- Bitcoin dominance seemingly wants to achieve between 62% and 70% for an altcoin season to start.

- Nevertheless, further points throughout numerous metrics additionally require critical consideration.

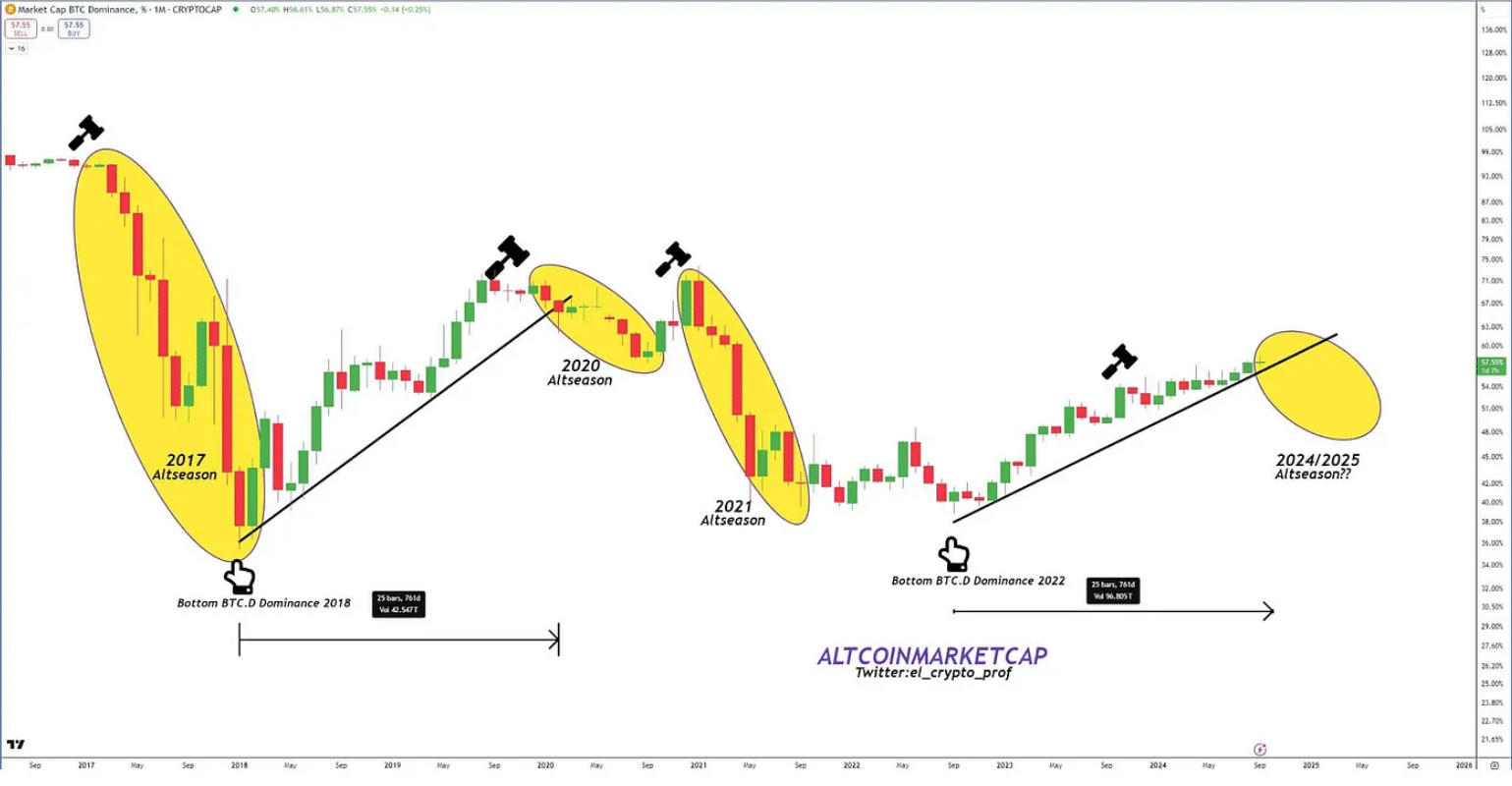

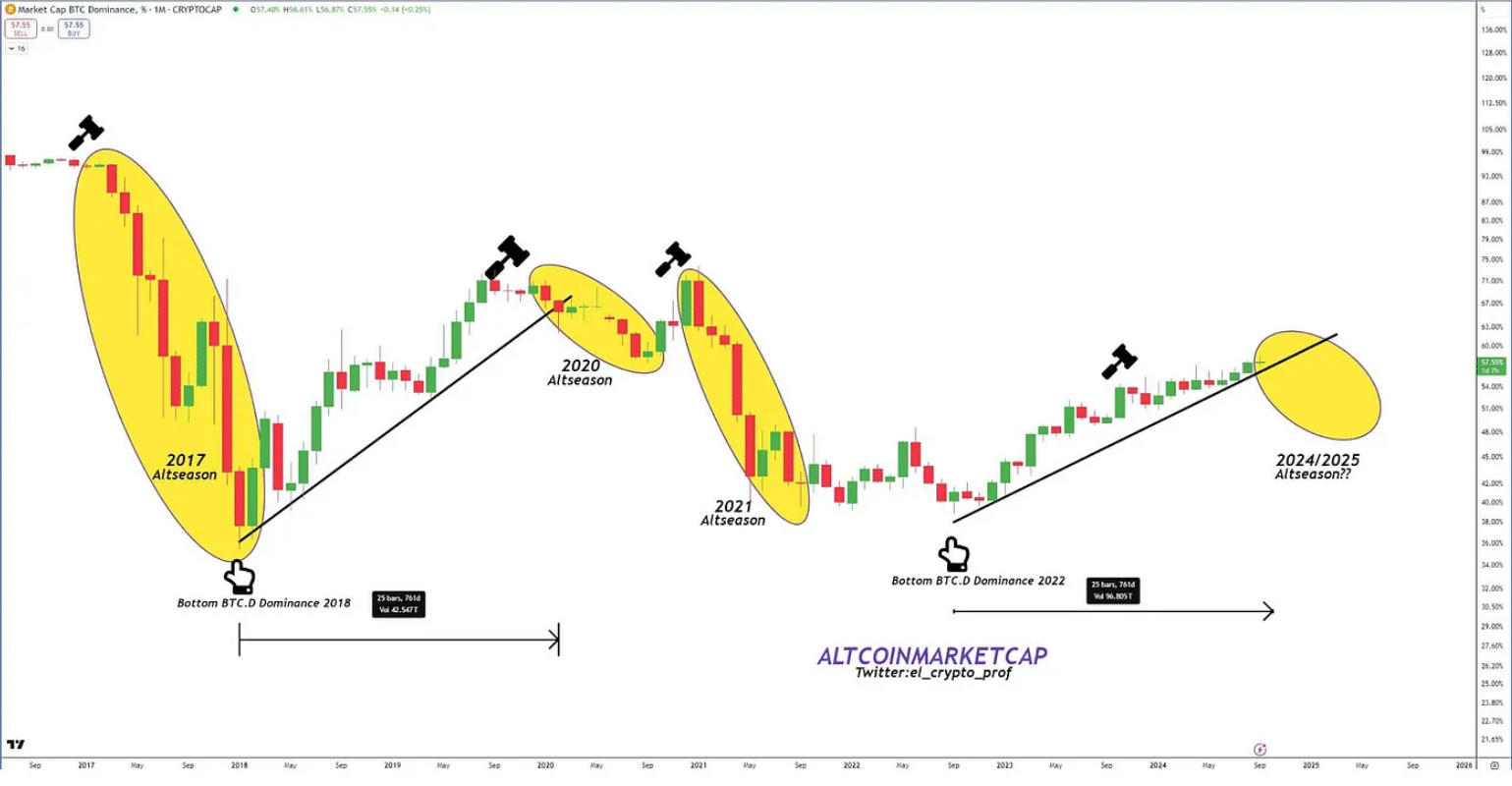

Market sentiment was typically bearish for altcoins in Q3, with Bitcoin [BTC] dominance rising to round 57%, recording a brand new all-time excessive. The Altcoin Season Index at present reads 35, after hitting its lowest-point in mid-August.

Usually, altcoins are inclined to carry out effectively after Bitcoin dominance peaks. As Bitcoin captures market share early in a cycle, capital usually shifts to altcoins as soon as BTC dominance begins to fade. This cycle advantages altcoins, as buyers search higher-risk, higher-reward property.

