- Bitcoin’s every day and weekly charts each flashed inexperienced indicators

- Quite the opposite, market indicators took a bearish flip

Bitcoin’s [BTC] worth has remained bullish over the previous week after a bout of depreciation, with the crypto even going previous $68k. Nevertheless, this may not be the top of BTC’s bull rally.

In truth, a key metric revealed that the cryptocurrency would possibly proceed to climb up, indicating that buyers ought to take into account HODLing the coin within the subsequent few days.

HODLing Bitcoin is… proper?

CoinMarketCap’s data revealed that Bitcoin’s worth hiked by greater than 2% within the final seven days. This bullish pattern continued within the final 24 hours, with the crypto valued at $68,136 at press time.

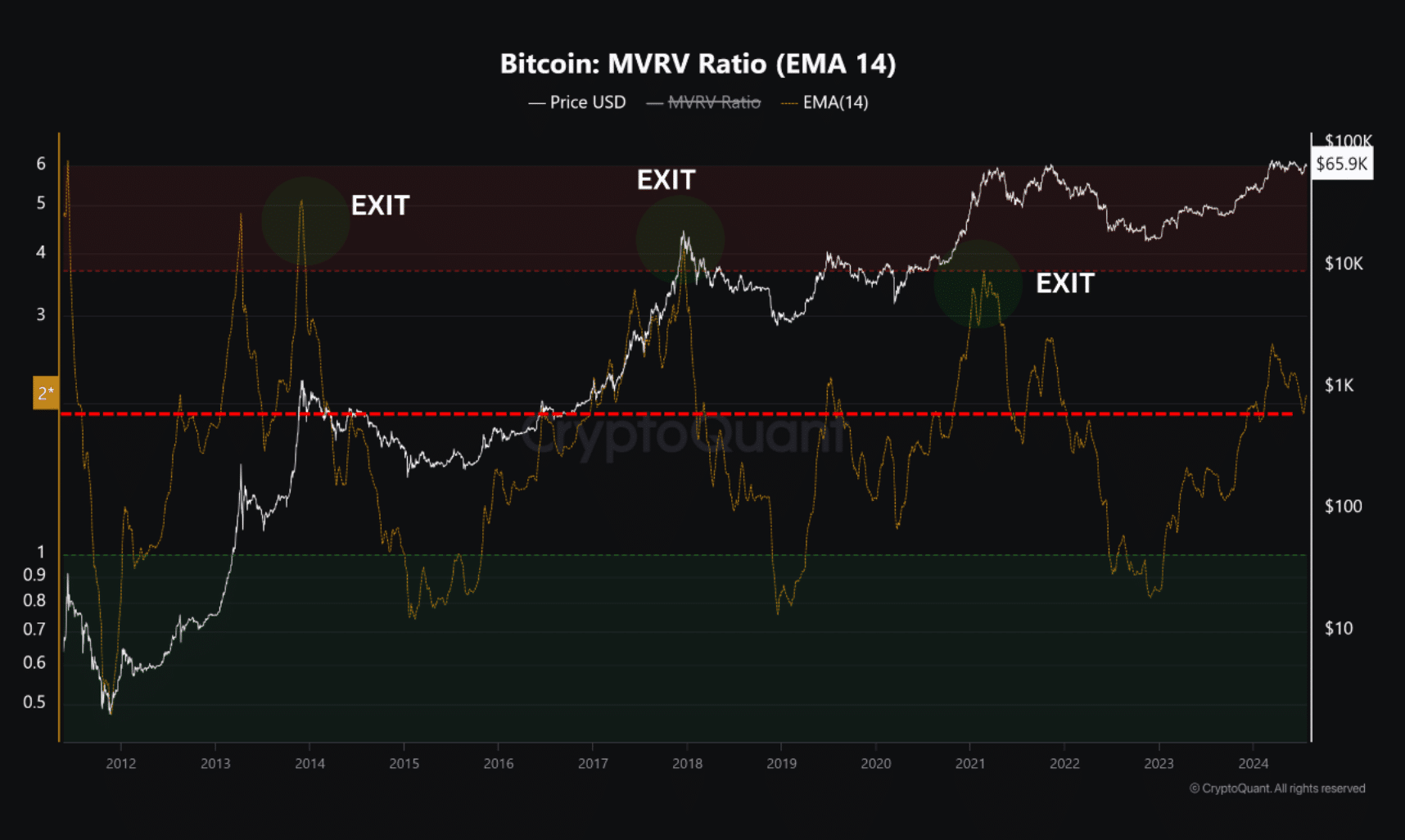

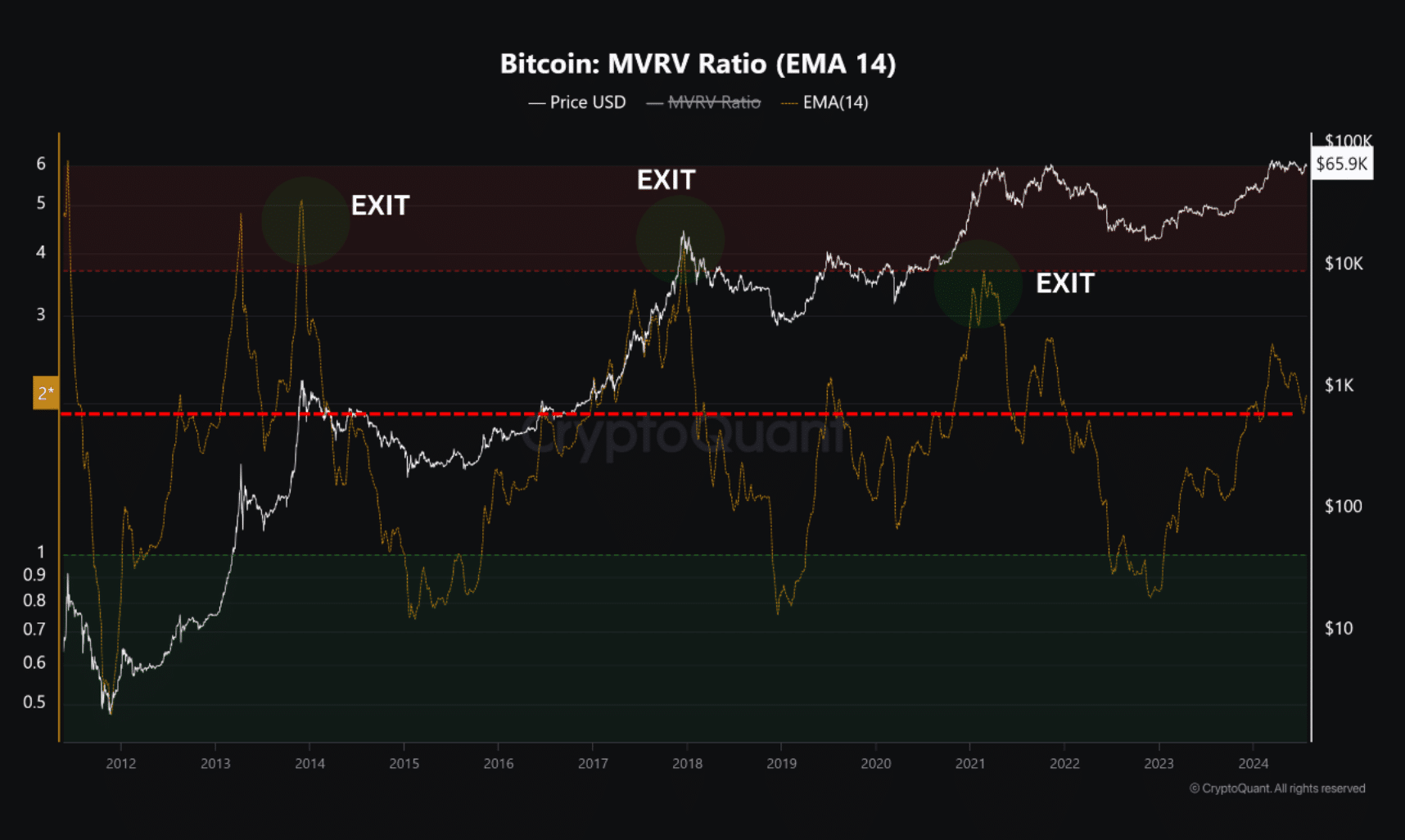

In the meantime, Tarekonchain, an analyst and writer at CryptoQuant, not too long ago shared an analysis revealing an attention-grabbing improvement. The evaluation used one of many key indicators, the MVRV ratio, to foretell what is perhaps anticipated from BTC within the short-term.

In response to the identical, the MVRV indicator, well known as one of the crucial correct for long-term buyers to find out worth peaks and troughs, could also be beginning to bounce from the essential stage of two.

This stage marks the start of a interval of volatility, earlier than persevering with its hike. In response to this indicator, Bitcoin nonetheless has vital potential for development earlier than reaching its peak, which normally happens when the MVRV hits a studying of 4 or larger.

The evaluation talked about,

“A protected exit technique from the market ought to start steadily when the MVRV is within the 3.7-3.8 vary.”

