Authored by Lance Roberts via RealInvestmentAdvice.com,

As soon as once more, as a result of ongoing lack of fiscal duty in Washington, the markets and the economic system confronted a Authorities shutdown. After a day of theatrics, Congress handed a “stopgap” measure that can hold the Authorities working for 45 days. However is {that a} good factor?

Initially, whereas a lot media hyperbole surrounds Authorities shutdowns, very like the debt ceiling, there’s a lengthy historical past of shutdowns going again to the 70s. As Katherine Buchholz of Statista lately penned:

“The 2018/19 Authorities shutdown was the longest in latest U.S. historical past at 34 days. A timeline exhibits that authorities shutdowns have been getting longer within the final three a long time, with the second and the fourth-longest Authorities shutdowns going down in 1995 and 2013, respectively. All through the Eighties, shutdowns have been quite a few however shorter, whereas within the Nineteen Seventies, additionally they ran considerably longer however solely surpassed two weeks as soon as, in 1978. Authorities shutdowns aren’t all that uncommon: Since 1976, there have been 20 shutdowns that lasted a mean of 8 days.“

Whereas the newest measure gives funding, we are going to doubtless take care of this once more in mid-November. What’s notable, nevertheless, is that the Authorities has stopped functioning usually since 2008. Earlier than the Obama administration, the Authorities operated on an annual fiscal price range. The Home of Representatives would put collectively a price range for spending, the Senate would make its modifications, after which it will return to the Home for reconciliation. As soon as full, it will transfer to the President for signature. Funding would then be allotted accordingly.

Compound Spending

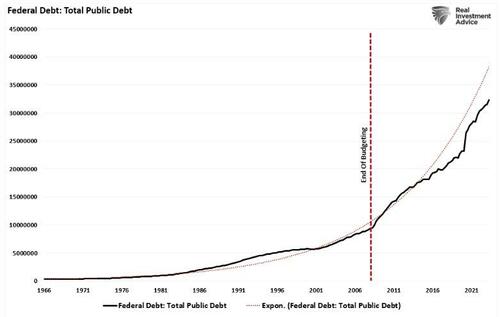

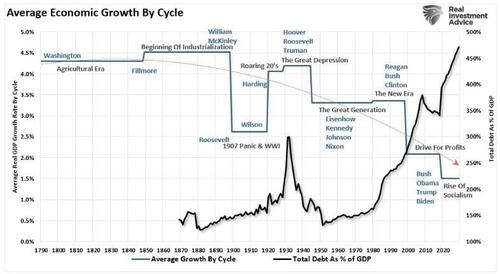

Nevertheless, since 2008, the Authorities has continued to function with out a price range. Slightly than passing a price range annually, a “Persevering with Decision” is handed to fund spending. The issue with utilizing “Persevering with Resolutions” is that it makes use of the earlier spending ranges and will increase that spending by 8%. Such is why, since 2008, the debt has exploded as spending is compounding yearly.

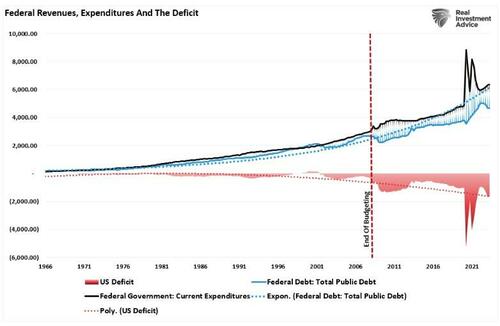

In fact, given the large surge in spending, revenues can’t sustain the tempo, resulting in a fast improve in debt issuance and a trending deficit.

It’s price noting that earlier than 2008, revenues have been larger than the operating development pattern of public debt. Nevertheless, post-2008, such has not been the case. Subsequently, the expansion within the deficit continues to speed up.

Nevertheless, does this imply a calamity is at hand with the Authorities now shut down?

