Decentralized crypto platform Aave (AAVE) has emerged because the chief among the many high 5 lending and borrowing protocols, recording greater than $24 million in charges over the previous 30 days.

Aave permits customers to create liquidity markets, permitting them to earn curiosity by supplying or borrowing belongings.

Aave Protocol leads in 30-day charges

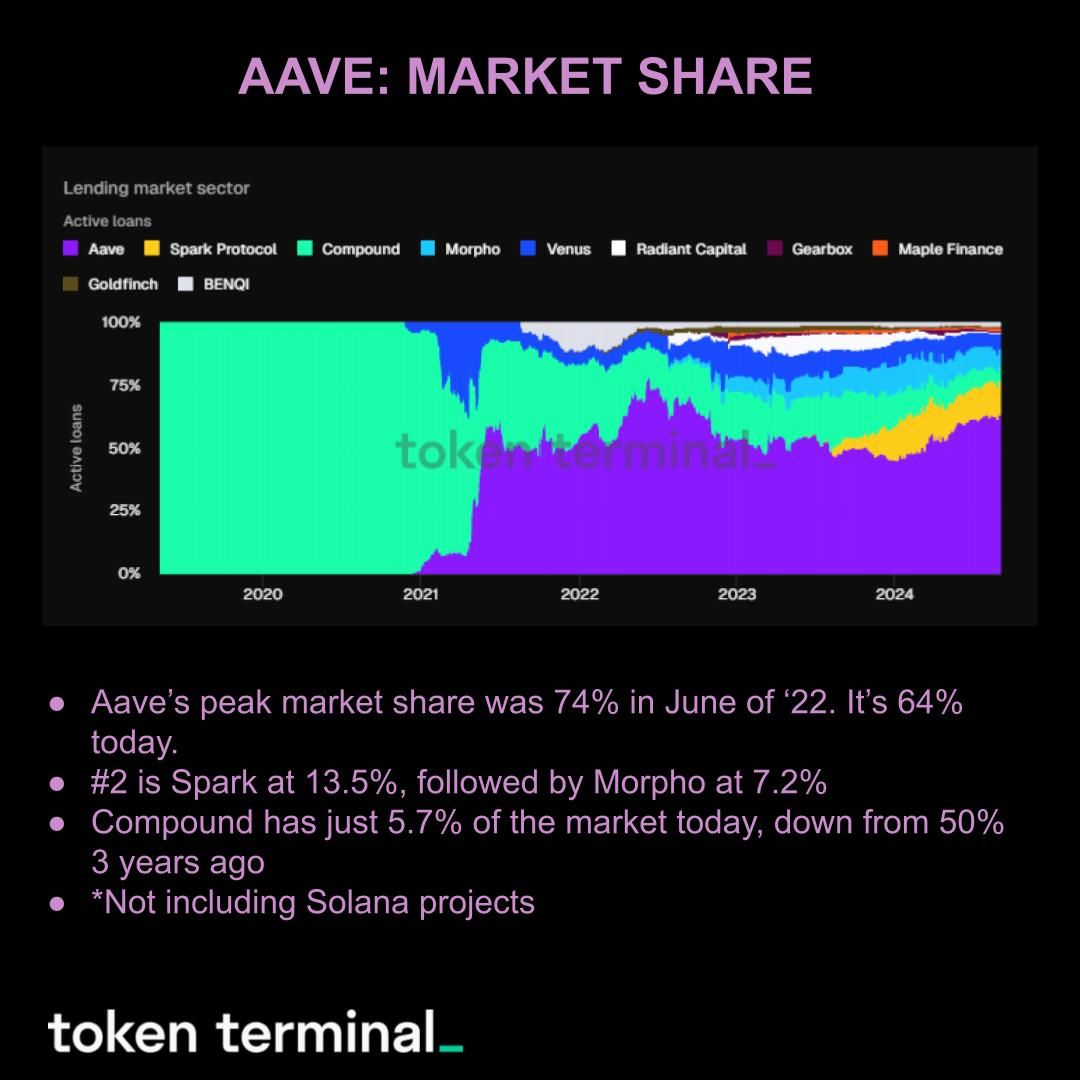

In keeping with Token Terminal, Aave leads the credit score and lending sector, adopted by Morpho Labs, Venus, Compound Finance and Moonwell. Michael Nadeau, founding father of The DeFi Report, notes that Aave has a 64% market share within the credit score and lending markets.

