Sundry Pictures/iStock Editorial by way of Getty Photographs

Introduction

It is fall. Soccer season has began. Baseball playoffs are about to start out, and the beginning of the NBA common season is only one month away.

One may say it is the perfect time of the 12 months!

What higher strategy to begin an article protecting one in all America’s go-to locations for sports activities gear?

DICK’S Sporting Items (NYSE:DKS) is a 3.6% yielding retail big catering to all kinds of sports activities gear wants. The corporate has persistently outperformed the S&P 500 and adopted a coverage of persistently rising dividends, buybacks, and particular dividends which have paid off handsomely.

On this article, we’ll focus on all of that, along with the difficult macroeconomic surroundings and the corporate’s mildly unfavorable volatility profile, which requires the power to considerably time one’s entry.

So, with out additional ado, let’s get to it!

About DICK’S And Its Dividend

Typically talking, I am not an enormous fan of the buyer cyclical business. Whereas it’s dwelling to some incredible corporations, it is aggressive, liable to (on-line) disruptions, and risky client sentiment.

I personal only one client inventory, which is House Depot (HD). One of many the explanation why I personal it’s its huge moat in a aggressive business and the truth that it has grow to be a go-to place for issues that individuals normally don’t purchase on-line. It additionally has methods to order on-line and decide it up on the retailer.

DICK’S is totally different but related. Though individuals purchase sneakers and associated gear on-line, most individuals want to check issues earlier than shopping for – particularly when making higher-ticker purchases. In-store experience is essential.

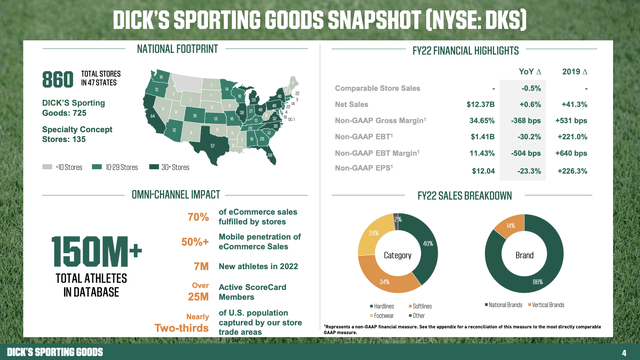

Based simply three years after the Second World Struggle, DICK’S has grown into a large with roughly 860 shops in 47 states.

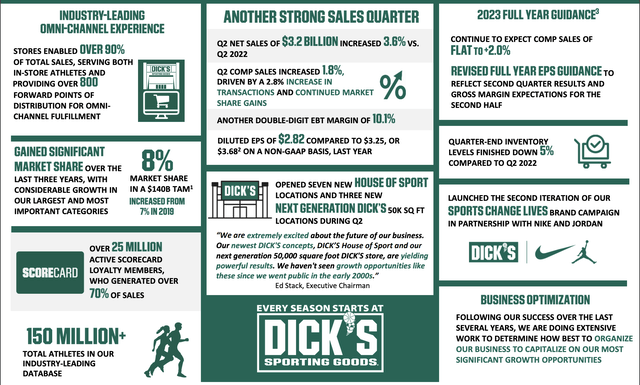

DICK’S Sporting Items

Paraphrasing the corporate’s 10-Okay, DICK’S has formulated a complete enterprise technique that facilities round its core perception within the transformative energy of sports activities in individuals’s lives.

This perception fuels their drive to supply an unparalleled athlete expertise, partaking model interactions, a various product vary, and, most significantly, a devoted staff of staff known as teammates.

In different phrases, the corporate has clearly realized that brick-and-mortar shops have powerful competitors from on-line shops. Thriving means excelling at providing nice service.

That is primarily based on various pillars, together with those under.

- Optimizing Assortment: DKS is providing a broad vary of merchandise inside every class, catering to totally different athlete segments and selling each nationwide and proprietary manufacturers to diversify the product portfolio.

- Omni-channel Platform and Achievement: To make sure a seamless expertise throughout retail shops and on-line platforms, the corporate is leveraging its intensive retailer community for environment friendly distribution and success.

- Merchandising: The bottom line is specializing in the correct mix of hardlines, attire, and footwear to drive gross sales and adapt the product assortment to altering market dynamics.

Thus far, this has been a extremely environment friendly technique, permitting the corporate to develop its market share from 7% in 2019 to eight% in 2022. 1% might not sound like a lot, but it surely undoubtedly is, on condition that the entire addressable market is $140 billion.

