From his early days on Ethereum to his intensive attain on low-2 and different chains, Aave has solidified as a pacesetter in decentralized funds.

Aave (Aave) Metrics Skyrouette: Overview

Aave -Tokens had an enormous improve of greater than 21% this week, which carry out significantly better than the broader cryptomarket. This rally follows a major administration proposal from a DAO, which tries to enhance the worth construction mechanisms of the token.

Crucial parts of the proposal embody:

- A revenue sharing mannequin for Aave strikers.

- A program “purchase and distribute” to assist value stability and lengthy -term worth.

- A brand new “anti-gho” mechanism for burning or changing GHO money owed for further rewards.

- A self -protection system referred to as “Umbrella” to guard customers towards unhealthy money owed

These proposed adjustments replicate a rising dedication to stimulating Aave holders and strengthening the monetary resilience of the protocol. Though the prize has virtually made a tour, it exhibits that the market is smitten by this new proposal and the way it will affect AAVE token.

Aave is a vital lively for Main Defi

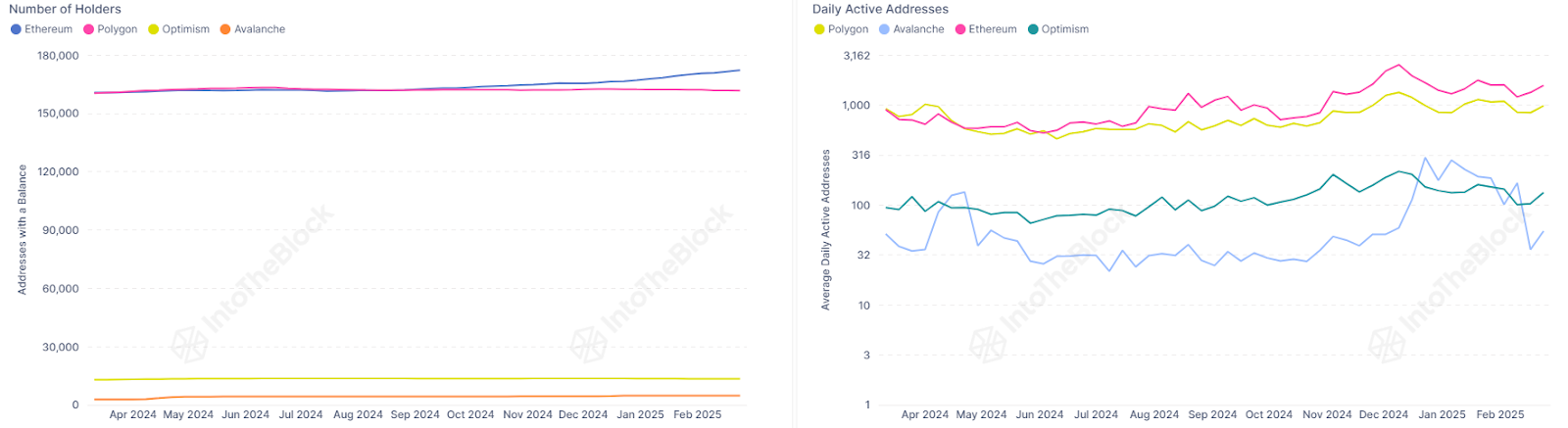

This latest improve in Aave additionally reinforces its position because the beating coronary heart of the protocol, which makes it potential to make administration selections potential and sooner or later probably earn rewards from the protocol itself. Token presently has greater than 170,000 AAVE holders on Ethereum alone, with virtually the identical quantity on Polygoon.

Regardless of the broad distribution, nevertheless, the AAVE -token solely sees round 3000 day by day lively addresses about block chains. This means that many customers select to maintain as an alternative of working recurrently, most likely pending additional value ranking.

