- BTC has managed to remain near its psychological resistance degree.

- Indicators confirmed the potential for a value breakout.

Traditionally, September has been a turbulent month for Bitcoin [BTC], usually marked by important adverse tendencies.

Regardless of this, the king coin has maintained a comparatively secure value, staying near its present psychological resistance degree. We might even see a extra optimistic motion in October if this pattern holds.

Bitcoin faces consecutive declines

Over the previous three days, Bitcoin has skilled consecutive declines, buying and selling at round $58,650 at press time.

This downward pattern started on the 14th of September, following Bitcoin’s surge above its psychological barrier throughout the earlier buying and selling session. BTC rose over 4% in that session, reaching roughly $60,543.

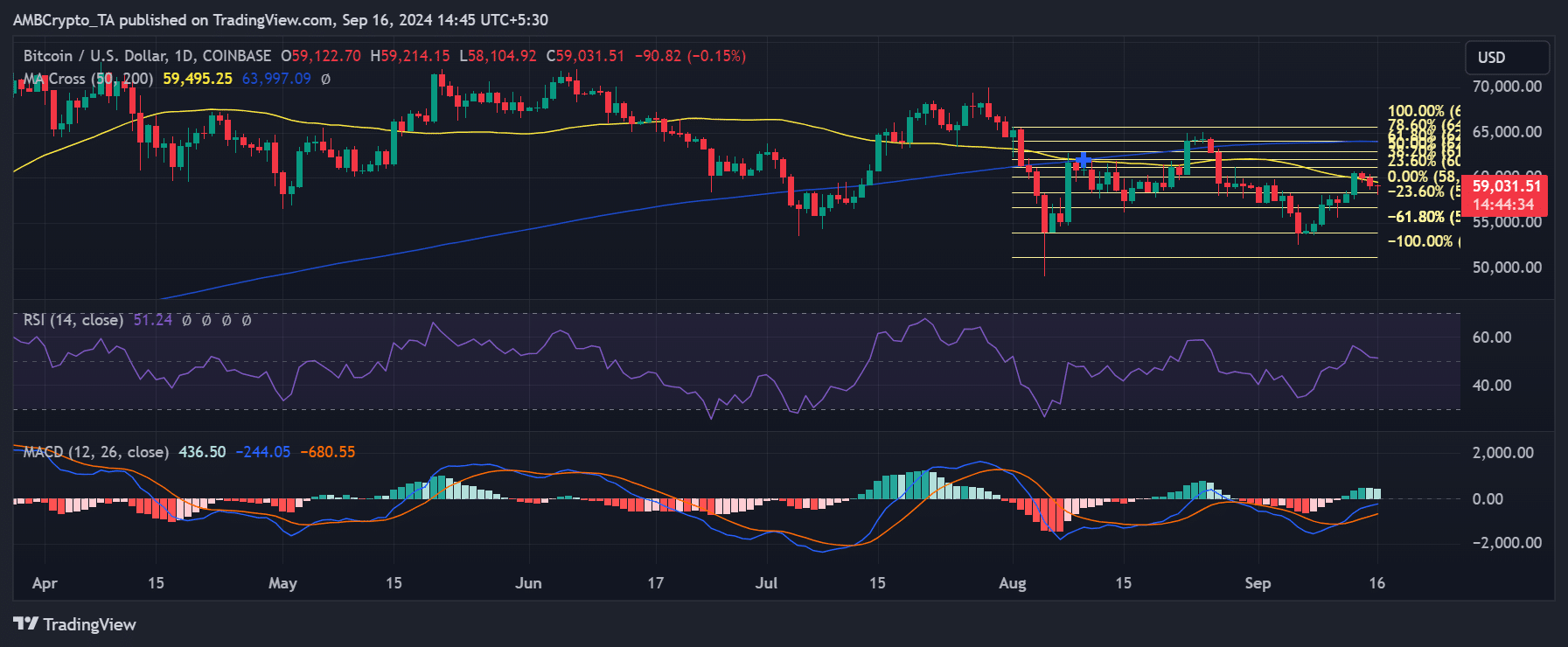

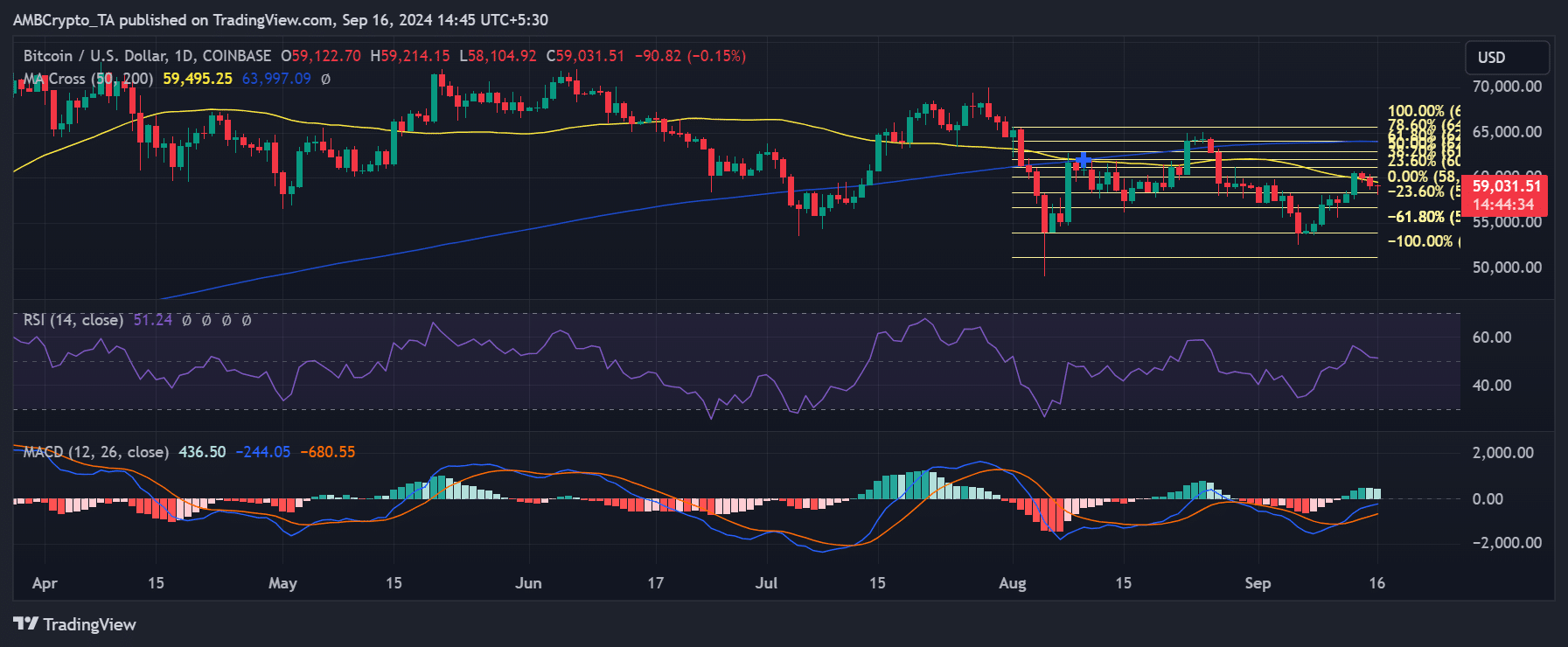

This uptrend briefly pushed BTC right into a bullish part, with its Relative Power Index (RSI) climbing to round 50. Nevertheless, the RSI rested on the impartial line at press time, signaling a weakening within the bull pattern.

Bitcoin: October rally forward?

Shifting into October, Bitcoin’s value was hovering close to key technical ranges. The yellow line represented the 50-day transferring common, at $59,495.25, whereas the blue line marked the 200-day transferring common at $63,997.09.

Bitcoin was buying and selling close to the 23.6% Fibonacci retracement degree, round $58,104.92, indicating potential resistance. On the draw back, the $55,000 degree emerged as the subsequent important help, based mostly on Fibonacci extensions.

Supply: TradingView

Suppose BTC can break above the 50-day transferring common round $59,500 and keep momentum. In that case, it could attain the 200-day transferring common at $63,997, an vital resistance degree.

Constructive indicators from the MACD and a impartial Relative Power Index (RSI) urged a potential upward motion in October, particularly if bulls regain management.

A surge to the $63,000 vary might set off FOMO (concern of lacking out), probably driving BTC to retest its all-time excessive.

Provide on exchanges reveals a slight uptrend

Current evaluation on Santiment indicated a slight uptrend within the provide of Bitcoin on exchanges. Regardless of this enhance, buying and selling quantity has remained comparatively secure, staying inside the similar threshold.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

On the time of writing, the full BTC provide on exchanges was roughly 1.8 million.

Given the current market declines, this uptrend in provide might sign a better likelihood of serious upward motion in October, as Bitcoin could also be poised for a possible rally.