A Momentary Delay Doesn’t Remedy The Downside

Whereas the media and Authorities officers will declare victory over avoiding a Authorities shutdown, is it a victory? Washington, D.C., has an extended historical past of “kicking the can” to keep away from doing its “job” of governing. That job generally contains making unpopular selections that trigger short-term ache for a more healthy economic system within the years forward.

Slightly than taking the straightforward path, it’s important to grasp what happens throughout a Authorities shutdown. Sure, roughly 900,000 “non-essential” staff will probably be furloughed. Whereas their salaries will accrue in the course of the furlough, the dearth of revenue will affect financial development. That affect could be comparatively minor, and based mostly on previous shutdowns, Goldman Sachs estimated a discount of annualized development by round 0.2% for every week it lasted after accounting for modest private-sector results.

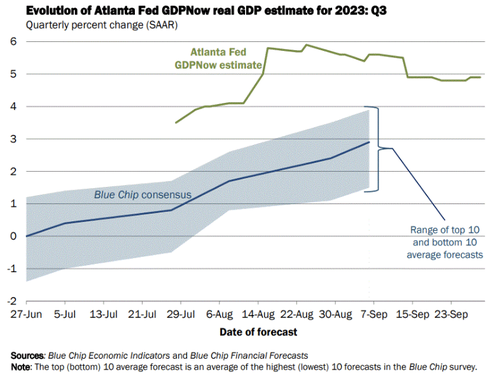

Provided that the longest shutdown lasted 35 days, as proven above, you possibly can estimate the affect on financial development might be roughly as a lot as 1%. Sure, that’s actually regarding, however with financial development operating close to 5% in keeping with the newest Atlanta Fed GDPNow, such just isn’t a recessionary concern.

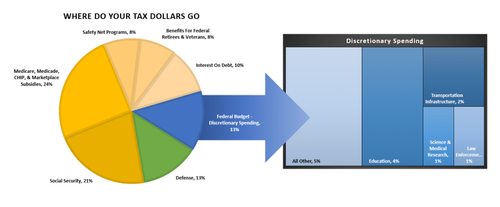

Shutdowns Are About Discretionary Spending

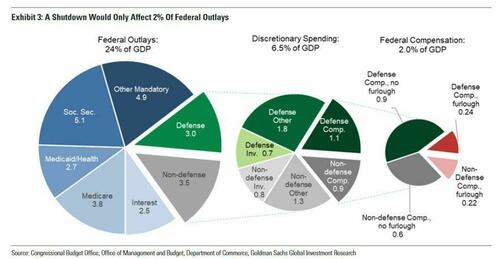

What’s important to grasp about Authorities shutdowns is that obligatory spending (social safety, welfare, curiosity on the debt) continues as wanted. Shutdowns are primarily about discretionary spending. Such is why it primarily includes Authorities employment and the shuttering of nationwide parks and monuments. In keeping with Goldman Sachs, the shutdown would have solely impacted about 2% of Federal spending total. Discover that the overwhelming majority of Authorities spending is straight a operate of the social welfare system and curiosity on the debt.

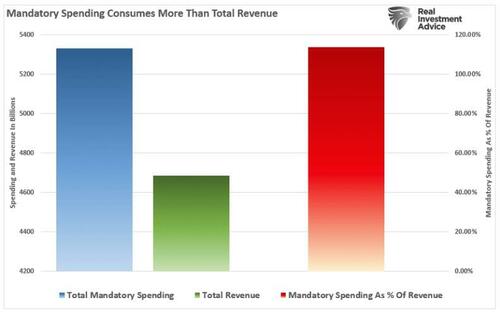

The above chart exhibits spending as a % of GDP. Nevertheless, utilizing the 2023 information from the Middle On Price range Coverage, we will higher perceive why we’ve got an issue with our welfare system.

As of the newest annual information, via the tip of Q2-2023, the Authorities spent $6.3 Trillion, of which $5.3 Trillion went to obligatory bills. In different phrases, it at the moment requires 113% of each $1 of income to pay for social welfare and curiosity on the debt. Every little thing else should come from debt issuance.

Whereas a Authorities shutdown would undoubtedly create a minor detrimental affect on financial development, perhaps such could be a suitable value to return the Authorities to some type of fiscal duty.

