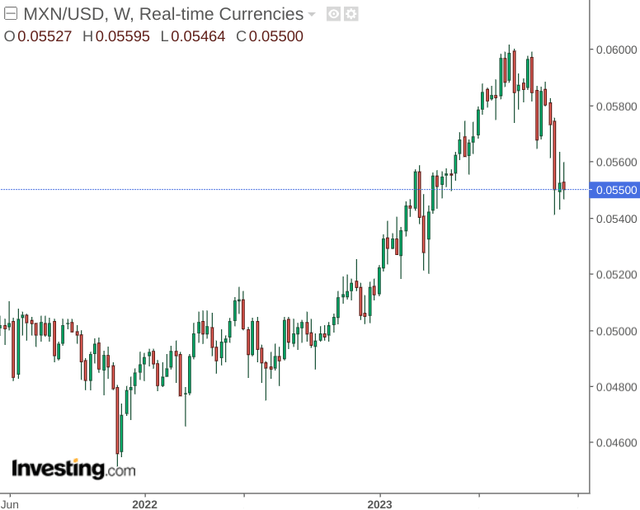

As well as, we now have seen that the appreciation of the Mexican peso has led to a gross sales lower in nominal phrases – as revenues throughout the corporate’s different working areas got here in decrease.

Whereas the trajectory of the forex and the corresponding impact on income development has but to be seen – we’re seeing indicators of the peso depreciating towards the U.S. greenback as soon as once more:

investing.com

However the above dangers, I take the view that America Movil is in place to see development over the long term.

Conclusion

To conclude, America Movil has seen encouraging development in LTV, and the truth that the corporate has concurrently been reducing its long-term debt ranges can be encouraging. For these causes, I take a bullish view on America Movil.