Aave has 4.6 occasions extra energetic loans than its nearest competitor and 6.3 occasions extra TVL than the 2 largest Solana mortgage purposes mixed. Lively loans on Aave have elevated 3.6x for the reason that FTX collapse, though they’re nonetheless 60% under their late 2021 peak.

Final 12 months, Aave generated a complete of $293 million in charges, whereas the Aave DAO retained 13.3% or $38.9 million. DAO revenues peaked in June 2024.

Learn extra: What’s Aave?

Aave market share. Supply: Token terminal

Nadeau’s analysis highlights that Aave has achieved on-chain profitability this cycle, with DAO revenues exceeding token incentives. This shift signifies that the protocol is turning into much less depending on token incentives to draw customers.

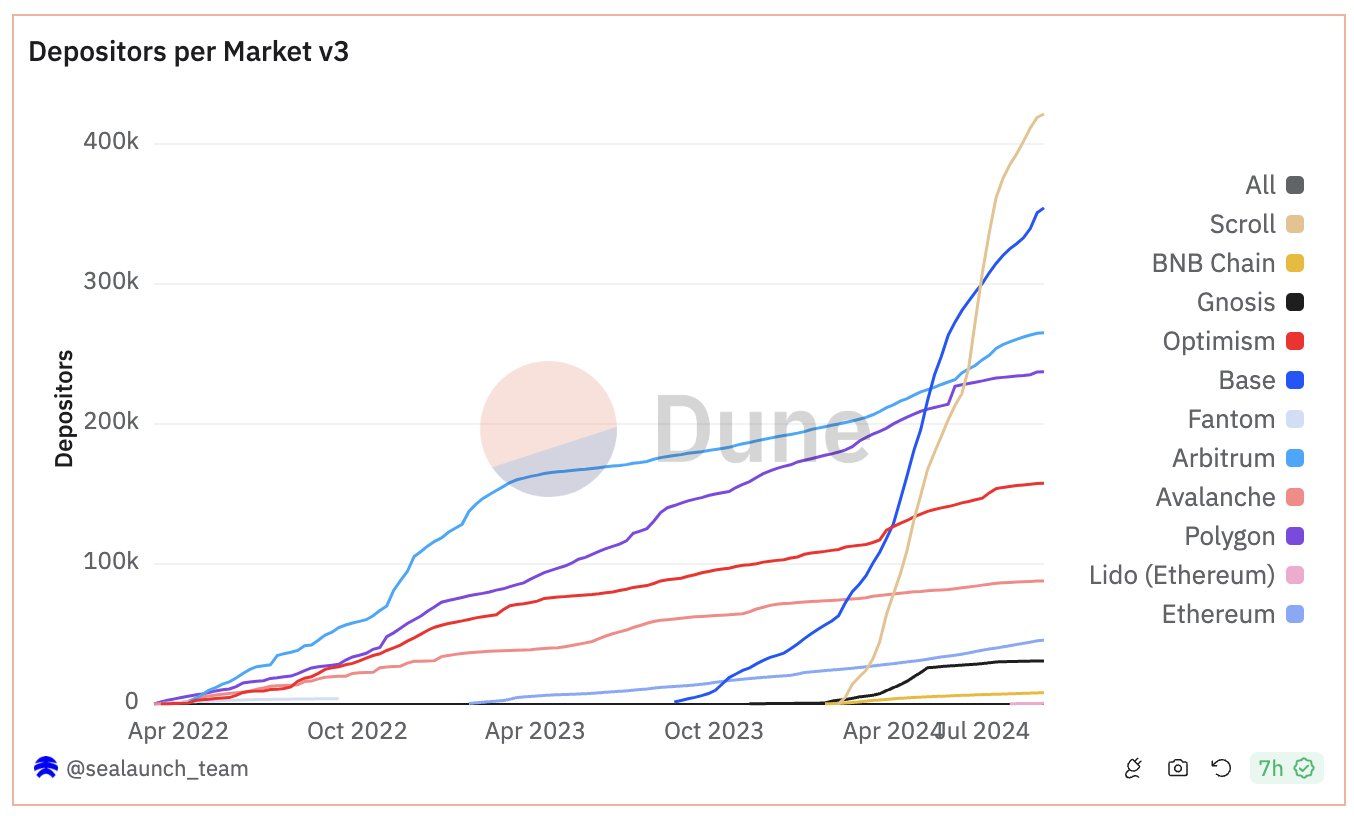

In the meantime, Aave creator Stani Kulechov seen the quiet success of the Scroll market on Aave. This adopted the implementation of Aave V3 on the Scroll mainnet, a strategic transfer with the potential to reshape the business.

Blockchain market exhibiting scroll progress. Supply: Dune

For Aave, this integration is a chance to leverage the Scroll’s excessive throughput and decrease fuel prices, successfully rising the scalability and accessibility of its lending companies. Moreover, Aave advantages from an in depth consumer base, leveraging the energetic group that Scroll has constructed.

Whales Focused on AAVE Amid Trump’s DeFi Enterprise

