JIE GAO/E+ through Getty Pictures

Funding Thesis

Allison Transmission Holdings (NYSE:ALSN) has proven spectacular development in key monetary metrics, significantly in its North America On-Freeway and Service Components segments, which represent 74% of its complete web gross sales. Whereas operational prices are rising, the standard of earnings stays strong, based mostly totally on core operations moderately than one-off occasions.

A number of elements drive the optimistic monetary forecasts for the quarter ending in September 2023. One of many catalysts is the surge in buyer demand, particularly in key segments like International OnHighway and Service Components. This heightened demand is not only a transient phenomenon however is mirrored within the analysts’ median income forecast of $764 million, substantiating the corporate’s strong gross sales pipeline. One other contributor to the anticipated sturdy income numbers is the corporate’s strategic determination to extend costs on sure merchandise. These development catalysts collectively provide a compelling case for the corporate’s promising monetary outlook for the upcoming quarter.

Regardless of some areas of concern, like rising present liabilities and excessive debt, the shareholder yield of 6.91% demonstrates the corporate’s dedication to returning worth to its traders. Given all these elements and an implied inventory value suggesting a possible upside of as much as 31.1%, Allison Transmission Holdings is a powerful purchase, significantly for long-term, aggressive traders.

Overview

Based in 1915 and headquartered in Indianapolis, Allison Transmission Holdings, Inc. focuses on car propulsion methods, together with computerized transmissions and electrical methods. The corporate has a powerful presence in North America, with 74% of its 2022 income coming from this area. Nevertheless, its international attain extends by a community of round 1,600 impartial distributors and sellers worldwide. Financially, the corporate is on strong floor; its web gross sales for Q2 2023 stood at $783 million, backed by a powerful EPS of $1.92. A number of development catalysts gas these numbers. Considered one of these is the rise in buyer demand, significantly within the International OnHighway and Service Components sectors. One other contributor to the income is the strategic value enhance on sure merchandise, a choice that has considerably enhanced web gross sales.

Regardless of the North American area being its main market, Allison Transmission is making strides in international growth. The corporate is not simply eyeing worldwide markets; it is already securing tangible contracts, such because the $13 million contract with the U.S. Military. This new protection mission alone is predicted to usher in $100 million in incremental annual income. Additionally, in a strategic transfer to diversify and faucet into rising markets, the corporate is investing closely in electrical and hybrid propulsion methods.

Whereas the trade is topic to macroeconomic situations and provide chain limitations, Allison Transmission is displaying outstanding resilience. Notably in North America, its varied finish markets like protection and repair components are experiencing strong development. This resilience can be evident within the firm’s monetary well being. There’s been a year-over-year web gross sales enhance of 18% to $783 million in Q2 2023, with a report first-half income of over $1.5 billion. Moreover, the EPS has grown by a powerful 52% year-over-year. This means not solely the corporate’s profitability but additionally its promise for long-term funding.

As for dangers, whereas the shift in direction of electrical automobiles is a long-term trade development that would probably impression gross sales, the corporate is already making ready for this by its investments in electrical and hybrid propulsion methods. Provide chain disruptions, as evidenced in 2023, pose a threat, however the firm’s monetary agility permits it to navigate these challenges successfully.

When it comes to monetary prudence, the corporate’s gross margin elevated by 190 foundation factors year-over-year. It has additionally returned capital to shareholders by dividends of $0.23 per share and repurchasing over 2% of its excellent shares. This sturdy working efficiency implicitly factors to efficient administration. Moreover, in a broader trade context, the inventory’s efficiency is noteworthy. It is up greater than 43% year-to-date, rating sixth out of 49 publicly traded auto components shares.

In conclusion, Allison Transmission Holdings, Inc. seems well-positioned for each fast and long-term development.

Income Evaluation

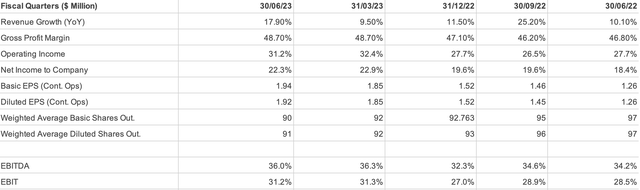

Writer evaluation

Phase Evaluation

After we analyse the earnings assertion, the North America On-Freeway section generated $397 million in Q2 2023, up from $340 million in Q2 2022-an spectacular 17% year-over-year enhance. This can be a sturdy indicator of sustained demand, particularly contemplating that this section alone contributes to greater than half of the corporate’s complete web gross sales. The North America Off-Freeway sector noticed a 25% development, going from $20 million to $25 million between Q2 2022 and Q2 2023. Though absolutely the numbers are smaller in comparison with the On-Freeway section, the share development is greater, suggesting that this market is rising and might be ripe for additional exploration.