DICK’S Sporting Items

Along with that, the corporate is dedicated to returning capital to shareholders.

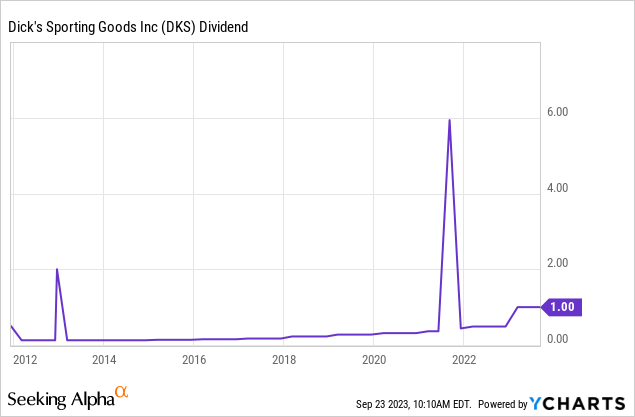

The corporate at present pays a $1.00 per share per quarter dividend. This interprets to a yield of three.6%.

The dividend is protected by a 25% internet earnings payout ratio.

Over the previous 5 years, the common annual dividend progress charge was 33%, primarily boosted by a 105.1% hike introduced on March 7.

Because the chart above reveals, the corporate additionally pays particular dividends.

In 2021, the corporate paid a particular dividend of $5.50 per share.

The dividend can also be protected by a wholesome stability sheet. Analysts count on DKS to finish this 12 months with $480 million in internet money, which suggests the corporate may have $480 million extra in money than gross debt.

This 12 months, the corporate is anticipated to generate $560 million in free money stream, which interprets to an implied free money stream yield of 6.0%. This quantity protects its 3.6% dividend. Subsequent 12 months, free money stream is anticipated to rise to $910 million, which might suggest a 9.7% free money stream yield.

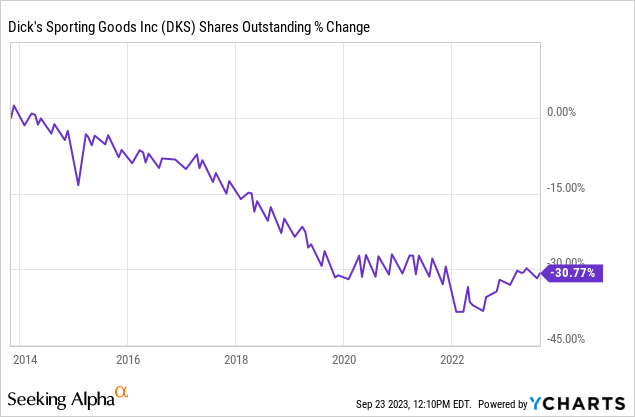

Moreover, over the previous ten years, the corporate has purchased again greater than 30% of its shares.

Having stated that, let’s dive into the corporate’s numbers, because it’s in a really difficult spot, given the disagreeable headwinds consisting of elevated inflation and weakening financial progress.

DICK’S Stays Robust

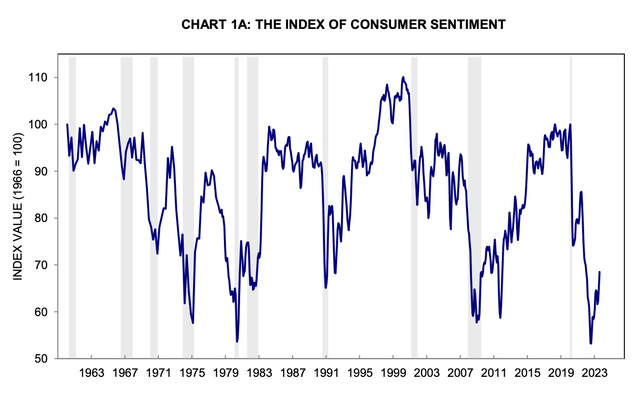

Though client confidence has rebounded, it stays at extraordinarily subdued ranges.

College of Michigan

Even worse is that oil costs have rebounded, pushing inflation up for 2 straight months. That is prone to preserve a lid on client confidence.

The excellent news is that DICK’S has been doing fairly nicely up to now.

Within the second quarter, complete gross sales noticed a notable 3.6% enhance, reaching $3.22 billion. The important thing driver behind this surge was a 1.8% rise in comparable gross sales, propelled by sturdy transaction progress of two.8%. The common ticket worth was down 1%.

