In a exceptional reversal, Bitcoin broke free from its historic September slumber, marking its first constructive efficiency for the month since 2016. This achievement occurred within the face of considerable resistance from the U.S. Securities and Alternate Fee (SEC) relating to Bitcoin spot exchange-traded fund (ETF) purposes.

Beginning the month at roughly $25,800, Bitcoin surged by nearly 4%, reaching practically $27,000 on the time of writing.

Bitcoin’s Rally Regardless of SEC Scrutiny

Regardless of the SEC’s repeated postponement of a number of BTC spot ETF purposes, the flagship cryptocurrency ascended.

Up to now month, the regulatory physique delayed choices on over seven purposes, even in gentle of latest efforts to expedite the approval course of.

As per Coinglass information, this worth surge marks Bitcoin’s fourth constructive September since 2013 and its first since 2016. Curiously, BeInCrypto reported on two crypto analysts who had did not predict its worth motion appropriately.

However, it’s essential to notice that regardless of this robust September, Bitcoin suffered its first quarterly lack of the yr, shedding roughly 12% of its worth over the previous three months.

Anticipating an “Uptomber”

Wanting forward, buyers are cautiously optimistic a couple of bullish October for Bitcoin. Traditionally, the cryptocurrency has carried out effectively throughout this month.

For context, regardless of a big market downturn final October that led to the collapse of a number of crypto-related corporations, together with FTX and Celsius, Bitcoin nonetheless managed to file a 5.56% achieve.

Crypto analyst Tedtalksmacro defined this robust October efficiency as “a interval of constructive seasonality.” He stated, “On common over the previous three years, October has been Bitcoin’s best-performing month, and this constructive seasonality sometimes extends into Q1 of the next yr.”

Nonetheless, the analyst warned that:

“Previous to 2022, BTC had by no means existed in a world with charges a lot larger than 2%… whereas now in late-2023, the Federal Funds price is above 5% and can doubtless stay there for for much longer whereas central banks of the world attempt to maintain the lid on inflation.”

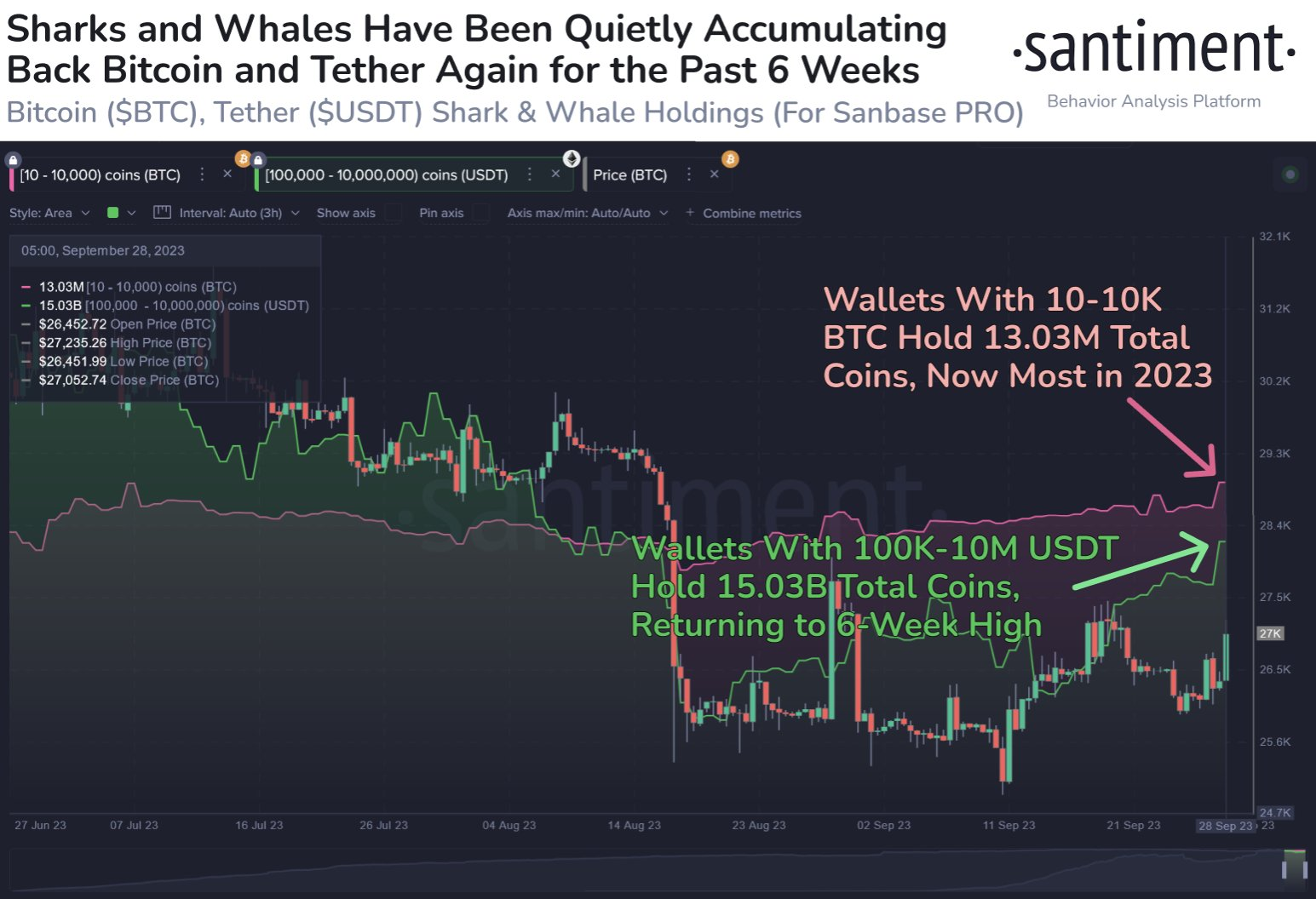

In the meantime, outstanding blockchain analytics agency Santiment identified that Bitcoin’s long-term prospects look promising. That is supported by the truth that whales have been accumulating Bitcoin alongside Tether’s USDT for the previous six weeks.

Based on the agency, this accumulation signifies shopping for energy and suggests the rally may persist into October.

Whereas expectations for October are excessive, it’s vital to keep in mind that the SEC’s choice relating to any of the spot-ETF purposes may doubtlessly affect Bitcoin’s worth conduct.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices based mostly on this content material.