Shutthiphong Chandaeng

By Lei Qiu

Technological turning factors previously have taught essential classes about learn how to establish long-term winners from transformative innovation.

The market response to generative synthetic intelligence (GAI) over the previous yr implies that buyers already know how this revolution will play out. However not so quick. Whereas we could also be on the cusp of a dramatic expertise paradigm shift, its outcomes are removed from apparent and can take time to discern.

For a lot of 2023, US fairness markets have been outlined by pleasure over AI. Returns have been concentrated in a really small group of shares seen to be AI winners. The market seems to be assigning a excessive likelihood to the belief that these firms would be the long-term leaders of the AI revolution with the best profitability positive aspects. Wall Road analysts are already projecting how a lot income and revenue the incumbents will see from AI. There’s a frenzy of forecasts for what number of preliminary customers Microsoft (MSFT) will entice for Copilot, its GAI device anticipated in November. Some even predict the tip of web search as we all know it.

The Race Is on for the GAI Working System

We expect it’s too early to make such daring predictions—significantly on profitability. Sure, GAI marks a paradigm shift with the potential to ship huge productiveness positive aspects by decreasing obstacles to entry and stimulating new enterprise fashions. But throughout technological turning factors previously, buyers additionally realized essential classes about evaluating the true long-term affect of transformational innovation.

As we speak, the highlight is on the expertise mega-caps. Every desires to construct their very own distinctive giant language mannequin that may turn out to be the longer term GAI working system. In mixture, the spending on AI-dedicated graphics processing items (GPUs) will attain at the very least $25 billion in 2023 alone. Disruptive innovation creates a window of alternative for the incumbents to enter one another’s enjoying discipline.

Classes from the iPhone and Web

However will all of the mega-caps be the most important long-term AI winners? And extra importantly, how can buyers decide which firms have the proper enterprise fashions to revenue in an AI future?

Some historic context might help reply these questions. AI itself isn’t new, however GAI, which took the world by storm in November 2022 with ChatGPT, has been dubbed an iPhone second for innovation. The iPhone mixed the web, cell broadband and smartphone in a single package deal that unlocked entry to huge quantities of data and created efficiencies throughout industries.

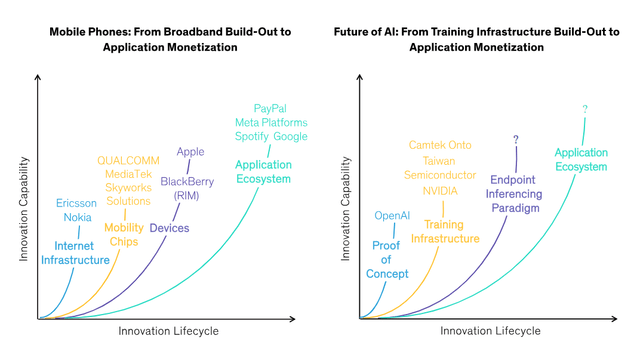

But when the iPhone was launched in 2007, the long-term winners and losers weren’t instantly obvious. The truth is, the most important firms—by market cap and by working revenue—have been very totally different in 2007 than they’re immediately. Over time, new leaders emerged with a lot bigger revenue swimming pools. Some, like Apple (AAPL), might have been extra apparent. However the smartphone spawned a complete new cell ecosystem. Solely then did family names together with Meta (META), Spotify (SPOT), YouTube (GOOG)(GOOGL) and Venmo (PYPL) actually started to take off (Show). In our view, the iPhone second has but to reach for AI.

When Will AI’s “iPhone Second” Arrive?

For illustrative functions solely

References to particular securities are to not be thought of suggestions by AllianceBernstein L.P.

As of September 30, 2023

Supply: AllianceBernstein (AB)

Capital Depth Wanted for AI Infrastructure

Nonetheless, we’re already seeing an enormous change from the cell web period, when buyers valued capital-light enterprise fashions that supported the tech giants’ profitability. Now, GAI’s compute-intensity coaching and inferencing infrastructure requires huge funding in information facilities and energy programs. This might shake up the investing calculus for future earnings—significantly in a world the place capital is scarce and costly.

To supply a single unit of output in an AI-focused information middle, hundreds of GPUs interconnect and behave as one, very like the extremely automated manufacturing traces at Tesla’s (TSLA) gigafactories. At this stage of the AI revolution—the infrastructure build-out—innovation has shifted from customer-facing industries to capital-intensive manufacturing and improvement.

