Aave (AAVE) may face promoting strain as whales and market makers return tokens to centralized exchanges. A number of massive trades moved AAVE to OKX, Binance and MEXC, doubtlessly slowing the asset’s rally.

Aave (AAVE) could also be halting its progress after a number of main whales despatched tokens to Binance. The lending protocol was expanded in 2024 because it turned the primary supply of returns. Three Whales moved AAVE to centralized exchanges, with potential worth strain on the token.

One of many trades was owned by market maker Cumberland, which moved 10K AAVE to OKX. Galaxy Digital and in addition a smaller holder not deployed their AAVE and moved the tokens to Binance.

The most important whale AAVE has moved has extracted 25,790 tokens from the protocol, price $3.38 million. This diminished the whale’s AAVE stability to zero, eradicating worth from among the lender’s vaults.

The identical whale retained AAVE for a comparatively very long time and began accumulating in the summertime of 2023. The typical buy worth of the whale was $77.75, giving a possible revenue of $1.31 million if the tokens had been bought on the present worth.

The trades came about after a market-wide correction, which pushed Bitcoin (BTC) again beneath $70,000. AAVE additionally traded close to a one-month low at $130, though open curiosity rose from $75 million to $85 million per day. The token was thought of one of many undervalued belongings for this cycle, based mostly on its low market cap to worth lock ratio. Aave additionally become one of many busiest DeFi protocols, after Maker misplaced its place throughout a rebrand to Sky.

The opposite attainable clarification for the transfers to exchanges is the potential of the Aave buyback program. The Umbrella improve means that Aave Labs should purchase again a few of its unique tokens and use them in a vault for ecosystem boosts. An announcement of a buyback would improve AAVE’s worth, doubtlessly resulting in larger realized income.

AAVE has a market cap of $1.95 billion, however has a complete worth of $13 billion. In current months, Aave has turn out to be the main lending protocol utilized by different DeFi apps for returns. Aave represents your entire DeFi sector and might be influenced by the outcomes of the US presidential elections. The protocol is feeling downward strain as ETH as soon as once more fell beneath $2,500.

AAVE is seen as a interval of reaccumulation and able to a brand new rally. The asset fell greater than 30% from its current peak above $170.

AAVE modified its on-chain profile in October

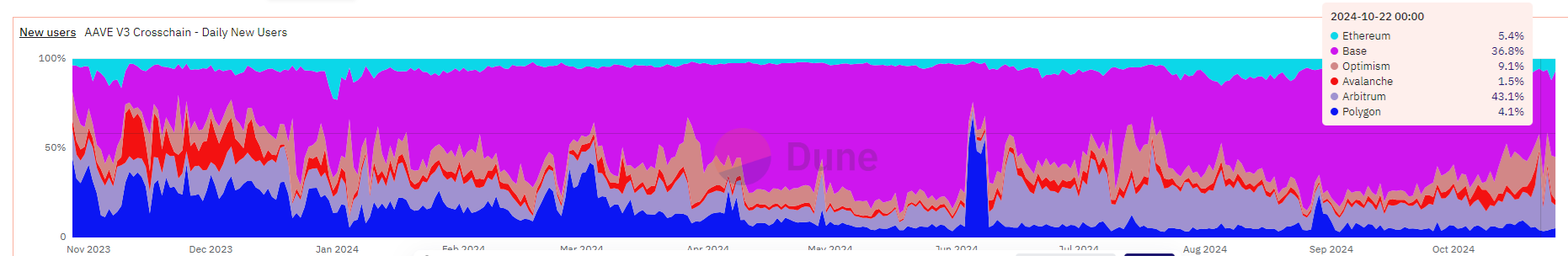

For a couple of months, Aave obtained most of its progress from Base. Nevertheless, beginning in October, Aave expanded its presence on Arbitrum and Optimsm. The bottom has declined as a supply of recent customers after the preliminary hype within the chain.

Arbitrum and Optimism are attracting extra new Aave customers up to now month, whereas Base’s share is declining. | Supply: Dune Analytics

AAVE nonetheless makes use of 13 chains with diverse credit score swimming pools on every community. Aave’s objective was to additionally make GHO a cross-chain stablecoin. For now, GHO is distributed throughout smaller DeFi protocols, as a lending asset in opposition to different crypto collateral.

Over the previous yr, Aave has seen no outflows from its energetic loans, whereas its vaults and swimming pools have regularly grown. Up to now six months, Aave’s loans have grown from about $5 billion to greater than $8 billion. Regardless of larger consumer exercise on different networks, the vast majority of loans are nonetheless on Ethereum $6.96 billion.

GHO provide is rising, however there are not any indicators of buybacks

GHO’s provide rose above the 175 million tokens threshold, which might set off among the first AAVE burns. GHO provide continued to rise in current days, including one other 5 million tokens to a complete market cap of $176,179,252 GHO. At one level, GHO’s provide reached 180 million tokens.

Nevertheless, the Aave Protocol remains to be not prepared with its Umbrella replace, which ought to exchange the outdated safety module. The brand new Aave incentives with token burns will not be prepared but.

For now, all GHO issued remains to be on Ethereum and has not been despatched to all 13 chains the place Aave has vaults. GHO can also be supplied as a substitute for USDT and USDC, and should turn out to be extra outstanding amongst DeFi protocols.