Raydium is closing in on Uniswap in each day spot volumes because the inflow of meme tokens does not cease. Raydium continued its actions as different markets slowed after the most recent crypto rally.

The meme frenzy exhibits no indicators of slowing down as Raydium overtakes Uniswap on weekly volumes. The Solana DEX ecosystem continues to be close to its peak exercise and Raydium reached weekly spot volumes of $20 billion. Raydium remained one of the resilient apps at the same time as your entire crypto market slowed down and moved away from its peak exercise and file valuations.

Uniswap was nonetheless first $26 billion in weekly volumes, primarily attributable to its distribution to a number of ecosystems. In response to information from CryptoRank, PancakeSwap is the third largest DEX, nonetheless with $10 billion in weekly buying and selling volumes. Whole spot quantity rose above $98 billion, though Ethereum-based buying and selling noticed some outflows attributable to unaffordable fuel costs.

Raydium’s development precedes that of Uniswap

Raydium and Uniswap are already in settlement with regards to each day volumes within the brief time period. The Solana DEX had a buying and selling quantity of $4.5 billion, whereas Uniswap had a each day turnover of $4.9 billion. Each DEX take a small share of the market, with round 26% for Uniswap and 23% for Raydium. The sluggish shift to the Solana ecosystem follows the decline in DEX exercise for Ethereum-based tokens. Meme tokens on Uniswap nonetheless exist, however are dearer to commerce.

Raydium achieved quantity development of 128% up to now 24 hours, demonstrating its capability to resist different market developments. Essentially the most exercise on Raydium got here from the highest 10 hottest meme tokenswith Peanut the Squirrel (PNUT) having the best buying and selling quantity.

Uniswap solely grew its each day volumes by 80%, regardless of counting on a number of extremely lively networks. Uniswap makes use of Base for its development, whereas Ethereum’s swaps grew to become unaffordable attributable to excessive fuel costs.

Raydium stays a single-chain DEX, coping with older and newly launched tokens. The exercise consists of each buying and selling older property and bot-driven sniping of recent tokens. Raydium outperforms a number of different DEXs as it’s the main device for tapping into the booming meme market.

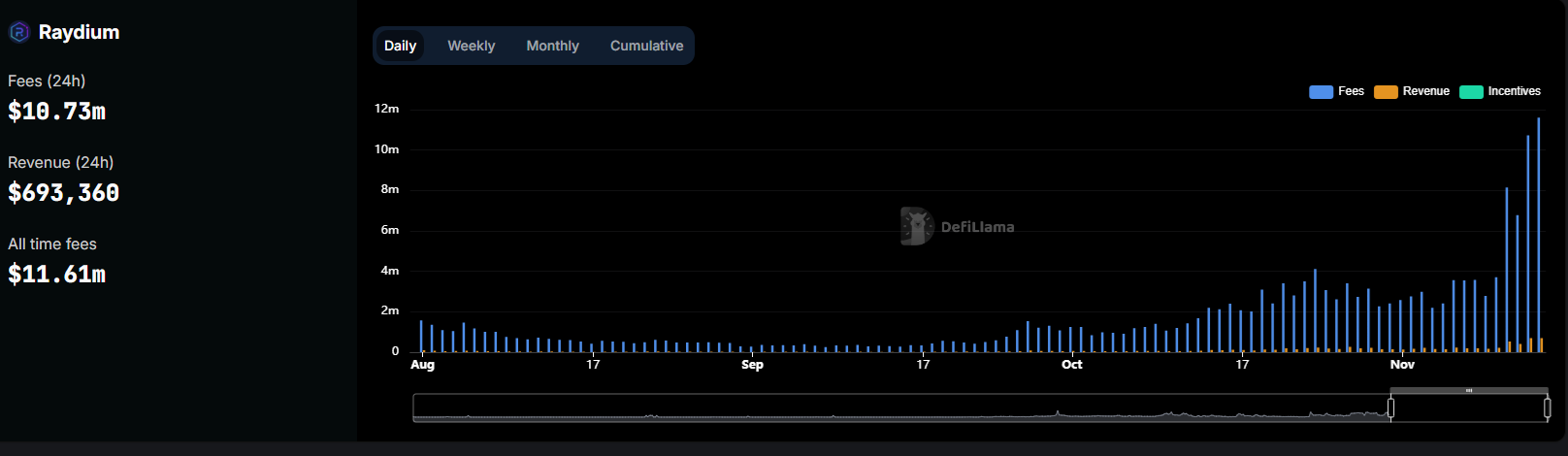

The DEX additionally ranked among the many high producers on the each day timeframe. Raydium was behind solely Ethereum and Tether, producing $10.37 million within the final 24 hours. Absolutely the payment file adopted one other peak day for meme tokens, however particularly Solana-based memes.

Raydium produced most each day charges of over $10 million, changing into the third most paid protocol, after Ethereum and Tether. } Supply: DeFi Lama

Raydium even surpassed the primary Solana chain in payment manufacturing, in addition to Jito, the primary Solana MEV block builder. On the similar time, Uniswap produced solely $5.11 million in 24-hour charges. After the height exercise, Raydium’s native token RAY rose to $4.70, though nonetheless beneath the preliminary buying and selling rally. RAY has been buying and selling since 2021 and has but to hit a brand new all-time excessive.

Solana’s high meme tokens are additionally valued close to their peak, with a complete market cap above $21 billion. Some memes have moved to centralized markets, however for newer tokens, Raydium is the primary supply of worth discovery.

Pump.enjoyable continues to provide new tokens

Pumping enjoyablethe primary supply of tokens for Raydium, continues to provide a baseline of 35K newly launched property. Of those property, 1-2% graduate to Raydium, whereas the remainder by no means enter worth analysis.

Raydium continues to be key to launching decentralized tokens attributable to its characteristic of locked liquidity. The newly launched tokens provide a assure that the workforce is not going to be sidelined and there will probably be no chance of draining liquidity.

After Raydium, even fewer tokens are going to centralized exchanges. Nonetheless, the hope of discovering the following winner retains the Solana DEX busy.

The impact on Raydium was explosive development in comparison with 2023, by as much as 100x when it comes to volumes and costs. Raydium not solely has meme tokens, however can also be a part of Solana’s DEX ecosystem.

Raydium may even department into DeFi, providing stablecoin choices, and internet hosting cbBTC, the packaged type of BTC on Solana. Raydium carries out cbBTC swaps and transactions and makes use of Jito’s companies for assured transactions.