Based on the corporate, this surge in gross sales and transactions reveals a rising reliance on DICK’S Sporting Items amongst athletes nationwide.

Notably, inside the quarter, gross sales demonstrated a major acceleration in July, coinciding with the beginning of the back-to-school season and the inauguration of the newest Home of Sport location.

DICK’S Sporting Items

Particularly the footwear and staff sports activities classes stood out by way of efficiency.

Sadly, regardless of the general gross sales enhance, gross revenue for the quarter got here in at $1.11 billion, representing 34.42% of internet gross sales, which is a decline of 161 foundation factors in comparison with the earlier 12 months.

This lower was primarily as a consequence of a drop in merchandise margin by 254 foundation factors.

Based on the corporate, actions have been taken to handle extra merchandise, particularly within the outside class, aiming to take care of optimum stock ranges.

Nevertheless, the corporate confronted challenges as a consequence of higher-than-expected shrink, accounting for a notable portion of the merchandise margin decline. This was partly offset by decrease provide chain prices.

Shrink means persons are stealing stuff. That is getting out of hand currently and doing a quantity on the profitability of many corporations.

After they reported second-quarter outcomes, some corporations like Goal and Dick’s Sporting Items supplied clues into how a lot shrink is costing them and squarely blamed theft. Goal misplaced about $219.5 million extra to shrink in the course of the three months ended July 29 than it did in the course of the year-ago interval. Dick’s misplaced about $27.1 million throughout the identical three months, in keeping with a CNBC evaluation.

In the meantime, Ulta and Foot Locker, which each blamed “organized retail crime” for losses in Could, didn’t point out theft throughout their most up-to-date outcomes. They solely used the time period “shrink” when discussing the way it squeezed margins.

Lowe’s has a number of the highest shrink numbers among the many corporations analyzed by CNBC. It has blamed a spread of things for the losses. Generally it has stated organized retail crime lower into income, however in different instances, it blamed weather-related damages. – CNBC

Regardless of these points, DICK’S reaffirmed its expectations for comparable retailer gross sales to be within the vary of flat to plus 2%.

Moreover, administration commented on macroeconomic uncertainties, together with the resumption of scholar mortgage repayments, that are integrated in its outlook.

For the complete 12 months, the corporate anticipates roughly 250 foundation factors of non-comp gross sales progress, together with the 53rd week.

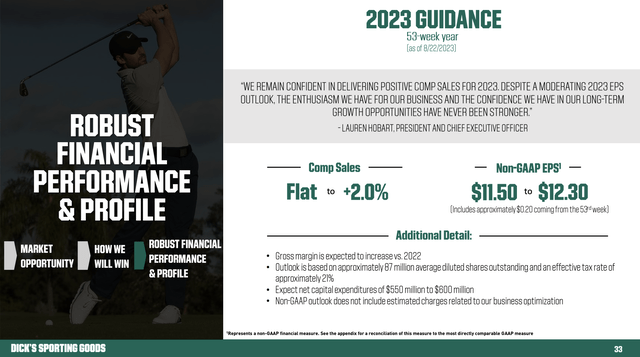

After adjusting its outlook primarily based on the 2Q23 efficiency and gross margin projections, the corporate now expects non-GAAP earnings per diluted share to be within the vary of $11.50 to $12.30. This consists of expectations of bettering gross margins, though impacted by increased shrink affecting the full-year gross margins.

DICK’S Sporting Items

With that stated, there’s one other factor I need to deliver up, which is said to the cyclical nature of the business DICK’S serves.

Unfavorable Volatility & Valuation

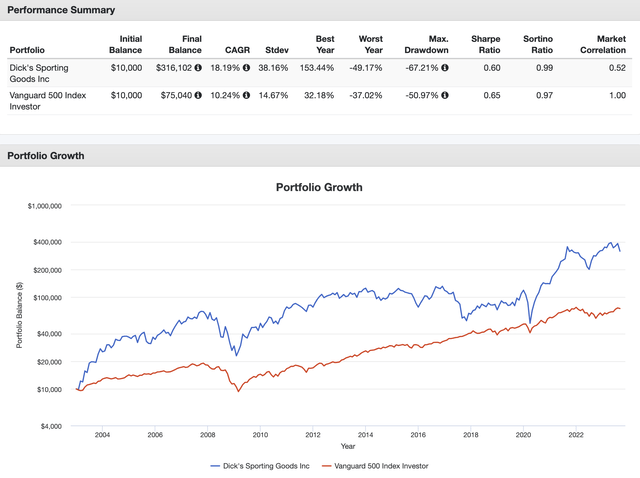

Since December 31, 2002, DKS shares have returned 18.2% per 12 months, turning a $10,000 funding into $316,102. This beat the S&P 500 by virtually 800 foundation factors per 12 months.