Supply: CryptoQuant

Due to this fact, buyers ought to plan to HODL because the possibilities of a sustained worth rise appear probably.

In truth, as AMBCrypto reported beforehand, on 25 July, Marathon Digital [MARA], the world’s largest Bitcoin mining firm, introduced the acquisition of $100 million price of BTC.

This improvement additionally prompt that buyers shouldn’t take into account promoting BTC within the brief time period.

What do the metrics say?

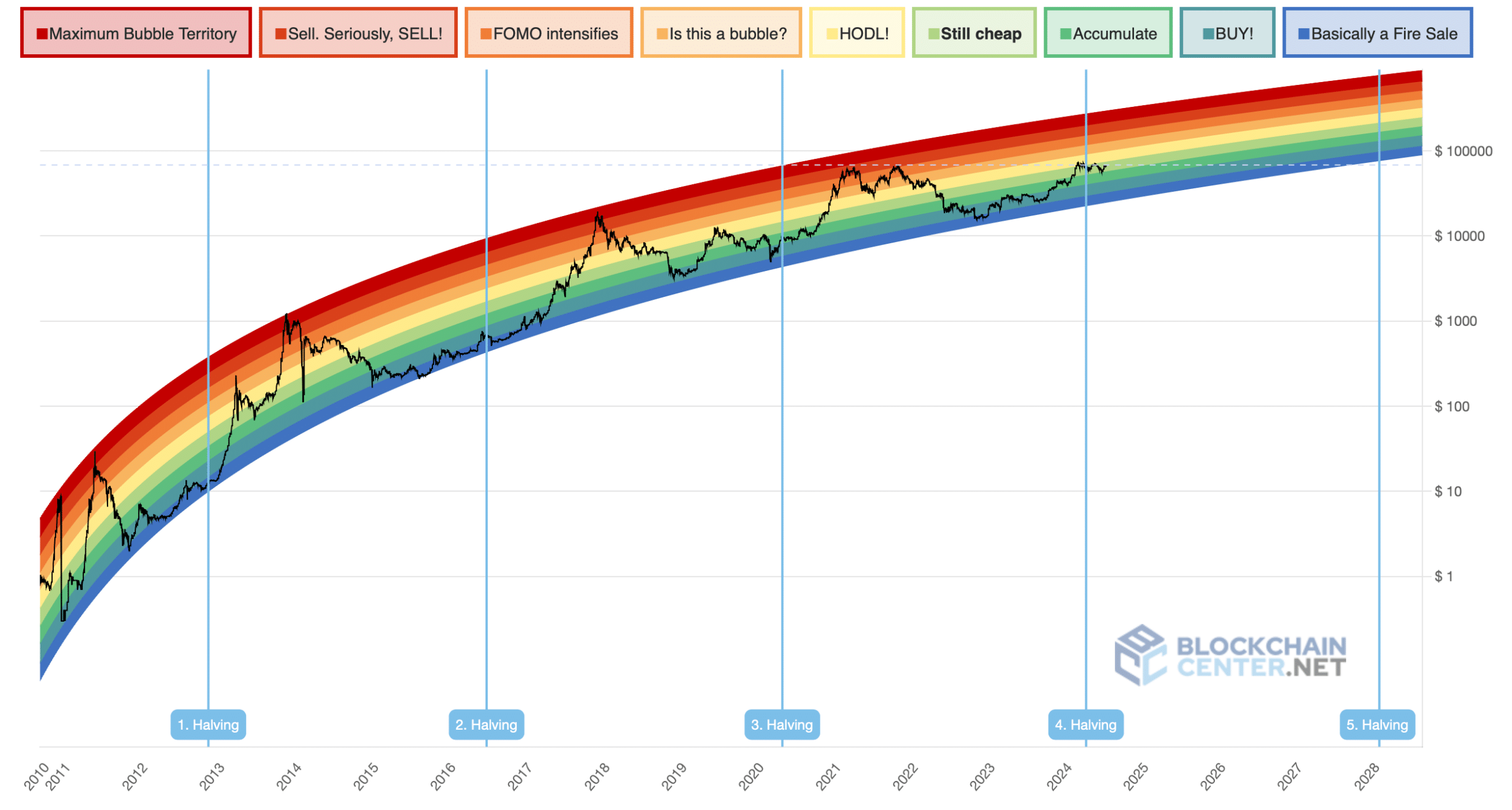

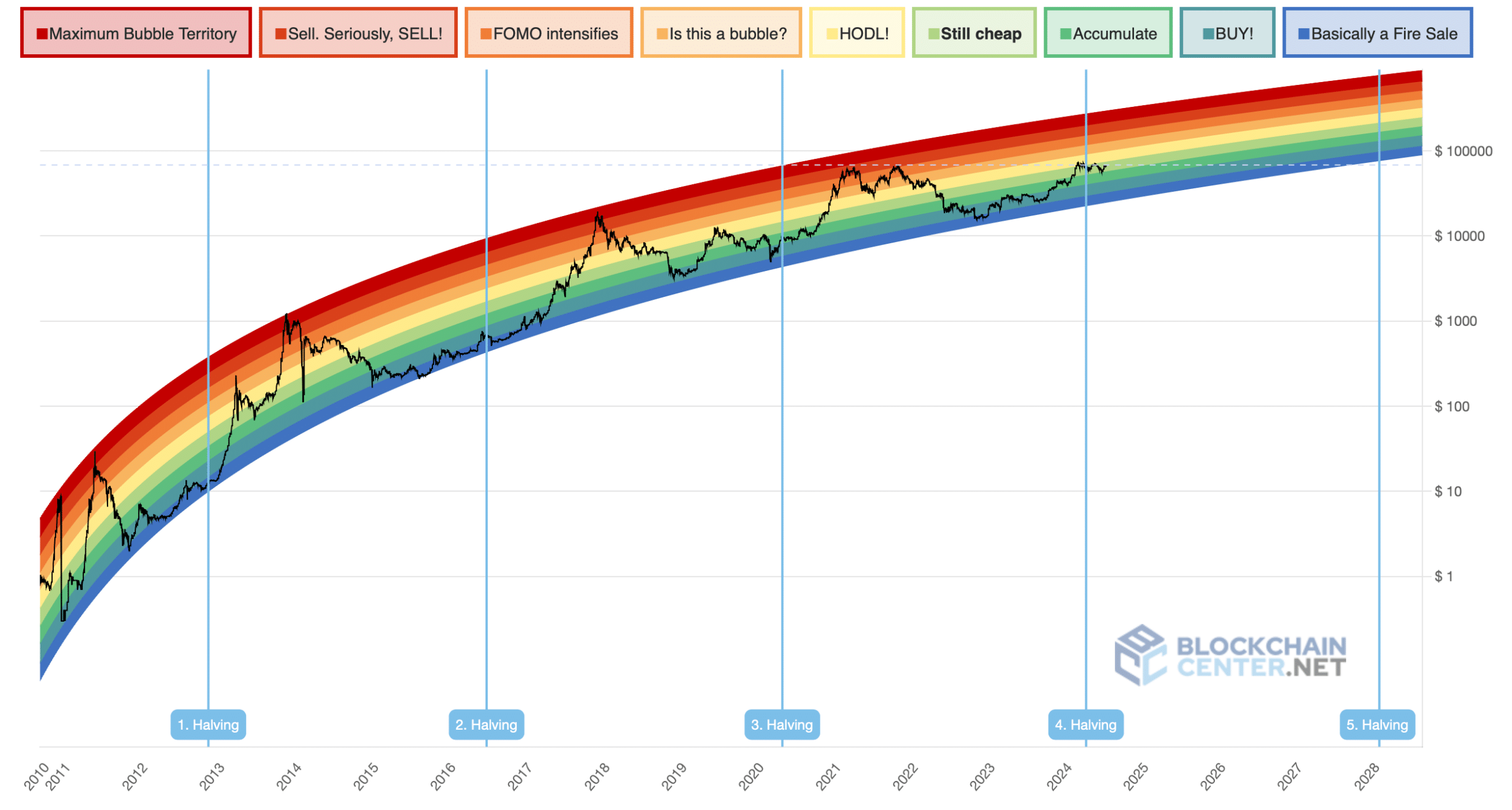

AMBCrypto subsequent checked the Bitcoin Rainbow Chart to search out out what that this indicator prompt.

As per our evaluation, BTC’s worth is within the “nonetheless low cost” zone, which means that the possibilities of a worth rise are nonetheless excessive.

Supply: Blockchaincenter

Lastly, our evaluation of CryptoQuant’s data revealed that BTC’s web deposit on exchanges has been dropping – An indication that promoting strain was low.

Its binary CDD was additionally inexperienced. This indicated that long-term holders’ motion within the final 7 days was decrease than the common. Merely put, they’ve a motive to carry their cash.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Quite the opposite, on the worth charts, each BTC’s Relative Power Index (RSI) and Cash Circulate Index (MFI) registered slight downticks – Hinting at a attainable worth correction.