- BTC wants to interrupt $66,000 for a bullish run.

- $5.64 billion in realized earnings sign robust market exercise.

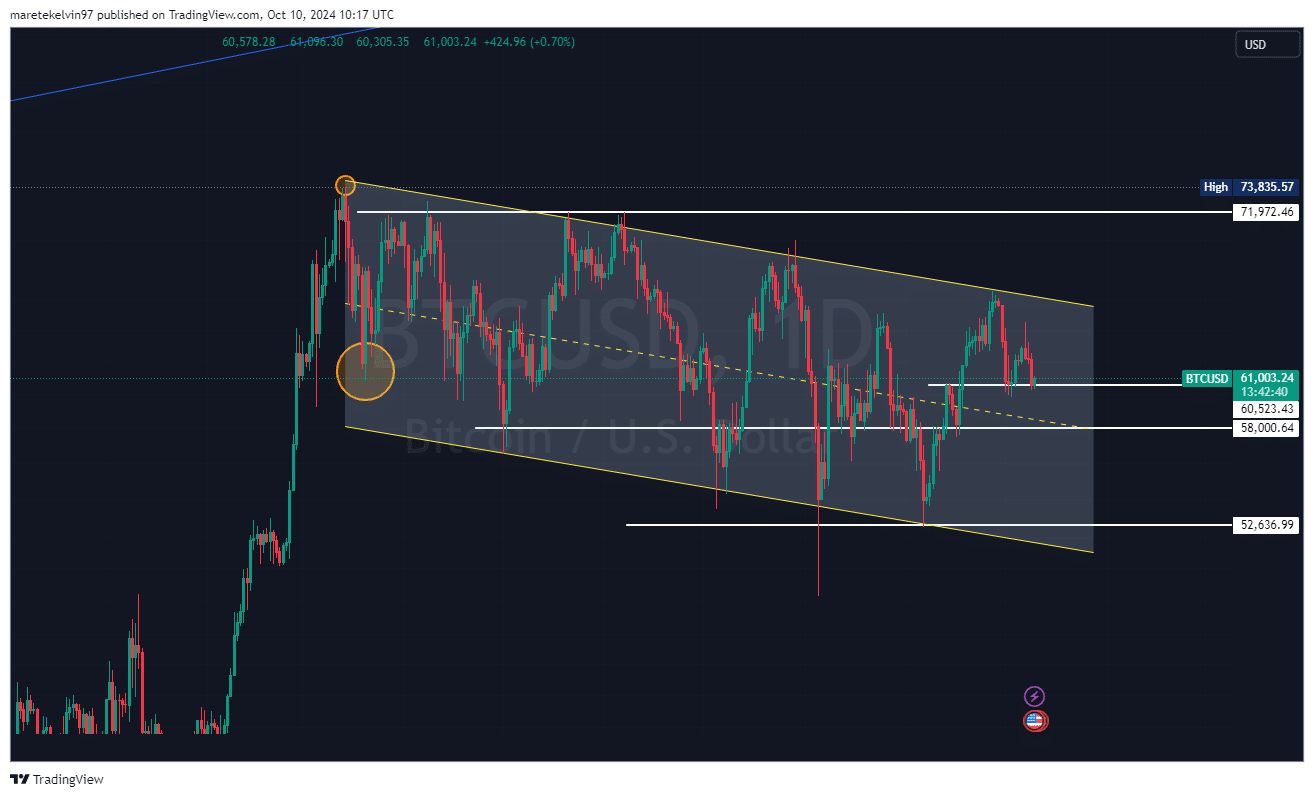

Bitcoin [BTC] continues to wrestle inside a descending parallel channel. From optimism a couple of days in the past, plainly a breakout is nowhere in sight.

After rejection on the higher boundary, BTC could possibly be on its method to decrease ranges until it clears one key worth stage.

THIS alerts extra bearish run

BTC’s newest worth met a resistance and was rejected from the higher boundary of the descending parallel channel at 66K.