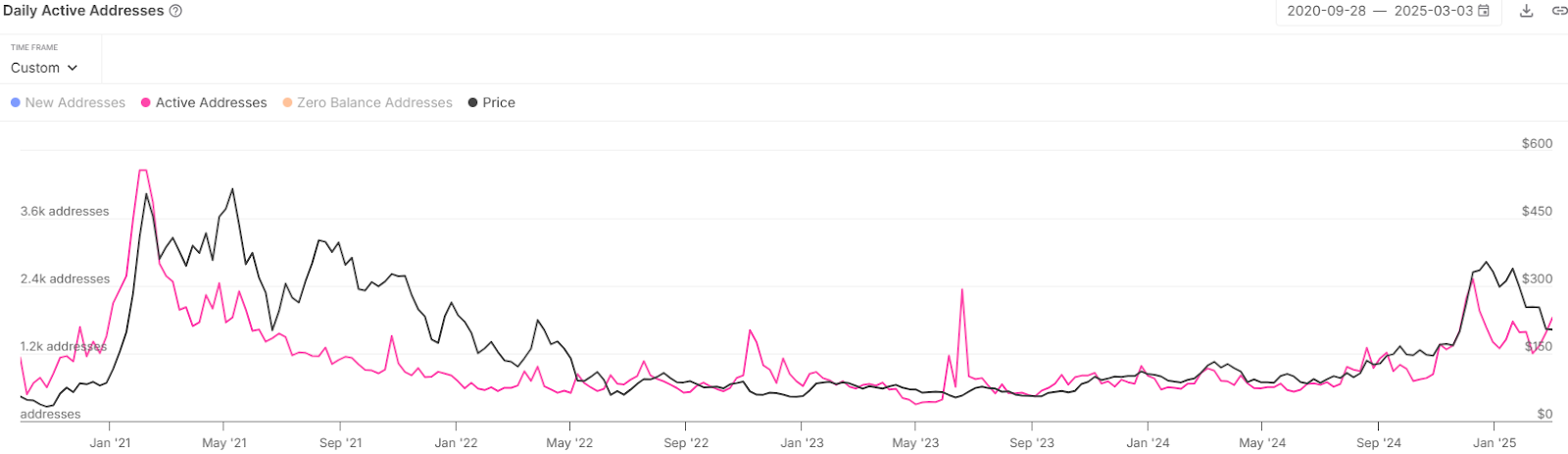

On-chain statistics for a promising look, as evidenced by a exceptional improve in exercise because the finish of 2024.

Early days of Aave

Aave’s journey started in 2017 when the Finnish regulation scholar Stani Kulechov launched Ethlend, a groundbreaking peer-to-peer mortgage platform on Ethereum.

Nevertheless, the mannequin was confronted with issues with liquidity and scalability, which inspired a serious shift. In 2018, Ethlend renamed Aave, which suggests ‘Ghost’ in Finnish and switched to a liquidity pool mannequin. This innovation considerably improved effectivity, in order that customers can deposit belongings into shared swimming pools from which debtors might pull, which eliminates the inefficiencies of the matching of direct lender.