From a statistical standpoint, Bitcoin’s market cap would wish to develop by roughly $280 billion to fall inside the 62%-70% vary for an altcoin season to kickstart. This development is more likely to happen when BTC hits $80K, amongst numerous different metrics.

Excessive Bitcoin dominance is essential

Over time, Bitcoin’s dominance has considerably declined, dropping from 90% in 2013 – when the market was nonetheless in its infancy – to a low of 39% in 2021, as altcoins started to achieve traction.

Supply : X

Notably, every altcoin season has been pushed by particular catalysts, just like the launch of recent cryptocurrencies, technological improvements resembling ERC-20 tokens, and broader tendencies like DeFi and NFTs.

This means that past Bitcoin’s market share, particular person contributions from altcoins may also play a essential function in sparking the subsequent altcoin season.

Presently, altcoin market standings are too restricted to drive a season independently, as altcoin losses usually depend on Bitcoin’s returns for stability. For a shift to happen, Bitcoin would seemingly want to steer with an preliminary rise.

This development suggests Bitcoin’s worth might have to exceed $80,000 to realize a BTC dominance above 65%, which might set off substantial capital inflows into the altcoin market.

Want for prime threat urge for food

In a latest report, AMBCrypto highlighted an rising shift within the altcoin market, calling for strategic measures from Ethereum builders to counter rising competitors.

Internally, this calls for cautious evaluation, whereas externally, Bitcoin’s enchantment suffers from a widening threat deficit, not directly hampering altcoins from receiving their due momentum.

Supply : xe.com

As gold costs attain new highs, pushed by rate of interest cuts and geopolitical tensions, Bitcoin’s stagnant efficiency underscores restricted market threat urge for food for crypto.

Traditionally, an upward development within the BTC/Gold ratio has been aligned with altcoin season. Due to this fact, the present decline in threat urge for food negatively impacts altcoin efficiency, indicating {that a} rising BTC/Gold ratio might function a sign for extra favorable situations forward.

In brief, as BTC undergoes a pullback, the declining BTC/Gold ratio displays a shift of buyers towards perceived safe-haven property, which undermines Bitcoin’s enchantment as a long-term retailer of worth.

This migration underlines the significance of market confidence in BTC’s function as a “digital gold” to assist a broader altcoin rally – a rally more likely to stabilize as soon as BTC approaches the $80K mark.