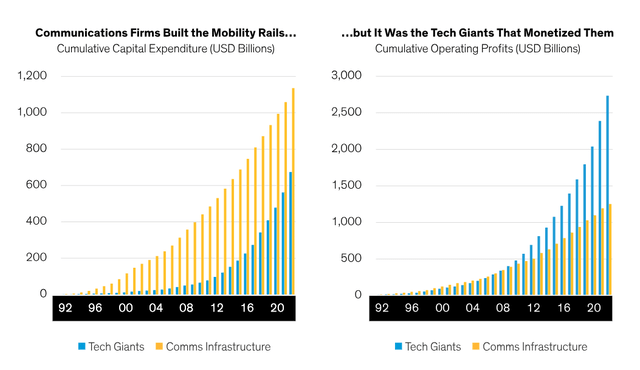

However these are early days for the AI revolution, and large spending doesn’t essentially assure massive earnings. On the daybreak of the web, telecom and cable suppliers poured billions of {dollars} into net infrastructure. But it was the rising tech titans that rode on these rails by creating new enterprise fashions that captured a lot of the upside (Show).

Corporations That Construct Infrastructure Are Not Essentially These Who Monetize Them

Present evaluation doesn’t assure future outcomes.

Earnings primarily based on earnings earlier than curiosity and tax (EBIT)

Tech giants: Apple, Alphabet Inc. (Google), Cisco Techniques (CSCO), Meta Platforms, Microsoft, Netflix (NFLX) and Oracle (ORCL)

Communications infrastructure: AT&T (T), Constitution Communications (CHTR), Comcast (CMCSA), Deutsche Telekom (OTCQX:DTEGY) (T-Cellular (TMUS)) and Verizon (VZ)

Supply: Bloomberg and AB

Market Panorama Is Poised to Change

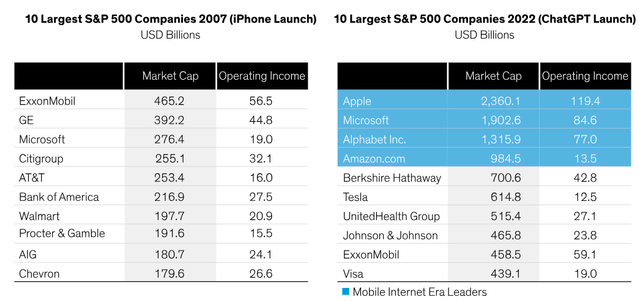

The cell web was a basic instance of how a shifting expertise paradigm modified the market panorama. The winners weren’t solely dominant firms with a first-mover benefit. Whereas a few of immediately’s mega-caps might certainly consolidate their positions by AI, we imagine new leaders will emerge and the most important benchmark names will change over time as we noticed within the cell web period (Show).

Future Leaders Aren’t Apparent at Technological Turning Factors

Previous efficiency doesn’t assure of future outcomes.

Left chart as of June 30, 2007; Proper chart as of November 30, 2022

Supply: S&P and AB

Discovering future leaders isn’t straightforward. Buyers typically anchor their outlooks to what has labored previously and is working within the current, whereas overlooking the transformational potential of innovators. Contemplate Amazon.com (AMZN), which was seen in its early days as an costly bookseller and advanced into an e-tailer. Again then, buyers couldn’t think about the corporate would rework itself right into a logistics supplier for huge business networks with a cloud-based infrastructure. Over time, Amazon’s market cap surpassed all US retailers mixed as a result of it disrupted your complete business and devoured up their earnings, whereas creating a complete new enterprise referred to as Amazon Net Companies.

Disruption may also destabilize some firms. If GAI is as highly effective as we count on, we may have yet one more iPhone second that redefines productiveness and conduct. New enterprise fashions will emerge that may problem the established order in lots of industries. However in our view, we aren’t there but.

Figuring out Innovation Requires Creativeness—and Endurance

Innovation is in regards to the energy of creativeness. As a substitute of dashing to the presumed winners at this early stage, buyers have to be affected person and open minded.

Specializing in near-term profitability could also be deceptive. Fairness buyers ought to conduct prudent evaluation of returns on capital and develop an knowledgeable outlook on future returns. In different phrases, firms shouldn’t essentially be penalized for spending on AI to bolster aggressive moats or to create progress alternatives. But they shouldn’t be mechanically rewarded primarily based on their degree of capital spending alone. Corporations should even be scrutinized to make sure that their present aggressive moats aren’t threatened by new AI functions.

AI winners won’t be the primary firms to monetize the brand new expertise. If GAI knocks down entry obstacles in several industries, new gamers will emerge. Thematically oriented energetic buyers with a long-term horizon ought to search past the tech giants to pinpoint firms with really distinctive enterprise fashions and aggressive benefits which are poised to profit from the AI disruption at our doorstep.

The views expressed herein don’t represent analysis, funding recommendation or commerce suggestions and don’t essentially signify the views of all AB portfolio-management groups.

References to particular securities mentioned are to not be thought of suggestions by AllianceBernstein L.P.

Editor’s Notice: The abstract bullets for this text have been chosen by In search of Alpha editors.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please pay attention to the dangers related to these shares.