Mimadeo/iStock through Getty Pictures

The ABNB Funding Thesis Stays Sturdy, However Not At These Lofty Valuations

We beforehand coated Airbnb (NASDAQ:ABNB) in Might 2023, discussing its decelerating reserving pattern in comparison with its journey friends, naturally triggering its underwhelming monetary and inventory efficiency then.

Whereas there had been a number of long-term progress drivers, together with the Airbnb-Pleasant Condominium and Airbnb Rooms, we had rated the inventory as a Maintain then, for the reason that unsure macroeconomic outlook over the subsequent few years remained headwinds to its prospects.

For now, it seems that ABNB continues to face uncertainties because the rental income progress decelerates and international lively listings develop, with many comparable anecdotal examples reported by Bloomberg.

The identical has been hinted by the corporate’s FQ2’23 outcomes, with over 7M total active listings (+0.4M from FY2022 levels of 6.6M and +1M from FY2021 levels of 6M).

In the identical quarter, ABNB’s Common Each day Charges additionally stabilized at $165.94 (-1.4% QoQ from $168.45/ +1.2% YoY from $163.90), in comparison with its historic excessive progress pattern, akin to FY2022 averages of $160.52 (+2.8% YoY), FY2021 averages of $156.02 (+26.1% YoY), and FY2020 averages of $123.7 (-3.1% YoY).

Then once more, buyers needn’t fret, since all of those are a part of the administration’s plan to drive improved affordability and quantity progress:

I feel our long-term progress goes to solely be as robust as our provide. If we had been to again out, what occurred in 2020, 2021, as that demand grew sooner than provide. And initially, this was an awesome factor.

However the issue is when demand grows sooner than provide and there is provide constraints, costs usually go up. And as costs have risen, whereas that is been good for the underside line, affordability on this financial system is a serious subject.

And so probably the most necessary issues we are able to do to make Airbnb inexpensive is to verify we have now sufficient provide within the platform. (In search of Alpha – Brian Chesky)

In the end, buyers should be reminded that ABNB is a journey reserving platform, much like Reserving (BKNG) and Expedia (EXPE), which thrive on aggressive pricing and quantity primarily based transactions, permitting the fittest host to outlive.

It is a direct distinction to resort chain homeowners, akin to Marriott Worldwide (MAR) and Hilton Worldwide Holdings (HLT), the place the administration could also be extra involved in regards to the delicate steadiness between room provide, client demand, and room charge progress.

Whereas short-term rental platforms akin to ABNB could also be delicate towards the continued regulatory tightening, we’re not overly involved, for the reason that international itemizing provide has been greater than sturdy. That is considerably aided by its larger ADRs at $165.94, in comparison with the global hotel ADRs of $150 (+11.8% YoY) for the week ending September 23, 2023.

We imagine that the administration’s method of sustaining the affordability of its Airbnb choices is extremely strategic throughout these instances of elevated rate of interest atmosphere, because it implies elevated choices for discerning shoppers because the competitors within the different keep section heats up.

Whereas ABNB might have been the pioneer of other stays, it’s obvious that many different platforms have encroached into the area, together with BKNG, EXPE, and many others. Even resort chains akin to MAR and HLT have began to supply house and villa stays for each budget-conscious and luxurious vacationers.

Regardless of so, ABNB’s revenues proceed to develop to $2.48B (+37% QoQ/ +18.1% YoY) and gross margins enhance to 82.6% (+6.1 factors QoQ/ +1.1 factors YoY) in FQ2’23, albeit at a normalized charge in comparison with FQ2’22 top-line progress of +57.6% YoY and FQ2’21 progress of +298.8% YoY.

Its improved working scale has additionally introduced forth glorious adj EBITDA margins of 33% (-19 factors QoQ/ inline YoY), in comparison with its FY2020 ranges of -7%.

These display that the ABNB administration’s FY2023 steering of “an Adjusted EBITDA margin that’s modestly larger than the full-year 2022” isn’t overly formidable, in our opinion.

