By Peter Tchir of Academy Securities

Should you have been hoping for a assessment of Cheech & Chong films, you’ll be sorely upset. With the S&P 500 breaching 5,000 and setting all-time highs, it appeared like an excellent time to do a retrospective of all-time highs. A minimum of those who I bear in mind, so we solely have to return to the Eighties.

One Factor That I’m Sure of Relating to All-Time Highs

We are going to all get sick of listening to about “all-time” highs. Sure, if the S&P 500 goes up a measly 1 level on Monday, we could have a “new” all-time excessive. Each dip that will get purchased will create “new” all-time highs. We are going to in all probability all get sick of being informed about “intraday” versus “closing” all-time highs. 5,100 on the S&P 500 will probably be trigger for “wild celebration” within the media, regardless of it “solely” being 1.5% away (which may simply occur in a day at its present tempo).

All that “all-time” excessive chatter (and cheerleading) will probably be a distraction from our actual jobs – determining the place the market is headed subsequent. Which is why I believe {that a} “retrospective” could be attention-grabbing and probably helpful.

All Kinds of Issues Occur Round All-Time Highs

Let’s begin with a fast “synopsis” of what has occurred since 1980. I in all probability ought to have used a log chart or one thing to dampen latest strikes relative to prior strikes. Nonetheless, since I went down this path, I didn’t really feel like going again and assume that it’s fairly efficient in illustrating some factors.

There are some things that stick out to me:

- We are inclined to get lengthy durations of comparatively regular uptrends. I assume that’s widespread sense since we began in 1980 at 115 and are actually at 5,027.

- It’s simpler to place labels on the “unhealthy” moments slightly than the “good” moments. Once more, partly, it is because going up is far more widespread.

- It was simpler, at the very least for me, to place labels on more moderen strikes slightly than historic strikes, as my recollection is healthier and I used to be far more straight concerned.

- On one hand, even adjusting for scale over time, some issues that appeared “vital” on the time have been mere blips within the grand scheme of issues. However, what appeared like good long-term traits usually had durations of volatility in each instructions. The “tech bubble” bursting had a number of great reversals.

- Whereas among the labels could be correct general, they don’t do justice to the complexities of every occasion. Throughout what is usually known as the “tech bubble” bursting, the world needed to cope with the tragic assaults on 9/11 and the aftermath.

Let’s study a number of of those in additional element to see what we will be taught.

The Crash of 1987

Portfolio “hedging,” the place managers tried to dynamically handle their portfolio slightly than shopping for choices, allegedly contributed to what (on the time) was referred to as “Black Monday.”

In a matter of days, the inventory market gave up about 18 months of positive factors. Whereas I’ve drawn a trendline from September 1986 to October 1987, there have been some significant pullbacks. In hindsight, was that first 5% “dip” a warning signal or a precursor of what was to come back? Or was it simply noise like earlier dips? Whereas we bounced on efforts to “resolve” the problem (with huge liquidity, although lengthy earlier than QE was a family time period), I didn’t notice that we dropped greater than 10% from there as we headed into November and early December. An extra 10% decline could be memorable in most conditions, however that transient sell-off was so massive that every thing else was forgotten (at the very least by me).

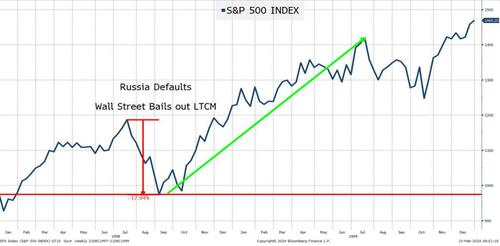

The Greenspan Put

Whereas the “Greenspan Put” began in 1987, it appeared like an inexpensive response to a set of circumstances that had uncovered flaws in market construction. 1998 appeared totally different to me. Sure, Russia was teetering on default. Sure, Lengthy-Time period Capital (the “smartest individuals within the room”) was apparently threatening to convey down Wall Avenue. This included huge bets, exceptional on the time, on esoteric devices that have been shifting a number of commonplace deviations and wreaking havoc with collateral administration. However have been they actually “systemic?” Did the Fed really want to intervene as aggressively because it didn’t simply on financial coverage, but additionally by “encouraging” (and I take advantage of that time period very loosely) the banks to cooperate in beforehand unheard-of methods? This one was close to and pricey to my coronary heart as I used to be straight concerned. One lesson that I realized from this, which solely turned obvious because the GFC unfolded, is that if you’re a CEO of an entity and requested by the Fed to assist, you certain as heck higher assist! (See Bear Stearns and Lehman Brothers).

The Greenspan Put, possibly as a result of it was “pointless” or definitely not as crucial because it was in 1987, helped shares recuperate their losses in a short time and we moved to new highs!

The “Tech Bubble”

First, what was generally known as a “tech bubble” on the time, merely appears to be like like a average misalignment of capital on reflection. Whereas some firms by no means grew into their valuations and by no means returned, a number of of right now’s market leaders look “grime low-cost” now even at ranges that have been then thought of “bubbles.” The info has pointed to a resilient shopper. I’ve been skeptical of how robust the patron will probably be going ahead. My impression, albeit subjective, is that reductions have been very prevalent throughout this vacation season (pulling future demand ahead) and inflation continued to skew spending increased (as we nonetheless should spend extra to get the identical quantity of stuff). Whereas that may have been a ample argument a number of weeks in the past, we have to dig deeper. A few of the excessive yield issuers (I used to be extra concerned with them) wound up defaulting however got here roaring again over time. I nonetheless have “fond” recollections of AOL being acquired and plenty of particular CDS associated questions on dilution not having to get resolved. However I digress.