The protection section posted a 14% development in gross sales, from $29 million to $33 million. It may not be an enormous contributor, however it provides a gradual circulate of income to the general portfolio. This steadiness is additional strengthened by a brand new $13 million contract with the U.S. Military, indicating not simply current income however future development.

Exterior North America, the On-Freeway section noticed a 17% enhance in gross sales, from $105 million to $123 million. This indicators that the corporate is making inroads into worldwide markets, a wholesome signal for diversification. Nevertheless, the Exterior North America Off-Freeway section skilled a 25% dip in gross sales, transferring from $32 million right down to $24 million. This decline requires scrutiny because it might level to underlying points associated to demand or competitors in these worldwide markets.

The Service Components, Help Tools, and Different section grew by 31% from $138 million to $181 million. Given this fast ascent, it is an space value injecting extra funding into for future development.

The North America On-Freeway and Service Components segments make up about 74% of complete web gross sales, making them essential for the corporate’s general monetary well-being. In distinction, exterior North America, regardless of the Off-Freeway section’s droop, the On-Freeway section has proven 17% development, which suggests a constructive efficiency.

With regards to penetrating the market, the corporate has an enormous community of roughly 1,600 distributors worldwide. On condition that 74% of the corporate’s enterprise is concentrated in North America and contemplating the wholesome development charges in that area, it is secure to infer that their market penetration technique is efficient there. Conversely, for worldwide markets, particularly the lagging Exterior North America Off-Freeway section, there’s probably a necessity for a renewed focus and funding to enhance penetration.

Historic Evaluation

First, we take a look at the Internet Gross sales, which grew by 17.92% quarter-over-quarter from $664 million to $783 million. Even on a half-yearly scale, the gross sales elevated by 13.65%, going from $1,341 million to $1,524 million. This enhance in gross sales, particularly the sooner tempo within the latest quarter, means that the corporate is gaining momentum.

Shifting on to the Price of Gross sales, the numbers elevated by 13.88% quarter-over-quarter, from $353 million to $402 million, and on a half-yearly foundation, it went up by 10.14% from $710 million to $782 million. Though the prices are rising, they’re doing so at a slower fee in comparison with the gross sales. This can be a good signal as a result of it implies that the revenue margins are prone to develop.

When it comes to Gross Revenue, the corporate recorded a quarter-over-quarter development of twenty-two.51%, rising from $311 million to $381 million. On a half-yearly comparability, the expansion fee stands at 17.59%, transferring from $631 million to $742 million. This implies that the corporate is making extra money and doing so extra effectively, as indicated by the sooner development in Gross Revenue in comparison with each gross sales and prices.

The Working Revenue noticed a considerable enhance of 29.41% quarter-over-quarter, transferring from $187 million to $242 million. Even on a half-yearly foundation, it grew by 21.34%, from $389 million to $472 million. This implies that the corporate’s operational efficiencies might be bettering, thus making the enterprise extra worthwhile.

For Internet Revenue, the expansion is much more vital. On a quarter-over-quarter foundation, it grew by 43.44%, from $122 million to $175 million, and on a half-yearly scale, it went from $251 million to $345 million, marking a 37.45% development. This dramatic enhance signifies that the corporate is not only producing greater revenues and managing prices, however it’s additionally retaining a bigger portion of its earnings, which is good news for traders.

Key Working Metrics

The Internet Revenue Margin for Q2 2023 is 22.35%, and the Working Margin stands even greater at 30.91%. Each these ratios underscore the corporate’s capacity to generate income effectively.

The corporate’s Promoting, Basic and administrative bills are rising. This development might be a possible weak point, as rising operational prices might eat into revenue margins over time in the event that they proceed to develop at a fee that outpaces income.

High quality of earnings

As for the standard of those earnings, based mostly on the constant development in key metrics like gross sales and working earnings, it appears that evidently the earnings are derived from core operations moderately than one-off occasions or manipulations. The sustained development in core operations displays positively on the corporate’s underlying enterprise mannequin and market demand. This might give it a considerable benefit in capitalizing on market alternatives and driving additional development.

