Laurence Dutton

Funding Thesis

Accenture plc (NYSE:ACN) is a top-tier IT providers agency with an interesting Free Money Move yield. ACN stands out within the IT providers {industry} because of its distinctive diversification throughout areas, industries, and repair choices. Roughly 70% of its workforce is situated in cost-effective areas, a excessive share in comparison with conventional IT providers companies. The corporate derives important income from roughly 190 purchasers, contributing over $100 million yearly. ACN’s constant investments in coaching and acquisitions are more likely to preserve its main place in high-growth areas of the IT providers sector. Nonetheless, a lower in spending on discretionary IT providers is having a unfavourable affect on the expansion of consulting gross sales, and I count on the strain to proceed within the close to time period. The inventory is already buying and selling according to friends; due to this fact, I keep cautious for now and assign a maintain ranking to the inventory.

Q4FY23 Evaluate and Outlook

Accenture’s fiscal yr 2023 closed reporting a 3.64% YoY development barely decrease than market expectations primarily because of industry-wide lowered discretionary spending, which impacted its consulting enterprise, and challenges within the Communications, Media & Tech (CMT) vertical that dragged down general development. Contemplating the macroeconomic challenges affecting the IT providers sector all year long, this efficiency might be seen as successful, because it aligns with the decrease finish of the unique 8-11% development steerage set a yr in the past (following an distinctive 26% development in FY22).

For fiscal yr 2024, Accenture’s income development steerage of 2-5% in native forex was barely beneath the 3-6% anticipated, primarily because of a slower begin to the yr and the necessity to construct up its e-book of enterprise. However, with a considerable backlog, a rise within the variety of Diamond purchasers (up 33 from the earlier yr), and investments in strategic areas like synthetic intelligence (AI) gross sales, I’m optimistic that Accenture can obtain mid-single-digit, high-quality development or higher by the tip of FY24, per its historic five-year common, and ship double-digit complete returns.

Regardless of the challenges in consultancy and slower spending within the CMT sector, Accenture doesn’t plan important modifications to its development technique. The corporate expects enterprises to proceed their digital transformation efforts to scale back prices and drive development. Accenture is well-positioned to seize this demand, having established a robust presence in cloud, information, AI, and safety providers by means of employees coaching and strategic acquisitions. With a wholesome stability sheet and an anticipated free money move of $8.7 billion to $9.3 billion for the fiscal yr 2024, I consider the corporate has the assets to execute its development technique.

Positioned to Drive Market Share Beneficial properties

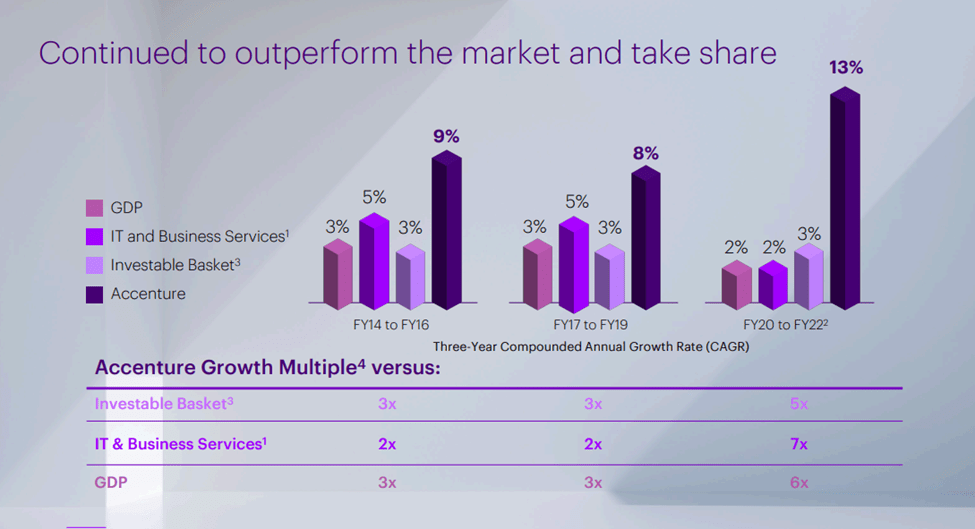

Accenture presently holds the highest place within the $1 trillion know-how providers market and has constantly outpaced {industry} development for greater than a decade. Remarkably, even with this spectacular efficiency, Accenture’s market share stays beneath 5%, indicating important room for enlargement if the corporate continues to take a position aggressively in rising applied sciences and captures a bigger portion of its IT finances. During the last 5 years, the {industry} has achieved development of roughly 5%, barely above the worldwide GDP, whereas Accenture has achieved a powerful 11% enlargement.

Accenture’s success in gaining market share, regardless of its dimension, might be attributed to its proactive method of investing in rising applied sciences forward of the curve. This dedication to steady innovation units it aside within the IT providers sector and allows the corporate to adapt its working technique as wanted. I anticipate that Accenture is well-positioned to take care of this trajectory within the coming decade, significantly as know-how spending continues to extend as a proportion of the worldwide GDP. Notably, Accenture’s workforce is substantial, with over 700,000 workers, surpassing different main gamers like TCS (over 600,000), Infosys (over 330,000), and IBM (round 300,000).

