Regardless of short-term market weak point, we stay optimistic as long-term traders

MinoruM/DigitalVision by way of Getty Photos

Brian Gown, CFA — Director of Analysis, Funding Advisor

Is anybody else bored with speaking in regards to the Federal Reserve?

After studying again final month’s publication, it looks as if we might be singing a well-known tune for you once more this week. Market contributors proceed to be involved in regards to the Fed and rates of interest; it appears to the exclusion of just about the rest taking place out there. In fact, on this month’s publication, we are going to deal with the happenings on the newest Federal Reserve assembly. However as we’ve got tried to do over the previous couple years, we need to make certain we preserve our give attention to what actually issues, the underlying companies that comprise the inventory market – a market of shares.

As we referenced in final month’s Amidst Rising Charges, Do not Neglect About Development!, the detrimental relationship between rates of interest and inventory costs stays extraordinarily robust. As we’ve got seen the 10-year US Treasury price proceed to rise, now close to to 4.50%, shares have persistently been weak for the primary three weeks of September. Because the begin of September, the S&P 500 has misplaced roughly 4% in worth, with the tech-heavy NASDAQ down practically 6% (tech shares reply extra dramatically than the general market to larger charges). This comes because the ten-year price rose from 4.09% to 4.44% as we speak.

We converse with traders each day and we all know that this could be a irritating phenomenon. After a robust first half of the 12 months, sentiment feels actually detrimental once more amongst traders. Imagine me, we will perceive the exhaustion with all of the Fed watching, we lament it repeatedly right here within the workplace!

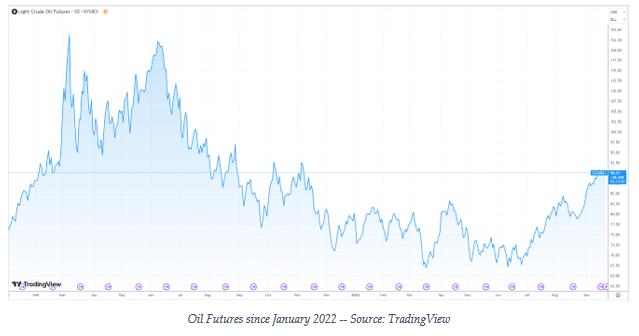

One sector of the market does look like discovering its footing but once more – vitality. Buyers piled into vitality shares in the course of the market turmoil of 2022, solely to rotate out within the first half of 2023, towards growth-oriented securities. Power is robust once more, with oil costs now again above $90 per barrel. In as we speak’s letter, we are going to focus on our ideas on vitality and one explicit sub-sector therein the place we expect there may be nonetheless alternative for progress.

Are you able to bear in mind the final time we acquired an earnings report? It’s been fairly a while since we’ve heard straight from CEOs and CFOs in regards to the well being of their particular person firms. We predict it’s no coincidence that shares have drifted decrease for the reason that final earnings season. Right here we discover that phenomenon and in the end urge endurance for traders. Within the short-term, macroeconomic components like rates of interest appear to be directing markets. We anticipate fundamentals finally to win out. On this part, we are going to point out a few healthcare shares which have already been by way of the wringer and have began to come back out the opposite facet, a bit below the radar.

Lastly, we are going to focus on some potential catalysts to reverse the detrimental emotions now plaguing the market. With this in thoughts, we think about a key attribute of a profitable long-term investor – endurance. In an funding journey spanning many a long time, having the endurance to hold in throughout quick and short-term durations of volatility is crucial to long-term success. We hope as we speak’s article lets you train endurance in a irritating time!

With that each one being mentioned, let’s get into it!

The Federal Reserve – Not Once more?!?

Essentially the most widely-followed occasion within the markets this previous week was the September Federal Reserve Board assembly, concluding on Wednesday. Chairman Jerome Powell announced that the Fed is leaving charges regular, conserving the in a single day funds price at 5.25-5.5%. Nonetheless, Powell indicated {that a} hike within the November assembly remained a robust risk. However what actually appeared to spook traders was the outlook for rates of interest sooner or later.

Chairman Powell reiterated that he does see regular progress towards the purpose of bringing inflation in keeping with historic averages, however that there nonetheless stays work to be executed. Powell additionally famous that financial progress is in extra of what he had beforehand anticipated. A comparatively robust economic system complicates the Fed’s efforts to manage costs. In our view, the Fed will proceed to speak robust till the final second earlier than they let up on the tightening cycle. The very last thing they need is for market contributors to start to position bets that charges will drop earlier than their meant work to carry down inflation is accomplished – that might defeat the entire objective of the tightening!