Ahead-Wanting Evaluation

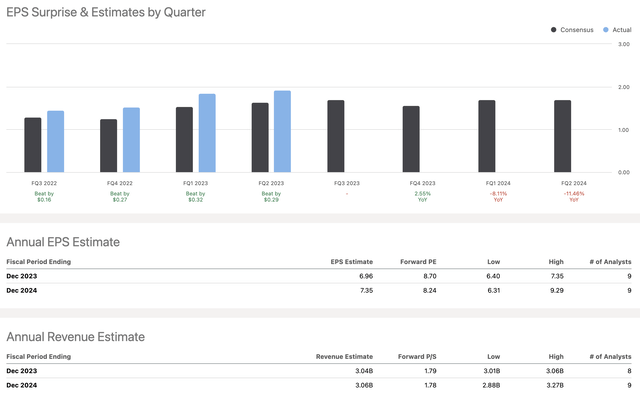

In search of alpha

For the quarter ending September 30, 2023, six analysts have weighed in on the income expectations for the corporate. The low-end forecast for this quarter is $751 million, whereas the high-end estimate stands at $773 million. The median income prediction is $764 million, which may be very near the common forecast of $762.344 million, indicating a basic consensus amongst analysts concerning the firm’s revenue-generating capabilities.

On the Earnings Per Share entrance, three analysts have supplied their forecasts for the September-ending quarter. The bottom EPS estimate is $1.73, whereas essentially the most optimistic prediction is at $2.1. The median EPS forecast stands at $1.79, which is barely under the common forecast of $1.87. This implies that the analysts are pretty bullish on the corporate’s profitability for the upcoming quarter.

The information clearly means that analysts, on common, anticipate each income and EPS to develop within the September-ending quarter.

Stability Sheet Evaluation

The agency’s liquidity ratios, together with a present ratio of two.15 and a fast ratio of 1.59, counsel that it is in a powerful place to satisfy its short-term obligations. These ratios are calculated from a complete present asset base of $1,069 million towards present liabilities of $497 million. With such ratios, the corporate has sufficient assets to repay its fast money owed and even has a cushion if you happen to exclude the inventories value $278 million. One other constructive is the corporate’s asset development, which has elevated from $4,671 million to $4,856 million. This might point out a rise in operational effectivity. The fairness has additionally seen a soar from $874 million to $1,056 million, signaling that the corporate might be retaining extra earnings or perhaps even issuing new inventory, each of which strengthen its monetary standing.

The corporate’s complete liabilities remained nearly static, transferring from $3,797 million to $3,800 million, indicating managed monetary administration. Nevertheless, the Debt to Fairness ratio stands at 2.37, calculated from long-term debt of $2,499 million towards a stockholders’ fairness of $1,056 million. This ratio is excessive and tells us that the corporate is extra reliant on borrowed funds than on fairness for its operations. This strategy is dangerous, particularly if rates of interest had been to rise, rising the price of debt. One other flag is the rise in deferred income from $38 million to $46 million. Deferred income signifies a future obligation, and a rise right here may imply the corporate is lagging in delivering its providers or merchandise, which is a priority for future income streams.

Based mostly on the present fee of asset development, it is anticipated that the full property might hit round $5,000 million by mid-2024.

The corporate’s money reserves look sturdy, rising from $232 million to $351 million. This can be a sturdy indicator of the corporate’s capacity to generate money, which is important for each day by day operations and any long-term funding plans. This enhance additionally means that the corporate is producing a constructive money circulate, probably from its core enterprise actions.

In abstract, Allison Transmission Holdings reveals sturdy liquidity, managed legal responsibility administration, and promising development in property and fairness. Nevertheless, there are areas of concern like its excessive reliance on debt and a rise in deferred income that have to be managed rigorously.

Free Money Move Evaluation

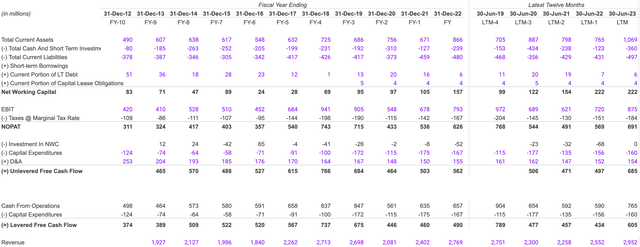

Writer evaluation

From 2021 to 2023, the corporate’s complete present property jumped from $798 million to $1,069 million, a development of 34%. Throughout the identical time, complete present liabilities went up from $429 million to $497 million, however that is solely a 16% enhance. Meaning property are rising sooner than liabilities, and that is typically a very good signal for any firm.

In 2021, the Internet Working Capital (NWC) stood at $154 million and elevated to $222 million in 2022 and 2023. This constant rise reveals that the corporate has sufficient assets for its day-to-day operations. The Earnings Earlier than Curiosity and Taxes (EBIT) was $621 million in 2021 and noticed a gradual uptick to $720 million in 2022 and additional to $875 million in 2023. This means that the corporate is not only producing income however can be effectively turning this into revenue. That is confirmed once we take a look at the Internet Working Revenue After Taxes (NOPAT), which went from $491 million in 2021 to $691 million in 2023.