What A Shutdown Would Imply For The Markets?

However what affect would a shutdown have on the monetary markets?

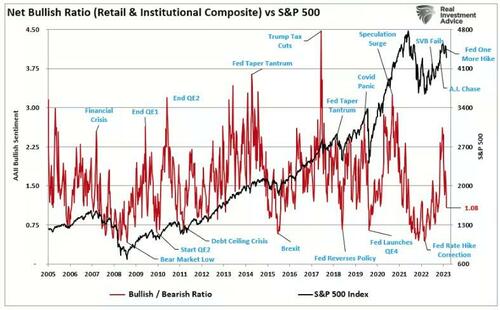

This previous weekend’s publication mentioned why the recent summer weakness laid the groundwork for a possible year-end rally. To wit:

“As a contrarian investor, excesses get constructed when everyone seems to be on the identical aspect of the commerce. With that mentioned, everyone seems to be so bearish the markets might reply in a way nobody expects. The chart beneath exhibits the comparatively sharp decline from the extra exuberant bullish sentiment we noticed in June and July. Traditionally, when the mixed readings of retail {and professional} sentiment reached present ranges, such fashioned the premise for a reflexive rally.“

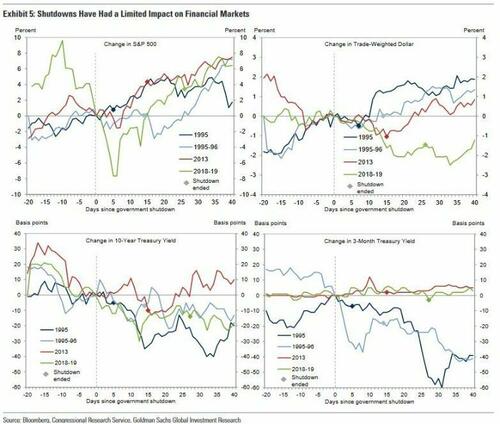

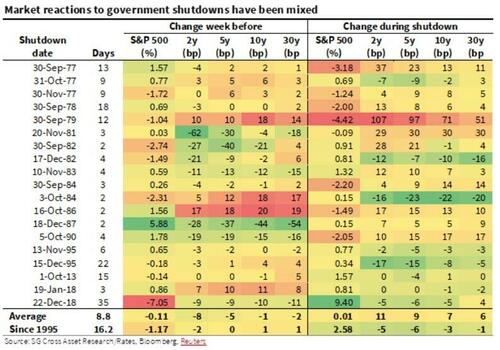

A Authorities shutdown would undoubtedly affect the monetary markets as traders stay skittish about committing capital into an unsure surroundings. Nevertheless, as famous by Zerohedge lately:

“What’s extra, market reactions to authorities shutdowns have turn out to be more and more muted on condition that regardless of the excessive odds of a shutdown, funding sometimes arrives on the eleventh hour by way of a ‘persevering with decision’ to supply non permanent funding at the beginning of the Oct. 1 fiscal 12 months, which finally interprets to longer-term spending payments. A failure to do both results in a shutdown – which appears doubtless at this level.”

As proven within the desk beneath, since 1995, markets are inclined to wobble heading into and in the course of the Authorities shutdown however are inclined to submit optimistic returns total.

Whereas the mainstream media’s hyperbole about Authorities shutdowns is undoubtedly regarding, the fact is that they’ve little affect on each the economic system and the monetary markets.

The fiscal irresponsibility in Washington, D.C., which continues to erode financial development, prosperity, and a stronger center class, needs to be of extra concern.

As we concluded in “Debts, Deficits, and Why $32 Trillion Matters,”

“{The debt] is likely one of the major the reason why financial development will proceed to run at decrease ranges. Adjustments in structural employment, demographics, and deflationary pressures derived from adjustments in productiveness will enlarge these issues.“

Like a forest hearth cleanses and fertilizes the soil, making the forest more healthy, perhaps a Authorities shutdown that returns some fiscal duty to Washington may be factor.

Loading…