- Bitcoin MVRV momentum exhibits a possible return to bullish territory.

- BTC has surged by 4.95% over the previous week.

Over the previous week, Bitcoin [BTC], has skilled a robust upward momentum. The worth restoration has seen BTC reclaim larger resistance ranges thus reviving market optimism.

In actual fact, as of this writing, BTC was buying and selling at $63,062. This marked a 4.95% improve over the previous week.

These good points on weekly charts have pushed BTC to document constructive good points on month-to-month charts recovering from a month-to-month low of $52,546 by a 3.95% rise.

Undoubtedly, these latest value actions have sparked widespread dialogue amongst analysts. One in every of them is the favored crypto analyst Ali Martinez who has predicted an upcoming bullish run citing the MVRV momentum.

What market sentiment says

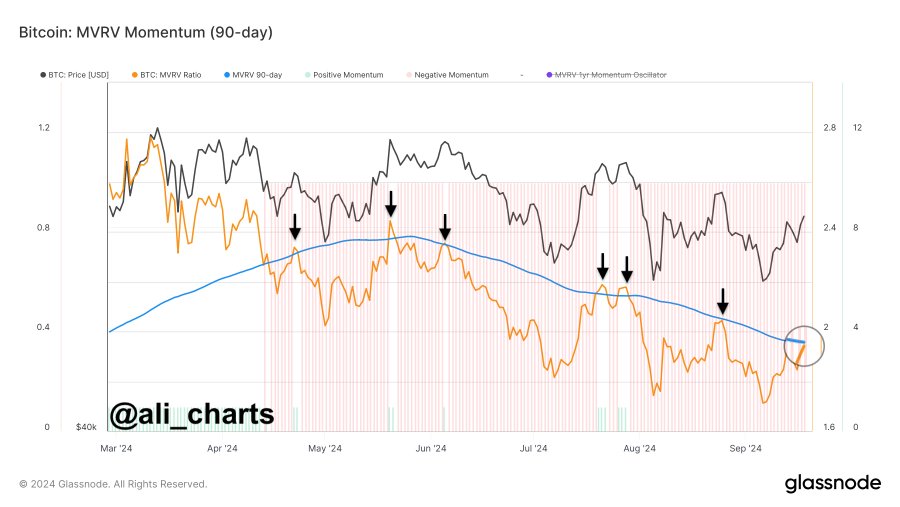

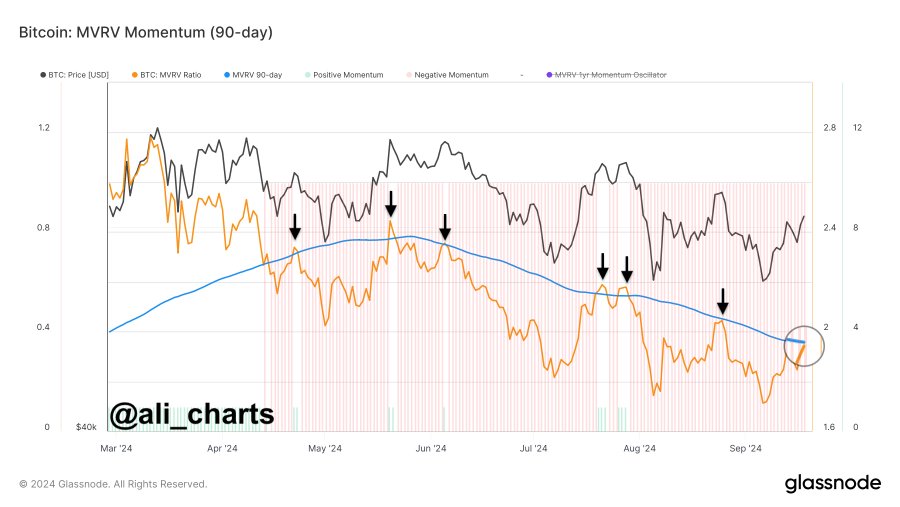

In his evaluation, Martinez cited the newest shift of MVRV from destructive to bullish territory.

Supply: X

Based on his evaluation, MVRV shifted to destructive momentum in late April. Throughout this era, BTC declined from a excessive of $67,241 to a neighborhood low of $49,577 earlier than a brief restoration and one other decline.