The issue is that these returns aren’t very in keeping with elevated volatility. The usual deviation of DKS is 38%, which is nicely above the 14.7% customary deviation of the S&P 500. Most returns got here from the 2002-2008, 2009-2012, and 2020-2023 durations.

Portfolio Visualizer

Over the previous ten years, DKS shares have returned 12.3% per 12 months. The S&P 500 has been compounded at 12.7% per 12 months throughout this era.

This is not a horrible end result. Nevertheless, DKS is a inventory I’d solely purchase on extreme weak point.

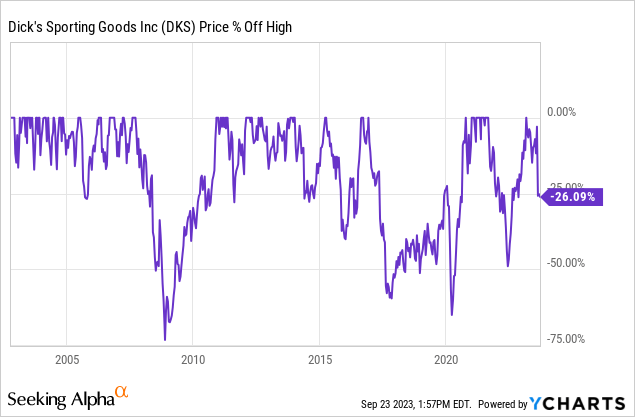

Traditionally talking, DKS traders have been by way of quite a bit. This additionally explains why its long-term customary deviation is elevated.

Presently, DKS shares are 26% under their all-time excessive.

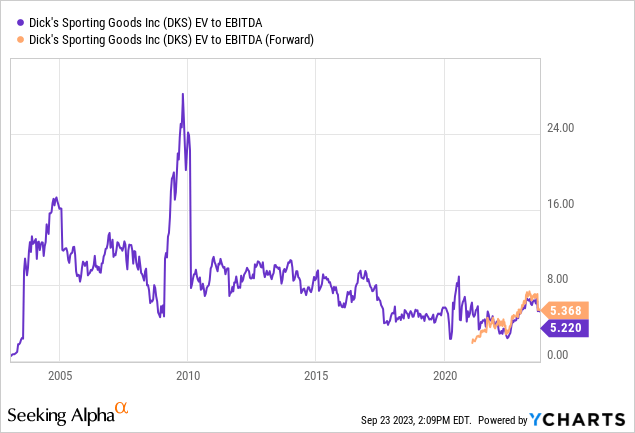

Shares are buying and selling at 5.4x ahead EBITDA. That is neither undervalued nor overvalued. It is a bit in no man’s land.

The present consensus worth goal is $133, which is 20% above the present worth.

If we have been in a regular financial surroundings of easing inflation and sturdy unemployment, I’d make the case that DKS shares are a purchase.

Nevertheless, as a result of I consider that inflation is prone to stay sticky, I can’t make the case that DKS is a purchase. I’ll give the inventory a Maintain score, as I’m not very upbeat concerning the client.

Evidently, please be happy to disagree with me within the remark part!

As a lot as I like how nicely DKS is managing its enterprise in a really powerful surroundings, I should see extra inventory worth weak point earlier than shifting to a purchase score.

Takeaway

DICK’S stands as a powerful participant within the sports activities gear retail sector, providing a singular mix of in-store experience and a various product vary.

Its dedication to returning capital to shareholders by way of persistently rising dividends, buybacks, and particular dividends has considerably contributed to a excessive long-term complete return.

Nevertheless, whereas DKS has navigated difficult macroeconomic circumstances nicely and maintains a constructive outlook, its business’s cyclicality and elevated volatility warrant warning.

The inventory’s historic efficiency has proven durations of great progress but in addition volatility.

As an investor, I respect DKS’s resilience and strategic strategy however stay watchful as a consequence of uncertainties within the present financial panorama, notably relating to inflation.