By Jan Nieuwenhuijs of Gainesville Coins

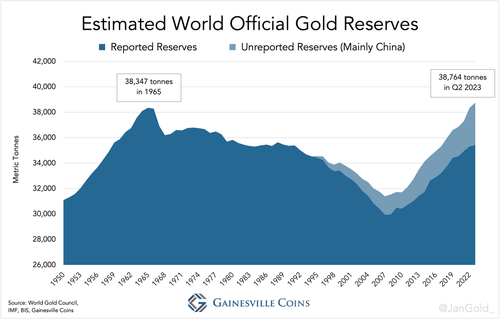

My estimation of world official gold reserves hit 38,764 tonnes in Q2 2023, breaking its earlier report from 1965. The brand new excessive confirms the world has entered a brand new period of gold. Central banks will proceed to build up gold and the steel’s function within the worldwide financial system will improve to the detriment of the US greenback.

Analysts broadly use the Worldwide Financial Fund (IMF) calculation for complete official gold holdings, although what’s normally ignored is that this quantity is an estimate by the Fund. As talked about in my previous article on the official gold reserves of China, not each central financial institution is clear about its gold holdings. The Chinese language central financial institution (PBoC) studies to have 2,113 tonnes, whereas it’s an open secret within the gold business the PBoC owns rather more than that—about 5,000 tonnes, according to my analysis. One other instance, the central financial institution of Syria stopped reporting its gold holdings in 2011. For its computation of world holdings, the IMF carries ahead the final recognized knowledge level, assuming Syria nonetheless holds 26 tonnes.

My private analysis of world official gold reserves is basically primarily based on how the IMF compiles its world collection, the primary distinction being “unreported purchases” traced by business insiders that I embody in my knowledge. My method:

- The bottom consists of the the final registered volumes from all central banks and financial authorities, additionally of those that stopped reporting years in the past.

- For China I exploit my own numbers going again to 1995.

- Unreported purchases by central banks aside from the PBoC are added, measured by the distinction between the World Gold Council’s estimated complete purchases based on field research and reported adjustments by all central banks mixed.

- Recognized reserves by sovereign wealth funds are included*.

- Gold owned by worldwide monetary intuitions such because the European Central Financial institution and West African Financial and Financial Union can also be added.

- Swaps on the stability sheets of the Turkish central financial institution and Financial institution for Worldwide Settlements (BIS) are subtracted.

Primarily based on my methodology, world official gold holdings reached 38,764 tonnes in June 2023, which is roughly 400 tonnes greater than the prior excessive set in 1965 at 38,347 tonnes.

The brand new report displays a want by central banks the world over to diversify away from the US greenback with its ever extra evident counterparty dangers. Central banks’ turning level in gold holdings got here simply after the Nice Monetary Disaster of 2008, since once they have purchased greater than 7,000 tonnes.

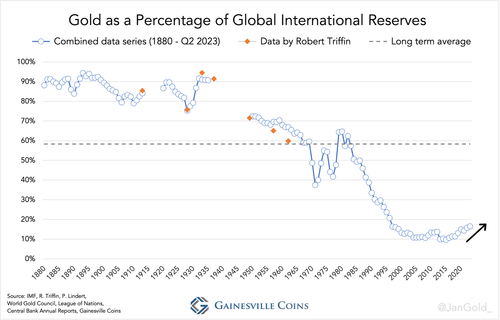

The worth of world gold reserves grew by 66% from that second, whereas overseas alternate reserves have swelled by 30%. Because of this, gold’s share of world worldwide reserves (gold and overseas alternate) is rising from an all-time low in 2015.

There’s loads of upside for the gold price if gold’s share of complete reserves (at the moment 17%) ought to ever come near its long-term common (58%). In a previous article I speculated gold might attain $8,000 within the subsequent ten years.

In context of accelerating geopolitical tensions, a weaponized greenback, and sky-high debt ranges throughout the globe (traditionally alleviated by means of inflation), central banks will proceed to purchase gold within the foreseeable future.

The brand new report in gold reserves is generally a symbolic milestone. Any tendencies I describe haven’t been altered however reconfirmed by the brand new excessive.

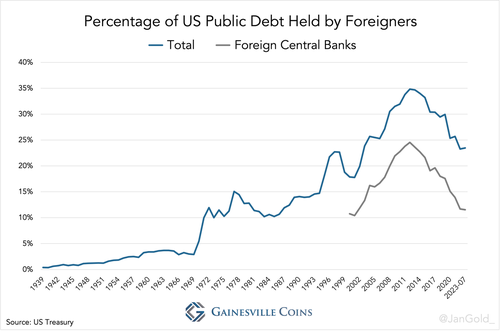

International central banks largely personal US authorities bonds (Treasuries) as greenback belongings. As their gold reserves are rising, their nominal holdings of Treasuries have been roughly flat prior to now decade. So, towards huge will increase in US public debt yearly, the share of overseas central banks proudly owning that debt is steadily reducing. This dynamic might result in a funding disaster within the US, additional eroding the greenback’s enchantment as a reserve foreign money.

*It’s unknown how the IMF precisely calculates its world collection, however I believe they don’t embody gold owned by sovereign wealth funds. My figures embody about 100 tonnes for such funds.

Loading…