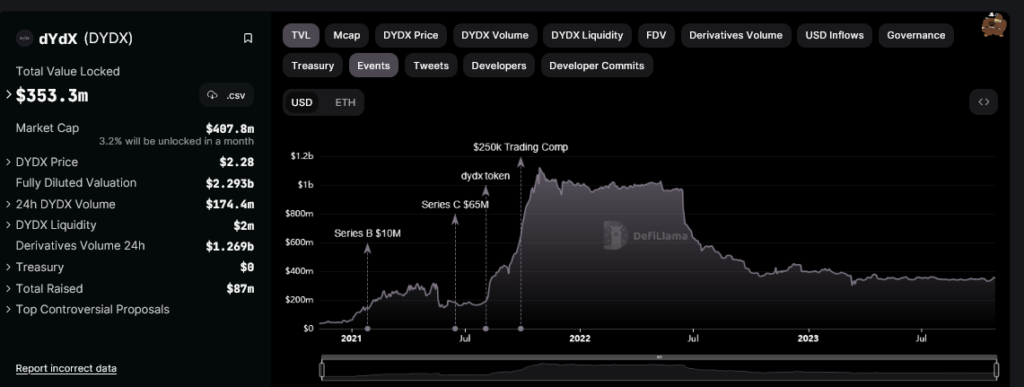

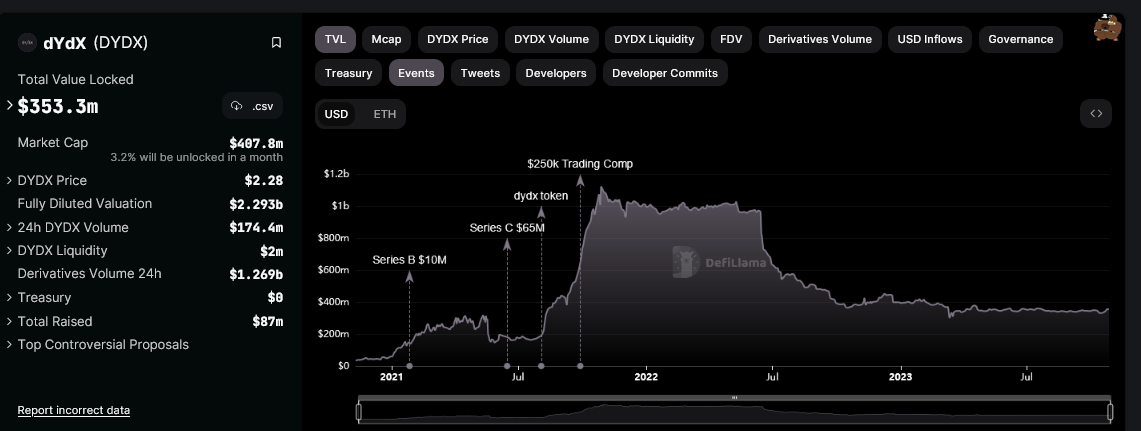

In what’s seen as a monumental transfer, dYdX, a layer-2 decentralized trade (DEX), is open-sourcing its code because the platform prepares to deploy v4. In line with the trade, the trade has a complete worth (TVL) of greater than $353 million DeFiLlama.

dYdX open supply code previous to V4

In line with an X after on October 24, dYdX plans to finally function on its standalone blockchain on Cosmos, migrating from a layer-2 trade that depends on Ethereum for safety. The standalone blockchain, dYdX Chain, will likely be constructed utilizing the Cosmos software program developer equipment (SDK) and powered by the Tendermint proof-of-stake consensus algorithm.

With blockchain, initiatives usually open supply their code, permitting the general public to scrutinize how good contracts work. By going public, the protocol helps construct belief amongst customers and neighborhood members, growing safety and growing decentralization. That is particularly essential as a result of the DEX processes delicate monetary information to allow dependable buying and selling for all customers.

Antonio Juliano, the founding father of dYdX, has already finished that mentioned the trade developer, dYdX Buying and selling Inc., is updating its constitution to turn into a Public Profit Company. The trade builders will work on an open challenge with out benefiting from it. Whereas the platform will stay a for-profit firm as a Public Profit Company (PBC), its founder and board “is not going to act solely to maximise shareholder worth, however will act within the public curiosity.”

Nonetheless, the layer 2 protocol should obtain neighborhood approval by way of a vote earlier than the challenge strikes to v4 on Cosmos. After that, as Juliano states, dYdX will turn into absolutely open-source and decentralized, that means the neighborhood will take over how the protocol evolves by way of a board vote carried out by the dYdX Basis.

Will new options propel the token to 2023 highs?

With v4, dYdX will construct an off-chain order ebook and launch an equally scalable matching engine that may deal with extra transactions. This fashion the event group believes this can “dramatically” enhance the protocol, all with out charging buying and selling charges, as it’s going to run on Cosmos, a scalable layer-1 and interoperable blockchain.

A few of these enhancements embody making dYdX extra environment friendly when buying and selling. Subsequently, numerous functionalities, akin to batch execution and restrict orders, will go dwell. On the similar time, dYdX v4 helps buying and selling in new asset courses, akin to shares, commodities and actual property, making the protocol extra versatile.

Forward of this transition, the trade’s native token is buying and selling at H2 2023 highs on the lookout for worth motion. Notably, the token has damaged by way of the resistance ranges from July to October 2023 with growing volumes. On the similar time, if we have a look at the event on the every day chart, the bull bars are forming alongside the higher BB, indicating sturdy upward momentum. The area round $3.25 and $3.5, which marks the highs within the first quarter of 2023, could possibly be a direct goal for bullish bulls.