Based mostly on this statement, after an extended interval of destructive momentum, now MVRV exhibits a return to bullish if it manages to shut above its 90-day shifting common.

What this implies is that the downtrend is reversing, and the market might shift again to bullish with the potential for additional good points.

For instance, the final time, it fell under its 90-day MA was mid-2023. After a restoration, costs stabilized adopted by a sustained rise.

Due to this fact, with the market having utilized the shopping for alternative, BTC is well-positioned for value development.

What BTC charts recommend

As noticed by Martinez, BTC market is displaying a possible return to bullish territory after a sustained interval of decline. Thus, the present market sentiment might set Bitcoin for additional value development.

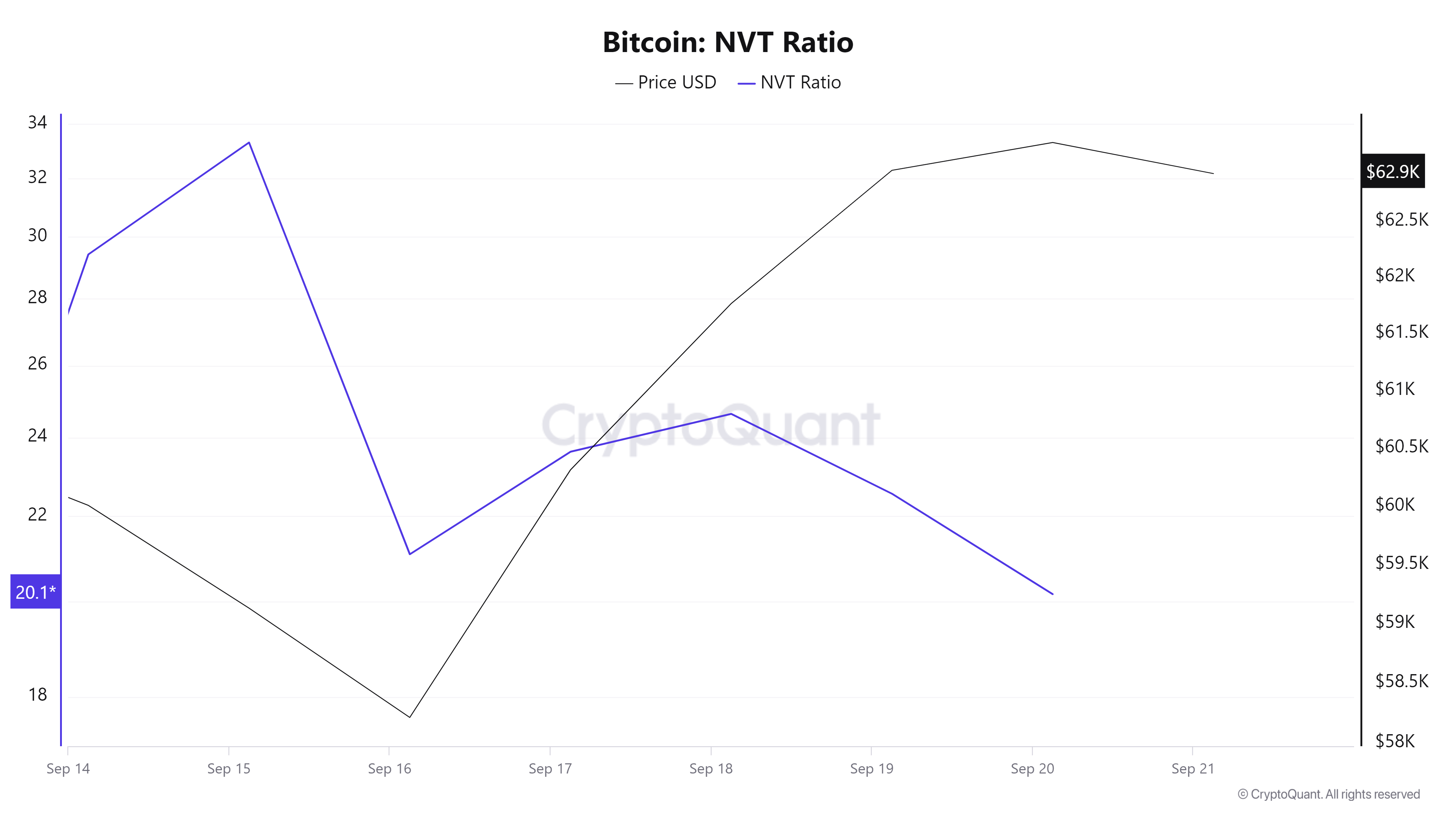

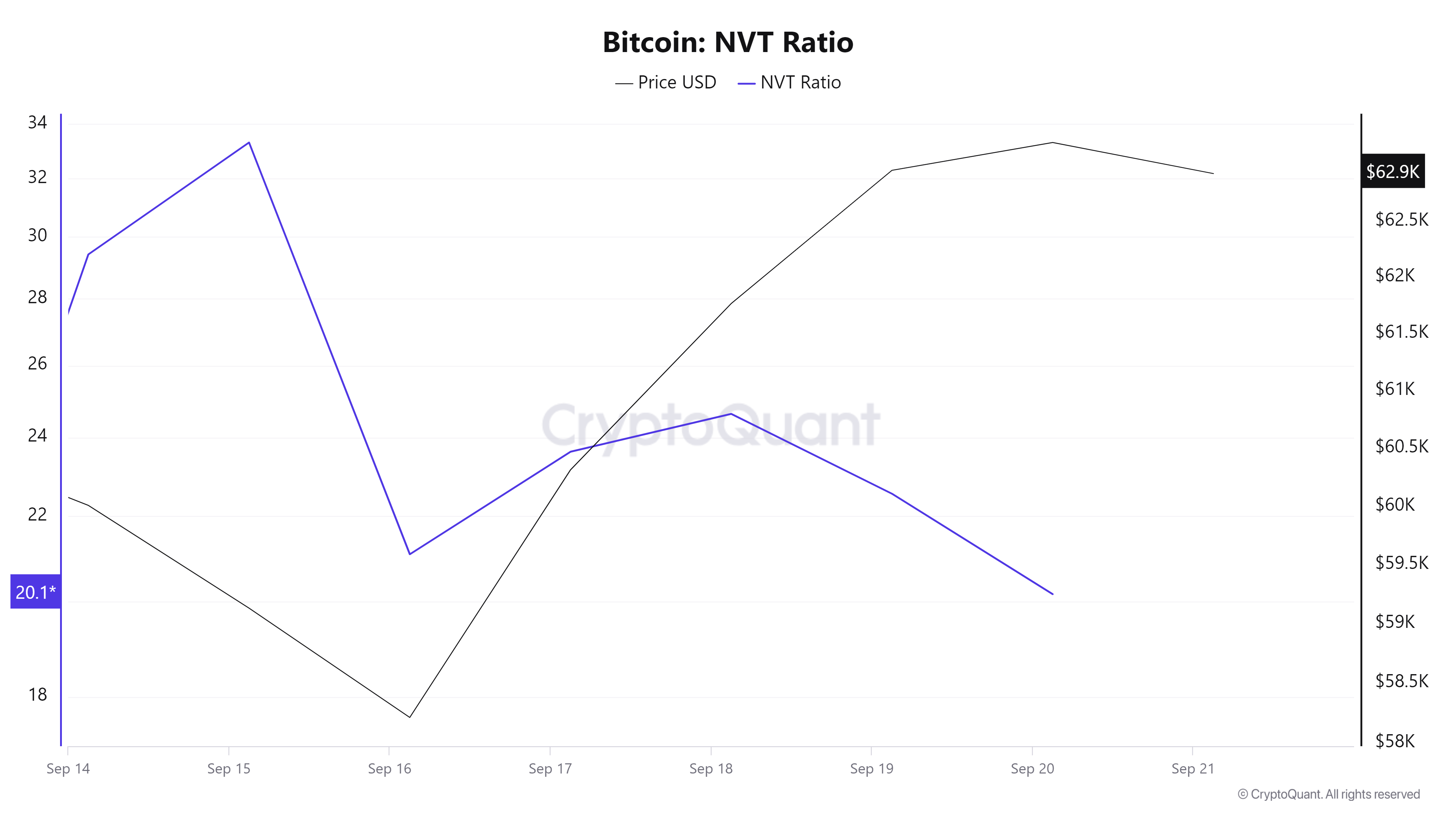

Supply: CryptoQuant

For instance, Bitcoin’s NVT ratio has declined from 33.3 to twenty.1 over the previous week suggesting that on-chain transaction quantity is rising quicker than MC.

