jimfeng/iStock by way of Getty Pictures

Introduction

Ambac Monetary Group, Inc. (NYSE:AMBC) appears to be like very low cost on a p/e and p/b foundation proper now, however what I’ve found is a major quantity of debt ranges which might be digging into the enlargement capacities of the corporate as little earnings are left over when paying down all of the money owed and obligations.

The corporate holds $3.4 billion in debt with a market cap underneath $600 million. AMBC is for my part a debt lure that’s presently disguised as a price alternative. I worry that traders shall be getting the quick finish of the stick right here and see their investments lose worth. The debt ranges will weigh on additional and the present downward development will doubtless proceed. The share worth has already gone down over 10% within the final 12 months and I feel it could actually go decrease, inflicting me to fee AMBC a promote proper now.

Firm Construction

AMBC is a outstanding insurance coverage firm headquartered in New York Metropolis, specializing in property and casualty insurance coverage providers. The corporate operates by two distinct divisions: Everspan and Cirrata. Everspan is devoted to providing specialty insurance coverage applications, with a selected deal with overlaying business and private legal responsibility dangers. This division gives tailor-made insurance coverage options to deal with a variety of legal responsibility considerations confronted by companies and people.

Cirrata, however, features as an insurance coverage distribution platform, encompassing a various portfolio of Managing Common Brokers and Managing Common Underwriters (MGAs and MGUs). By Cirrata, Ambac extends its attain and capabilities within the insurance coverage market, partnering with numerous entities to develop its insurance coverage choices and improve its market presence.

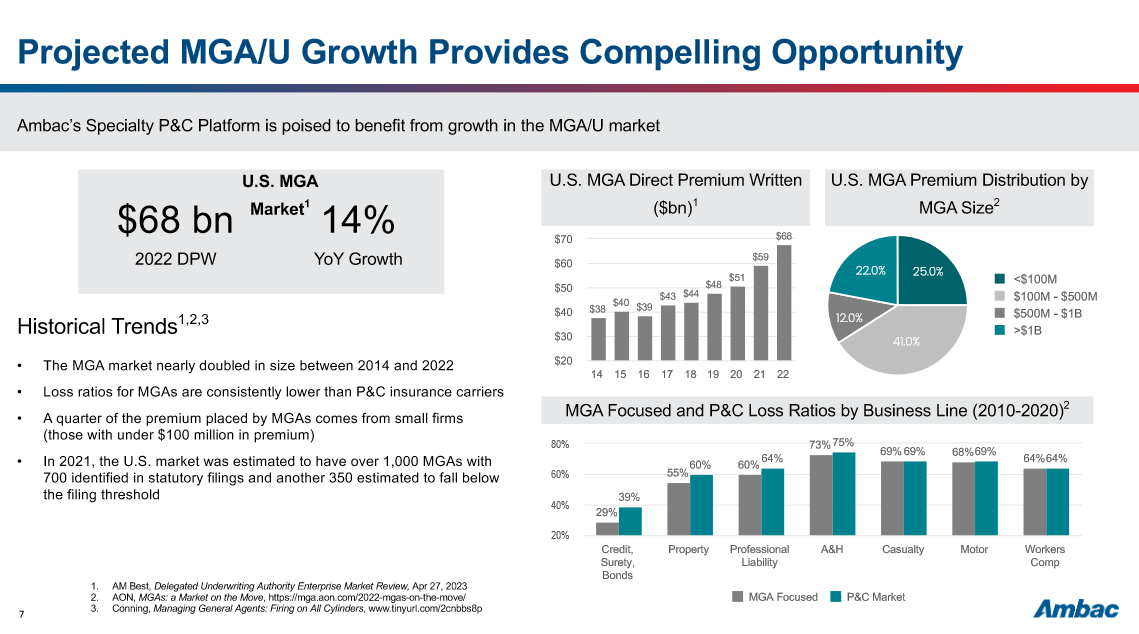

Firm Overview (Investor Presentation)

The corporate presents itself as a stable alternative to achieve publicity to the rising specialty protection market. The US MGA market is expected to showcase progress of 14% as offered by the corporate. A number of the historic developments supporting this assumption are the doubling of the market since 2014, showcasing the demand it has. The quantity of direct premiums written can also be rising at a really sound fee. Not too long ago as properly the main focus has come to make sure the loss ratios are enhancing as catastrophic occasions and weather-based occasions are inflicting some mayhem within the insurance coverage markets.