You may see 9/11 within the chart. What I don’t spotlight, which I believe is an issue once we focus on the interval, was the failing of WorldCom and Enron. Two “allegedly” funding grade firms went “poof” comparatively rapidly. How may analysts do their jobs when the information was deceptive or outright fraudulent? I strongly consider that the priority these two bankruptcies induced for credit score markets performed an amazing position in not simply the depth of the issue, but additionally why it took nicely over 5 years to recuperate!

It would eternally be often called a “tech bubble” however I believe that may be a misnomer and too simplistic.

What you’ll be able to see from the chart is that it was a “nice” interval for merchants, in the event you caught among the strikes accurately, or it was one of many few occasions that “purchase the dip” failed, repeatedly.

Sure, the “bubble burst” however there have been a number of strikes increased of 10% or extra, and bear in mind, that is the S&P 500, not the Nasdaq, which had even “crazier” strikes.

The 2007 “All-Time” Excessive

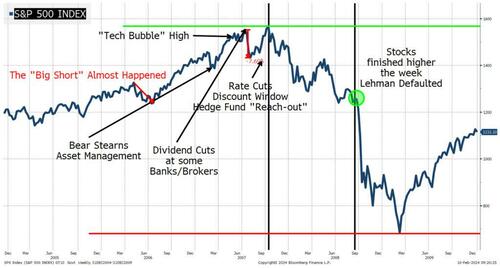

Of all of the all-time highs, that is the one which I’m most bitter about, and it appears weird in virtually each respect.

I jammed quite a bit into this chart. I really feel obligated to focus on my “frustration” with Michael Lewis’s guide “The Massive Quick.” It makes it sound like solely a choose few noticed housing begin to crack. From my seat, many individuals noticed it, however the timing was extremely troublesome, and also you have been definitely “preventing the Fed.”

We “lastly” received again to the “tech bubble” highs in the summertime of 2007. It was helped by housing, but additionally extremely tight credit score spreads, as merchandise like CPDOs appeared “miraculous” in that you possibly can take BBB credit, leverage them in a automobile, and get a AAA score (flawed). This was coupled with every thing that went on within the mortgage-backed market (the place points with the unique tranching fashions have been multiplied when tranches have been re-tranched into CDO squared).

But it surely was the “Bernanke Put” that strikes me as probably the most odd. The all-time highs in shares have been set after some critical issues had been uncovered. However the measures Bernanke took (from financial coverage to the media) helped us attain new highs. Then, whereas we tried to bounce each time the Fed (or D.C.) intervened, we continued to slip. We didn’t backside till March of 2009, a full 6 months after Lehman defaulted. I nonetheless assume that the Lehman Second is the best misnomer in monetary markets as shares rallied that week and there have been much more issues (many higher than this). However possibly a “scapegoat” helps everybody really feel higher?

However, to today, I nonetheless don’t perceive how the Bernanke Put, which got here shortly after all-time highs have been breached, may overcome all the apparent issues.

Having mentioned that, I did be taught the laborious means that you just don’t want to grasp one thing to commerce it, which got here in very useful, most not too long ago throughout COVID.

Extra “on the highs” Ideas

Nearly all are surrounded by frantic volatility, particularly after they fail.

It’s virtually disturbing (truly I discover it fairly disturbing) what number of highs appear depending on financial coverage, which can clarify why the uptrends and downswings each appear extra manic.

Brexit, which induced markets to commerce restrict down after the shock vote, was “solved” by the point markets opened for enterprise with central banks offering “globally coordinated” help. Ditto for the 2023 “banking disaster.” This was the primary time that I used to be requested to take part in a “disaster” particular – which was an apparent purchase sign. 😊

We’ve all lived by way of the previous few years, so no cause to expound on them anymore, apart from that they too appear to suit the patterns of the previous.

Backside Line

May this be simply the beginning of breaking by way of to increased and better highs?

- If AI is passing on value/profit evaluation already, then it’s definitely an actual risk!

- As provide chains shift and we redevelop a powerful “working class” in America, the place jobs are safer and better paying, then it’s definitely an actual risk.

- If the Fed cuts and forces “savers” again into equities on something like the size that occurred throughout ZIRP, then it’s a actual risk.

However, if all we now have accomplished is chase financial coverage to ranges that aren’t at present sustainable by way of innovation, jobs, and actual financial progress, then the decline is more likely to be speedy and depart lots of people scratching their heads and questioning the way it was potential to dump so rapidly (though traditionally, that’s the “norm”).

I assume that if I used to be writing to Ann Landers, that is the place I’d signal the report “torn and confused.”

I stay resolute on increased yields and tighter credit score spreads, however I’m actually combating what to do with shares right here, besides so as to add to commodity associated holdings and wait to see how business actual property does.

Good luck, benefit from the Tremendous Bowl, and take the over on the variety of occasions Taylor Swift is talked about!

Loading…