The rejection on the higher boundary brings the center boundary of the channel into view, which lies at $58,000, and even the decrease boundary at $52,000 for the worst.

Supply: TradingView

Market members in search of a breakout within the route of the bulls might want to see BTC shut above $66,000—a worth resistance stage that has proved to be formidable.

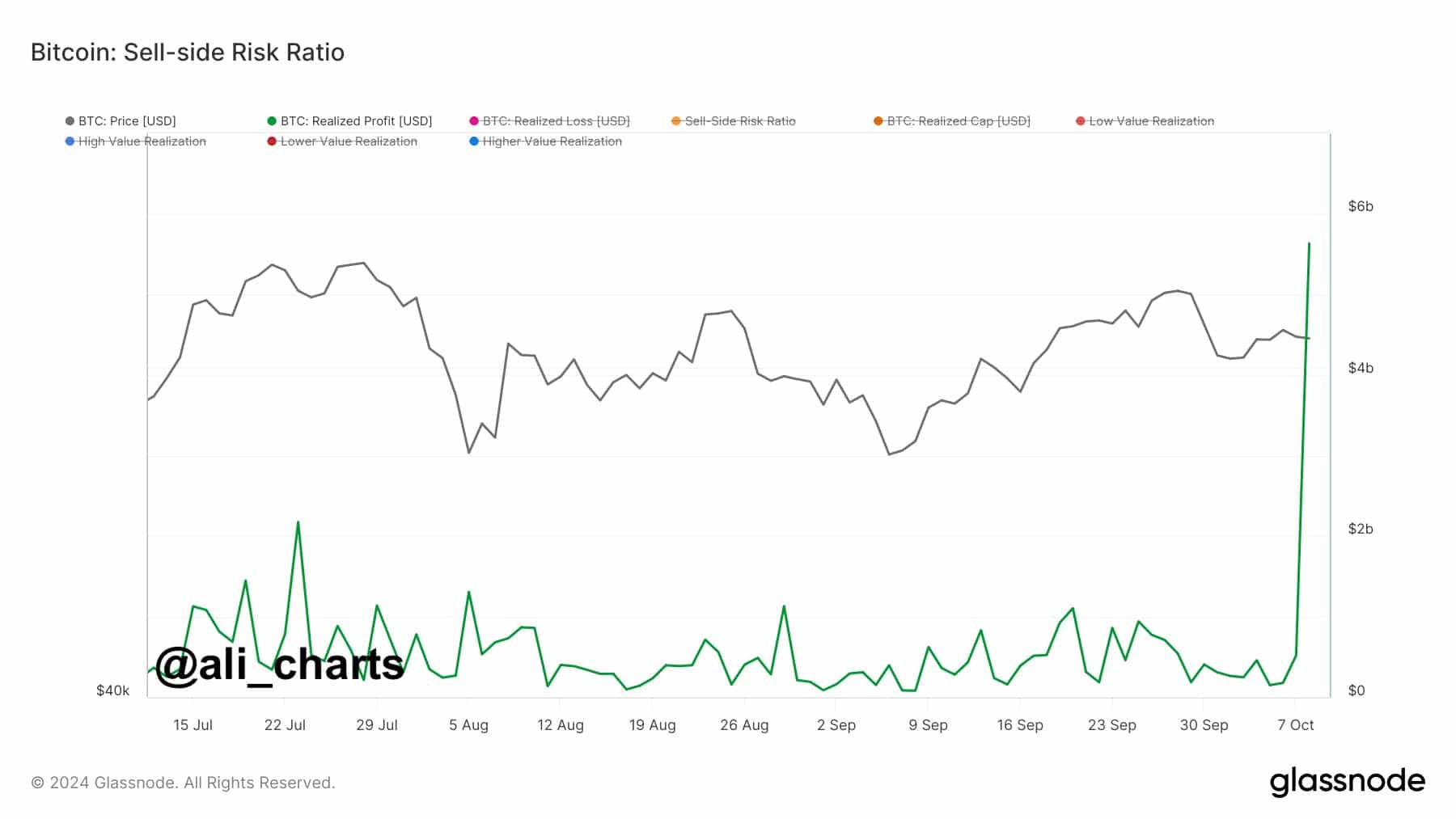

Realized earnings enhance market exercise

The Bitcoin market remains to be so energetic. Judging by the efficiency of the final 24 hours alone, the recorded $5.64 billion in realized earnings was a key indicator of large-scale profit-taking.