On the Free Money Move entrance, the Unlevered Free Money Move jumped from $471 million in 2021 to $685 million in 2023, and the Levered Free Money Move adopted swimsuit, rising from $457 million to $605 million over the identical interval. These numbers counsel the corporate has a very good amount of money that can be utilized for reinvestments or distributed to shareholders. Nevertheless it’s not simply the money flows which are spectacular; the standard of earnings can be strong.

The corporate’s income noticed a 31% development, climbing from $2,258 million in 2021 to $2,952 million in 2023. The regular enhance in EBIT and NOPAT signifies that the earnings are probably coming from core enterprise actions moderately than one-off occasions. Additionally, the secure NWC negates the opportunity of earnings manipulation by short-term property or liabilities.

Wanting forward, the corporate appears set for extra development. The EBIT elevated by 7% from 2021 to 2022 and 21% from 2022 to 2023. If we take a conservative estimate of 15% development for 2024, the EBIT would stand at roughly $1,006 million. After making use of the marginal tax fee, the NOPAT could be round $795 million. Assuming the capital expenditures stay secure, the Unlevered Free Money Move might attain roughly $790 million. The overall present liabilities have elevated by 16%, going from $429 million in 2021 to $497 million in 2023, which might turn into a monetary threat if the present property do not develop in tandem.

The corporate’s strengths lie in its rising EBIT, NOPAT, and free money flows together with secure NWC, pointing to operational effectivity. The weak point is the rising present liabilities. Alternatives are plentiful given the constant development in EBIT and NOPAT, which might imply room for growth. The menace could be the rising capital expenditures that would probably pressure free money flows if not managed properly.

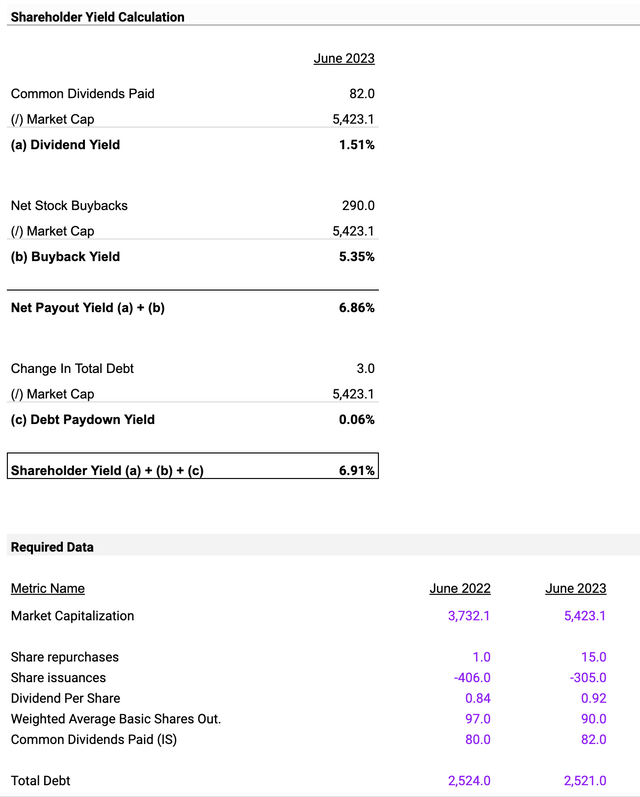

Shareholder Yield

Writer evaluation

The shareholder yield is 6.91%. This quantity is essential as a result of it is basically a snapshot of what the corporate is giving again to its shareholders. Damaged down, the 6.91% contains a dividend yield of 1.51%, a buyback yield of 5.35%, and a minuscule debt paydown yield of 0.06%. The dividend yield displays the corporate’s coverage of returning worth to shareholders by money funds, whereas the buyback yield signifies that the corporate can be repurchasing its shares to presumably enhance inventory worth. The small debt paydown yield means that decreasing debt shouldn’t be at present a spotlight for the corporate. From the get-go, the excessive shareholder yield, particularly the massive contribution from buybacks, serves as a inexperienced flag, demonstrating the corporate’s efficient technique of worth return to its traders.

Specializing in what drives the corporate’s worth, it is evident that the buyback yield of 5.35% and the dividend yield of 1.51% are the primary engines right here.

