In accordance with a current report from Milk Street, Aave, a number one decentralized finance (DeFi) protocol, has reported a powerful $500 million improve in income since early 2024.

This achievement positions Aave as one of many high protocols by way of income generated inside the DeFi house.

Nevertheless, regardless of this success, AAVE’s value has been on a downward trajectory since mid-September.

The AAVE value has fallen by 14% in two weeks

In accordance with CoinGecko information, the AAVE value has fallen by over 14% over the previous two weeks and round 4% over the previous month.

Aave has proven a powerful bullish pattern because the starting of the yr, regardless of a slight pullback in April.

The token continued to report a two-year excessive of $177.42 on September 23, 2024, earlier than turning bearish virtually instantly afterwards.

Understanding the components contributing to this value drop is important for buyers and market observers, particularly given the excessive revenues that decentralized lending platform Aave has achieved to this point this yr.

Aave community exercise is lowering

One of many foremost causes for the worth drop is the lower in community exercise.

Though Aave’s income has soared, its person engagement statistics present a worrying pattern.

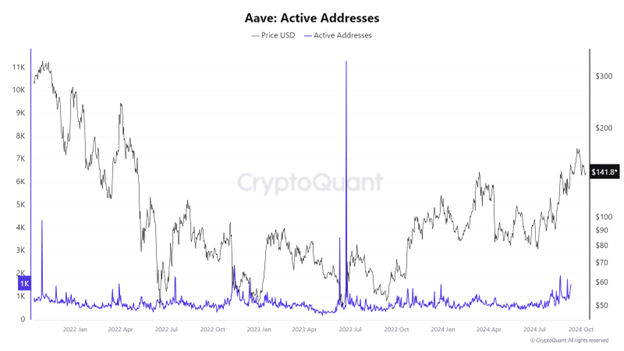

Each day energetic addresses, a essential indicator of person participation, peaked in September however then started to say no.

Supply: CryptoQuant

The lower within the variety of transactions is carefully linked to this lower within the variety of energetic customers, indicating a potential lack of curiosity or involvement within the platform.

A discount in community exercise usually results in bearish sentiment, because it signifies that fewer customers are utilizing the protocol’s providers.

Moreover, the birth-to-death ratio of addresses inside the Aave ecosystem has additionally decreased.

This ratio measures the variety of new addresses created versus the variety of addresses which have remained inactive for greater than a yr.

Supply: IntoTheBlock

A declining birth-to-death ratio signifies that fewer new customers are getting into the ecosystem, whereas current customers could lose curiosity.

This may occasionally contribute to the notion of Aave as a much less enticing funding, additional negatively impacting the token’s value.

Growing gross sales strain

One other main issue affecting Aave’s value is the rising promoting strain seen in current weeks.

Santiment information signifies a pointy improve in AAVE provide on exchanges, coupled with a decline in off-exchange provide.

This pattern signifies that buyers are actively promoting their investments, possible in response to market circumstances and shifts in sentiment.

Elevated promoting strain normally results in value corrections as a result of it overwhelms shopping for curiosity.

Market sentiment round Aave has additionally turned noticeably bearish. As investor enthusiasm wanes, total sentiment could shift, leading to decrease demand for the token.

Sentiment statistics point out that unfavorable sentiments in the direction of Aave have elevated, additional exacerbating the pricing challenges going through the protocol.

The concern of potential losses usually leads buyers to liquidate their positions, exacerbating the downward value motion.

Can the Aave value bounce again?

Whereas AAVE’s spectacular income efficiency of $500 million is commendable, a number of components, together with declining community exercise, elevated promoting strain and altering market sentiment, are contributing to the continued decline in AAVE’s value.

Nonetheless, regardless of these challenges, there’s a glimmer of hope for Aave buyers.

The token not too long ago examined an important assist stage round $135, which if sustained may sign a possible bullish reversal.

If shopping for strain will increase and buyers regain confidence, there might be alternatives for restoration and progress within the token’s value.

The report that Aave’s value has fallen since mid-September regardless of $500 million in gross sales: this is why it first appeared on Invezz