Within the Fed’s “dot plot”, Federal Reserve Governors anonymously give their projection for future charges. Beforehand, the dot plot implied a Fed Funds price in 2025 of three.4%. There was a significant shift within the plot on this week’s assembly, as implied possibilities now challenge a Fed Funds price of three.9%. Basically, we’re seeing the Fed telegraph a coverage of “larger for longer”, which dashed the hopes of traders that rates of interest is likely to be lowered considerably in 2024.

Whereas it’s true that some industries will battle in a excessive rate of interest atmosphere – housing and cyclical companies come to thoughts –historical past tells us that robust inventory efficiency is feasible in a comparatively excessive rate of interest atmosphere. We predict as we speak has robust similarities to the mid-Nineteen Nineties: at the moment, the Federal Funds price vacillated between 5-6%, however the Web Revolution 1.0 led to very robust inventory market returns from 1995 to 1999.

Given the primacy of Synthetic Intelligence (AI) and the very actual enterprise makes use of for the rising expertise, we expect drawing an analogy between as we speak and the mid-Nineteen Nineties is sensible. Whereas previous outcomes are not any indication of future returns, we will envision a state of affairs during which shares ship above-average returns within the coming years, regardless of excessive rates of interest. Brief-term thinkers will disagree with me vehemently and that’s simply superb. On this case, we ourselves train endurance and recommend different traders undertake an analogous perspective!

Power – Reemerging with Little Fanfare

The final decade within the vitality enterprise has been a journey! Oil costs spiked within the early 2010s, in the end plateauing and falling sharply in 2014. As oil costs collapsed within the mid-2010s, we noticed a major variety of oil and fuel firms submitting chapter, having horribly overextended themselves to drill for oil in an atmosphere of excessive costs.

Within the early days of the Covid pandemic, oil costs fell so sharply that they really traded to a detrimental worth for 2 days in early 2020. Apparently, we noticed far fewer bankruptcies on this interval, as these left after the previous bust cycle have been the stronger operators. However past that, the trade had discovered its lesson – the plan going ahead could be to take care of self-discipline in capital expenditures, not solely to protect solvency, but additionally to constrain provide. Whether or not implicit or specific, we’re seeing cartel-like conduct right here, not simply from the standard OPEC producers, but additionally from Western-based oil firms.

That each one appears like historic historical past now. In 2022, the Russian invasion of Ukraine despatched oil costs hovering to ranges unseen since 2014 (roughly $125/barrel). With Russian oil/fuel embargoed, world provide now has an underlying constraint, placing upward stress on costs. However curiously, oil costs erased a lot of that progress, closing 2022 within the low $70s. Buyers largely deserted the preferred theme of 2022, vitality, in search of larger returns from tech and different progress sectors.

TradingView

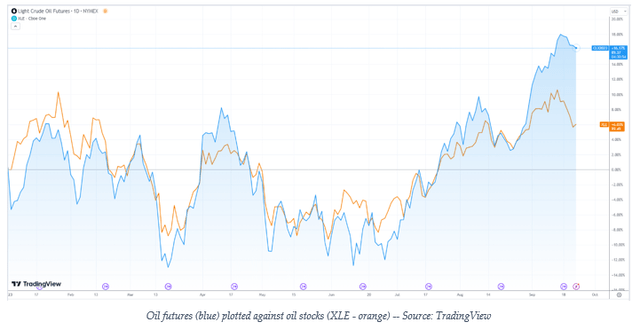

A bit below the radar, we’ve got seen oil costs creep again up roughly 25% over the previous 9 months, just lately eclipsing the $90/barrel mark. Nonetheless, within the year-to-date chart of oil costs plotted in opposition to oil shares, with the Power Choose Sector SPDR Fund (XLE) as a proxy, we see a major lag. We predict this means that there’s nonetheless a very good alternative so as to add publicity to this space with a robust risk of above-market returns over the subsequent 12 months.

TradingView

For these traders in search of a extra particular funding thought right here, we expect it’s price contemplating firms that function within the oil companies area, the forms of which comprise the VanEck Oil Companies ETF (OIH). Since COVID, oil firms, notably within the US, have been tapping already drilled wells that had not but been transformed into oil/fuel on the market. The availability of the so-called Drilled, however Uncompleted (DUC) wells is starting to dwindle. Due to this fact, we expect that main oil firms are more likely to enhance their spending on drilling within the coming years. This implies a possible boon for firms in oil companies. Two that we like notably are Schlumberger (SLB) and Transocean (RIG).

