Lemon_tm

An Interview with Sam Peters, CFA

Key Takeaways

- This new market cycle of upper rates of interest and larger fiscal spending is unequivocally good for worth however is being largely ignored as a result of concentrate on AI and an financial tender touchdown.

- We consider the market’s consideration on massive progress shares has created a pretty worth menu, notably in power, insurance coverage and IT {hardware} producers.

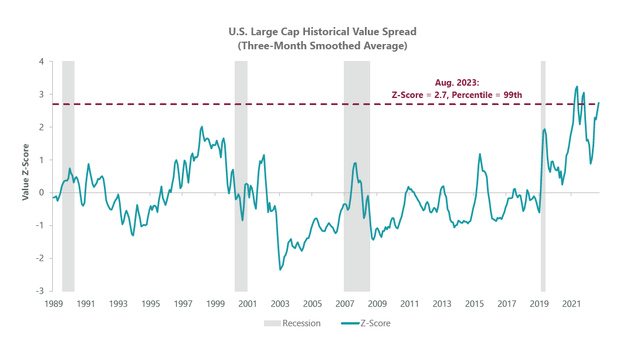

- The relative worth of worth versus progress is again to all-time highs, suggesting worth shares could have an edge over the cycle and make an funding case for a wholesome worth allocation.

After a powerful efficiency by progress within the first half of 2023, larger macro uncertainty and the prospect of a higher-for-longer rate of interest surroundings have shifted investor consideration towards the alternatives in worth shares. We not too long ago sat down with Portfolio Supervisor Sam Peters, CFA, to focus on why he thinks present market situations make a cogent case for long-term worth investing.

Q: Yr so far, the Russell 1000 Development Index has outperformed the Russell 1000 Worth Index considerably. Do you consider the expansion rally is overstretched? And in that case, what would a pullback imply for worth shares?

It’s very regular for progress to have a rebound. Clearly, worth did very nicely final 12 months, and progress not a lot. However then, coming into this 12 months, we had two massive surprises: the regional banking disaster in March and synthetic intelligence [AI], as ChatGPT got here on the scene. The outcome has been an enormous rebound in valuation multiples for progress, with each earnings progress and multiples up about 10%.

The hot button is figuring out what occurs going ahead. Issues have drastically modified from the FAANG cycle, which was an enormous progress driver. The continued rise in rates of interest and an period of free cash, I feel, is totally over. That is unequivocally a superb factor for worth, but it surely’s being utterly ignored by all of the concentrate on AI and the prospect of an financial tender touchdown. The relative worth of worth versus progress is again to all-time highs, suggesting worth could have an edge over the cycle. I feel we’re in a good time to stability out the rebound with a wholesome allocation of worth. There are many alternatives for energetic managers keen to look past the highest of U.S. indexes, and worth is a superb lens to do this with.

Q: The place are you discovering one of the best alternatives in worth shares proper now?

The worth menu proper now could be fairly engaging, and you may get an incredible seat on the desk as a result of all people’s targeted on the highest progress shares in U.S. indexes.

One of many sectors we’re most bullish on is power. Many power firms presently match the invoice, with double-digit free money move yields, and a few even rising above 20%, permitting you to get your capital again in about three or 4 years. We’ve additionally seen unbelievable capital self-discipline within the sector specializing in bettering free money move. This provides us a free choice on the structural underinvestment in power, together with increased costs. Many of those shares then have the best dividend yields and buyback yields out there, leading to returns on capital which can be the second highest after tech. After two years of main market returns, power’s taken a break this 12 months, however at the same time as the worth per barrel dipped down into the $70s, free money move and returns have been nonetheless very wholesome. So, the basics are there, and even when one or two extra issues enhance, we predict the sector can do even higher.

Insurance coverage shares are additionally massive for us. We presently see them following the identical sample by means of rising pricing energy on account of a scarcity of insurance coverage capital and eradicating dangers out of their enterprise fashions, main to higher returns and constructive pricing. Moreover, regardless of a loopy macro surroundings, we’re seeing alternatives within the dynamic random-access reminiscence cycle, which is expounded to each AI in addition to shopper items.

Q: You’ve got not too long ago mentioned how tech transitions are traditionally unsteady. May you elaborate on what you imply by that?

AI goes to be massively transformative over time. We noticed this with the Web again in 2000, which has been an even bigger deal than anybody thought, however nonetheless took about 10 years to succeed in maturity. And, whereas the long-term winners like Amazon (AMZN) emerged in an enormous style, there have been additionally a number of extinctions, a whole lot of Pets.com alongside the best way.

One instance of the challenges we’re seeing is provide chain points. To start out, you’ll be able to’t get sufficient superior processors, however I’ve additionally heard firms struggling to get the expert labor and having to seek out methods to handle elevated power demand. So, there’s a number of bottlenecks. In different areas, we’re going to overbuild. We’ve additionally gotten used to digital disrupting analog, the best way Amazon pushed out retailers like Sears. This time, massive tech shall be looking one another, and there’s going to be these new, AI pure-play entrants, which can problem the legacy tech gamers the place all of the capital goes.

The difficulty I’ve is that hype cycles are nonetheless cycles; they’re not linear they usually nonetheless take time to culminate. I feel there shall be large alternatives as soon as the hype cools and we see the precise impacts of AI.

Q: Let’s return to the worth of worth being at historic highs relative to progress. May you elaborate? Why is there a compelling case for investing in worth proper now?

All through my profession, I’ve seen the market rotate between progress and worth, in cycles sometimes lasting 10 to fifteen years. The hot button is that the winners of the brand new cycle, regardless of whether or not they’re progress or worth, all start extremely low cost. So, the best way we measure that is: how are worth shares valued relative to progress? Earlier than the FAANG cycle, progress shares have been at all-time report lows relative to worth. Nonetheless, that reversed itself and, throughout COVID, worth received to the most affordable it had ever been. A few of that received labored off final 12 months however, with progress roaring again this 12 months, we’re again to close the all-time highs in worth of worth. So, I think that we’re arrange for a really massive worth cycle.

Exhibit 1: The Worth of Worth Returns to Historic Highs

As of August 31, 2023. Supply: ClearBridge Investments, FactSet Analysis Programs

Sam Peters, CFA is a Portfolio Supervisor and co-manages the Worth Fairness Technique and the All Cap Worth Technique, and has over 30 years of funding expertise. Sam earned a BA in economics from the Faculty of William & Mary and an MBA from the College of Chicago. He acquired the CFA designation in 1997.