This acts as a bullish indicator because it implies the community is getting used actively and the value is much less valued in comparison with the utility. Such a decline indicators investor’s confidence within the community’s long-term viability.

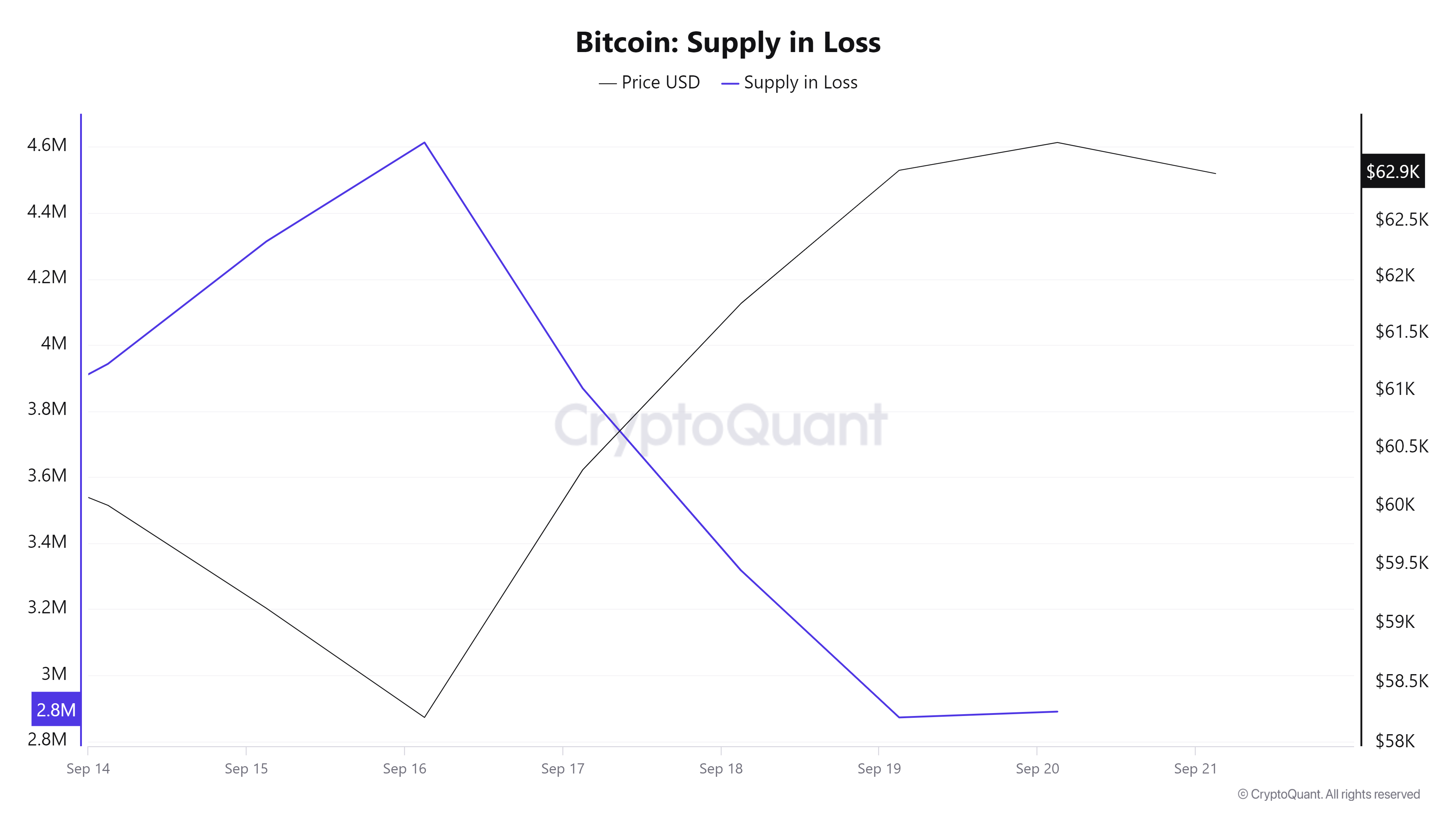

