- Bitcoin ETFs have surpassed 1 million BTC in whole holdings

- On its sixteenth anniversary, the cryptocurrency depreciated on the worth charts

Lower than a yr post-launch, U.S. Bitcoin [BTC] ETFs have collectively accrued over 1 million BTC. That is vital as only recently, Eric Balchunas, Senior ETF analyst at Bloomberg, had predicted that the ETFs may surpass the holdings of Bitcoin’s pseudonymous creator – Satoshi Nakamoto. On the time, he had projected that this could occur by mid-December.

Nonetheless, BlackRock’s single-day buy of 12,127 BTC, in line with Lookonchain, has hastened the timeline. Balchunas reacted to this large accumulation on X, stating,

“At this charge, they’ll go Satoshi in lower than two weeks. Altho they’ll’t sustain this Joey Chestnut-level tempo, can they?”

At press time, BlackRock held 429,185 BTC, valued at roughly $30.8 billion.

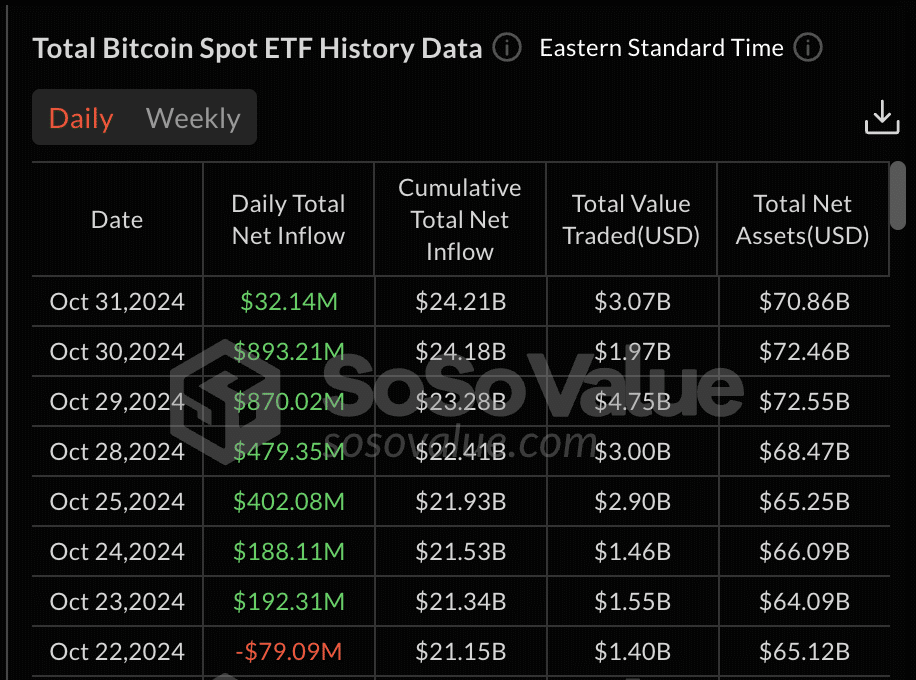

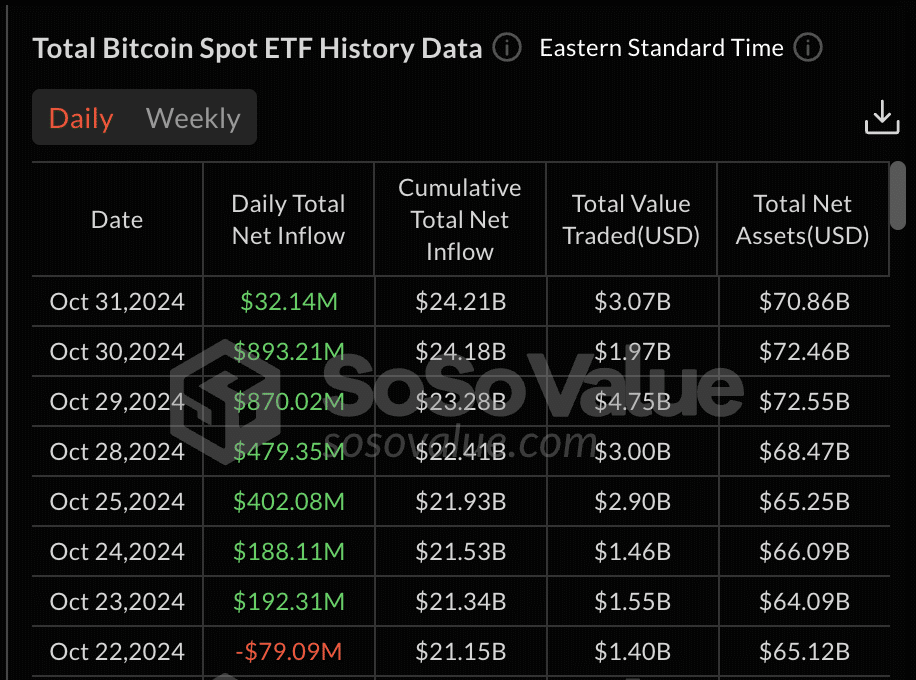

Mixed, U.S. Bitcoin ETFs now handle belongings totaling $70.86 billion, representing 5.12% of Bitcoin’s market cap. This, in line with knowledge from Soso Value.

For context, Nakamoto holds an estimated 1.1 million BTC, at the moment price $76 billion.

Are ETF inflows slowing down?

Beforehand, AMBCrypto reported that on 30 October, BlackRock’s IBIT marked its largest single-day influx since January. This surge in funding adopted a pattern of each day triple-digit whole web inflows since 23 October.

Supply: Soso Worth

Nonetheless, each day whole web inflows dipped to $32.14 million on 31 October. Furthermore, solely IBIT and the CoinShares Valkyrie Bitcoin Fund ETF (BRRR) introduced in $318.80 million and $1.89 million, respectively.

Different ETFs noticed both outflows or no inflows in any respect. Apparently, this drop coincided with the king coin dropping its standing over the $70,000-level.