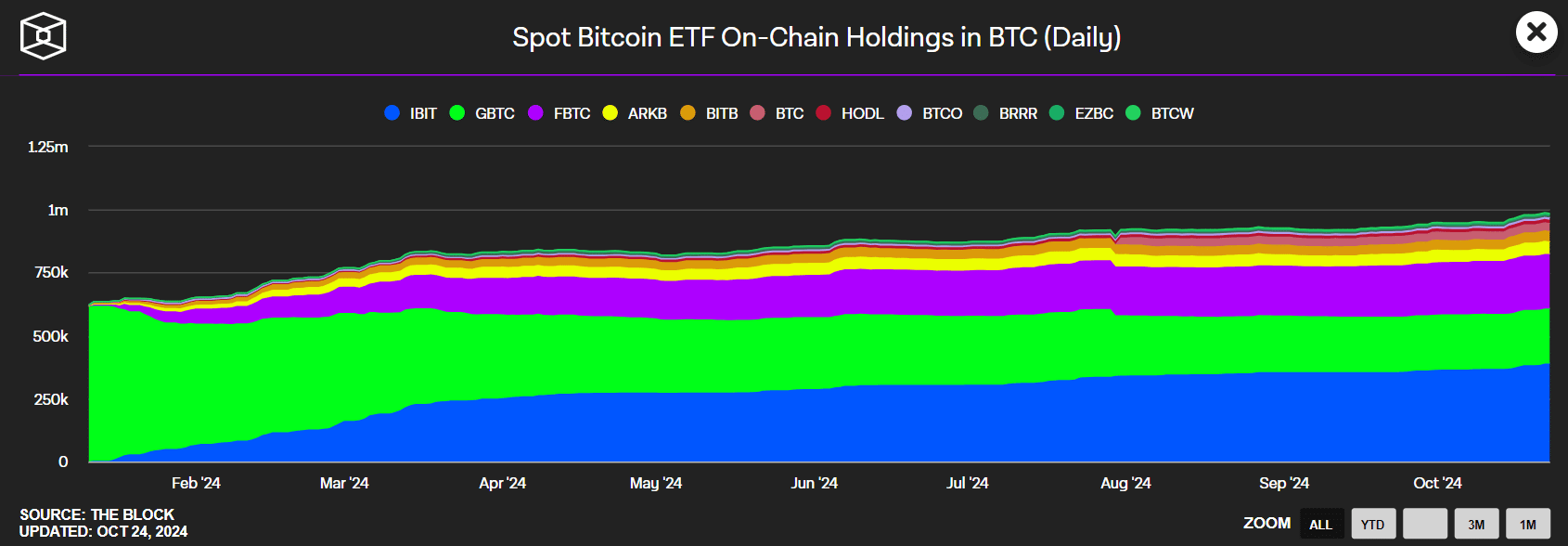

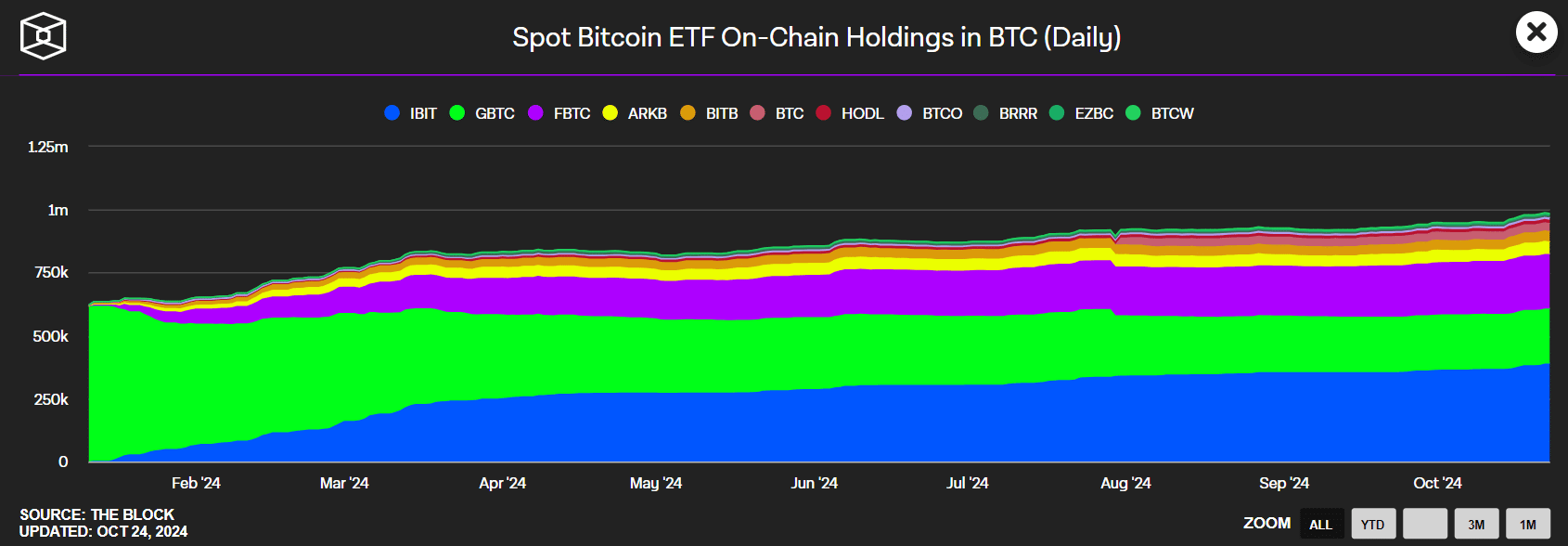

Much less ETF pushed momentum

One other issue is the connection between Bitcoin’s worth surge and ETFs. Whereas ETF-driven rallies are typically constructive, the influence on altcoins can fluctuate. The ETF market has skilled important development in 2024.

Supply : The Block

Nevertheless, when ETFs lead market momentum, funds have a tendency to stay inside Bitcoin or Ether somewhat than rotating into altcoins, as mainstream buyers usually have restricted direct entry to them. As an alternative, capital is more likely to movement into crypto-related shares.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

In consequence, a mix of inside and exterior components continues to postpone the onset of altcoin season, which stays intently tied to Bitcoin’s worth efficiency.

For altcoin season to materialize, Bitcoin would seemingly have to surpass $80K, a threshold that, given present dynamics, could also be difficult to achieve by the tip of This fall.