Chinnapong/iStock through Getty Photos

The biopharma house continues to face loads of ache with the LOE on main medication. AbbVie Inc. (NYSE:ABBV) is the most recent firm to amass a promising biotech within the type of ImmunoGen, Inc. (IMGN) to enhance the drug pipeline. My funding thesis is Bullish on the inventory, which is buying and selling close to the yearly lows regardless of the robust money flows.

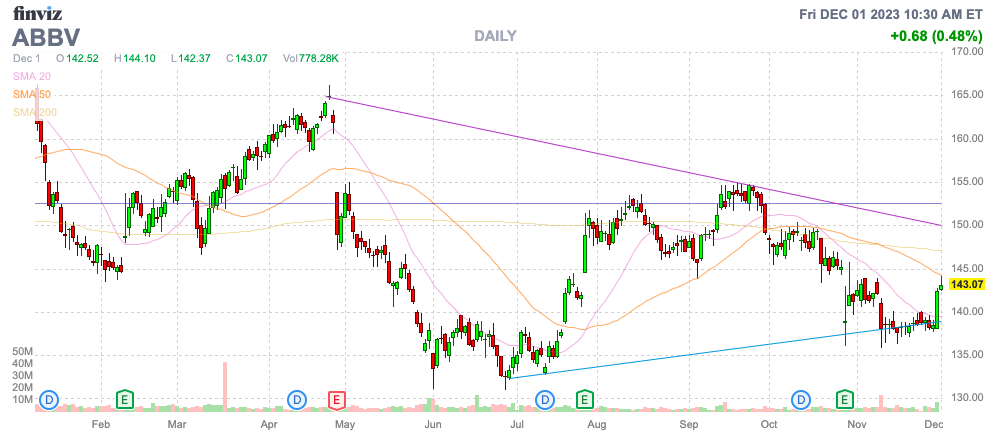

Finviz

ImmunoGen Deal

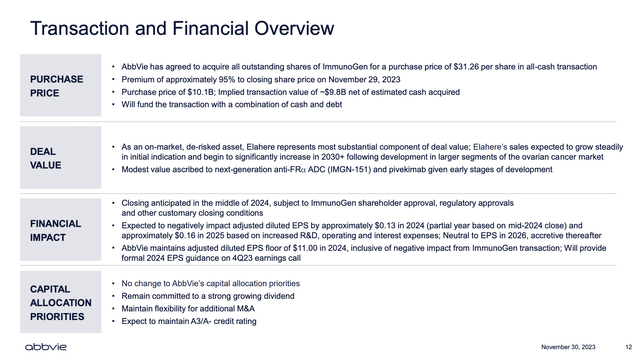

AbbVie reached a deal to amass ImmunoGen for $31.26 per share in an all-cash transaction valued at $10.1 billion. ImmunoGen obtained a 95% premium to the prior closing worth, sending the inventory hovering 83% on the day.

AbbVie ImmunoGen Merger Presentation

The small biotech has the ovarian most cancers drug Elahere accepted, with a consensus income goal of $375 million this yr and leaping to almost $1 billion by 2026. The deal is dilutive by $0.13 in 2024 relying on the precise cut-off date of the transaction.

The novel most cancers drug within the class known as antibody-drug conjugates (ADCs) is not a mega-drug at present. AbbVie is shopping for ImmunoGen for the drug pipeline and for the potential to make use of the AbbVie advertising machine to develop the drug’s gross sales profile and develop the accepted medical situations over time through new ongoing trials.

The market forecasts a $3+ billion world marketplace for ovarian most cancers with a forecast to double in 5 years and attain $12 billion in 10 years, or 2033. The large key for buyers to grasp the chance with Elahere is the market enlargement and development alternatives, not as a lot for any blockbuster gross sales within the close to time period.

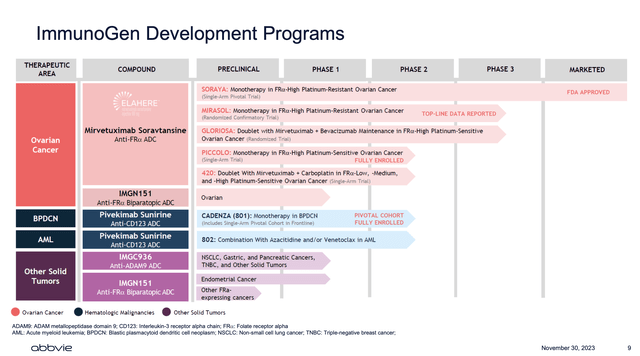

ImmunoGen has a stable improvement program, with medication concentrating on stable tumors and hematologic malignancies. The hematologic malignancies drug has a number of Section 2 research ongoing.

AbbVie ImmunoGen Merger Presentation

AbbVie Wants Progress

The massive biopharma simply reported Q3’23 earnings of $2.95 per share and guided as much as an $11.21 EPS for 2023. AbbVie continues to run into points with income declines from LOE of Humira offset by new drug launches.

Again in Q3, Humira revenues had been down 36% to $3.55 billion. Total, AbbVie solely reported a 6% dip in revenues to $13.93 billion. Loads of the Humira income features had been offset by 50% features in Skyrizi and Rinvoq, with mixed quarterly revenues of $3.24 billion.

The corporate guided to a 2024 EPS of as much as $11.00 for a slight dip from the 2023 stage. The ImmunoGen deal will decrease the upside EPS goal to solely $10.87 whereas revenues will rise primarily based on half a yr of gross sales.

One of many new points with money merger offers within the decrease curiosity earnings or further debt price. Up to now few years, firms instantly made constructive earnings on money offers attributable to idle instances not producing a return.

AbbVie ended final quarter with a money stability of over $13 billion and almost $56 billion in debt. The online debt place is about $42 billion. The curiosity earnings jumped to $157 million, whereas curiosity bills had been steady at $555 million for a internet price of $398 million.

In essence, AbbVie can pay no less than $400 million in further internet curiosity bills. The quantity contains the lack of curiosity earnings from utilizing the present massive money stability to pay for ImmunoGen.

With 1.8 billion shares excellent, the steering for a $0.13 dilutive EPS affect in 2024 is principally as a result of affect to curiosity bills. ImmunoGen is forecast to be barely worthwhile subsequent yr, incomes ~$100 million primarily based on a $0.37 EPS goal.

AbbVie generates $20+ billion in annual money flows and spends about half of these money flows on the dividend, at present yielding round 4.4%. The corporate will generate sufficient money movement to pay for the deal by the point it truly closes.

The extra revenues will assist the view of the biopharma, contemplating the market desire for development equities. AbbVie will want the ImmunoGen enterprise to achieve revenues far past the $1 billion vary to maneuver the needle on a enterprise already topping $50 billion.

Takeaway

The important thing investor takeaway is that AbbVie Inc. has a drug deal in ovarian most cancers, pushing the corporate again into development mode in 2024. The inventory is not overly low-cost, buying and selling at almost 13x EPS targets whereas this deal is dilutive within the brief time period. Finally, although, if AbbVie can return to development and put the Humira LOE within the rearview mirror, the inventory will reward shareholders with a powerful revenue and a big dividend yield.