naphtalina/iStock by way of Getty Pictures

AES Company (NYSE:AES) has dramatically underperformed the broad market this yr, because it has plunged 51% whereas the S&P 500 has rallied 15%. The explanation behind the huge underperformance is the surge of treasury yields to a 16-year excessive. AES Company has a excessive debt load and therefore the surge of treasury yields and the expectations for top rates of interest for an extended interval than beforehand anticipated are prone to take their toll on the outcomes of the corporate.

Nonetheless, AES Company has practically all its debt at fastened charges and doesn’t have any debt maturities earlier than 2025. Given its dependable development trajectory, the corporate just isn’t prone to have any downside servicing its debt. As well as, its inventory has been punished by the market to the intense, as it’s at present buying and selling at a ahead price-to-earnings ratio of solely 8.1x. Due to its exceptionally low-cost valuation and its dependable development prospects, the inventory is prone to extremely reward traders at any time when rates of interest start to reasonable.

Enterprise overview

AES Company owns and operates energy crops that use numerous sorts of fuels, similar to pure gasoline, diesel, coal, and renewable power sources. It has operations in 14 international locations and has greater than 100 energy crops, with an put in energy in extra of 32,300 megawatts.

A key attribute of AES Company is its resilience to recessions, as demand for power hardly decreases even below probably the most hostile financial circumstances. The corporate proved resilient all through the Nice Recession, which was the worst monetary disaster of the final 90 years. AES Company additionally proved resistant to the coronavirus disaster, because it posted file earnings per share in 2020, 2021, and 2022. The defensive enterprise mannequin of AES Company is vital, significantly given the worldwide financial slowdown this yr.

The opposite key attribute of AES Company is the extreme room for future development. The worldwide transition from fossil fuels to scrub power sources has remarkably accelerated over the last three years, particularly after the fierce international power disaster skilled final yr because of the conflict in Ukraine. With a view to keep away from a future power disaster, most international locations are actually investing in renewable power sources at full throttle.

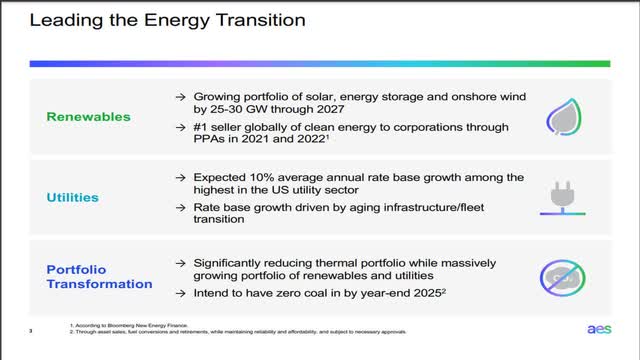

AES Company is ideally positioned to learn from this development and is investing within the enlargement of its enterprise at a wide ranging tempo. To make sure, the corporate expects to remove coal from its portfolio by the tip of 2025 and develop its portfolio of photo voltaic power, power storage and wind energy by 25,000-30,000 megawatts by the tip of 2027.

Development Prospects of AES (Investor Presentation)

Which means AES Company will practically double its put in energy over the subsequent 4 years. The corporate additionally expects a ten% common annual development of its charge base within the upcoming years. This development charge is among the highest in all the utility sector.

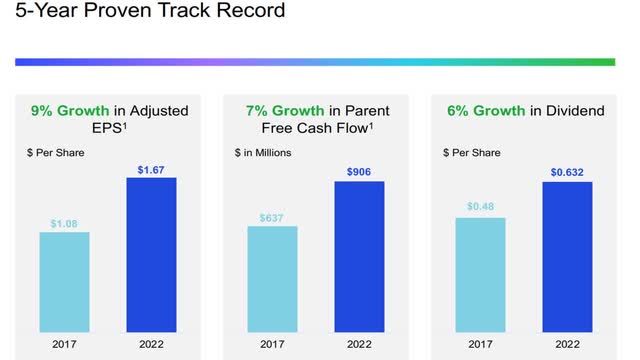

Some traders could declare that the quick enlargement of put in capability could not translate into excessive earnings development. Nonetheless, AES Company has exhibited constant earnings development during the last 5 years.

Development Document of AES (Investor Presentation)

Throughout this era, the corporate has grown its adjusted earnings per share, its free money circulate and its dividend at a mean annual charge of 9%, 7% and 6%, respectively. Additionally it is vital to notice that the corporate has grown its earnings per share for six consecutive years. The constant efficiency is indicative of a dependable development trajectory. Certainly, analysts anticipate AES Company to develop its earnings per share by 11% in 2024 and by one other 10% in 2025, from $1.69 this yr to a brand new all-time excessive of $2.08.