Aave about blockchains

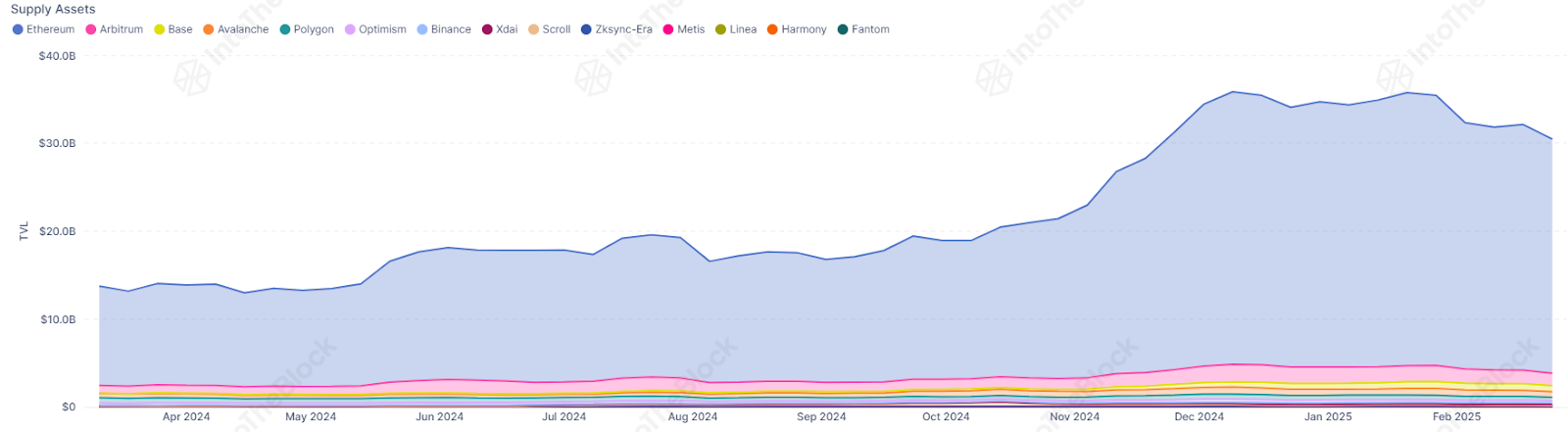

Though Aave clearly gone cross-chain and is now accessible on 13 completely different chains, a very powerful Aave-Hub Ethereum stays. Right here Aave recommends:

- $ 26.6 billion in belongings delivered in 49 markets, primarily in Weth and Wsteth.

- Greater than $ 11 billion in borrowed belongings, strongly centered on Weth and USDT.

These figures account for nearly 90% of the whole equipped and borrowed belongings from Aave, which exhibits that, not shocking, Ethereum nonetheless stays a very powerful hub for Aave.

Aave’s multi-chain domination

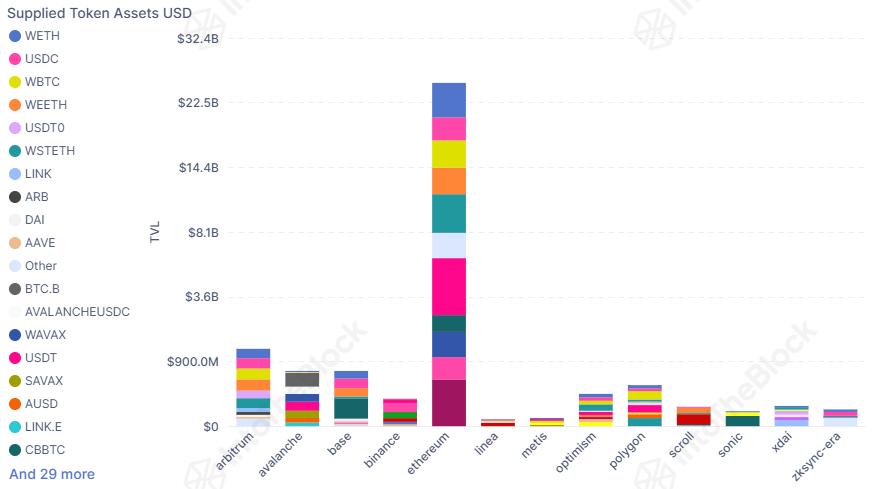

Why accept one blockchain if you happen to can conquer a number of? Aave’s enlargement technique seems to be like a collection of nicely -planned chess actions on a number of networks:

- Arbitrum: at least $ 1.4 billion in belongings equipped, due to excessive transit and low prices.

- Fundamental: already $ 699 million host on belongings equipped, a sign of a powerful early adoption.

- Avalanche: about $ 630 million in belongings, enticing for individuals who worth velocity and environmentally pleasant consensus.

- Polygon: greater than $ 393 million, these customers who crave effectivity and near-instant finality.

Develop: What’s the subsequent step for Aave (Aave)?

With an ever-increasing consumer base, multi-chain implementations and lively board, Aave doesn’t present any indicators of delay. Aave’s plans even embody increasing to different block chains within the close to future.

If in recent times are a sign, the Aave course of continues to push the boundaries of what’s potential in Defi.