Bitcoin L2 Labs, the core improvement group behind Stacks, introduced the profitable mainnet launch of a programmable 1:1 Bitcoin-backed asset, sBTC. It marks a major step towards constructing an on-chain Bitcoin economic system and follows October’s Nakamoto Improve, which introduced sooner transactions and 100% Bitcoin finality to the Stacks community.

For the broader Bitcoin neighborhood, that is greater than only a milestone: it heralds a brand new period of programmable Bitcoin. Probably the most safe blockchain on the planet can now actively take part in decentralized finance (DeFi).

sBTC debuts on Stacks Mainnet

sBTC is designed to unlock the liquidity of Bitcoin (BTC) and comes after Stacks initiated the Nakamoto Improve in late August. It should allow BTC holders to entry DeFi capabilities whereas sustaining Bitcoin’s unparalleled safety ideas.

Particularly, customers can have interaction in DeFi functions akin to lending and borrowing by way of protocols like Zest, decentralized exchanges (DEXs) like Bitflow and ALEX, and even AI-based instruments like aiBTC.

“In contrast to locking BTC in proof-of-stake techniques, sBTC is totally expressive and allows an on-chain Bitcoin economic system. It might probably energy decentralized lending, DEXs, AI bots and extra, whereas inheriting 100% Bitcoin hash vitality safety,” mentioned Muneeb Ali, founding father of Stacks, in a press launch shared with BeInCrypto.

One of many key options of sBTC is a 1:1 Bitcoin backing, with the pioneer crypto totally collateralizing every sBTC token. Second, there may be the institutional signatory community, which reduces dependence on particular person entities and due to this fact will increase belief.

Moreover, sBTC has 100% Bitcoin finality, that means it’s secured by Bitcoin hashing energy, making certain sturdy safety. Moreover, the product has clear, open-source code, which gives transparency and auditability for builders and customers.

Nonetheless, the present mainnet section introduces a deposit-only performance, capped at 1,000 BTC. Regardless of this limitation, this cover will present preliminary liquidity for builders and allow additional integrations with institutional managers and ecosystem companions.

Based on the press launch, withdrawals won’t be out there till the primary quarter of 2025, when the system transitions to a totally open, permissionless signer set. Depositors may also earn annual rewards of as much as 5% in sBTC for holding the asset, offering a singular return alternative for Bitcoin holders.

Unlocking Bitcoin’s Full Potential

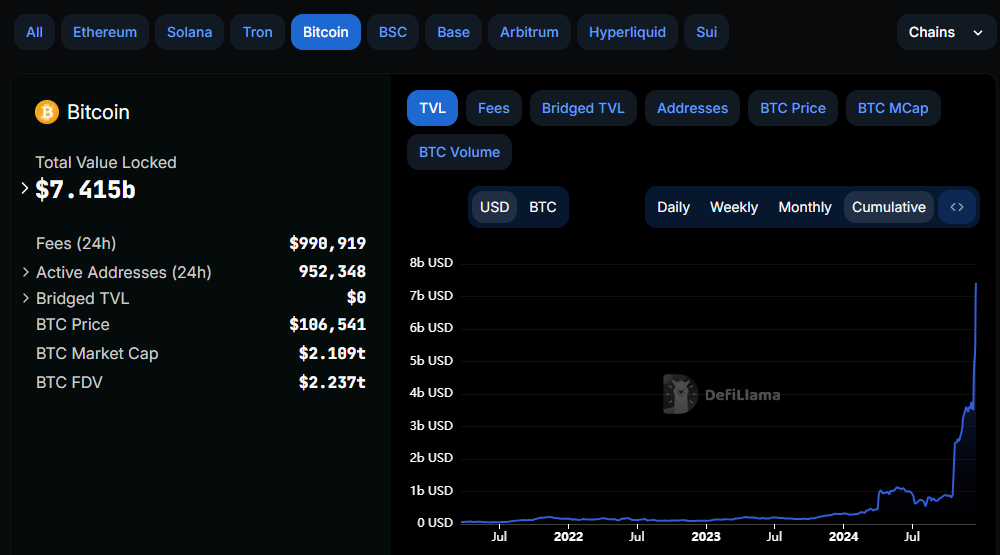

In the meantime, the launch of sBTC is poised to convey Bitcoin nearer to Ethereum’s dominance within the DeFi area. Whereas Ethereum boasts a complete worth (TVL) approaching $80 billion, Bitcoin is quickly approaching the Binance Sensible Chain (BSC) rollover, in keeping with DefiLlama knowledge.

Bitcoin TVL. Supply: DefiLlama

The profitable rollout of sBTC lays the muse for a stronger Bitcoin Layer-2 ecosystem. The gradual removing of the BTC restrict, the introduction of withdrawals and the transition to a permissionless signing community might drive additional adoption. With sBTC, Bitcoin is not only a retailer of worth, however a flexible asset for decentralized functions (dApps).

“With sBTC, Bitcoin turns into extremely succesful along with being a retailer of worth, unlocking BTC’s full potential in decentralized functions,” highlights Andre Serrano, Head of Product at Bitcoin L2 Labs.

This improvement additionally will increase alternatives for DeFi builders. For instance, Zest Protocol permits customers to earn further rewards whereas proudly owning sBTC.

“Earn extra Zest factors. Simply holding sBTC earns customers a 5% return, due to the Stacks rewards program. Zest permits customers to extend their returns with sBTC,” the platform mentioned.

As Bitcoin capital flows into DeFi protocols, builders, builders and customers will profit from improved liquidity and modern monetary devices.