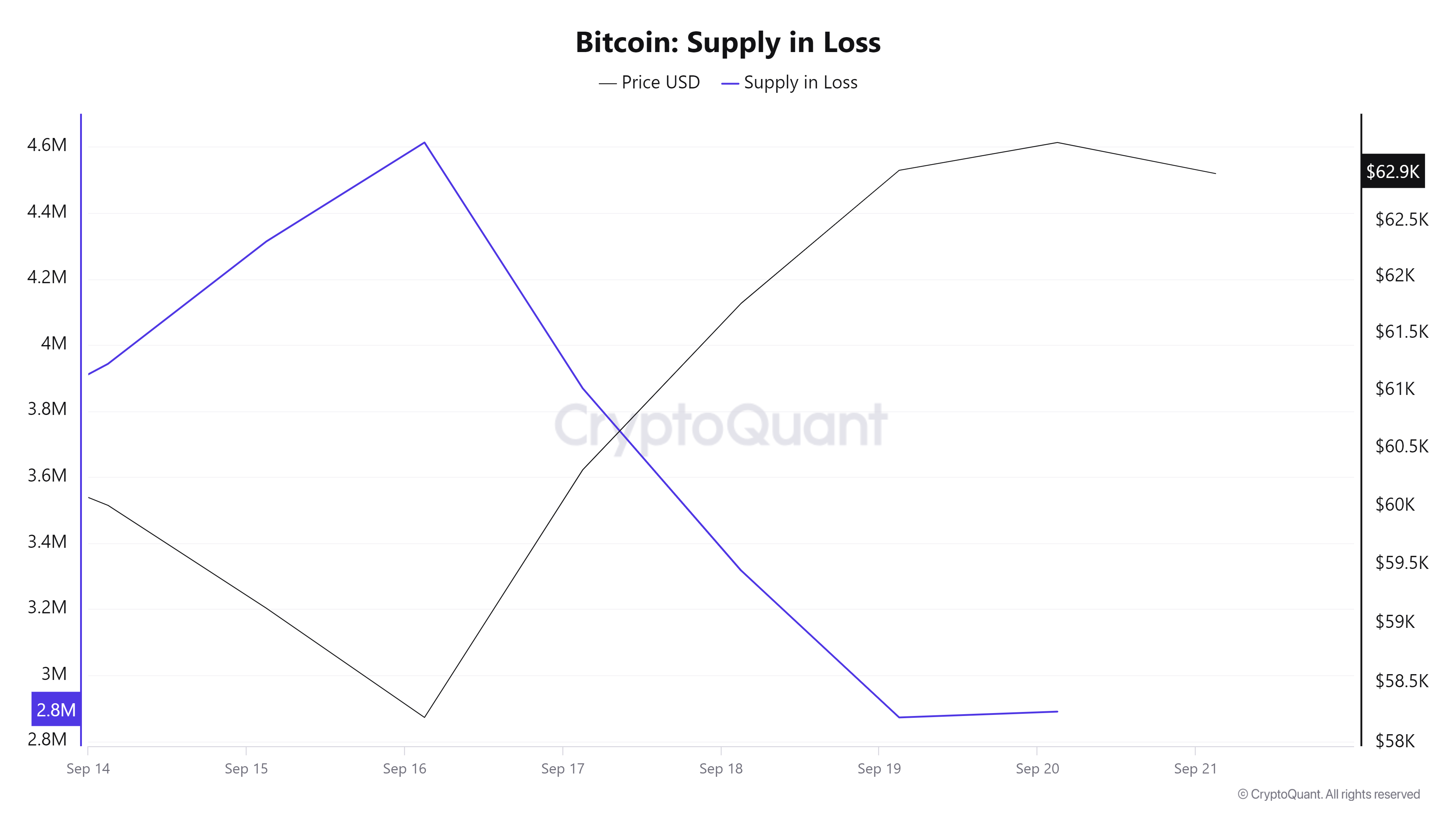

Supply: Cryptoquant

Moreover, Bitcoin’s provide in loss has declined over the previous week from 4.2 million to 2.8 million. This decline means that the BTC value is rising pushing earlier underwater belongings into profitability. That is one other bullish sign indicating upward momentum.

