Energetic on-chain lending has returned to ranges not seen because the peak euphoria of 2021. The proxy measure for DeFi exercise exhibits that debtors have been assured within the bull market to date, in search of earnings by way of collateral based mostly loans.

DeFi lending has grow to be one of many main apps in 2024. Whereas the general DeFi worth remains to be decrease than in 2021, on-chain lending is as lively because it was throughout the earlier bull cycle.

The leverage on the chain metric reveals a extra mature market, the place the main protocols have unfold to a number of chains. Furthermore, the present leverage within the chain is just comparable in nominal phrases to that in 2021.

This benchmark was reached at a time when Bitcoin (BTC) is at a crossroads, which has as soon as once more raised questions on its cycle peak. In 2021, the spike in lending coincided with worth euphoria, however in the end unfold the contagion to a number of protocols. Since then, DeFi lending progress has been extra conservative, making an allowance for the worth of the collateral.

Moreover, some protocols switched to T-Payments as collateral, eradicating a layer of threat related to crypto costs.

Lending will get a lift from a bigger pool of stablecoins

As a proportion of the obtainable cash provide within the crypto market, this cycle nonetheless makes use of a smaller proportion of the obtainable stablecoins. This has led to expectations for even broader lending, which might in flip gasoline DEX swaps and different exercise.

With a higher provide of stablecoins, DeFi lending additionally limits their contagion within the occasion of a market downturn.

Leverage is rising, however as a proportion of cash provide, #DeFi lively lending has solely exceeded 50% of final cycle’s ranges. pic.twitter.com/2kysPxjyQg

— Jamie Coutts CMT (@Jamie1Coutts) December 17, 2024

Throughout the 2024 cycle, DeFi and centralized buying and selling could have almost 200 billion publicity to numerous stablecoins. The DeFi house additionally options new algorithmic or asset-backed cash and tokens that may create area of interest sources of liquidity, as within the case of USDe, USDS, DAI’s remaining choices, and different small stablecoins.