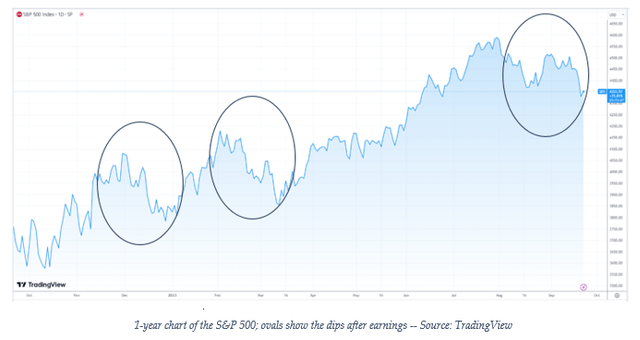

Now It’s a Phenomenon – Weak spot Between Earnings

What was as soon as a curiosity is now a phenomenon. We seen in late 2022 that shares, as a collective, appeared to carry out fairly effectively in the course of the earnings seasons and tended to float decrease in earnings “quiet durations”, when investor focus shifted from usually stable enterprise fundamentals to worries about macroeconomics, particularly rates of interest.

We now have what I think about to be ample proof that that is taking place. Earnings season tends to come back within the 3rd by way of 6th week after quarter shut, so largely we’re talking of the time durations of mid-January to mid-February, mid-April to mid-Might, mid-July to mid-August, and mid-October to mid-November. I believe one of the best ways to inform this story is to inform is visually trying on the 1-year chart of the S&P 500:

TradingView

As we take a look at the 1-year chart, this sample has performed out in three of the final 4 quarters (represented by the ovals). We theorize that in the course of the barrage of earnings releases, traders are seeing general robust outcomes on the microeconomic degree and responding to the excellent news they hear from earnings stories by buying shares. Whereas, on the similar time, traders appear to be shifting their gaze to macroeconomic challenges within the absence of elementary information.

What’s our takeaway from this phenomenon? We preserve optimism in what we’re seeing on the company degree. There are dozens of firms in numerous industries driving earnings and gross sales larger, whether or not it’s in tech, healthcare, industrials, or financials. We predict there may be pessimism straight associated to rate of interest jitters, a narrative we’ve got been telling for a really very long time now, precise enterprise outcomes do appear to be robust.

Lastly, there may be one extra phenomenon I wished to deal with: robust responses to earnings disappointments. Three shares come to thoughts after I consider this: Amgen (AMGN), Cigna (CI), and Alteryx (AYX), although there are a lot of others who’ve exhibited this sample.

Cigna has been certainly one of our favourite healthcare insurance coverage shares over the previous few years. In February, Cigna delivered what we thought was a reasonably robust earnings launch, however the market completely punished the inventory:

TradingView

As you’ll be able to see, the inventory has rebounded neatly since. Typically instances, counterintuitive inventory worth strikes after earnings can represent wonderful alternatives to buy shares we’ve got been following carefully however battle so as to add as a result of inventory costs appear “costly”. We predict that is one thing to observe when earnings season begins once more in a month from now.

What’s the Attainable Catalyst?

In durations of detrimental sentiment, it could possibly really feel to an investor like nothing can change the dynamic. Understandably, the rate of interest concern has hung over traders’ heads like a sword of Damocles, ad infinitum. Charges could proceed to trigger concern for traders over the subsequent 12 months, however we expect there are a selection of occasions on the horizon that would shake up the dynamic and put the bulls again answerable for this market.

The primary, and most blatant, for us is the approaching earnings season. Market leaders like Meta Platforms (META), Alphabet (GOOG, GOOGL), Nvidia (NVDA),amongst others, have delivered robust outcomes for a couple of quarters operating. Markets have rallied strongly after these releases all through 2023. Since there may be appreciable enterprise momentum at among the largest shares which have led the market this 12 months, we anticipate the development to proceed in 3rd quarter earnings, starting subsequent month.

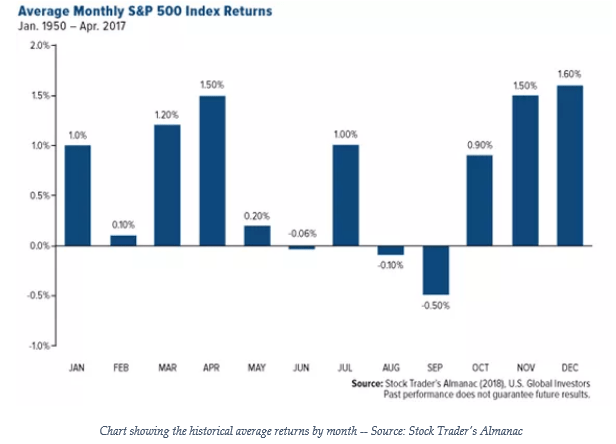

The following catalyst is the so-called “Santa Claus rally”. For no matter cause, November and December have usually been among the strongest months for inventory market efficiency over a protracted historic time-frame. Apparently, August and September are typically among the worst months for inventory market efficiency. If historical past serves as any information, issues may decide up within the 4th quarter.