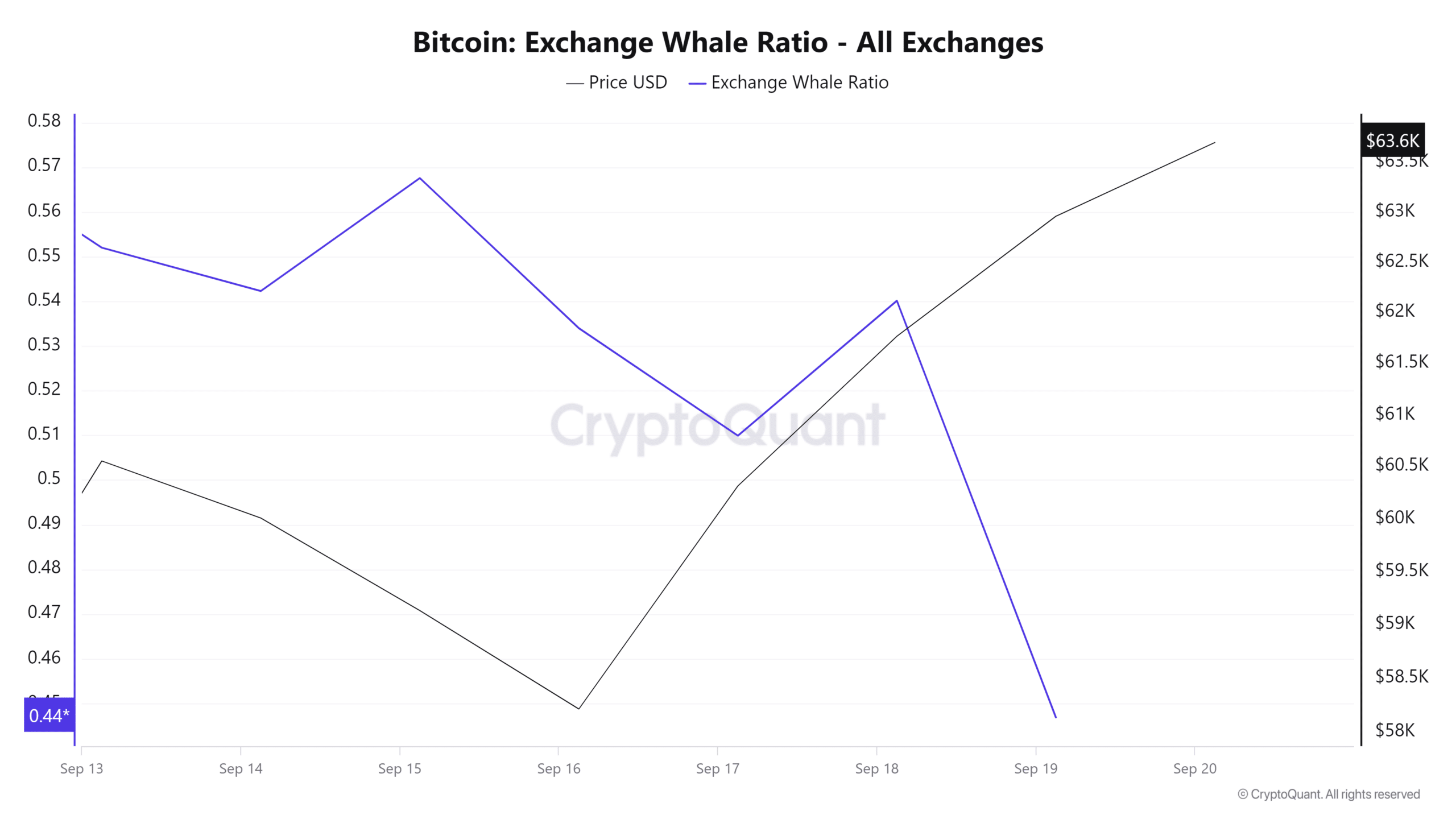

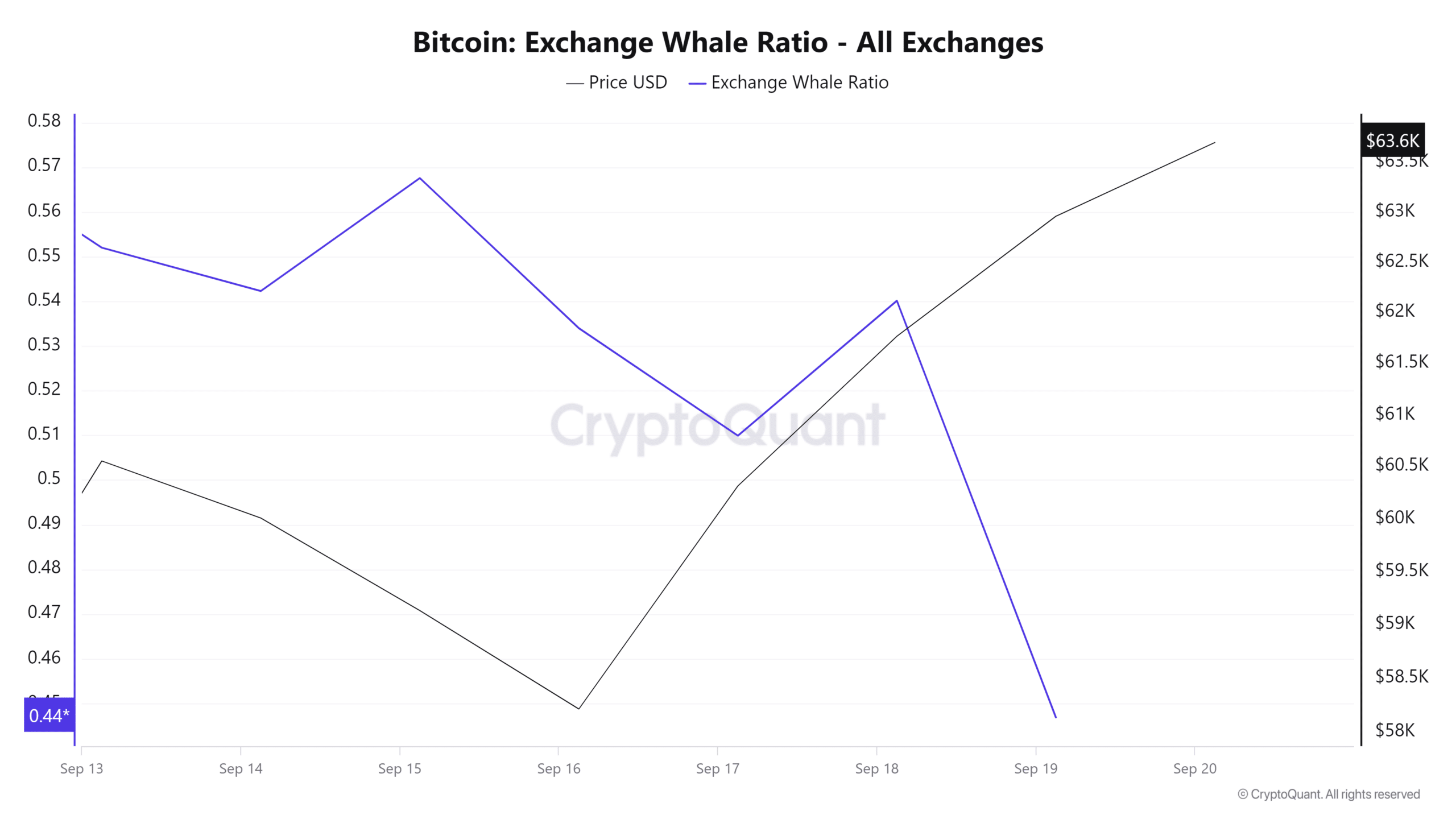

Supply: Cryptoquant

Lastly, Bitcoin’s Alternate provide ratio has declined over the previous week from a excessive of 0.13128 to 0.1308. This means that holders are shifting their BTC from exchanges to chilly wallets.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

This means holding conduct for long run relatively than promoting. Such exercise reduces promoting stress, which is often a bullish signal.

Due to this fact, as noticed, BTC is more and more having fun with larger investor favorability. If the present market sentiment holds, BTC will problem the subsequent resistance stage of $64262.