Amid the constructive developments at Aave, main traders have expanded their portfolios. BeInCrypto reported that on August 21, a whale purchased greater than 50,000 AAVE tokens value $6.65 million, shortly after one other whale purchased 11,101 tokens value $1.45 million. Moreover, Lookonchain revealed that on Thursday, two extra whales had acquired 16,592 AAVE tokens value $2.2 million.

This rising curiosity is fueled by Aave’s strategic integrations and Donald Trump’s DeFi initiative. Trump’s venue goals to construct a decentralized monetary system utilizing Aave’s non-custodial lending platform and Ethereum infrastructure, introducing his followers to DeFi.

With the launch of Trump’s new AAVE protocol, it’s unbelievable to see DeFi turning into a focus on this election. IMO, DeFi is the guts of crypto and its future,” wrote Jared Grey, a builder at Sushi Labs.

Gabriel Shapiro, authorized counsel for World Liberty Monetary, acknowledged that the DeFi enterprise would function a “light-weight non-custodial feeder” for Aave, permitting customers to deposit with out the necessity for a fork.

Learn extra: Aave (AAVE) Value Prediction 2024/2025/2030

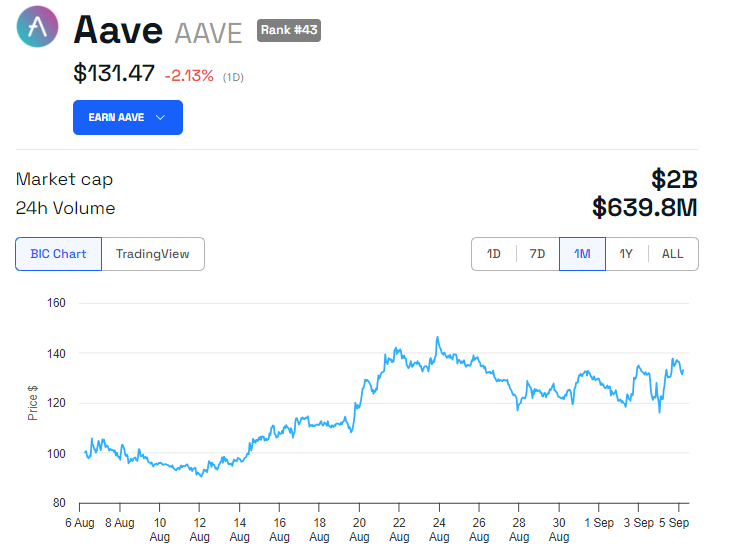

AAVE worth efficiency. Supply: BeInCrypto

The information surrounding World Liberty Monetary boosted confidence within the potential for mainstream adoption of Aave, driving speculative AAVE purchases. After the information, the AAVE rose by 10%. Nonetheless, information from BeInCrypto reveals that the token has since worn out most of those good points and is buying and selling at $131.47.