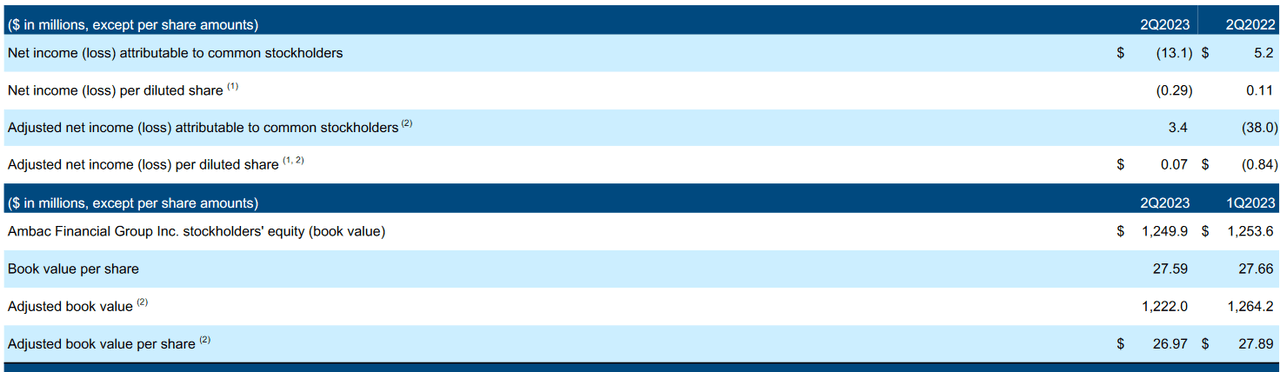

Earnings Assertion (Earnings Report)

AMBC has had a final couple of adverse quarters as seen above right here. The Q2 FY2023 showcased a destructive backside line, down closely from the $5.2 million constructive the final 12 months. The adjusted worth although for the corporate tells a distinct story because the adjusted EPS resulted to be $0.07, up from $(0.84) in Q2 FY2022. Going ahead I feel traders will wish to see a continuation of this development to make it attainable to divert extra capital to paying down debt and getting right into a much less leveraged monetary place. The debt ranges have been extremely excessive for over a decade and taking a look at the way it has affected the EPS I feel we see one thing fairly disappointing proper now. The EPS has averaged a CAGR of destructive 3.68% within the final decade. This tells me that AMBC has been unable to lift the underside line considerably by taking over at one level over $15 billion in money owed.

Earnings Transcript

I’ve been fairly pessimistic about AMBC to this point and I feel it is solely truthful we embody some feedback from the administration itself as properly on this piece. The CEO of AMBC Claude LeBlanc had the next to share the final earnings name.

-

“Our differentiated market positioning, mixed with favorable market developments, place us properly for continued sturdy progress within the coming quarters. Our consolidated monetary outcomes for the second quarter confirmed a modest hole web loss and constructive adjusted web revenue, reflecting the momentum of our new companies and the rising stability of our Legacy Monetary Assure enterprise”.

The administration of AMBC appears to be fairly bullish on their outlooks nonetheless and expects continued progress over the subsequent few quarters. I’m not as satisfied and I feel that there needs to be some important catalyst if the EPS is to exhibit a continued uptrend any more. A catalyst that may allow AMBC to develop margins by offsetting much more expense to their buyer base. However with a aggressive market setting, I feel that may simply drive new acquisitions away and into the palms of friends as a substitute.