The uptick signifies that traders are cashing in, most likely creating downward strain within the close to future.

Supply: X

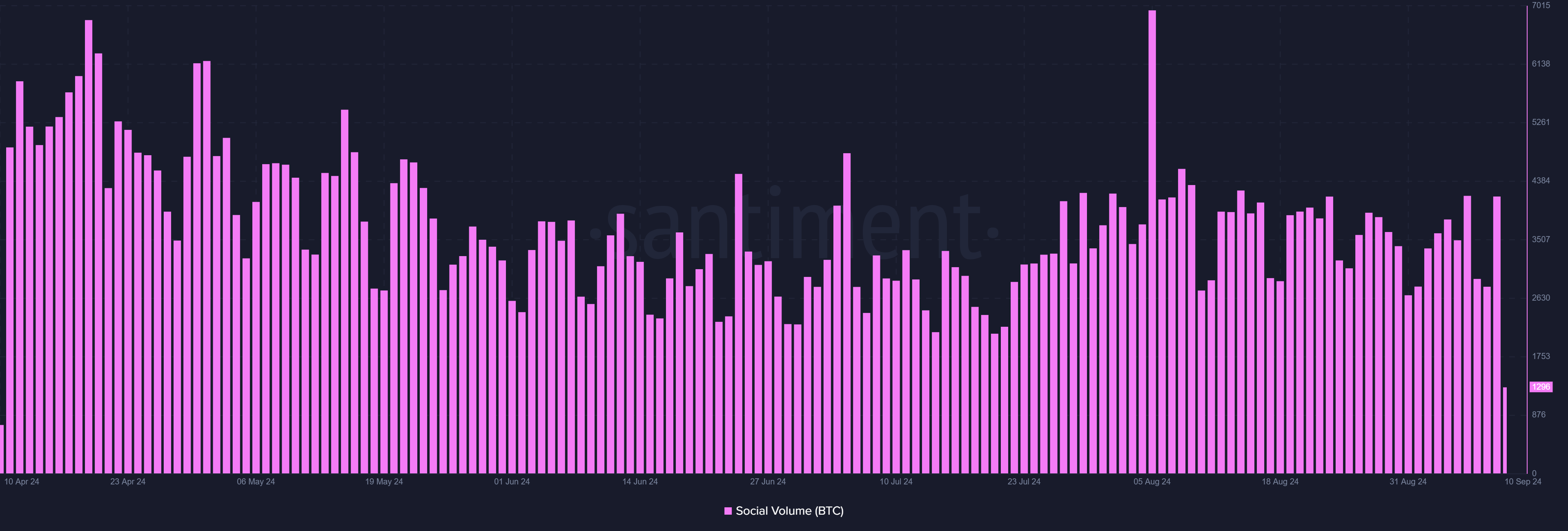

Bitcoin social sentiment spikes

Including to the aforementioned metrics, social sentiment round BTC has additionally exploded in latest instances, in line with Santiment information.

A lot of the thrill could possibly be as a consequence of recent speculations over Satoshi Nakamoto, the mysterious creator of Bitcoin.

Whereas a leap in Bitcoin social sentiment might gas short-term volatility, the possibilities of holding up a chronic worth enhance with out first breaking above $66,000 are minimal.

Supply: Santiment

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

Whereas the realized earnings and the social sentiment point out a buzzing market, the technical outlook for BTC stays unclear. The $66,000 mark is the important thing stage to look at for a breakout.

Till then, market members ought to put together for potential dips to $58,000 and even $52,000.