- Bitcoin dominance continues to battle at key resistance.

- The altcoin season index reached its highest degree in six months.

Bitcoin [BTC] dominance has struggled at a key resistance degree of 58%, elevating market optimism of a stronger altcoin season if its market share decline compounded.

Traditionally, altcoins exploded when BTC dominance declined.

Since 2023, BTC dominance (BTC.D) has elevated from 40% to a latest excessive of 58%.

Nevertheless, the 58% degree doubles as a resistance degree, which, if not breached, would drag BTC dominance decrease. Most market observers consider such a drop might speed up the altcoin rally.

Supply: X

Altcoin season hits 6-month excessive

One of many metrics used to gauge the well being of altcoin sectors is the ETH/BTC ratio. It gauges ETH’s worth relative to BTC.

Moreover, since ETH is the biggest altcoin, the ETH/BTC ratio additionally evaluates the general altcoin sector efficiency.

Supply: CoinMarketCap

For the reason that Fed pivot on the 18th of September, ETH has outperformed BTC. This instructed improved altcoin efficiency over the identical interval, which noticed BTC dominance drop by 2.5%.

Final week, memecoins confirmed an enormous bounce and led the market restoration, with Shiba Inu [SHIB] taking the lead.

On the month-to-month charts, Sui community [SUI], Bittensor [TAO], and Popcat [POPCAT] dominated the highest September greatest performers with double and triple-digit good points.

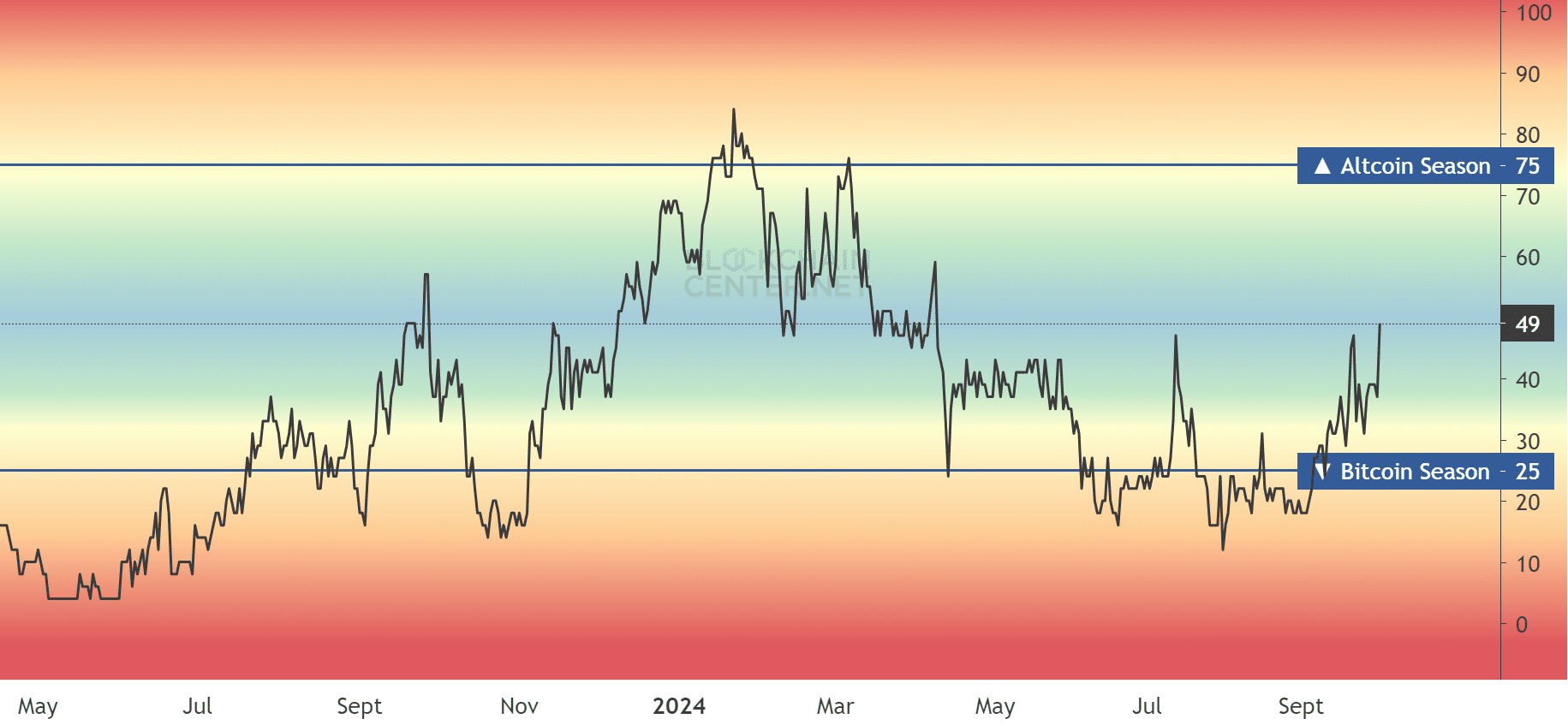

Supply: Blockchain Middle

At press time, the Altcoin Season Index reading was 49, close to impartial, the best degree since March. This underscored final month’s exceptional altcoin efficiency.

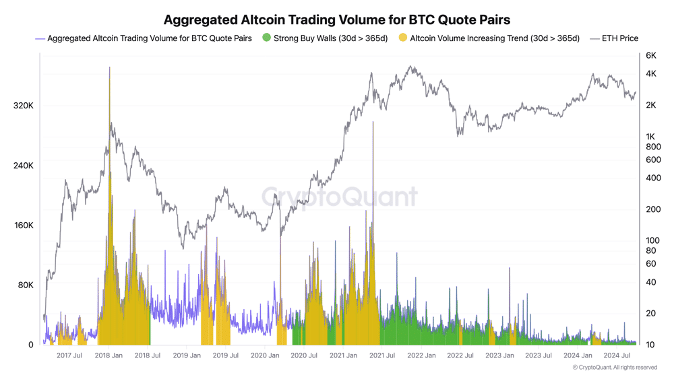

Regardless of the robust investor curiosity in altcoins, CryptoQuant’s founder noted that large capital rotation from BTC to altcoins was but to start.

“Asset rotation from #Bitcoin to altcoins hasn’t began, however purchase partitions are getting stronger general. I just like the calm earlier than the storm.”

Supply: CryptoQuant

Put in a different way, altcoin season was gaining momentum and introduced upside potential for individuals who had publicity. Ergo, BTC dips could possibly be nice alternatives to seize extra ‘low cost’ altcoins with large potential.