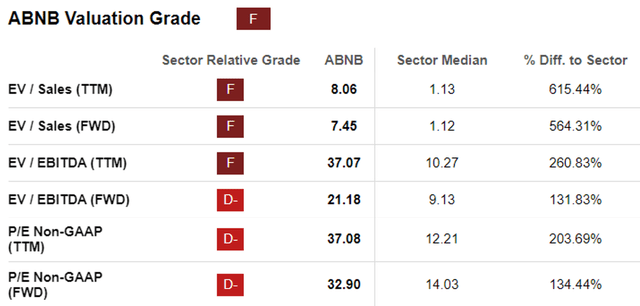

Its Valuations Stay Wealthy, As ABNB Transitions To A New Enterprise Mannequin

ABNB Valuations

In search of Alpha

For now, as ABNB’s progress decelerates, we are able to perceive why its FWD valuations have been impacted in comparison with its 1Y means, although nonetheless elevated in comparison with the sector medians.

ABNB Valuations

In search of Alpha

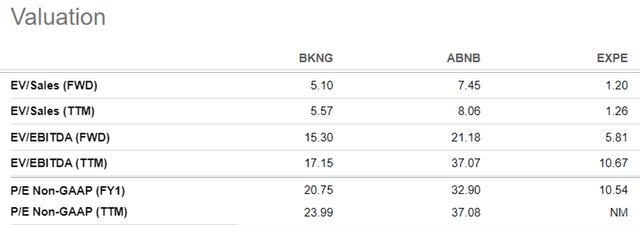

Then once more, ABNB nonetheless trades at a notable premium FWD EV/ EBITDA of 21.18x, in comparison with its different journey reserving shares, akin to BKNG at 15.30x and EXPE at 5.81x.

We preserve our conviction that ABNB’s valuations seem like lofty, particularly for the reason that consensus estimates that it could solely document a backside line CAGR of +17.4% by means of FY2025, in comparison with BKNG’s +19.9% and EXPE’s +12.5% on the similar time.

Mixed with ABNB’s persistently moderating FWD EV/ EBITDA valuation since its February 2022 heights of 57.33x and July 2023 heights of 26.65x, we imagine its correction will not be over but.

Primarily based on its FQ2’23 annualized adj EBITDA of $3.27B (+212.5% QoQ/ +15.1% YoY) and share rely of 665M, we’re taking a look at an adj EBITDA per share of $4.92.

Mixed with its moderated FWD EV/ EBITDA valuations of 21.18, the ABNB inventory can also be buying and selling method above its truthful worth of $104.20, providing buyers with a minimal margin of security at present ranges.

So, Is ABNB Inventory A Purchase, Promote, or Maintain?

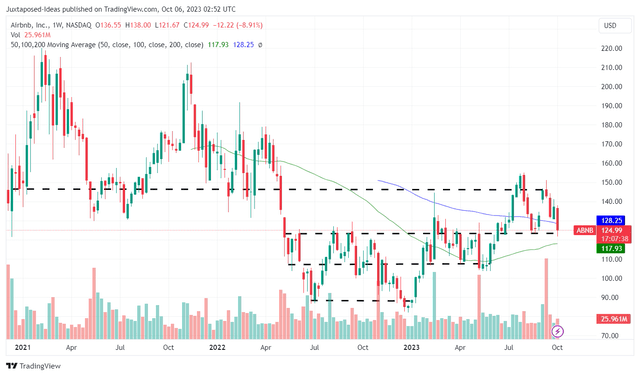

ABNB 3Y Inventory Value

Buying and selling View

Whereas ABNB has already recorded a powerful restoration of +18.52% since our earlier Maintain article, properly outpacing the SPY at +3.04%, the inventory has additionally failed to interrupt out of its resistance ranges of $145 twice, with it presently retesting its crucial help ranges of $120s.

Because the North American area contains the lion’s share of its general FQ2’23 revenues at 47.9%, we imagine the inventory might not have the ability to maintain on to its positive factors, because of the pessimism surrounding the restart of the US federal pupil mortgage reimbursement from October 2023 onwards.

Mixed with the 6.34% of quick curiosity on the time of writing, we want to charge the ABNB inventory as a Maintain right here. It could be extra prudent to watch the state of affairs a bit longer.

buyers might wish to look forward to an extra retracement to its Might 2023 help ranges of $105 for an improved upside potential to our long-term value goal of $149.53, primarily based on the consensus FY2025 adj EBITDA estimates of $4.7B.

Even then, portfolios should even be sized appropriately because it stays to be seen if the premium embedded within the ABNB inventory valuation is sustainable.