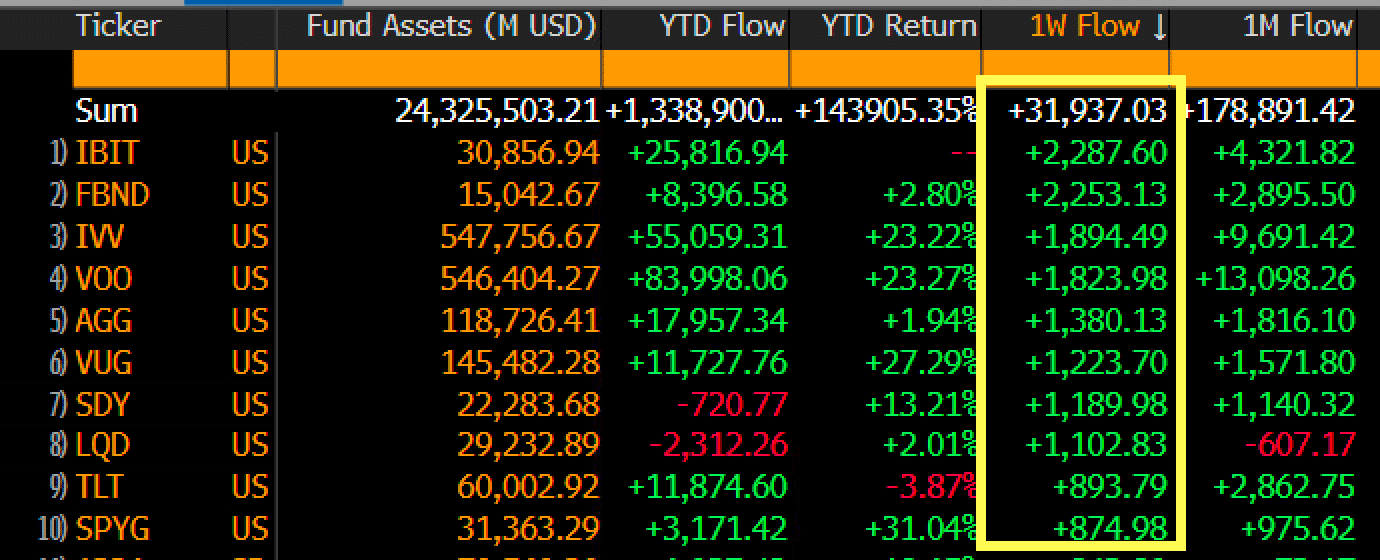

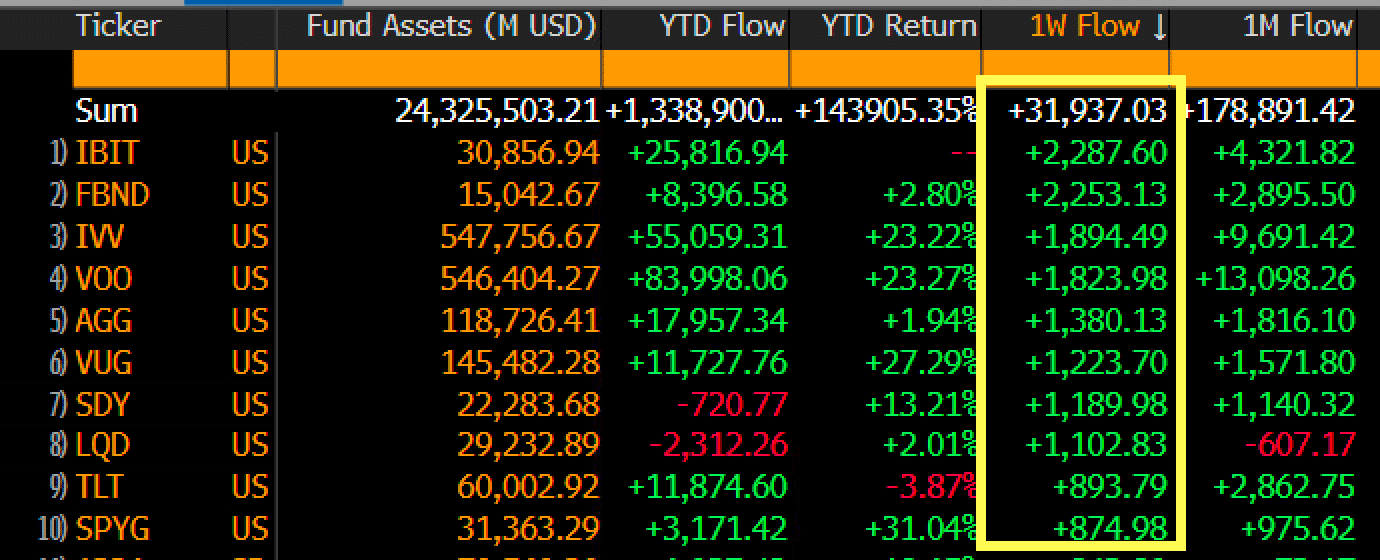

Regardless of this decline, nonetheless, Balchunas revealed that IBIT managed to draw more money than the full of 13,227 ETFs worldwide over the previous week. He emphasised that this achievement is especially vital for an ETF that’s nonetheless underneath a yr previous.

Supply: Eric Balchunas/X

Execs weigh in

IBIT’s outstanding efficiency didn’t go unnoticed by business specialists. Nate Geraci, President of the ETF Retailer, shared his perspective on X:

“This factor is popping right into a $$$ vacuum cleaner.”

Geraci highlighted that BTC ETFs’ $70 billion in belongings was greater than 50% of the $130 billion held by gold ETFs since 2004—All inside simply 10 months of their 2024 launch.

Quinten Francois, Co-founder of WeRate, echoed this sentiment, stating,

“Bitcoin ETFs had extra inflows within the final 2 days than the Gold ETF took in throughout its total first yr.”

Bitcoin turns 16

In the meantime, the Uptober rally got here to an finish with BTC’s sixteenth anniversary, marking the day Nakamoto launched the nine-page whitepaper titled “Bitcoin: A Peer-to-Peer Digital Money System.” This milestone laid the inspiration for a decentralized digital foreign money and the cryptocurrency period.

Apparently, on its anniversary, Bitcoin dipped under the $70,000-mark. At press time, it was valued at $69,821, down by 3.33% over the past 24 hours.

Whereas the downturn could have disillusioned some, it additionally poses an intriguing query – Might this be a chance for institutional traders to “purchase the dip” and takeover Nakamoto before anticipated?

Such a transfer would speed up the shift in direction of institutional dominance in an area Nakamoto initially envisioned as decentralized.