Valuation

I’m doing a comparables valuation for the corporate. For my evaluation, I’ve chosen six benchmark corporations to attract comparisons with Honeywell (HON), CNH Industrial (CNHI), Winnebago Industries (WGO), THOR Industries (THO), Sypris Options (SYPR), and Allison Transmission Holdings (ALSN). These corporations function in related industries and have comparable monetary metrics, making them appropriate for a valuation comparability.

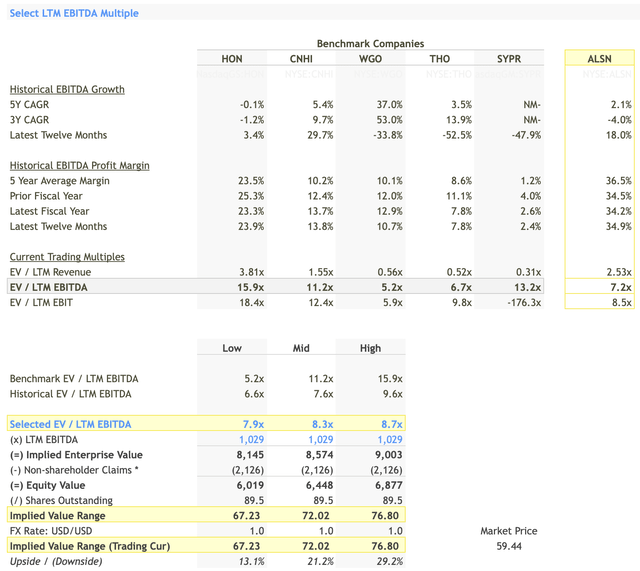

Choose LTM EBITDA A number of

Writer evaluation

- Benchmark Ranges: EV/LTM EBITDA for the chosen corporations ranges from 5.2x (WGO) to fifteen.9x (HON).

- Chosen A number of: Based mostly on this, I’ve chosen an EV/LTM EBITDA a number of vary of seven.9x to eight.7x. It is a conservative estimate, nearer to the decrease finish of the benchmark vary however greater than the historic vary of 6.6x to 9.6x.

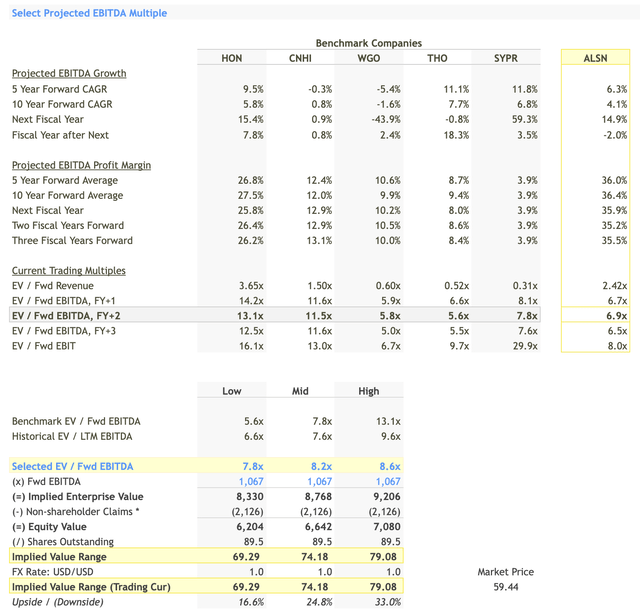

Choose Projected EBITDA A number of

Writer evaluation

- Benchmark Ranges: EV/Fwd EBITDA ranges from 5.6x (WGO) to 13.1x (HON).

- Chosen A number of: My chosen vary for EV/Fwd EBITDA is 7.8x to eight.6x. This aligns intently with the chosen LTM EBITDA a number of and represents a balanced view of the corporate’s future prospects.

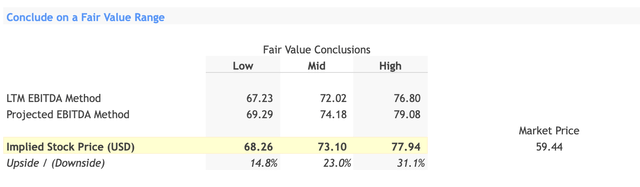

Truthful Worth Vary

Writer evaluation

- LTM EBITDA Technique: Implied Worth Vary is $67.23 to $76.80 per share.

- Projected EBITDA Technique: Implied Worth Vary is $69.29 to $79.08 per share.

- Implied Inventory Worth: Averaging each strategies, I arrive at a good worth vary of $68.26 to $77.94 per share.

Purchase Determination

Based mostly on my evaluation, the implied inventory value ranges from $68.26 to $77.94, in comparison with the present market value of $59.44. This implies a possible upside of 14.8% to 31.1%, making it a powerful purchase.