Valuation – Debt

As a result of its 51% plunge this yr, the inventory of AES Company is at present buying and selling at an almost 10-year low price-to-earnings ratio of 8.1x. This earnings a number of is an almost 10-year low valuation stage, a lot decrease than the 10-year common of 11.5x of the inventory. Additionally it is exceptional that the inventory is buying and selling at solely 6.6 occasions its anticipated earnings in 2025. That is undoubtedly an especially low-cost valuation stage.

The depressed valuation of the inventory has resulted from the surge of treasury yields to a 16-year excessive, which is prone to burden AES Company, given the weak steadiness sheet of the corporate. Its internet debt (as per Buffett’s system, internet debt = whole liabilities – money – receivables) is standing at $32.4 billion. This quantity is greater than 3 times the present market capitalization of the inventory ($8.8 billion) and roughly 30 occasions the annual adjusted earnings of the corporate. Due to this fact, the debt load of AES Company is extreme, primarily based on these metrics.

Nonetheless, internet curiosity expense consumes solely 32% of working revenue. Furthermore, the overwhelming majority of the debt of the corporate is at fixed rates whereas there is no such thing as a debt maturity earlier than 2025. That is essential, as the corporate has managed to keep away from a rise in its internet curiosity expense during the last three years, in sharp distinction to most indebted corporations, which have incurred a steep enhance of their curiosity expense throughout this era.

Moreover, AES Company enjoys far more dependable money flows than a typical firm due to the important nature of its enterprise and the multi-year contracts it indicators with its clients. Additionally it is on a dependable development trajectory and therefore it’s seemingly to enhance its monetary metrics within the upcoming years. Administration just lately said that it expects to enhance the leverage ratio (Internet Debt to EBITDA) till 2027. To chop an extended story quick, AES Company just isn’t prone to have any downside servicing its debt due to its low curiosity expense, its resilient enterprise mannequin and the quick development of its enterprise.

Dividend

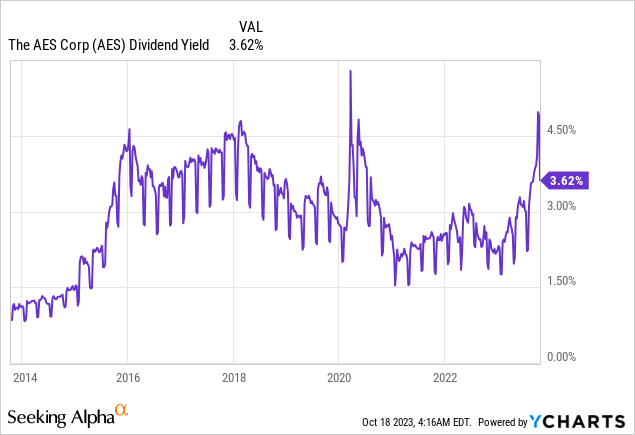

As a result of its depressed valuation, AES Company is at present providing an almost 10-year excessive dividend yield of 4.8%.

The inventory has a payout ratio of solely 42% and therefore its dividend has a significant margin of security. Additionally it is value noting that the corporate has raised its dividend each single yr because it initiated its dividend, in 2012. AES Company has grown its dividend by 5% per yr on common during the last 5 years and during the last three years. Given its wholesome payout ratio and its promising development prospects, AES Company is prone to proceed elevating its dividend at a modest tempo for a lot of extra years.

Threat

The current surge of treasury yields to a 16-year excessive is a unfavourable growth for AES Company, which can be compelled to refinance some parts of its debt at excessive rates of interest once they mature, after 2025. If rates of interest stay excessive for a number of years, they’ll nearly actually take their toll on the earnings of AES Company. Nonetheless, even in such an hostile situation, due to its fixed-rate debt and its laddered debt maturities, AES Company just isn’t prone to be severely harm by excessive rates of interest over the subsequent few years.

Furthermore, the Fed has repeatedly said that it’s going to exhaust its means to drive inflation to its long-term goal vary of two.0%-2.5%. Due to its aggressive stance, the central financial institution has already decreased inflation from final yr’s peak of 9.2% to three.7% now. At any time when the Fed accomplishes its aim, almost definitely in 2024 or 2025, it should most likely start lowering rates of interest. When that occurs, the inventory of AES Company will most likely start recovering towards its historic valuation ranges.

Ultimate ideas

So long as rates of interest stay round their 16-year highs, the inventory of AES Company just isn’t prone to retrieve its current losses. Due to this fact, the inventory is appropriate just for affected person traders, who can preserve a long-term standpoint. Alternatively, at any time when rates of interest start to normalize, the inventory is prone to extremely reward traders due to its depressed present valuation stage and its stable earnings development potential.