Firm Presentation

Continues Innovation Supplies Edge

Accenture possesses a number of distinct benefits that set it aside from its opponents. These embrace its sturdy model, a tradition of staying forward in know-how investments, a sturdy consulting division, and shut and enduring shopper relationships. Accenture’s longstanding collaborations with main world firms, spanning a number of many years, allow it to safe enterprise with out the necessity for aggressive bids. Roughly 70% of Accenture’s new bookings come from sole-source agreements, indicating that different opponents should not even thought of for these tasks. Remarkably, 99 out of its high 100 purchasers have maintained partnerships with Accenture for greater than ten years. The corporate’s distinctive tradition of steady reinvention and substantial investments in rising applied sciences contribute considerably to its potential to attain gross sales development that surpasses {industry} averages. Moreover, Accenture’s technique of focusing on smaller acquisitions after which scaling these companies is a key differentiator.

Monetary Outlook & Valuation

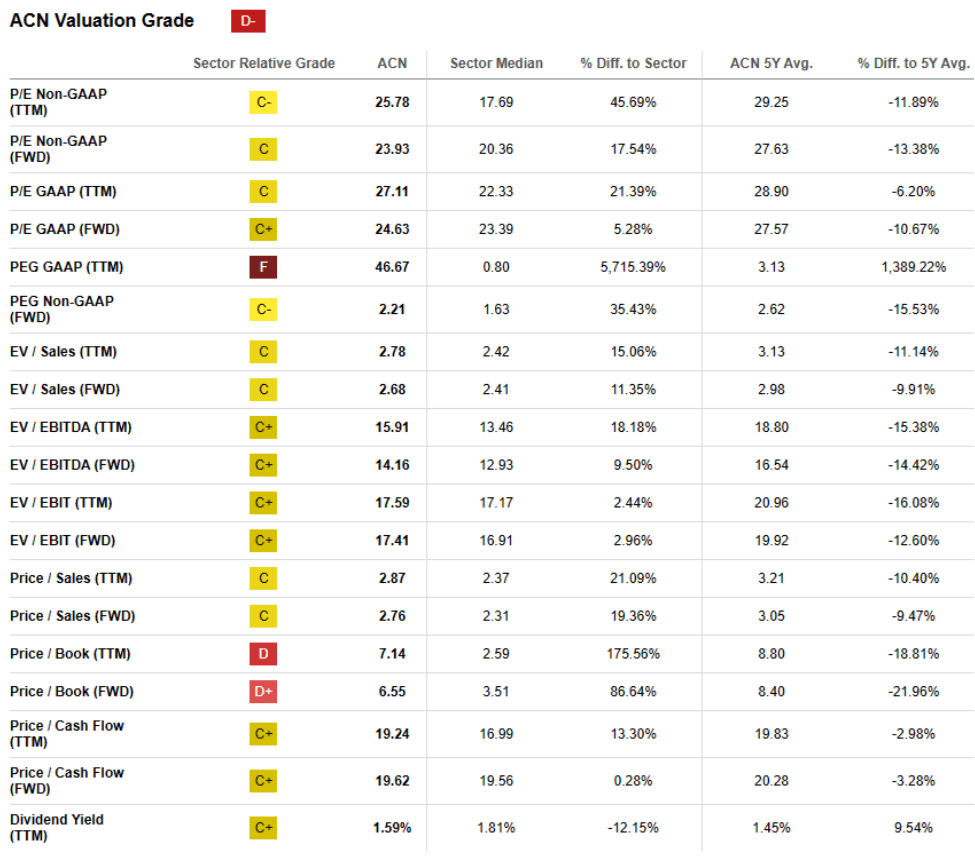

I consider Accenture’s margins might present slight enchancment over the following 12 months, aided by falling worker attrition, muted subcontractor prices, and the potential for decrease wage will increase. I anticipate the corporate to proceed to reinvest its extra revenue, given the corporate’s historical past of reinvesting in development. The current announcement to invest $3 billion in information and AI is one such space for brand spanking new outlays. I consider Accenture is healthier positioned than different consulting-focused service suppliers to realize from an acceleration in AI-related tasks within the subsequent 3-5 years, which, together with a possible rebound in cloud spending, might push its annual gross sales development price again to double digits. ACN is presently buying and selling at 24x ahead PE, roughly across the sector median of 23x. Over the previous yr, ACN has sometimes traded at a premium in comparison with its friends when trying on the subsequent twelve months price-to-earnings ratio. ACN’s present premium of 32% in comparison with the S&P 500 index is per its historic buying and selling patterns. ACN’s sturdy positions in each Managed Companies and Consulting justify a valuation much like main Enterprise Course of Outsourcing (BPO) firms like ExlService Holdings, Inc. (EXLS), which commerce at multiples of 23x. Moreover, ACN’s valuation aligns with that of high Digital firms like EPAM Methods, Inc. (EPAM), regardless of ACN having a decrease development price because of its considerably bigger income base. Due to this fact, I stay cautious for now and assign a maintain ranking to the inventory.

Searching for Alpha

Funding Dangers

A lower in IT spending might lead to decrease demand for Accenture’s providers, making the efficient execution of mergers and acquisitions vital since any unexpected points would possibly hinder the corporate’s potential to realize recognition for future M&A actions. There may be additionally a possible danger of value competitors, particularly given the continued offshore outsourcing development, which might have an effect on revenue margins. Furthermore, if main outsourcing contracts underperform relative to expectations, it might have hostile results on each monetary efficiency and market notion.

Conclusion

Accenture holds a outstanding place within the $1 trillion technology-services market, constantly exceeding {industry} development for over a decade regardless of a market share. With a outstanding 11% enlargement within the final 5 years, Accenture’s success in gaining market share is attributed to its proactive method to adopting rising applied sciences, enabling versatile technique adaptation. Nonetheless, the discount in discretionary IT service spending is adversely affecting the enlargement of consulting gross sales, and I count on this strain to persist within the quick time period. Provided that the inventory is presently buying and selling according to peer firms, I stay cautious for now and assign a maintain ranking to the inventory.