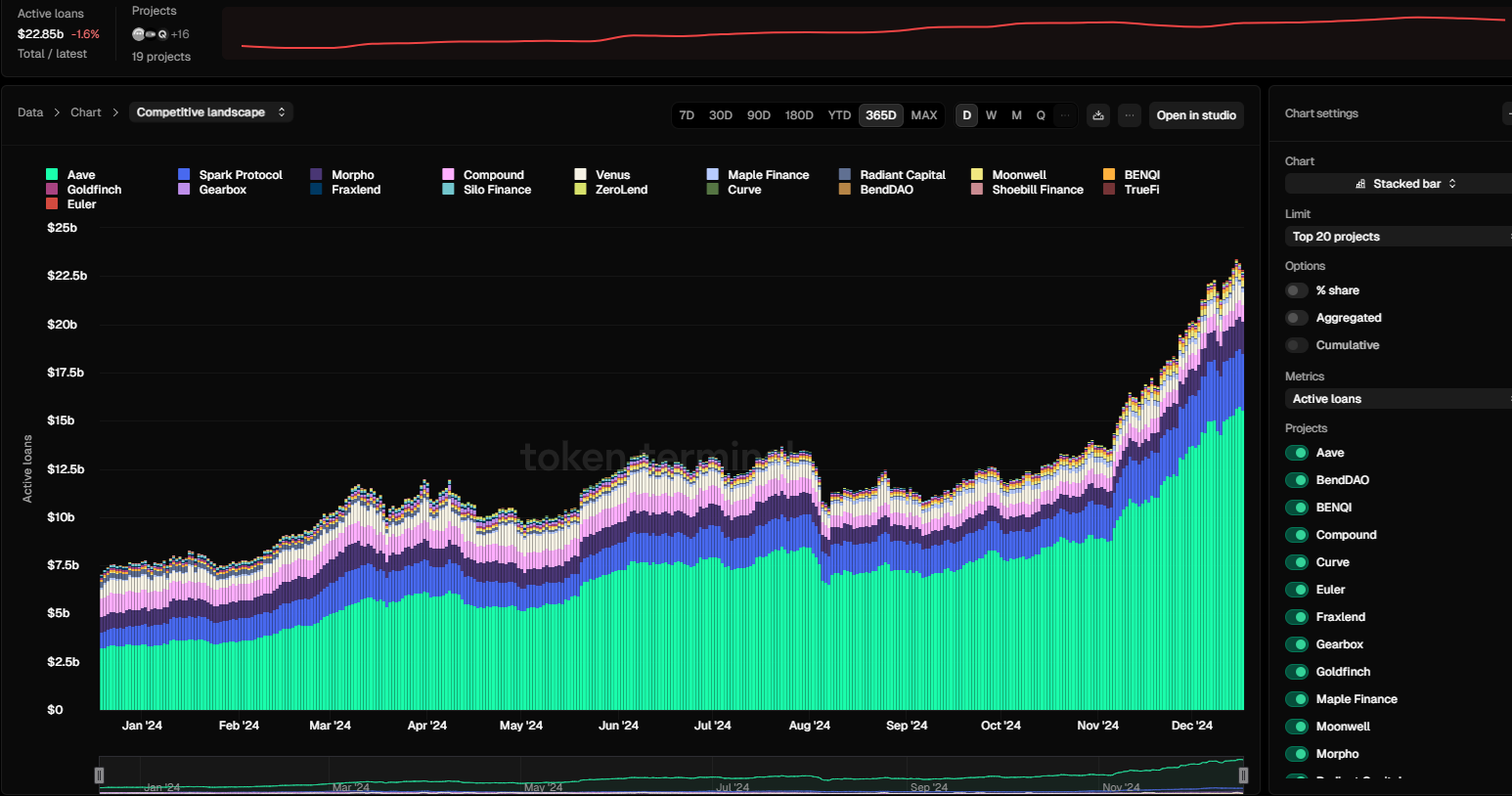

Loans to the chain have surpassed $22.85 billion because the 2021 lending protocols had been changed with new hubs. The DeFi lending market has recovered from the crash following the breakup of Terra (LUNA), in addition to the following crash of FTX.

On-chain leverage works so long as the underlying collateral is secure and better than the mortgage. The loans are then typically utilized in different DeFi protocols. Loans are normally within the type of stablecoins, which may then be used to buy property or park in high-yield vaults.

DeFi lending reporting will depend on the tactic used to trace worth. The present stage of lively loans, as measured by Token Terminal, is decrease in comparison with different leverage metrics.

Based mostly on knowledge from DeFi Llama, the lending protocols safe a price of greater than $50 billion, the very best stage since earlier than the LUNA and UST crash.

Aave is main the credit score motion

Whereas different protocols grew with some warning, Aave (AAVE) was the main app when it comes to lively lending and worth seize.

Aave is the main protocol for crypto-collateralized on-chain lending. | Supply: Token terminal

Aave was obtainable throughout bear market years and constructed up its infrastructure and consumer base. The lending protocol is now rising aggressively and providing the lending pool mannequin to different DeFi hubs.

The worth in Aave is now above $22 billiontogether with the reported loans and collateral. The mission additionally points its personal stablecoin, GHO, though progress is restricted and comparatively conservative.

Aave nonetheless depends primarily on WETH and WBTC, whereas additionally together with smaller tokens in its credit score vaults. Even different lending protocols have moved their operations to Aave, in an effort to consolidate liquidity and supply customers with an easier method.

The native AAVE token just lately did not climb to $400, as an alternative falling to $343.61. AAVE observers anticipate charges to rise to four-digit valuations as they’re thought of to be early within the credit score cycle.

AAVE additionally just lately obtained a lift from the acquisition of whales. On-chain lending is typically rolled again into DeFi tokens, comparable to within the case of a just lately reported whale exercise. The whale took GHO as an on-chain mortgage and used the proceeds to purchase extra AAVE. These practices can improve the worth of a token. Nevertheless, that might additionally expose the loans to liquidation.

A step-by-step system to launch your Web3 profession and land high-paying crypto jobs in 90 days.