Threat Related

AMBC presently carries a considerable debt load on its monetary books. Whereas the corporate successfully meets its debt obligations and is actively pursuing methods to cut back this debt burden utilizing accessible money reserves, it is essential to notice that rising rates of interest can have an effect on AMBC’s monetary flexibility. Curiosity bills stay fairly excessive for AMBC nonetheless at $161 million for the final 12 months, a results of the numerous quantity of money owed the corporate has taken on.

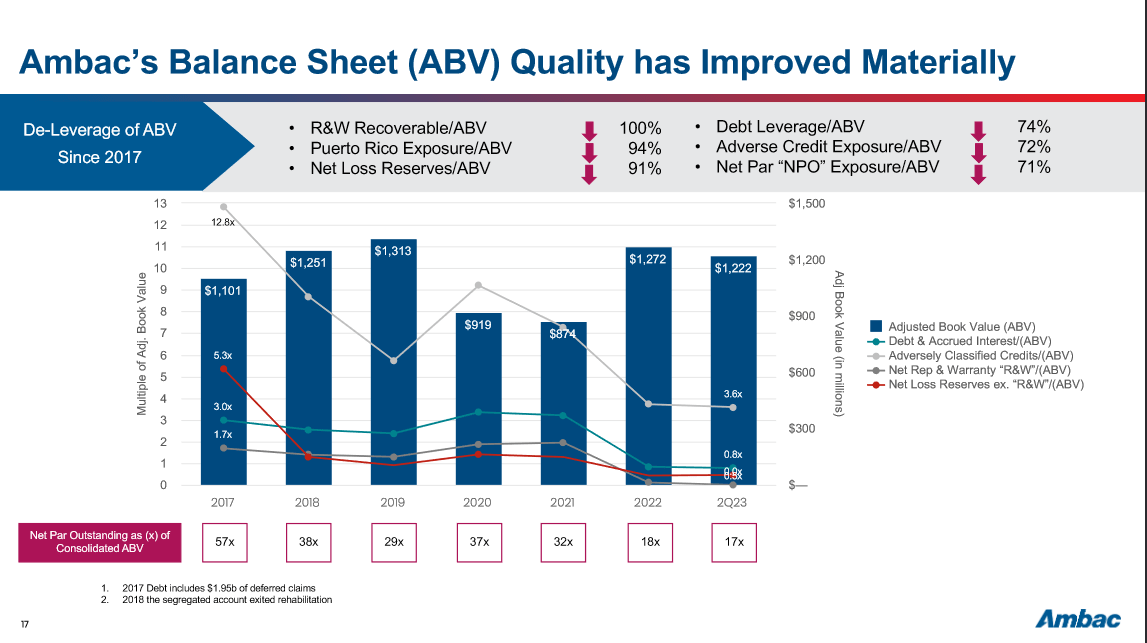

Stability Sheet (Investor Presentation)

As rates of interest climb, the corporate might discover its potential to put money into different potential progress alternatives considerably constrained, doubtlessly affecting its capability to generate future money flows. This underscores the importance of carefully monitoring rate of interest developments and their potential implications for AMBC’s total monetary well being and strategic selections. Balancing debt discount with strategic investments stays a key problem in AMBC’s monetary administration method. Wanting again although I feel the corporate has finished an excellent job at deleveraging their stability sheet. The debt leverage/ABV, for instance, has gone down 74% during the last 6 years, and lowering their leverage additional stays a key precedence for the administration workforce. This I feel shall be finished by additional lowering the debt ranges sitting at $3.4 billion proper now. Seeing as AMBC solely has a market cap of round $580 million that could be a important quantity of leverage for them to have. It should doubtless weigh on the share worth within the medium time period which explains the corporate is buying and selling on the low multiples it does.

Investor Takeaway

The worth of AMBC may be very low on a p/e and p/b metric correctly in my opinion. The corporate holds a large amount of debt nonetheless and that appears unlikely to alter within the short-term. AMBC must develop its margins quickly to drive sufficient incomes progress to pay down obligations and liabilities. It will doubtless weigh on the expansion prospects of the enterprise and end result within the share worth going even decrease. I’m not a fan of the inconsistent backside line and shall be score AMBC a promote for now.