A mixture of robust fundamentals of some outstanding particular person companies, coupled with the place we stand on the calendar, give us some hope that the present spate of pessimism may finish quickly. Bear in mind, if you’re within the wealth accumulation part, short-term durations of inventory market weak point are in your favor. Shares buying and selling at decrease costs means you should purchase extra shares of a inventory at a lower cost for a similar cash than you’ll have been in a position to do on the larger worth. For long-term traders which are repeatedly investing cash, this era of weak point needs to be seen as a chance!

Inventory Dealer’s Almanac – 2018

Takeaways

That is the second straight month of market weak point, fueled largely by the Fed and investor worries round rates of interest. We’ve got seen progress in slowing inflation over the previous few months, so we proceed to assume that macroeconomic fears are solely short-term.

We’ve got seen one sector beginning to creep larger within the present atmosphere – vitality. Because the motion of vitality shares has lagged the worth of the commodity, we nonetheless assume there may be alternative right here for traders, notably within the oil service phase of the trade.

We now assume we’ve got recognized a sample out there that traders can doubtlessly make the most of – market weak point within the quiet durations between earnings seasons. We’ll watch to see if this continues subsequent quarter, however with enterprise momentum in a wide range of sectors, it definitely may.

It could be tough as an investor in these durations of pessimism, however we proceed to counsel endurance. There are a couple of catalysts on the horizon, together with the subsequent set of earnings and a positive positioning within the calendar. If historical past repeats, we could also be poised for a robust 4th quarter in markets. For long-term traders, decrease costs symbolize a chance to buy shares at a reduction, which is in the end advantageous.

DISCLAIMER: This report incorporates views and opinions which, by their very nature, are topic to uncertainty and contain inherent dangers. Predictions or forecasts, described or implied, could show to be incorrect and are topic to alter with out discover. All expressions of opinion included herein are topic to alter with out discover. Predictions or forecasts described or implied are forward-looking statements based mostly on sure assumptions which can show to be incorrect and/or different occasions which weren’t taken under consideration could happen. Any predictions, forecasts, outlooks, opinions, or assumptions shouldn’t be construed to be indicative of the particular occasions which can happen. Investing includes danger, together with the doable lack of principal. The opinions and knowledge on this report have been obtained from sources believed to be dependable; neither Left Mind nor its associates warrant the accuracy or completeness of such and settle for no legal responsibility for any direct or consequential losses arising from its use. As well as, please observe that Left Mind, together with its principals, workers, brokers, associates, and advisory shoppers, could have positions in a number of of the securities mentioned on this communication. Please observe that Left Mind, together with its principals, workers, brokers, associates, and advisory shoppers could take positions or impact transactions opposite to the views expressed on this communication based mostly upon particular person or agency circumstances. Any choice to impact transactions within the securities mentioned inside this communication needs to be balanced in opposition to the potential battle of curiosity that Left Mind, its principals, workers, brokers, associates, and advisory shoppers has by advantage of its funding in a number of of those securities.

Previous efficiency shouldn’t be indicative of future efficiency. The worth of securities can and can fluctuate, and any particular person safety could develop into nugatory. A excessive or favorable ranking, ranking outlook, gauge, or comparable opinion shouldn’t be indicative of future efficiency, and no consumer ought to depend on any such ranking, ranking outlook, gauge, or comparable opinion to foretell efficiency or potential for return. Future efficiency could not equal projected or forecasted efficiency or potential for return. All scores and associated evaluation, in addition to knowledge, statistics, evaluation, and opinions contained herein are solely statements of opinion and are usually not statements of reality or suggestions to buy, maintain, or promote any safety or make every other funding selections.

This report could comprise “forward-looking” data that isn’t purely historic in nature. Such data could embody, amongst different issues, projections, and forecasts. There isn’t a assure that any forecasts made will materialize. Reliance upon data herein is on the sole discretion of the reader.

THE REPORT IS PROVIDED ON AN “AS IS” AND “AS AVAILABLE” BASIS WITHOUT REPRESENTATION OR WARRANTY OF ANY KIND. Left mind Wealth Administration DISCLAIMS ALL EXPRESS AND IMPLIED WARRANTIES WITH RESPECT TO THE REPORT, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF ACCURACY, TIMELINESS, COMPLETENESS, MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE.

The Report is present solely as of the date set forth herein. Left Mind Wealth Administration has no obligation to replace the Report, or any materials or content material set forth herein.