Mohammed Haneefa Nizamudeen

I used to personal Mirum Prescribed drugs (MIRM) however let go after its first approval. I lined it final in Might 2022. Mirum has two medicine, maralixibat (LIVMARLI) and volixibat, focusing on a set of uncommon liver illnesses involving cholestasis, or the blockage of bile. This causes pruritus and liver injury, and the method is catalyzed by an enzyme, which these two molecules inhibit. The distinction between the 2 – maralixibat is broad spectrum whereas volixibat is selective.

The corporate’s lead program was maralixibat in Alagille syndrome (ALGS), an ultra-rare illness with a market potential of $300mn. The corporate did properly in its trials, and it was accepted in September 2021. I famous how the corporate had a busy knowledge drop schedule from a number of applications all through 2022 and 2023; the label expansions would account for a 20x growth within the goal market.

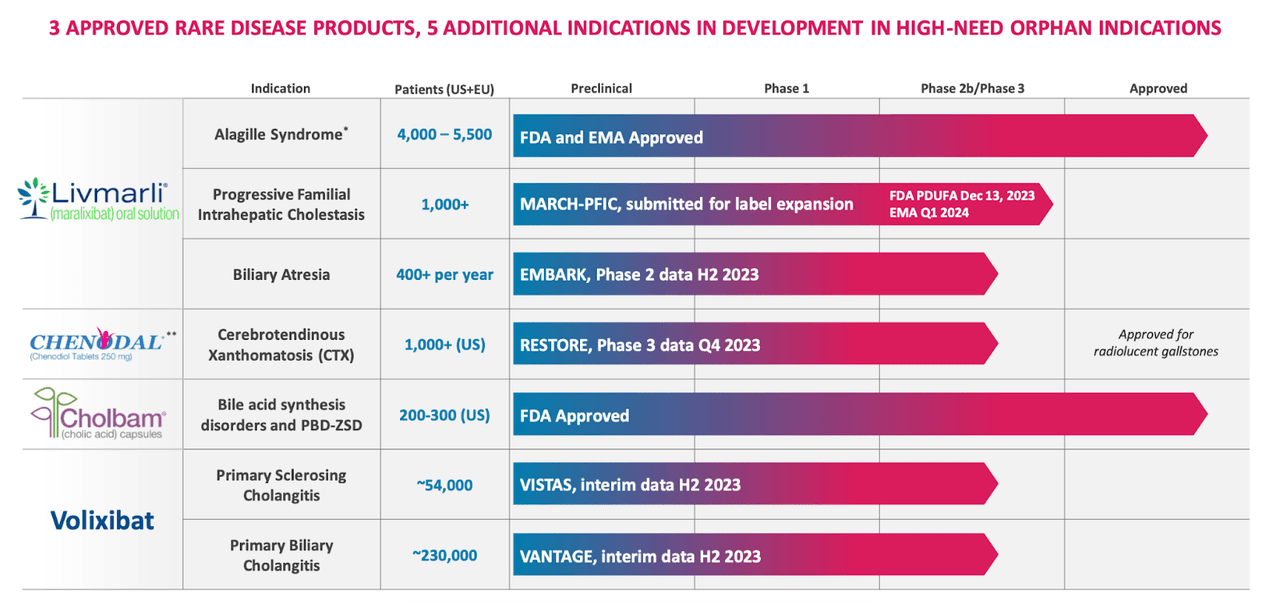

The corporate’s present pipeline appears like this:

MIRM Pipeline (MIRM web site)

That is a reasonably spectacular pipeline, though there’s a little bit of invoice padding, within the sense that the primary income generator right here remains to be LIVMARLI. Its subsequent indication is PFIC, the place it produced optimistic part 3 knowledge.

PFIC is a uncommon, progressive illness characterised by bile acid buildup which causes pruritus and liver injury, the place 80% of sufferers want a liver transplant to outlive by the point they’re 18.

In part 3 knowledge in a broad spectrum of sufferers with PFIC, i.e. All-PFIC Sufferers (PFIC1, PFIC2, PFIC3, PFIC4, PFIC6), maralixibat exhibits robust optimistic knowledge. Within the main endpoint of proportion of pruritus rating assessments ≤ 1 level, 62% of maralixibat sufferers confirmed an enchancment versus simply 28% placebo (p<0.0001) sufferers. Serum bile acid enhancements additionally confirmed a robust optimistic correlation with transplant-free survival, which is the final word purposeful measure of enchancment for PFIC sufferers. The security profile was reasonable and similar to placebo. Total, this was a profitable trial. PDUFA is on December 13, 2023.

Different applications in numerous levels of growth. Chenodal has a part 3 trial working in CTX, the place it has seen optimistic knowledge in earlier trials. The corporate acquired chenodal and cholbam from Travere Therapeutics in July this yr for $210 million upfront and $235 million in potential milestones., which, together with its present liver illness applications, makes Mirum a correct liver illness franchise. These two medicines are prescribed by the identical people who prescribe LIVMARLI, so there’s that advertising and marketing synergy.

Moreover these, Maralixibat will publish knowledge from a part 2b trial in Biliary Atresia in H2 2023. Vorolixibat has part 2b research working in two varieties of Grownup Cholestasis and can produce interim analyses from each in H2. Earlier, in a strategic acquisition, Mirum acquired Satiogen, which held rights to each its liver molecules. This diminished their royalty obligations significantly.

In June, the FDA expanded Ipsen’s Bylvay drug’s label to ALGS; nonetheless, it’s accepted for sufferers 12 months or older. Since ALGS has an onset in kids under 12 months in lots of instances, the influence is probably not a lot. Even so, given the small market measurement of ALGS, the brand new approval took MIRM inventory down.

Financials

MIRM has a market cap of $1.2bn and a money stability of $330mn. The corporate had $37.5 million whole income, together with web product gross sales for LIVMARLI of $32.5 million, for second quarter 2023. The corporate lately closed an upsized providing of $316.3 million combination principal quantity of 4.00% convertible senior notes due 2029. R&D bills had been $22mn and G&A bills had been $32mn. At that fee, and considering their income, the corporate has a runway of 5-6 quarters in any case.

Most of MIRM inventory is held within the arms of establishments. Key holders are Frazier, Eventide, and Biotech Worth Fund. Retail holders have little or no possession right here. Insiders have an honest mixture of buy-and-sell transactions.

Bottomline

MIRM is a key development inventory of the sector, quick rising as an all-rounder pediatric liver illness specialist. Its accepted indications aren’t heavy hitters, however MIRM’s plan has all the time been to get its molecules accepted in uncommon indications as proof of idea applications, after which develop them into illnesses with bigger markets. That is stable strategizing and has labored properly for MIRM to this point. Due to this fact, I count on this firm to be a stable grower over time until a key program fails. Thus, this can be a long-term, buy-the-dip and accumulate inventory, and whereas I performed it earlier than its first approval, having first bought it within the early days of the pandemic, I may get again in once more with a small pilot place.

Concerning the TPT service

Thanks for studying. On the Complete Pharma Tracker, we provide the next:-

Our Android app and web site contains a set of instruments for DIY buyers, together with a work-in-progress software program the place you possibly can enter any ticker and get in depth curated analysis materials.

For buyers requiring hands-on assist, our in-house specialists undergo our instruments and discover the perfect investible shares, full with purchase/promote methods and alerts.

Join now for our free trial, request entry to our instruments, and discover out, for gratis to you, what we will do for you.